- Sherwin reported softer volume results in a lower-volume period, reflecting still soft end-markets. However, the quarter ended and Q1 has started at a faster pace.

- Sherwin’s 2026 is “softer for longer” and a continued tepid new and existing housing market. Consequently, like in Q4, Sherwin is planning for market share gains to drive top-line growth.

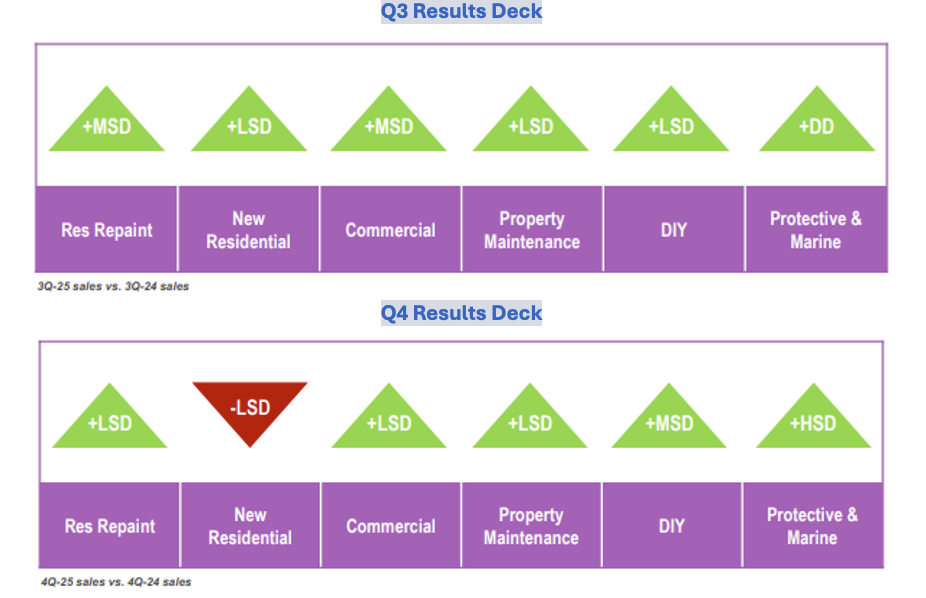

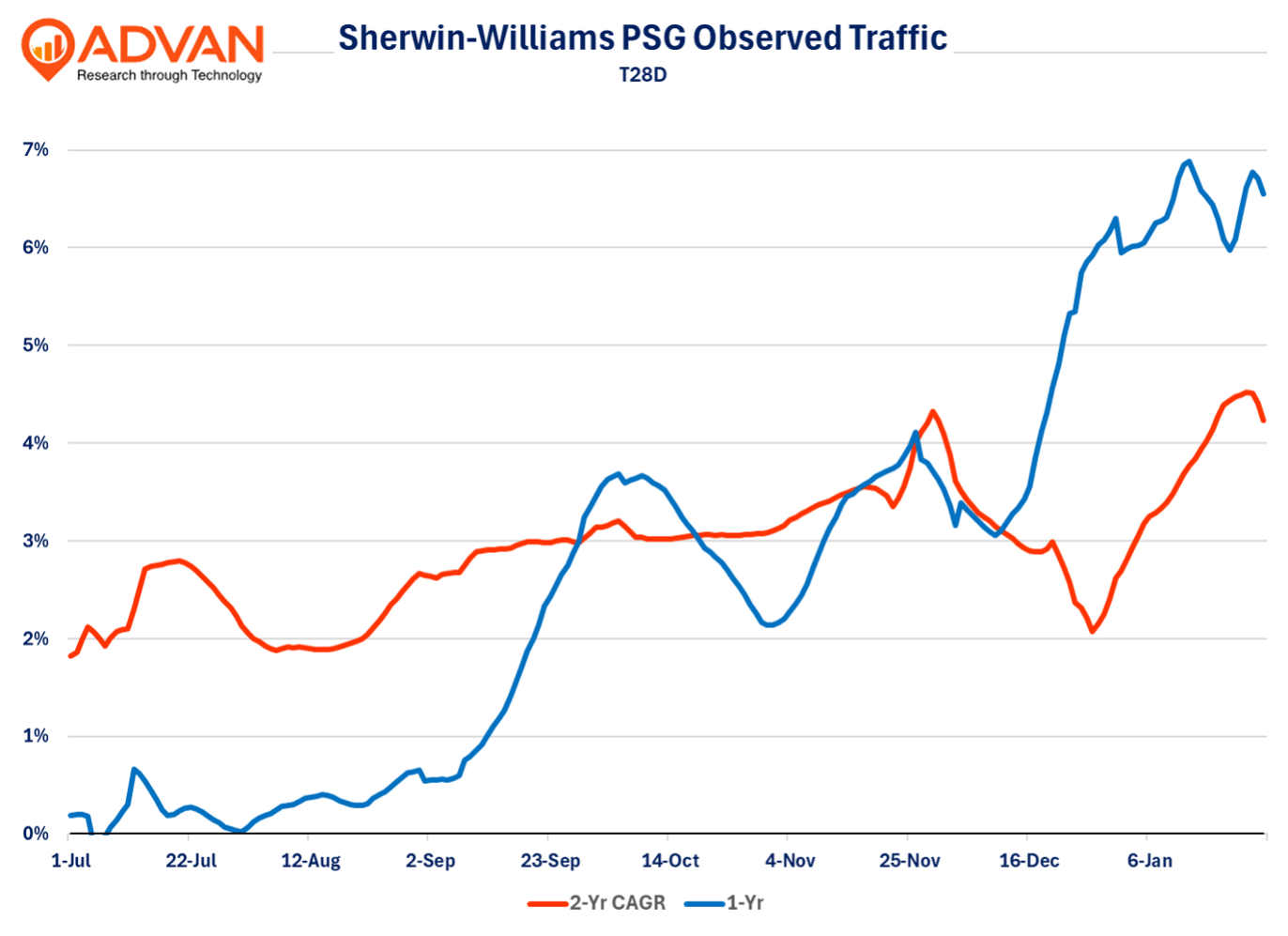

Sherwin-Williams produced a +2.7% sales increase for its Paint Stores Group (PSG) business segment which was softer than Q3 (+5.1%) as volume slipped (-2% and -400bps QoQ). As shown in their by-vertical charts below, most verticals slowed by 200-400bps QoQ, except Property Maintenance and DIY; DIY improved by +200bps QoQ. Interestingly, its Consumer Brands Group (which is sales to retailers), the North American segment was consistent QoQ at -LSD. And so, the DIY business improved at the PSG, but didn’t at big-box retail. (Lowe’s is the largest customer for the Consumer Group.) Observed traffic (Advan) also shows the improved trend of DIY at the PSG with the trend +260bps stronger QoQ on a 1-yr basis as shown in the chart below. The strength in the 2H of the quarter, into Q1, and the 2-yr CAGR also improved (+55bps), all of which point to a good start for 2026 despite more cautious guidance, which will cover next.

For Q1 and ’26. Sherwin guided for LSD sales growth for the PSG; that’s based upon price increases, volume is expected to be flat to down. CEO Heidi Petz said, “The demand environment feels much like it did a year ago. The softer for longer dynamic… remains intact. While some conditions are gradually becoming more stable, many of the indicators we track along with cautious consumer sentiment provide little support for any broad-based or accelerated recovery at this time…. On the architectural side of the business, Residential Repaint remains our single biggest growth opportunity, and we have and will continue to make investments to win here. Demand remains difficult to predict with industry forecasts for existing home sales growth varying widely, from slightly down to up double digits. The mortgage rate lock-in effect remains real. Harvard’s LIRA index is projecting very modest growth and select retailers have forecasted flattish home improvement growth as a base case. Additionally, consumer sentiment remains muted. These same dynamics also signal another potentially challenging year for DIY. We expect the new residential market to be down at least in the mid-single-digit range this year, given negative single-family starts over the back half of 2025 and many forecasters’ expectations for further softening in 2026.” As a reminder, given that the professional / commercial market is a B2B billed business, other alternative data types are less robust for monitoring the PSG’s activity.

LOGIN

LOGIN