As we previewed last week, high-end consumer spending in the US accelerated during Q3, which drove better retail sales for September and which we see in LVMH’s much better organic revenue growth for the quarter. Moreover, we also take Dollar Tree’s reiteration of its guidance and **Domino’**s very strong Q3 US Comps (+5.2%) as added evidence that there has not been a material degradation in spending by the less-affluent (despite market fears that there was and some data pointing to degradation). We also see support for our view of ongoing strength in the strong credit card business results from Citigroup, JPMorgan, Wells Fargo, and Bank of America. Lastly, we found additional support in today’s released Fed Beige Book, particularly on the strengthening high-end, but also an ongoing K-Shaped economy.

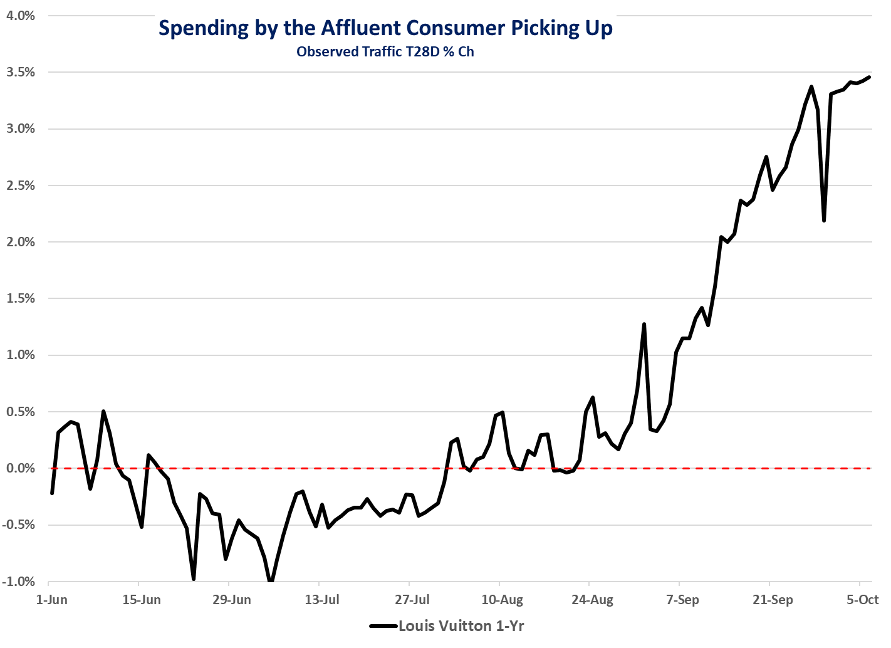

Focusing on LVMH, US organic revenue growth improved to +3% from LQ’s flat. By division, and just for the US, Champagne was particularly strong. Tiffany enjoyed double-digit growth from its iconic lines, and record sales for its high-end collections. Bvlgari also accelerated. On Fashion & Leather Goods, finance chief Cecile Carbanis said, “The sequential improvement was mostly made through improvement of traffic and volume. Price was not very different from Q2 and the mix was around neutral. So you can consider that the bulk of the improvement is really around traffic and volume.” Below is traffic to Louis Vuitton stores, which cranked up starting in August. Assuming continued gains in the equity markets, one should expect the high-end to be very strong for the holidays. Carbanis also said, “Sephora U.S. performance was very strong. You have to keep in mind that Sephora is everything, Amazon is not, because Sephora – the model of Sephora is really it’s a destination. It’s where you can find brands 1 over 2 only at Sephora. And it’s where you have beauty consultants where you have a brand. People that don’t say, I will buy some from Amazon, but they will say, I go to Sephora. So it’s a very different model. And again, we have a Q3 where – and also in the U.S., both the traffic and the average basket have increased.“

For context, Domino’s has been winning share with its “Hungry for More” marketing and value positioning. Domino’s domestic comp-sales accelerated to +5.3% from +3.4%, with the lift coming from improved transactions, mix, and pricing. Carry-out accelerated by nearly +200 bps to +8.7%, which is benefiting from trade in. Given a strong contribution from mix, consumers are choosing to buy more toppings and get the Parmesan Stuffed Crust (+$4 per pie), again a signal that consumer spending has improved vs. deteriorated. Management also shared that the pizza QSR category’s growth improved to +1% from flat in the 1H. Also for reference, Domino’s delivers 1 in 3 pizzas in the US, i.e. it’s a broad macro indicator.

Lastly, we are sharing a few quotes from bank executives on what they are seeing in consumer spending.

Citigroup – CEO Jane Frasier, “The macro environment reflects the global economy that’s proved more resilient than many anticipated. The U.S. continues to be a pace setter, driven by consistent consumer spending as well as tech investments in AI and data centers.” CFO Mark Mason, “I think consumers are being very discerning in terms of how they spend. The spend increase that we’ve seen is largely in brands that have tended to be in the higher income consumers.”

Wells Fargo – CEO Charlie Sharf, “The performance of the consumer is just very, very consistent. Consumer spending, kind of week after week, is up the same amount that we’ve seen over the past bunch of months on both credit and debit… we don’t see any meaningful changes across different affluence levels… In fact, when we look at it, payment rates are better as opposed to even flat or worse. Deposits remain strong. And so when you look at it, you see really strong credit results. You see strong consumer spending and stable deposits and those things just kind of paint a picture of a consistently strong consumer, even though what you read about is – would lead you to believe that they’re being more cautious. Our results just say that there’s a high degree of consistency there without any real pockets of slowing.

JP Morgan Chase – CFO Jermy Barnum, “Consumer spending remained robust… the consumer is resilient, spending is strong and delinquency rates are actually coming in below expectations.“

LOGIN

LOGIN