Two months ago, we reviewed Target’s fiscal 1st quarter results, and before that, the news that they would be accelerating the store opening pace to 30 per year. Since then, the false narrative that boycotts following DEI policy changes were leading to severe traffic declines, along with growing media scrutiny of management’s decisions, including from CNBC with the title – **“Lost their identity: Why Target is struggling to win over shoppers and investors.” **Our view on the topic differs from CNBC’s take as we believe that Target’s issues are principally threefold: first, they are being encroached upon by four behemoths (Walmart, Costco, Sam’s, and Amazon) like never before, second, we have a Thrifty K-Shaped economy which privileges the Big-4 just mentioned, and third, they are behind on having a scaled 3rd party marketplace and store delivery service (these components are currently scaling at Target). That said, the CNBC article noted issues with out-of-stocks, something that we’ve heard in other reports; our review had pointed out that units-per-transaction (UPTs) were slipping, which is a signal that there could be an out-of-stock issue. We don’t have a view on how the Tarzhay-Moxi is working / not-working, which the article implies is “not working.” However, yes, falling UPTs would also be the consequence of it not working. That Christina Hennington, Target’s former Chief Strategy and Growth Officer, is suddenly out is suggestive. We also have data to interrogate Target’s new stores – new stores being a key component to their long-term earnings growth and value creation (see our analysis here ). This week, Target released the locations for eight new stores that open in August, which were preceded by three that opened on April 13th. What does the data show?

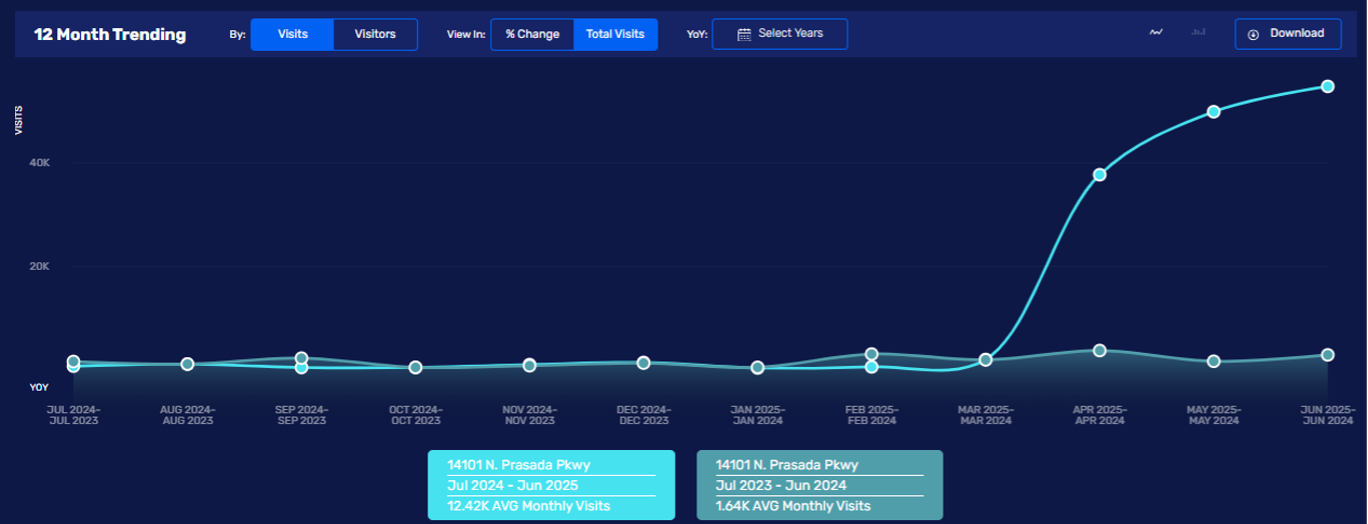

- Advan has data on two of the April openings, which are shown in the first two figures below. The average Target store in June 2025 had 150K visits to the parking pad, far more than the Prasada Parkway’s 54.7K and Tahoe Village’s 91.2K. (Prasada Parkway is northwest of Phoenix.) However, both locations are still climbing, and so it’s early. Of the two, Prasada is the critical one given its very large size, 151K sq-ft and 200 employees. (Target provides these figures in its press release.) By contrast, Tahoe is only 64K sq-ft and 100 employees.

