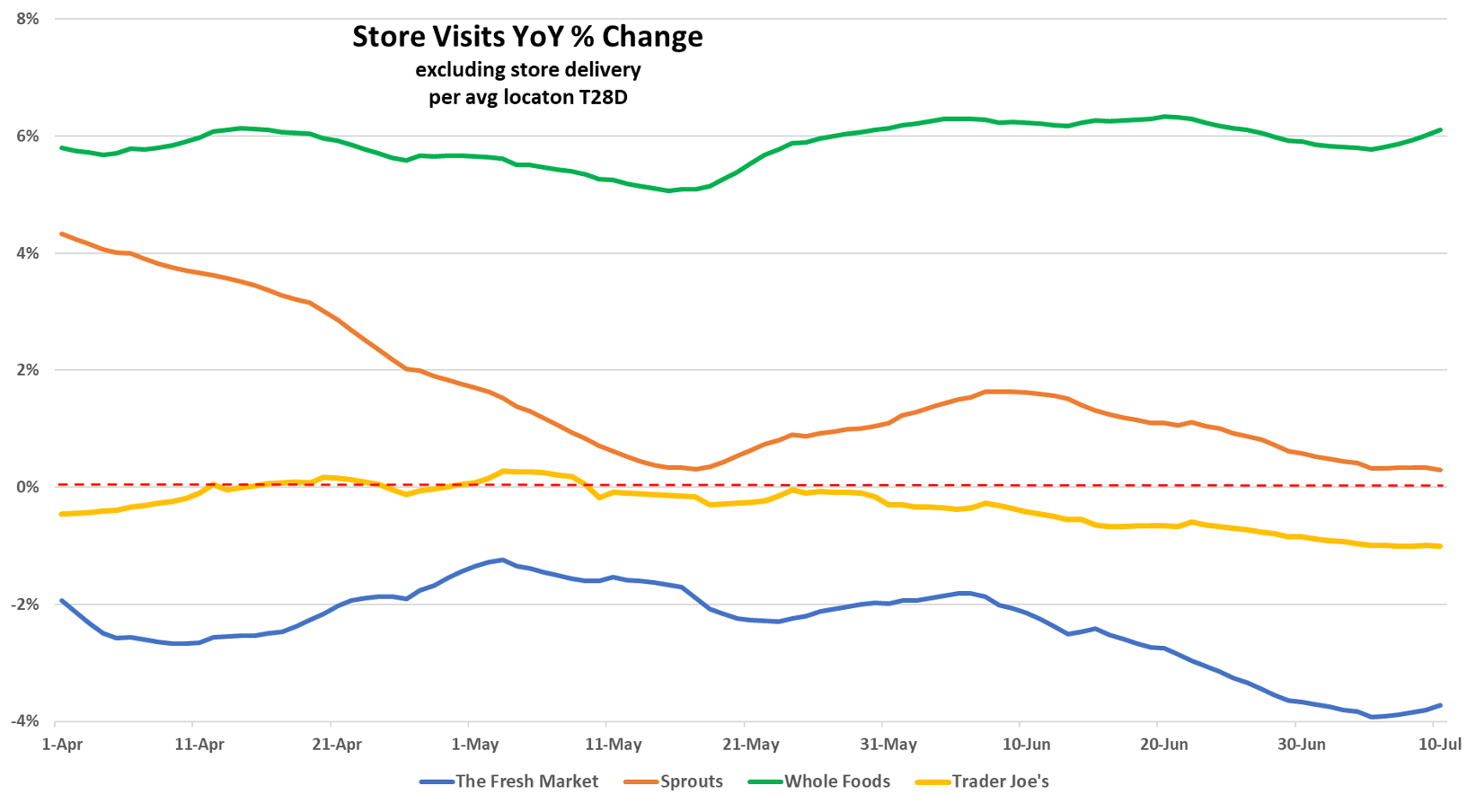

In light of our Tuesday article on the slower pace for retail sales in June and the tough earnings report by Conagra on Thursday, we wanted to delve into how “advantaged” grocers were doing. (Conagra reported a segment profit decline of -10% for its May-end quarter and profits for the next twelve-month period are expected to decline another 20%-ish.) As the chart below demonstrates, these specialty grocers slowed in mid-June as well. However, in the case of Sprouts and The Fresh Market, the stepdown was largely due to difficult comparisons as the two-year CAGRs strengthened. Whole Foods’ traffic growth and outperformance is simply impressive; however, it is perhaps also a little misleading given that Kohl’s has stopped accepting Amazon returns at many of its locations, which results in Whole Foods being the alternative.

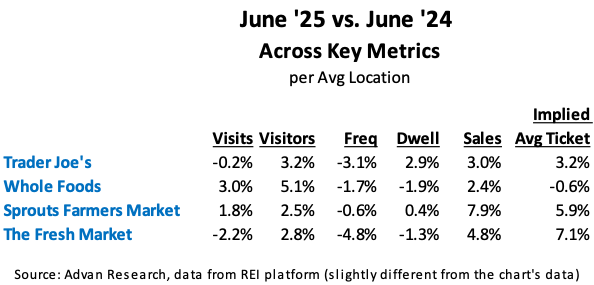

We wrote “advantaged” as all benefit from three powerful macro trends, which we frequently write about; those being, (1) the shift from center-of-the-store categories to the store-perimeter (i.e. fresh), (2) share-of-stomach moving from national brands to private label and the retailers that excel at it (as well as prepared foods). And (3) the “thrifty K-shaped economy” with those brands leveraged to the affluent, benefiting from more stability in household spend, and those that can show more value (this is what Whole Foods is doing), benefitting from trade-in. All of these macro trends are hitting Conagra (and its peers). What we can see in trip behavior is shown in the table below.

Trader Joe’s – the increase in the dwell time aligns with the change in average ticket and suggests more items in the basket (UPTs). Visitor growth implies that they are gaining households, both metrics are diluted by new stores that enter the denominator of these figures, especially as +6.5% unit growth is a sizable figure, and as such, on a comp-basis visitors and visits are up a healthy amount. Whole Foods – the decline in dwell time likely reflects the dilution effect from the Amazon returns, that too, is lifting the visitor growth. The flat