· Simon Property Group’s 18-year project of turning around the first indoor mall, Southdale, has come to fruition as a sharply curated pinnacle brand and luxury showcase and experience.

· Visits were up +11% this holiday season (Nov + Dec). Even consumer spend at Southdale’s legacy retailer Macy’s was strongly up (+17%), outperforming other comparable Macy’s locations in the market.

While shopping for Christmas gifts, we visited the first indoor mall in the US — **Southdale Center Mall **in Edina, Minnesota, owned by Simon Property Group. Wow! Simon has completely remade Southdale into a hot brand and luxury shopping experience (spending $400M on the renovation ). The only things that we recognized were the location and the iconic golden architecture tower in its open hall. Even the legacy Macy’s location looked terrific, and not at all what we remembered (overstocked clearance racks and difficult to find sight lines and staff). Observed sales** for this Macy’s are up 20%. Back in the 90s, Southdale held Macy’s, Mervyn’s, JCPenney, and lots of middle-brands, all in a somewhat shabby state. No longer –Southdale is now Louis Vuitton, Moncler, Ralph Lauren (the pinnacle version), etc., and all the new hot brands (Vuori, Aritzia, gorjana, Garage, etc.) in what felt to be a highly curated experience. Given these new brands, one would expect overall sales for the Center to be far ahead of the Macy’s increase.

Southdale of the 1950s

A bit of background, I had the privilege of growing up in Southwest Minneapolis, which made Southdale the place where I grew up as a mall rat and a place that I know well. In the mid-1950s, it was imagined and crafted as a shopping destination that would rival downtown Minneapolis —the region’s central shopping district / gifting destination prior to indoor malls. (Indoor malls being a popular alternative in Minnesota during the winter.) As a kid, Southdale’s three anchor stores were Dayton’s, Donaldson’s, and JCPenney, and the mall was vibrant; it thrived on the many visitors from the affluent suburbs of Edina and West Bloomington. As a kid, my favorite venues at the mall were the magic store (I was an amateur magician at the time), the B. Dalton Bookstore, the game arcade, and the pet store that had a parrot outside that cursed like a sailor. (I had nothing to do with influencing that.) As I hit the mid-teens, there were also a lot of teenagers – that’s where you met kids (girls) from different schools. Southdale was a success and was followed up with three more “Dales” – Ridgedale, Rosedale, and Brookdale.

Despite being in a very affluent area, Southdale began to lose its draw in the 90s as the Mall of America (MOA) opened in 1992. The MOA offered a far greater selection of retail, dining, and entertainment, along with ample parking. (I would also guess more girls as well, but I was off to college by then.) Moreover, it was only 6 miles from Southdale, which, for a day’s outing, is only a small inconvenience.

Under Simon’s ownership of Southdale, the first major transformation was the opening of a pinnacle Lifetime Fitness location in what had been the JCPenney anchor corner in December 2019. As this was my fitness club, I can attest to it being very packed despite a $200 per month per member price – demonstrating that the area’s affluent would show up if the offering was right. Over the past three years, Southdale has largely been re-merchant-ed. The only legacy tenants that I saw were Coach, Banana Republic, Macy’s, Dave & Buster’s, and AMC Theaters. LensCrafters as well, but it has been completely recast-ed as a pinnacle experience. In addition to Louis Vuitton, Southdale / Simon added Tiffany, Vineyard Vines, Lululemon, etc., all pulled from the neighboring “luxury” shopping center, Galleria Edina (locally owned). (Here is a nice take from a local journalist on the transformation

Southdale from December 2025

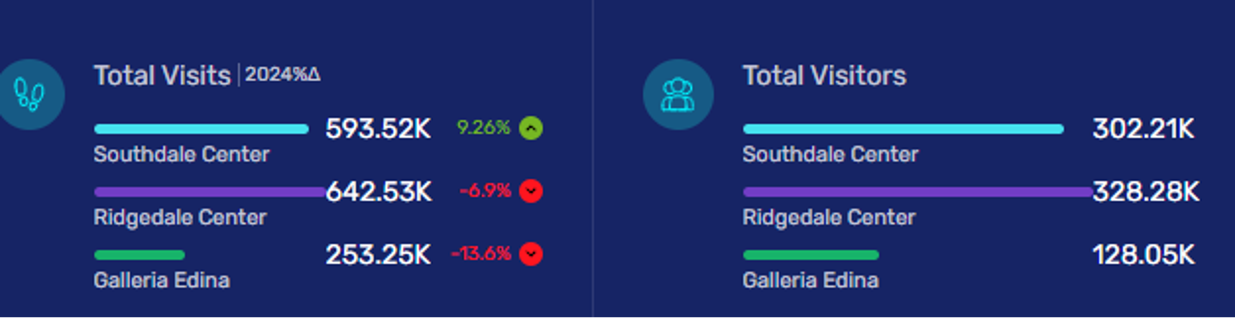

For Southdale, Advan’s data shows strong outperformance in growth for this holiday season; the table below is data for December; November shows similar outperformance by Southdale. The Ridgedale Center sits next to the affluent suburbs west of downtown Minneapolis and it provides the best comp; Ridgedale had a stronger November (+3%), but not at Southdale’s level (+15%). Observed sales** for Macy’s at Ridgedale were down -4% in November, and its Nordstrom was up only +3%, less than the Nordstrom chain (+6%). For the November two-year period, Southdale’s observed visits are up +20%, Ridgedale +5%, and Galleria Edina flat. Given that many of Southdale’s new brands have recently been added, with more on the way, including Arc’Teryx, Mango, and Tommy Bahama, we’d expect Southdale’s momentum to build during 2026.

In terms of shopper types / cohorts***, Southdale made large gains (December ’25 vs. December ’23) in retired and mostly single households renting in classy urban areas (called GoldenCitySolos) with the cohort going from #7 (out of 80 cohorts) in importance to #5. Gains were also seen in wealthy family-focused households straddling the suburban/rural line (called SuburbChic), going from #3 to #2. And young, high-income young professionals renting near city centers or in nice, denser suburbs (called YoungStars), going from #4 to #3.

Visits / Visitors – December, 2025 (YoY % Ch)

‘* Per Advan’s foot traffic data for the months of November and December.

** Per Advan’s transaction data for the months of November. December’s data has yet to be released.

*** Psychographic segmentation from Spatial.ai.

LOGIN

LOGIN