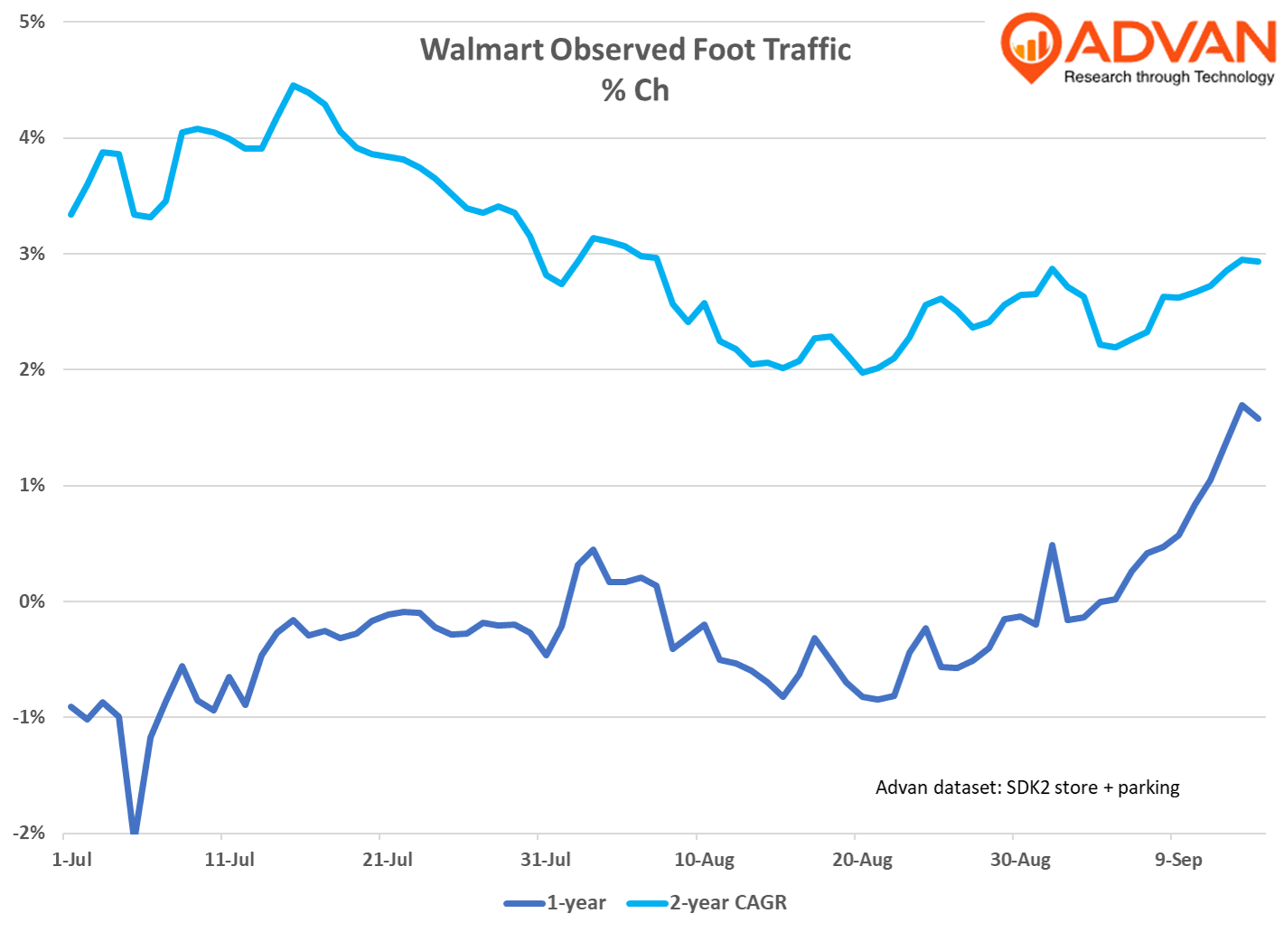

As expected, observed foot traffic and retail sales slowed slightly from July’s strong back-to-school showing; however, contrary to our expectation that it would slow further following back-to-school, the first half of September has demonstrated improved foot traffic momentum, especially at Walmart. We last wrote about Walmart two weeks ago after CEO Doug McMillon’s very favorable commentary at the Goldman Sachs’ investor conference. Walmart’s sustained strong foot traffic trend demonstrates that its compelling value messaging and consumers’ even greater sensitivity to inflation are leading to more foot traffic for the brand. (Last week, we wrote that this is also true for the club channel. See the NY Fed’s Consumer Expectations Survey , Michigan’s Consumer Sentiment , or Morning Consult’s work.) If we assume that Walmart’s Q2 contribution from average ticket and e-commerce applies to Q3, that would put the current total US comp-sales increase around +6%. Other general merchants and dollar stores also showed an improved September, but not to the extent of Walmart’s.

