- Starbucks reported much improved comp-growth for its Dec. quarter, including in the US. The improvement stems from the turnaround initiatives devised by CEO Brian Niccol (now five quarters in the role.)

- Advan data closely matches management’s proof points on the turnaround. The introduced annual guidance indicates that management expects the momentum to build. Niccol’s plan is working, including the reinvestment in store standards, service levels, and brand. Better profit levels are to come in the 2H.

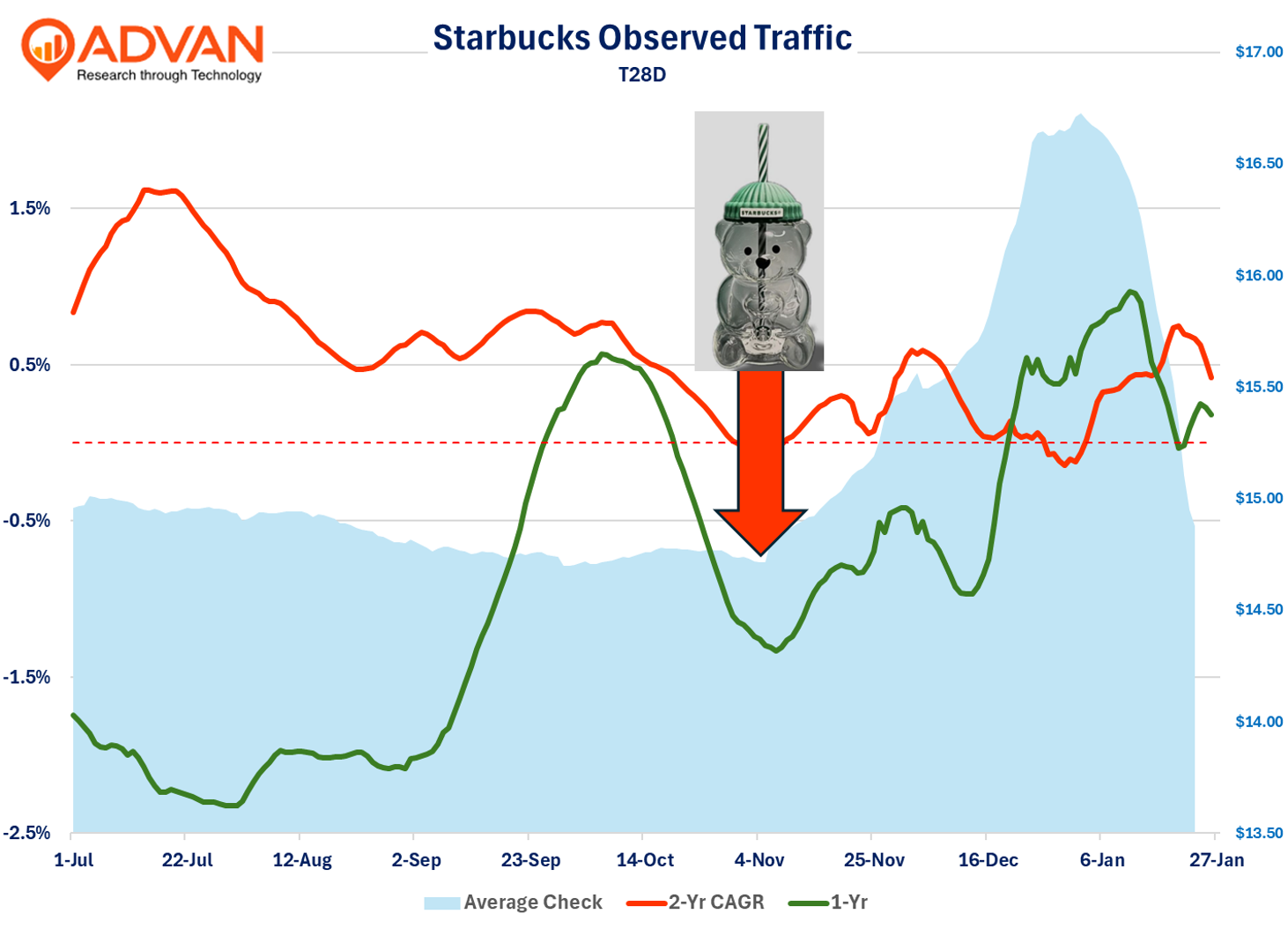

Starbucks drove a +4% comp-sales increase in the US for the December quarter, with traffic up +3% and ticket, +1%. Net revenue for the region increased +3%, despite a -1% decline in store count. The 2- and 3-yr comp / traffic CAGRs all materially improved QoQ. One should expect some of that when a larger number of underperforming stores are removed from the comp-base (50 bps of the improvement came from transferred sales from the closed locations); however, the 500bps improvement in the 3-year comp-traffic CAGR is atypical. The +3% traffic increase was more than Advan data observed (+1% per location), which likely stems from the larger change in the store base, which creates noise in the store mix. In terms of dayparts, morning outperformed the average by 200bps and afternoon by 350bps. Per the 200bps, CEO Brian Niccol, “We wanted to win the morning, and that is exactly what we’re seeing. The 350bps gain is a strong proof point of Starbucks’s success in reclaiming its role as the 3rd place in consumers’ routines (a key objective of Niccol’s). Additionally, there was a +4% increase (total day) in average store visit duration, another proof point. (We’ve been watching this metric turn around since last spring.) The chart above shows that the 2-year traffic comp is holding firm; the Bearista Cup introduction also produced a nice uptick in average-ticket; more espresso drinks (i.e. mix) also helped.

Reclaiming the 3rd Place comes from improved store standards and friendly service, Niccol said, “Our Green Apron Service standard continues to improve our Coffee House experience, creating value for our customers and underscoring our growth potential in North America. Through the quarter, we leveraged bigger rosters, new customer service standards, continued low hourly partner turnover, and our SmartQ algorithm to deliver more consistent, timely and personal service. As a result, across our U.S. company-operated coffee houses, positive