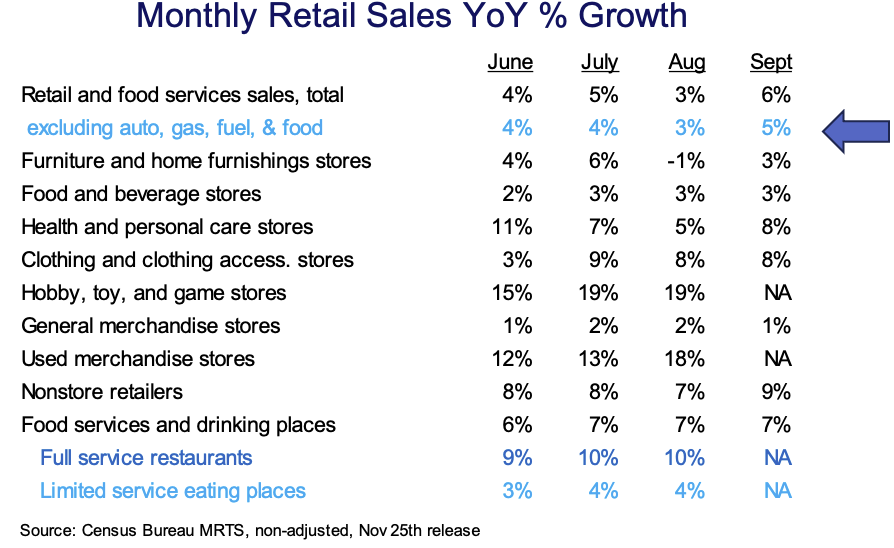

- September core retail sales growth, per the Census Bureau’s monthly report , accelerated from the prior three-month trend, with strength coming from more affluent consumers, weight loss drugs, K-Pop Demon Hunter merchandise (and like categories), and the absence of Temu (a previously disruptive agent).

- September also faced a number of large 1-off headwinds; their lapsing sets up October for stronger growth on a MoM basis. However, October ’24 was a very strong month, making it a difficult compare, plus there was the shutdown jitters and SNAP break, and so we doubt that it will outgrow September’s +5%; +3% would still be solid.

- The September report, along with earnings reports across consumer, supports our view that the Thrifty K-Shaped economy is extending its rightward arms and becoming more pronounced.

While September is “way back there,” we are seeing misreads of the data, with commentators saying that retail sales slowed, and so want to also opine on the month as well as to circle back to our “preview ” for September, which read, “Retail Sales – September per Census should be good (when it’s eventually reported),” as well as to offer some perspective on October’s eventual reading.

First off, as to September’s context – it was a warmer-than-average month, which meant that outerwear was of less need – something that Burlington, Target, and Tractor Supply all discussed. Additionally, the month lapped Hurricane Helene, which meant less stock-up of supplies and less cleanup, something that Costco, Home Depot, and Lowe’s all called out. Finally, back-to-school sales were robust in July and August, meaning that little of the B2S season flowed into September, something that impacted Target’s quarterly cadence. It was also a month where the less-affluent started to get jitters that inflation was picking up again, especially food inflation, leading to more shopping around for deals and a more pronounced paycheck cycle (i.e. traffic > sales). Given all this context, it’s surprising to see September’s core retail sales grow by +5%, stronger than the +3-4% prior three-month trend.

Our call-outs on the table are:

- Furniture & home furnishings stores +3% growth for September provides support for our view that housing-related retail has put in the floor on its downcycle and has started an upturn centered on the more-affluent .

- Health & personal care stores +8% growth reflects ongoing momentum in GLP-1 prescription sales. (Circana recently reported that 23% of US households are now using a GLP-1.) While the rapid growth in GLP-users is a headwind to food consumption (calories), it appears to be a larger headwind for limited-service eating places than food & beverage stores. The GLP-1 story will grow in significance in 2026 due to price reductions and the pill formulation that should hit late this year or early next year. Per price cuts, the news was $350/mo for Zepbound / Wegovy on TrumpRX.com and $245/mo on Medicaid / Medicare.

The lost calories may also be a contributor to the very strong growth at clothing & clothing accessories stores, as the newly slimmer bodies need clothes that fit / match. It is very rare for this category to be growing at a high-single-digit rate; it grew at a +0.7% CAGR from ’16 – ’19.