average-ticket likely reflects Whole Foods keeping a lid on price increases. The Sprouts Market – the increase in the dwell time aligns with the change in average ticket suggests more items in the basket (UPTs) and the strong merchandising by its merchants, the “foragers” which we’ve written abou t. The Fresh Market – the sharp increase in average ticket while dwell time decreased is puzzling. However, things are not “the same” at the brand as its new CEO (arrived in February) is mixing things up. He was interviewed this week and the take-away from that is that the grocer has put its goal of creating a European-esque grocery shopping experience back at the forefront, with foodservice as a star attraction along with a soothing atmosphere and a hospitable staff. Those are dynamics that should be driving UPTs and average price (AUR); Advan’s data shows that they are gaining traction on those metrics.

TFM CEO Brian Johson, “I would say that our differentiation starts with our service and our people. Because we are a smaller footprint, and because we offer a lot of services in our stores — with fresh cut meat, our service meat counters, our service deli counters, our service bakery counters — there are many, many instances when a guest shops with us, they’re going to interact with our people. So that’s a service, and we call it impeccable hospitality… and that makes up that differentiated shopping experience from a service perspective. Being called The Fresh Market, our fresh department is certainly a differentiator for us. We offer fresh-cut meat that we cut fresh every single day… Our produce is the highest grade product that we can buy. In our deli, or our convenience meal solution area, as we call it, we’ve got many, many either low- or no-cook meals that are chef-quality… In our grocery department, we’ve got a very interesting assortment. We have some of the world’s best products, but we also have some of the highest quality and unique local products from around the different markets that we serve here in the U.S., and that’s something that we’re really working on expanding in our stores — having more of those local items.”

LOGIN

LOGIN