customer comments grew in the quarter. All day and peak throughput steadily increased… We’re measuring five key metrics that are closely tied to comp growth and are within coffeehouse leaders’ control. While it’s only been a few months, leaders across our North America operations are already using the new report to help them better run their coffeehouses and take ownership of their action plans to improve performance.”

Per the remodels, which are difficult for Advan to isolate, Niccol, “Our 650 pilot stores continue to outperform the fleet by about 200 basis points in comp, and we’re seeing most of that – it is all pretty much driven by transactions.” However, if we focus on Santa Monica, CA and the nearby region (<10 miles), traffic per location increased +300bps, exactly the level that Niccol described. Niccol, “We’ve put seats back into our cafes. We’ve not put uplifts everywhere, but we’ve tried everything we can to get at least seats back in dollar cafes, and you know what, every cafe I walk into, guess what? People are sitting in those seats, enjoying a cup of coffee or a beverage, and dwelling.”

More evidence of the turnaround came from Niccol’s share, “Starbucks Rewards 90-day active members reached a record 35.5 million customers during the quarter [+3.3% YoY]. Rewards transactions grew year-over-year for the first time in 8 quarters and non-rewards transactions grew even faster. In fact, this was the first quarter we grew both rewards and non-rewards transactions since FQ2 of fiscal 2022.” Advan shows that visit frequency improved slightly YoY, vs. a decline in the base period and Q3, i.e. much improved. Niccol “People came back to the brand and we also drove engagement or more frequency with our existing customers.” As such, the underlying improvement in frequency is above what Advan data shows. Niccol, “What is great about what’s happening in a Rewards customer is it’s through better engagement that we’re getting people to be active, not through discounting and couponing, but rather giving people the Starbucks experience and the thing that really makes Starbucks unique, which is our personalization.”

Management guided for a +3%+ US comp for the entirety of the fiscal year, i.e. the improvement is to be sustained, and for margins to expand in the 2H. Given that they are now providing full-year guidance, that implies that they have a firm hold on the business.

See our last write-up on category trends here and SBUX’s prior earnings report .

LOGIN

LOGIN