- Hobby, toy, and game stores’ high-teens growth is spectacular, driven by collectables, K-Pop Demon Hunters, trading cards, and the absence of Temu. See our prior story on Five Below.

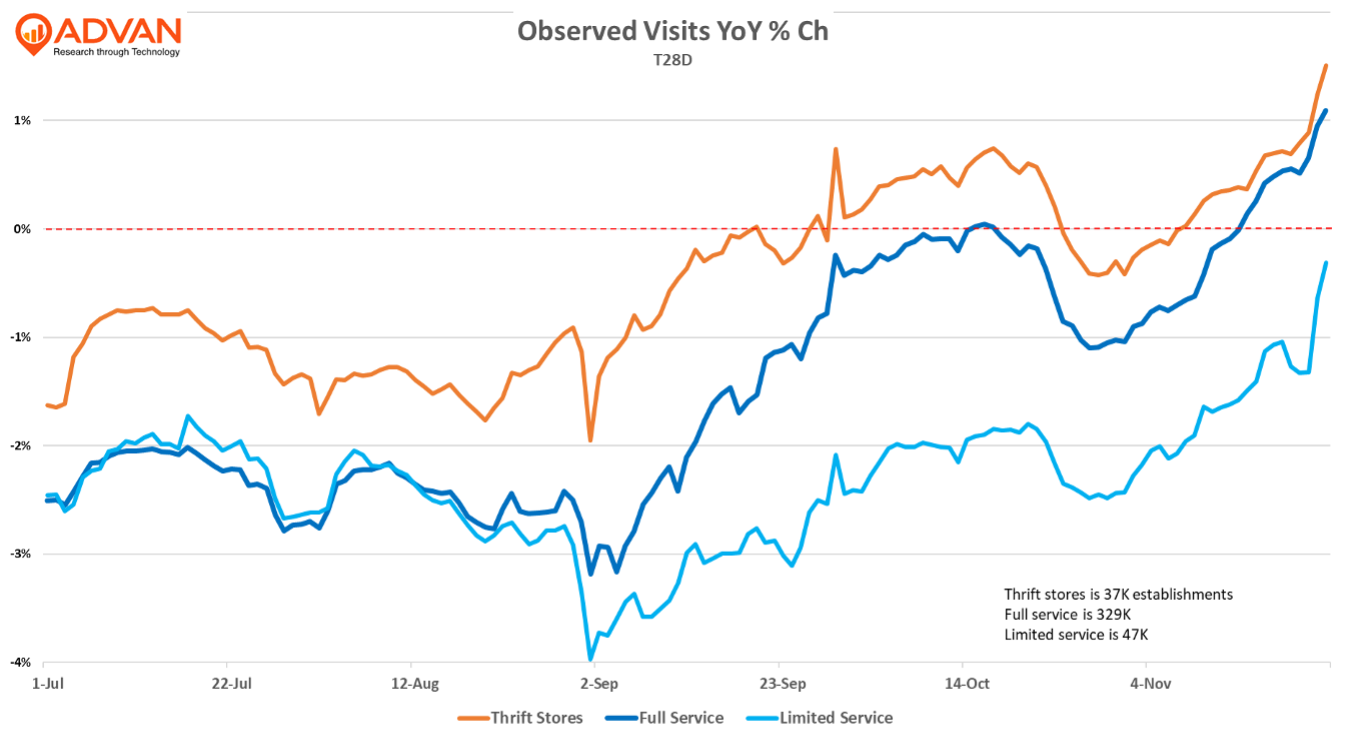

- Used merchandise stores’ growth is equally spectacular, fueled by the thriftiness trend and also the absence of Temu. Halloween is the category’s “Christmas season” and it had a strong Christmas per October’s observed traffic, as shown in the chart below.

- Finally, Food-at-home consumption (real, not nominal) is outpacing food-away-from-home consumption due to the economic pressures on non-affluent households. Full-service restaurants continue to produce a stronger trend than limited-service, driven by the more-affluent feeling good and the fact that full-service is more of an occasional visit and tied to a celebratory event, and not as a home meal replacement or where one cuts out meaningful calories (GLPs), unlike limited-service .

LOGIN

LOGIN