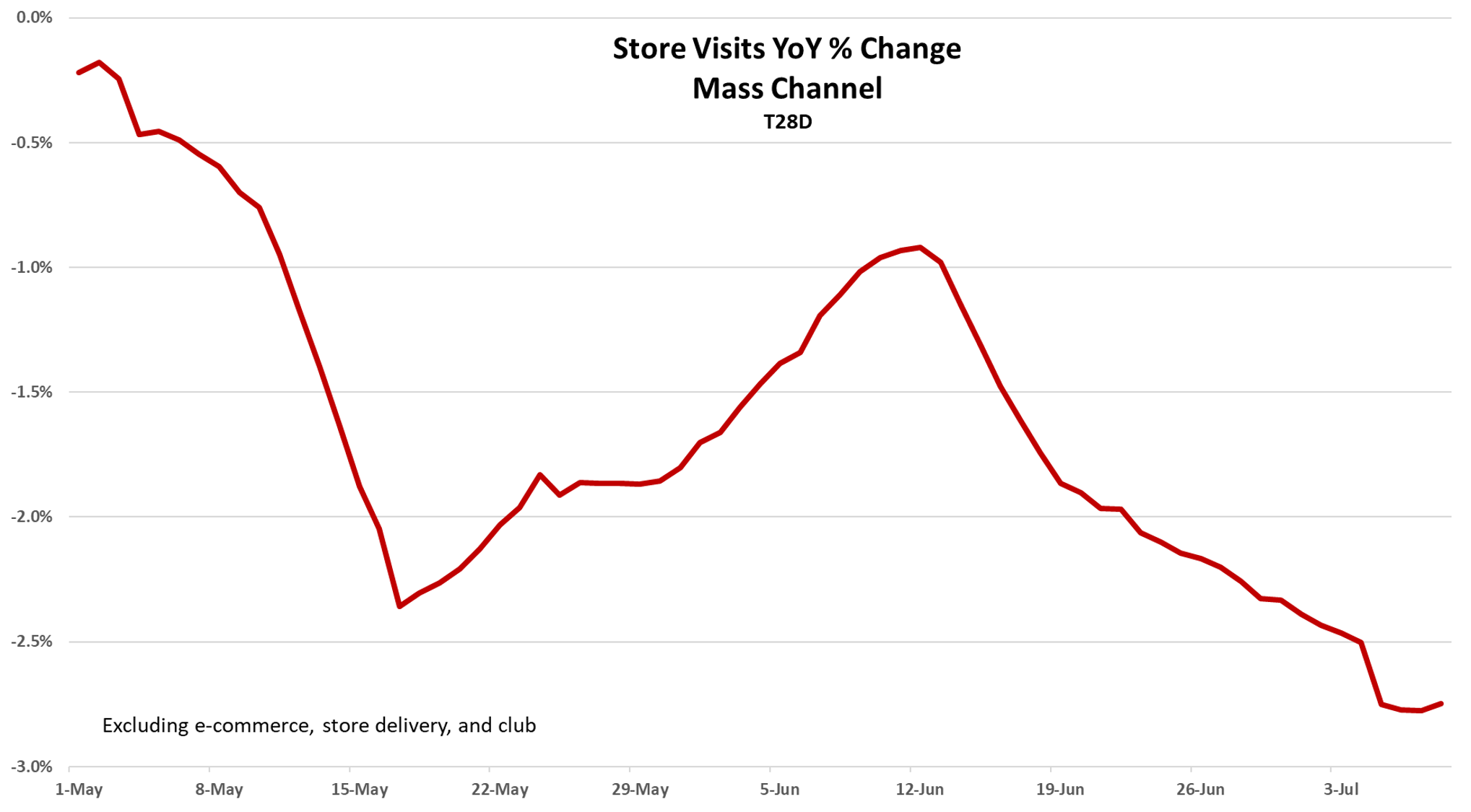

We forecasted in our review of May retail sales that June’s pace would likely be stronger than May’s; well being a forecaster, we know that we are going to be wrong some times and based on Advan’s foot traffic and transaction data, June looks to be softer AND NOT stronger. (Recall, the retail calendar puts July 5th as the end of the month vs. July 6th last year.) The first half of the period was stronger than the second half; the second half aligned with the extreme temperatures in the Great Lakes Region and the Northeast. However, the softness extended through the 4th of July weekend (again contrary to our expectations). Moreover, the same trend also holds for several retail brands in California, where the weather was not extreme, i.e. there’s something more at work.

June is a lighter month than May, which is a larger month (6%), excluding auto, gas, food, etc. We’ve seen increased seasonality since the start of 2023, with higher peaks and broader and lower troughs. That continuing into 2024 could be at play here. Additionally, since 2021, we’ve also seen wallet share shift back and forth between leisure and goods (or “stuff” in our vocabulary). Perhaps the shift towards leisure that began last month continued to build, leaving less spending power for stuff.

Parsing the data more finely, reveals stronger spending than foot traffic and transaction counts, implying the start of some pass-through of tariff costs. It is our understanding that suppliers and retailers have been slow to pass the costs through for several reasons. First, the largest tariffs were imposed in early April, given that already shipped goods were clear from those and general inventory turns at vendors and retailers, we are still early. Second, as the rates are still moving around, vendors and retailers want to limit the impact of the price reset to just once; as such, they are eating it now until the final levels are settled. After that, they will adjust the shelf price. And third, many also pulled forward inventory early to get ahead of the tariff, and it is that pull-forward inventory has finally sold through and tariffed goods are now working their way onto the shelf.

The slowdown is across retail categories, including: mass, dollar, home improvement, sporting goods, craft, department stores (including off-price), beauty, secondhand, BevAlc, and restaurants (both limited-service and full-service). Off-price experienced the sharpest deceleration. Burlington outperformed in off-price and Walmart was firmer than Target. Target looks to have passed through more, which makes sense given its merchandise mix is substantially more general merchandise sourced internationally. Home improvement and mass experienced the least deceleration. “Across categories” indicates breadth and that again points to macro. And so, while the stock market ripped in Q2, that accrued wealth seems neither to have loosened up pocketbooks nor sparked any frivolity. This week, the New York Federal Reserve District released its Survey of Consumer Expectations . In the Survey, nearly every reading moved in a favorable direction, save one; expectations for government debt growth moved up by 35% MoM (i.e. unfavorably). Moreover, it increased across all demographics and other cuts of the data, again showing something that’s macro in nature. To conclude, we remain in a thrifty K-shaped consumer economy; that’s becoming a persistent macro trend and it creates a high level of stress on the supplier and retail industries.

LOGIN

LOGIN