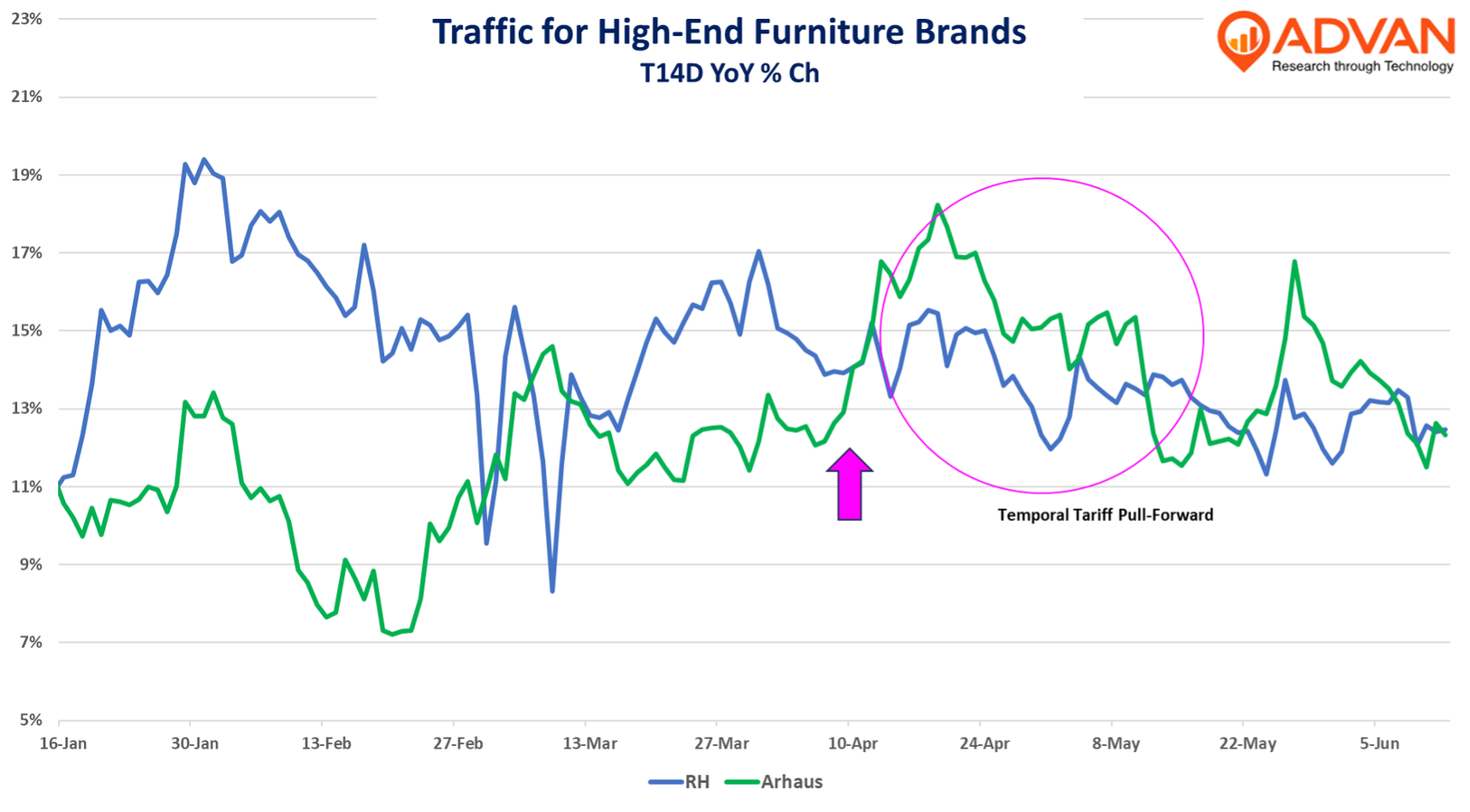

Despite tremendous noise on trade and the economy, and our ongoing frozen housing market, Restoration Hardware’s fiscal Q1 results and outlook affirmed what Advan’s traffic and transaction data suggest, that is – demand remains undiminished for the high-end brand, as well as peer Arhaus. Written orders, which measures current demand, is no longer disclosed by Restoration Hardware (RH), and so the next quarter’s guidance is a proxy; guidance for fiscal Q2 revenue growth was +15% (on an adjusted-basis) which is above for the April-end period of +12%, or reflective of stronger demand. The shareholder letter read, “Despite that fact, we are performing at a level most would expect in a robust housing market. We believe it’s a result of investing with a very narrow focus and a long-term view, or what we like to call, “An inch wide and a mile deep.” Elevating and expanding our platform by creating the most desired products presented in the most inspiring spaces in the world, with bespoke interior design services and beautiful restaurants that generate energy, engagement and tremendous awareness of the RH brand, while also serving as a profitable customer acquisition vehicle. Our intentions and attention to detail are reflected in everything we do, and in every house we turn into a home. While our business has been strong, it has been so due to action versus inaction, innovating versus duplicating, investing versus divesting, and aggressively taking market share during this downturn so we are positioned to create long term strategic separation on the other side of it.” Looking at traffic, the chart below shows that traffic has been largely stable since “Liberation Day,” with Arhaus’ traffic improved QoQ. (Arhaus reported +4% written-order growth for its March-ended fiscal Q1, and based upon the traffic trend, it looks like Q2 should be above that level.) Advan’s transaction data for RH’s quarter shows spend growth that was substantially higher than traffic growth, which indicates a large step-up in conversion rate. For May, that step-up lapsed, indicating the natural air pocket following the pull-forward.

A key part of RH’s strategy is to foster aspirational luxury demand through its marque venues and restaurants. It’s 10-K describes this as follows:

Brand Elevation. Our strategy is to move the brand beyond curating and selling product to conceptualizing and selling spaces, by building an ecosystem of Products, Places, Services and Spaces that establishes the RH brand as a global thought leader, taste and place maker. We believe our seamlessly integrated ecosystem of immersive experiences inspires customers to dream, design, dine, travel and live in a world thoughtfully curated by RH, creating an impression and connection unlike any other brand in the world. Our hospitality efforts will continue to elevate the RH brand as we extend beyond the four walls of our Galleries into RH Guesthouses, where our goal is to create a new market for travelers seeking privacy and luxury in the $200 billion North American hotel industry….These immersive experiences expose new and existing customers to our evolving authority in architecture, interior design and landscape architecture.

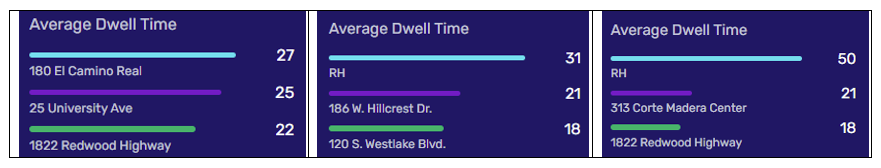

Per the strategy relative to peers, one would expect visitor dwell time for its locations to be much longer than its peers; Advan data shows that on an apples-to-apples basis, they are delivery on that strategy, and overall, dwell-time increased by +5% YoY in May – twice the rate of its near competitors.

RH vs. Arhaus vs. Pottery Barn (in five trade areas in California)

LOGIN

LOGIN