- Coach (Tapestry) and Ralph Lauren had a very successful holiday quarter in both sales and profit growth.

- Their ongoing success stems from elevating their brand and using the proceeds to increase top-of-the-funnel marketing and presence in key influential (cer) cities such as Miami, Los Angeles, and New York. It’s a playbook that European luxury brands are also employing. As such, for the right trade areas, demand for real estate is hot and will remain so. Denver and Minneapolis make the list. See our piece on Southdale .

Consistent with our holiday (unwrap) presentation , Coach and Ralph Lauren once again delivered outstanding holiday-quarter results. Coach’s sales in North America increased a very robust +27%, slightly ahead of last quarter’s +26% and aligned with the improvement seen in Advan’s SpendViewTM data. Moreover, the gain was on a much higher comparative base (+11pts) and a larger quarter (the holidays), making the result truly spectacular.

On the performance, CEO Joanne Crevoiserat said, “Led by continued growth with our target Gen Z consumer. Our relevance with Gen Z is influencing all other generations, and we’re driving healthy gains from existing customers, reflecting broad and increasing brand desire and reach. Growth was led by our core leathergoods assortment, where we have deep expertise and clear differentiation with broad-based strength… Within leathergoods, growth was well diversified with both average unit retail and unit volumes increasing at mid-teens rates, demonstrating multiple drivers of sustainable growth in the core.”

Crevoiserat went on to say, “The compounding benefits of our strategic brand investments were evident during the quarter with a clear focus on long-term demand creation. We increased marketing spend by approximately 40% versus the prior year with a continued shift to our top-of-funnel brand building to support sustained customer acquisition. This sustained investment in fueling brand desire, supported accelerating customer acquisition during the quarter even as we meaningfully reduced promotional messaging during the most discount-driven period of the year, demonstrating both our commitment to the strategy and its effectiveness.”

Advan is seeing multiple brands reprioritize top-of-the funnel brand spending vs. tactical search / bottom-of-the-funnel spend, leading to stronger overall category growth. Previously, too much was spent on the bottom-end, leading to no brand building / elevation, too much discounting, and lower consumer demand. This is a reversal / theme that we expect to broaden out in 2026. It’s also going to be interesting to see how agentic commerce plays here; read our prior thoughts here . However, it’s dependent on having the $s, the right creative, and the right targeting (which means having accurate shopper panels; something that Advan provides).