In off-price, August was down from July’s pace, but September is back to July’s better rate; TJ Maxx is enjoying the most relative improvement, with visits per average location increasing +1.3% YoY September-to-date. In sporting goods, the pattern was similar, but August’s softness was more pronounced. In specialty, American Eagle continues to demonstrate a meaningful improvement in consumer spend resulting from the **Travis Kelce **and Sydney Sweeney campaigns. (You can find our review of July retail sales and American Eagle here .)

In terms of this year’s hot retail categories – secondhand / thrift, again had a very strong August; Savers Value Village is up +6% in traffic September-to-date. That strength reflects the consumer pattern of Thrifty K-Shaped and the absence of disruption from Temu. We expect the secondhand / thrift category to have a gangbuster October as Halloween is its Christmas season – costumes. The other “less Temu winners” are craft and novelty. Michael’s transaction spend is up double-digits in the June – August period. (Michael’s and Hobby Lobby also benefit from “no Joann.”) Five Below again had a very robust August, but not as good as July‘s.

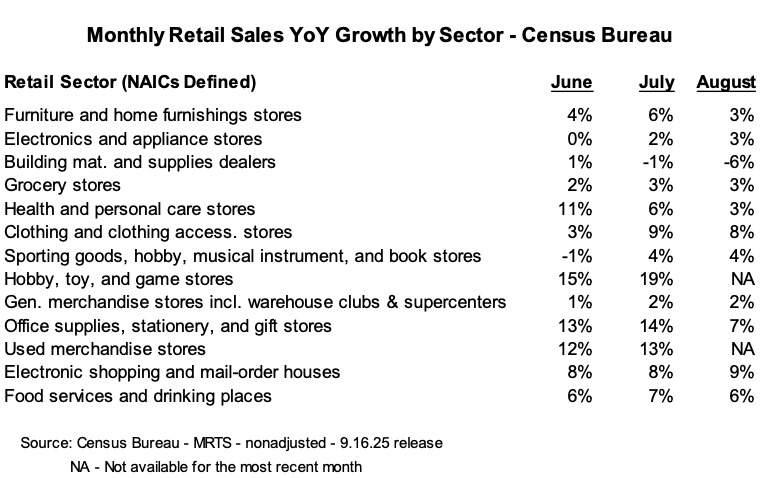

The table below is the Census Bureau’s retail sales report for August . The outsized gains Hobby, Toy, & Game Stores reflect strong category trends (general merchandise retailers and the dollar stores called the strength in their earnings results ); as noted above, Five Below had a very strong July and August. Less Temu is driving the strength at Gift Stores and Used Merchandise Stores. The strength at Electronic Shopping is Amazon’s push into more same-day and next-day delivery, and the consumables category (see our Q2 results story ). The growth for Clothing & Clothing Accessories Stores is remarkable; perhaps a little too remarkable given what the retailers themselves reported for fiscal Q2. The slowdown in Building Materials & Supplies Dealers looks to be a measurement / statistical issue. Census’ seasonal adjusted numbers puts the category at about -2.4% for both July and August. Home Depot / Lowe’s reported July comp-sales of +3.3% / +4.7% respectively. (Our FQ2 write-up here .) Additionally, we do not see a material slowdown in foot traffic or spend for August at Home Depot or Lowe’s. Had there been such a stark underlying softening for the sector, we’d have heard about it at the recent Goldman conference . (HD/LOW are also stronger in September.) We also see consistent traffic growth at Sherwin-Williams retail stores. That said, the CNBC/NRF report on August retail sales also showed strong results for Clothing & Accessories stores (+8% YoY) and Building & Garden Supply down -8%. Its release quoted NRF CEO Matthew Shay, “Spending was supported by lower fuel costs, tax-free holidays, and consumers buying products before tariff increases take effect. We may be seeing inflationary impacts from tariffs since recent data shows price increases in commodity goods.” Our conclusion – certainly the official data is becoming noisier.

LOGIN

LOGIN