- The wireless / cable industry’s competitive fervor is intensifying, for which the i-Phone 17’s high consumer appeal has been an agent; Apple is a large beneficiary of that fervor. The intensity has risen because: (1) increasing overall wireline-to-wireless convergence (lots of new fiber being laid down and traditional cable’s contraction is worsening), and (2) Verizon has a new CEO (or sheriff) that’s gunning for market share of net-adds.

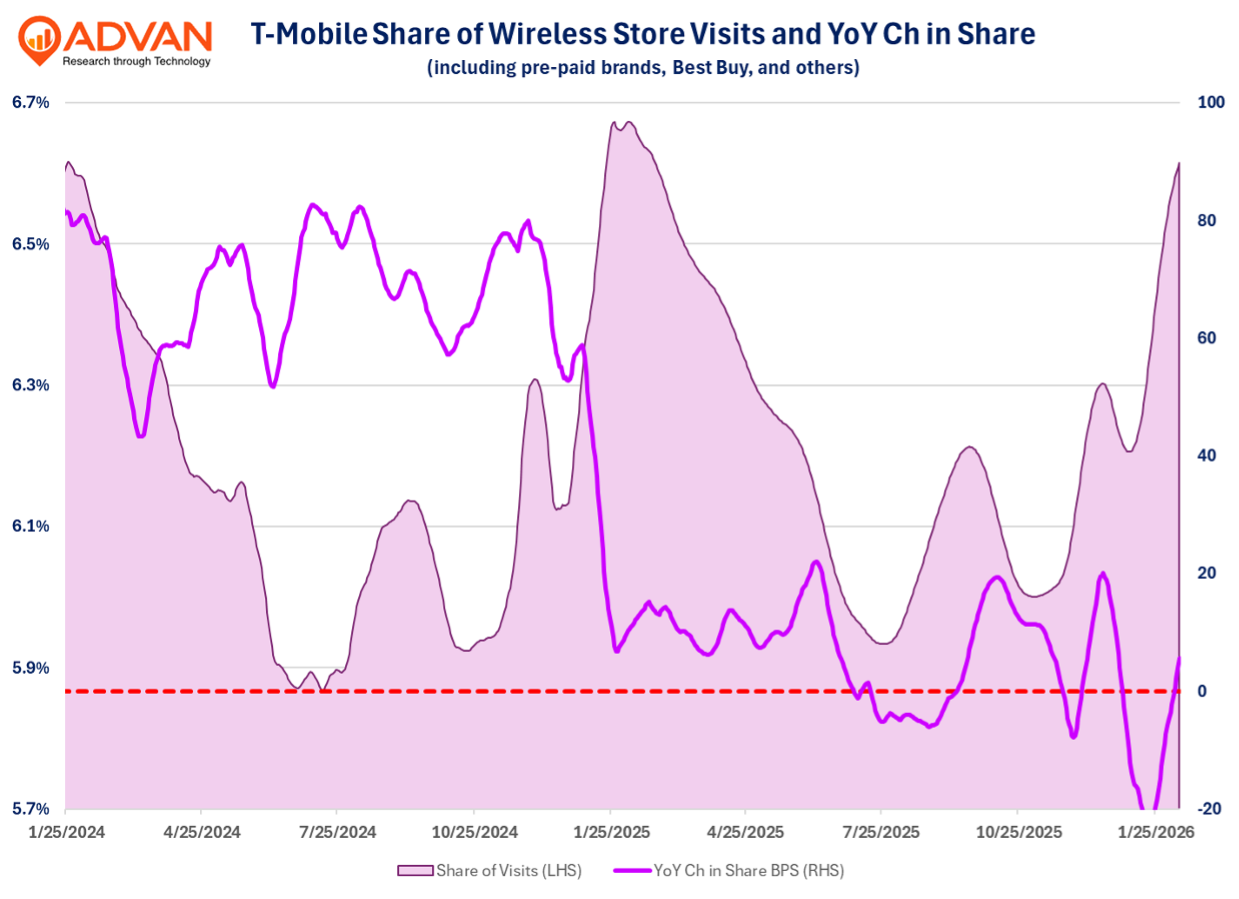

- Observed visitation (Advan) market share trends have aligned with T-Mobile’s trends in postpaid phone net adds.

As previewed in our note two weeks ago about Apple’s strong results and iPhone sales, Verizon’s new tenacity, convergence (between legacy wireless, wireline, and cable), and the service operators use of the iPhone 17’s strong consumer appeal to lock in subscribers is revealing that the industry’s competitive fervor is intensifying, and Apple is a large beneficiary of that. T-Mobile’s Q4 results allow for a more complete view of that fervor, and as we previously concluded, it’s fierce and adversely impacting T-Mobile’s KPIs and financial results. In the note, we alluded that T-Mobile’s outsized market share capture of the post-paid phone business was likely to mellow. Well, that’s what Q4 and the 2026 guidance show; Q4 net adds of 952K were below consensus* (991K) and sequentially down in what historically is a sequentially up quarter. 2026 guidance for 0.90M to 1M net adds was also below consensus (1.3M). Like its peers, T-Mobile’s equipment revenue increased a large +14% YoY (+$665M), and versus +9% in the prior 6-month period, putting more dollars in Apple’s coffers.

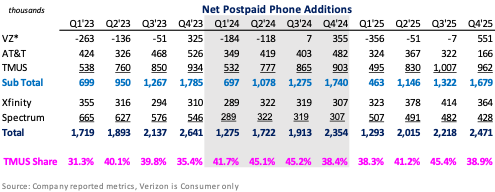

In terms of Advan’s observed visitation data**, what a diminution in T-Mobile prior “outsized market share capture” looks like is shown in the chart above. In the 1H’24, T-Mobile captured a massive +774bps of YoY market share in post-paid phone net adds. During the 1H’25, Verizon changed its pricing to deliver greater value to the consumer, as did Charter; the result, T-Mobile gave back -362bps of net add market share – still up a lot on a two-year basis. For the 2H and Q4, its market share gains were modestly up. The main differences in the market during the quarter were Verizon’s newfound tenacity (+551K subs) and the iPhone 17. T-Mobile’s Q4 results also revealed a moderation in net new postpaid accounts (not lines), which increased only +261K, down from Q3’s +396K and Q4’24’s +263K. The release stated that the decline was due to “higher industry switching,” i.e. higher competitive intensity. Postpaid phone churn was also substantially worse at 1.02%, up from last year’s 0.92%, Q3’s 0.89%, and consensus’ 0.95%, driven by “higher switching.” ARPU was lowered due to “increased promotional activity.” Quarterly EBITDA and free-cash-flow were pressured by Equipment Expense (i.e. dollars in Apple’s coffers) and other competitive pressures.

See our last write-up on industry trends here .

‘* Visible Alpha ‘** Our NAICS code needs to be refreshed given the flurry of consolidation in the industry over the past three years. We are in the process of that and so don’t hold the market share # calculated in the chart as precise. We will have an updated chart and measurement when we preview Q1 results.

LOGIN

LOGIN