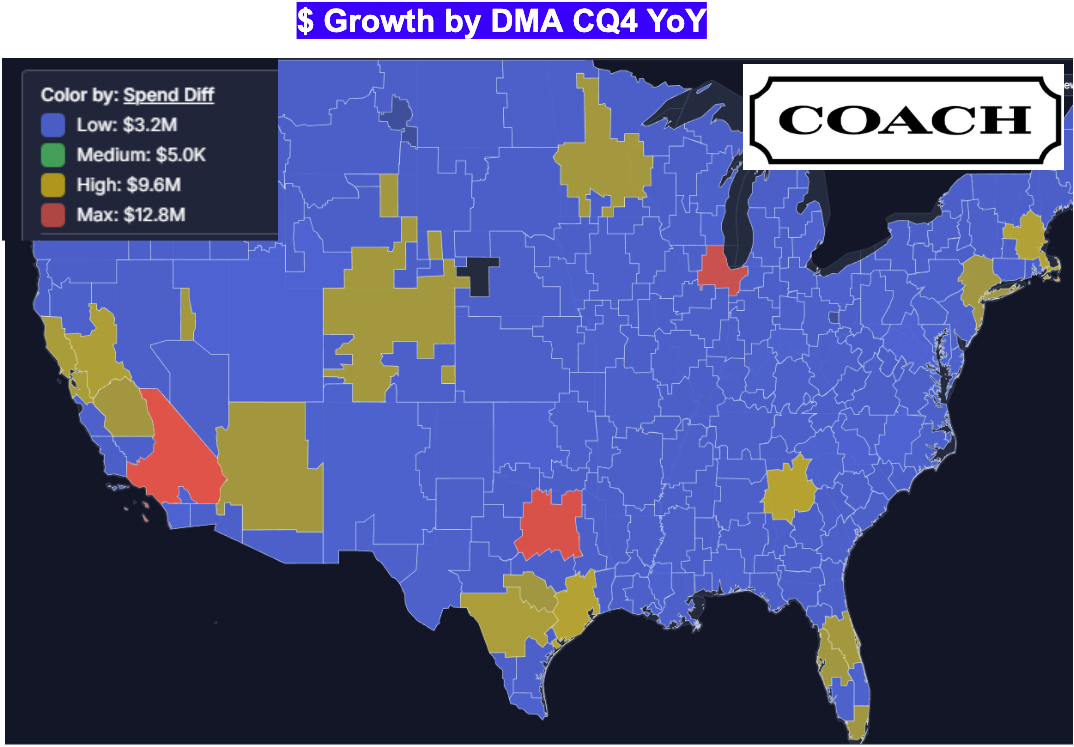

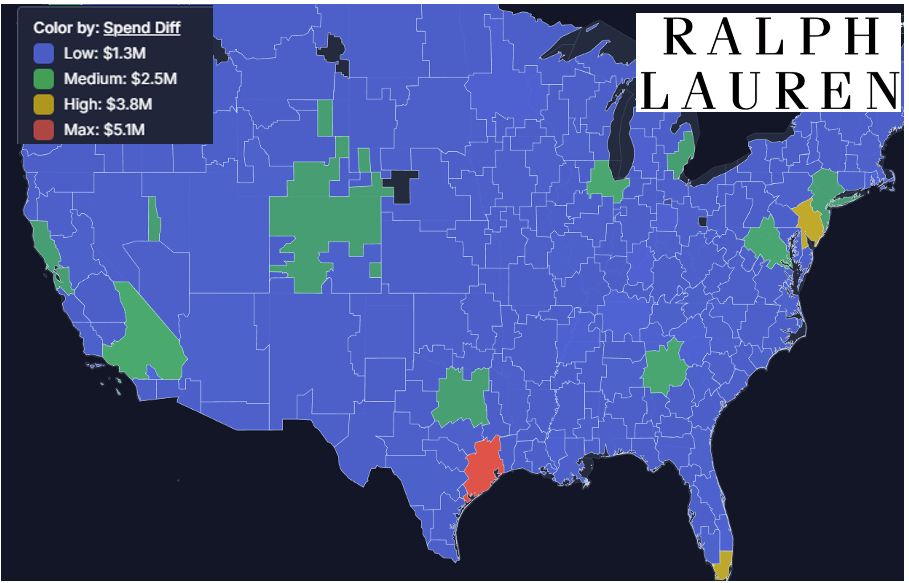

Shown on the third page, geographically by DMA, Coach is driving the most $-volume growth in LA, Chicago, and Dallas. Additionally, Minneapolis, Denver, and Tampa were also big drivers relative to their size. (Shown here is DTC consumer spend on the brands, which includes ecommerce, but excludes wholesale.) By contrast, for Ralph Lauren, it’s Houston, Miami, and Philadelphia. As shown, Denver, LA, and Dallas were also strong. Between the two brands, one can see that the outsized DMA $-growth are 2.6X higher in Coach’s favor. Coach’s US DTC business (both retail + ecommerce) is larger than Ralph Lauren’s DTC at $3.1B vs. $2.0B, but that’s only a 1.5X ratio. The 2.6X versus 1.5X indicates that while both are gaining market share, Coach is gaining more on a relative basis. That’s curious because Ralph has a much larger men’s business and it participates in more categories.

Ralph Lauren reported a +7% increase at its stores (Advan at +6.6% per our SpendViewTM data) and a +11% increase for its wholesale business. Last quarter, the wholesale business increased +13%; the consistent gains in wholesale demonstrate that Ralph Lauren is enjoying strong sell-through in their retail partner doors (Nordstrom, Macy’s, and Bloomingdale’s had successful holiday results per Advan data). On the holidays, CEO Patrice Louvet said, “Our holiday campaigns also drove healthy full price demand in our core children’s programs led by our elevated sweaters, midway down jackets, and knit and fleece sets. Our high-potential categories, including women’s apparel, outerwear. and handbags, continue to be accelerators for our business. Together, these categories increased high teens, outpacing total company growth in the quarter.“

One of Louvet’s initiatives is to expand in key influential(er) markets, on which he said, “Turning to our third key initiative - Win in Key Cities with Our Consumer Ecosystem. We continue to expand our consumer ecosystems to deepen our presence in our top 30 cities around the world. We are also laying the groundwork for long-term sustainable growth in our next 20 cities. Across each of these ecosystems, we’re establishing a cohesive consistently elevated experience to allow consumers to engage with and step into the Ralph Lauren lifestyle.” The markets include NY, LA, SF, Seattle, Chicago, Atlanta, Denver, and Miami—all of which are outperforming in the next page’s figure (Seattle is hidden under the legend).

On marketing, which Ralph Lauren is increasing, Louvet said, “We have stronger confidence than ever in our marketing ROI, which has enabled us to take up our investments meaningfully over many years and even this quarter relative to last year, as you just heard Justin mentioned…. We’re fundamentally shifting our consumer base towards a higher-value consumer over time, think more full-price, skewing younger and more women. Now this isn’t just about marketing, right? Our consumers stay with us because we’re consistently delivering what only Ralph Lauren can, the cinematic storytelling that we pair with AI-powered insights, a broad, timeless product portfolio offering superior value and our elevated go-to-market experiences across both digital and brick-and-mortar. And it’s the consistent execution across all aspects of our business. That has led to 50% – 50% of our customers staying with us over 10 years and 25% for over 20 years. So together, this is what’s reinforcing our luxury equity and our value proposition, and it’s reflected in the way our brand is resonating broadly across generations, across geographies, channels, and cultures, not just today or for a trend cycle but for a lifetime.”

The increased marketing expense is afforded because Ralph Lauren, under Louvet, has sharply elevated the brand’s prestige, which has resulted in a lot higher average unit retails, gross margin, and gross profit dollars. Since 2019, the gross margin rate has expanded from 62% to 69% and gross profit dollars have grown 38% (+$1.5B). Marketing expense as a ratio of net revenue is to reach 8.5% for the fiscal year; that’s up from 4.2% in 2029. Broadly speaking, the rush by brands to reach consumers DTC / ecommerce vs. elevated brand building and sharply curated retail (be it wholesale or their own doors) has led many brands and businesses to extremely diminished straits, recent notable examples include Nike and Capri Holdings. It’s a welcome development that brands and mall owners can see what a successful turn looks like with the examples of Ralph Lauren and Coach. In terms of real estate and shopping centers, we’d point readers to our recent piece on Southdale .

LOGIN

LOGIN