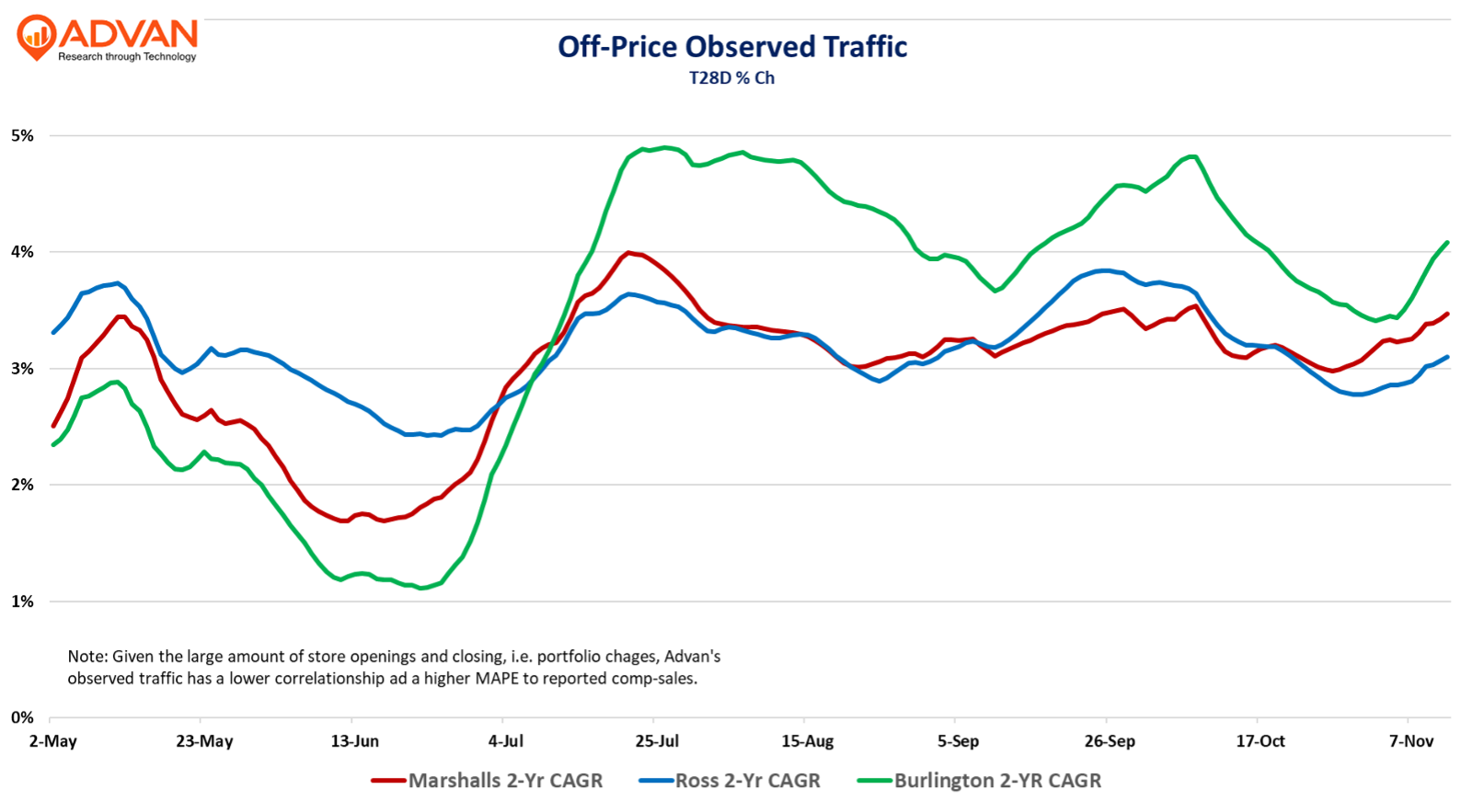

When prices are inflating and the consumer is evermore thrifty, it’s a great time to be an off-price retailer. That, plus easy comparisons allowed the sector to drive a +400bps sequential acceleration in comp-sales; however, as shown in the table, the 2-year CAGR was little changed. That said, the sequential improvement in the observed traffic trend suggests that the underlying pace of the business has improved due to the “evermore thrifty” component as well as the brands success in sourcing more better & best product brands, especially for **Ross Dress for Less **and Burlington stores, whereas TJX is already playing that card well. The success in getting better brands was both intentional from a merchandise assortment plan and facilitated by tariff disruption and turmoil in the traditional market. We also suspect (don’t know given the absence of Federal economic statistics), that the improvement at Ross and Burlington is also due to better execution and new initiatives vs. the macro. As a reminder, Target’s related categories (which is 0.7X the size of TJX’s domestic business and 1.6X Ross’) comp-ed down -6%.

Burlington reports next Tuesday, and so, we’ll come back to them next week. As a reminder, Ross has a new CEO, Jim Conray, and three of his initiatives are to demonstrate even greater value to shoppers, bring in better & best brands, and “contemporize” Ross marketing, especially in the use of social media (something that TJX has long excelled at, i.e. there is nothing “incremental” for them that can really move the needle, unlike at Ross and Burlington.) On its quarterly results, Conray said, “Our merchants delivered a compelling assortment of brand name values which led to broad-based growth across all major merchandise categories. Those assortments, coupled with our **new marketing campaigns **drove excitement, higher customer engagement and increased store traffic. We had an excellent back-to-school selling season with strong trends that continued through the balance of the quarter… The merchants have been laser-focused on delivering high-quality branded bargains at compelling values. They’ve been able to deliver an assortment that spans good, better and best brands to ensure that we are providing exceptional values to our diverse customer base. We would attribute a portion of the sequential improvement in the business to the successful implementation of the branded strategy… Additionally, the increased emphasis on brands has further strengthened our vendor partnerships and increased closeout opportunities. These efforts not only drove higher sales but also helped us partially offset tariff impacts resulting in better-than-expected merchandise margins for the third quarter. While tariff uncertainties persist, we are encouraged by the exceptional product availability in the marketplace. This has enabled us to secure opportunistic buys that position us favorably for the holiday season.”

Conray, “From a pricing perspective, it is clear the consumer is prioritizing value, and our updated assortment is driving stronger customer engagement. While pricing has increased across the retail environment, our commitment to delivering value remains unchanged. (For the quarter, merchandise margin declined by -10bps.) … Our strategy is, I think, a pretty typical off-price strategy, keeping an umbrella under traditional retailers in terms of pricing. We tend to be very intensely focused on the values that we provide, which is one of the reasons why we were a little bit slower to make any changes to AUR because we really wanted to underscore with the customer that we were going to be delivering values including during a tariff environment… “

Conray, “The challenge that I gave to the marketing team and to the new agency was how do we create cut-through in a – with a refreshed marketing message. So we’ve really contemporized how we go to market in terms of a creative standpoint. We’ve tweaked the merchandise mix a bit… But I think sort of this refreshed view of how you can look at the store and reach out to customers in a slightly different way and perhaps reach out to younger customers in a more aggressive way… it’s how can we modernize it slightly, so we continue to resonate with all customers, particularly younger customers…. If you go through the analytics provided by Meta platform and you go through TikTok, I think it’s safe to say we have improved our engagement.“

In terms of Ross’ comp metrics vs. Advan’s “observations,” the larger improvement in comp-transactions relative to observed traffic implies an improvement in conversion rate – a strong signal of merchandise success for the period and aligning with Conray’s commentary. Per management, the drivers of the increase in comp-ticket were product mix towards better & best, more items in the basket (UPT), and like-for-like price increases. These are listed in order of significance per our judgement, having followed the company for two decades. We also see evidence of the UPT and “happy customers” improvements in the +3.7% increase in dwell-time. The improvement in comp-transactions was due to the marketing per Conray’s comments.

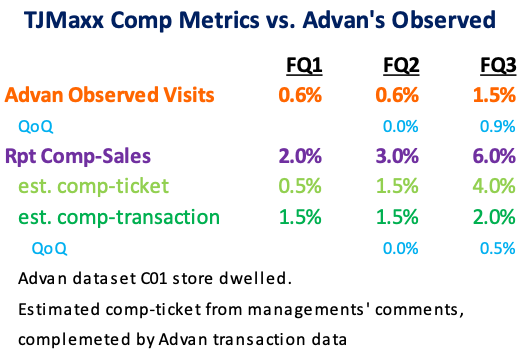

Comp-sales for TJX’s Marmaxx (TJMaxx and Marshals) division accelerated +300bps to +6% growth, due to like-for-like price increases and more better & best brands (+3%-ish), more UPT (+1%-ish), and stronger comp-transactions (+2%-ish). Similar to Ross, dwell-time increased (+3.2%); additionally, conversion rate was stronger given the faster rate of comp-transaction growth vs. observed visits.

On the outlook for the holidays, CEO Ernie Herrman said, “As to the fourth quarter, we are off to a strong start (see the observed traffic in the chart above), and as always, we’ll strive to beat our plans. I am very excited about the initiatives we have underway for the holiday season, and we are convinced that we will keep attracting shoppers to our retail banners. Availability of quality branded merchandise has been exceptional, and we are in an excellent position to flow a fresh assortment of goods to our stores and online. We feel great about the strength of our business and are confident that our flexibility, wide customer demographic and focus on value will continue to be a tremendous advantage… The comp momentum, you can see we’ve been kind of building momentum for a bit now, right? It’s come back for a number of months. I think when you look around the board here at the opportunity to deliver a shopping experience and merchandise that is branded at tremendous value across good, better and best. And then you look at the lack of that customer mission being serviced really by anybody else around us, nobody’s really doing that. So – and I’m talking good, better, best branded at tremendous value in a shopping environment, which I think over the last decade has become more important to consumers in terms of not only the merchandise, but our shopping environment is very pleasant. Our associates are very accommodating. They’re happy. We’re providing, I think, an overall pleasant, exciting treasure hunt shopping experience, even if they’re not in for treasure hunt, our consumers, and we have data on this, really enjoy shopping us. It’s a very positive experience.” (Thus, the improvement in conversion rate.)

LOGIN

LOGIN