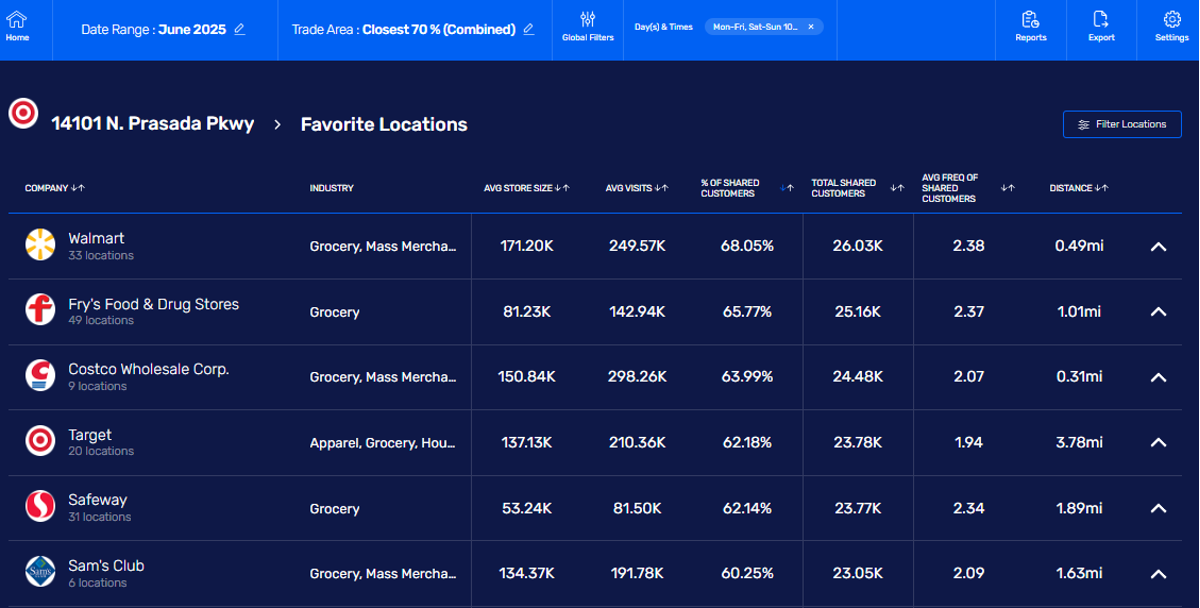

- The Prasada store shares customers with the Big-4, 68% of the Target-Prasada visitors visited a Walmart in June, with the closest being only a half a mile away, 64% with Costco, and Sam’s, 60%. The Prasada shopping center itself is relatively new, having opened in November of 2022. For 2024, it ranked 2nd out of 40 like-centers in Arizona.

- To invert and focus on the Walmart-Prasada location, it ranked 11 out of 109 Walmarts in Arizona traffic-wise, for ’24, (i.e. it’s a top performing location). For June-2025, 55.7% of its customers visited a Target location, up from 53.1% last year, or +260 bps. The Target-Prasada location captured 11.6% of the visits, indicating that other Target locations lost their cross-visitation with the Walmart-Prasada location, which likely stems from the Target-Prasada location being more convenient for them.

- Advan has data on five of the eight centers that will see a new Target store opened next month. (We will have data on all next month.) Only one of the five had improving visit / visitor / ranking metrics from 2019 to 2024. That one also has a Costco (Bradenton, FL, which is inland from Florida’s west coast), which is an interesting choice by Target for a cotenant given our above view. Moreover, this Costco opened in August 2019, and so, it’s behind the improvement for the center’s traffic and ranking. Target has high expectations for the store given its large 149K square feet size and plans for 200 store employees. The staffing plans for the other seven stores average 130 plant employees.

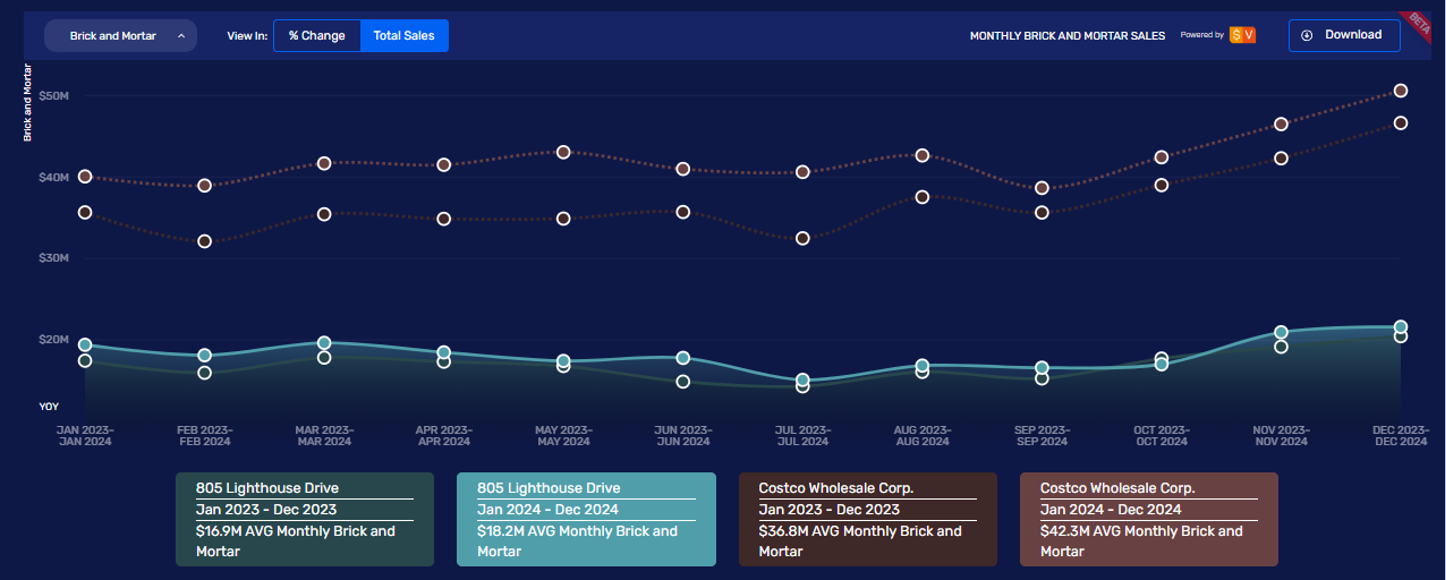

- Costco-Bradenton ranked 18 out of 27 in 2024 traffic-wise in Florida. It also did substantially less in sales volumes than the average Costco-Florida location, $18.2M/mo vs. $42.3M/mo for the average location in Florida as shown in the third panel below. In terms of who visits this location, the median age of over 50, the skew is highly Caucasian (76%) and more affluent; Boomers are the largest subgroup. In our experience, these are not the characteristics known for a highly successful Target, which is more middle-income+, multi-ethnic, young families.

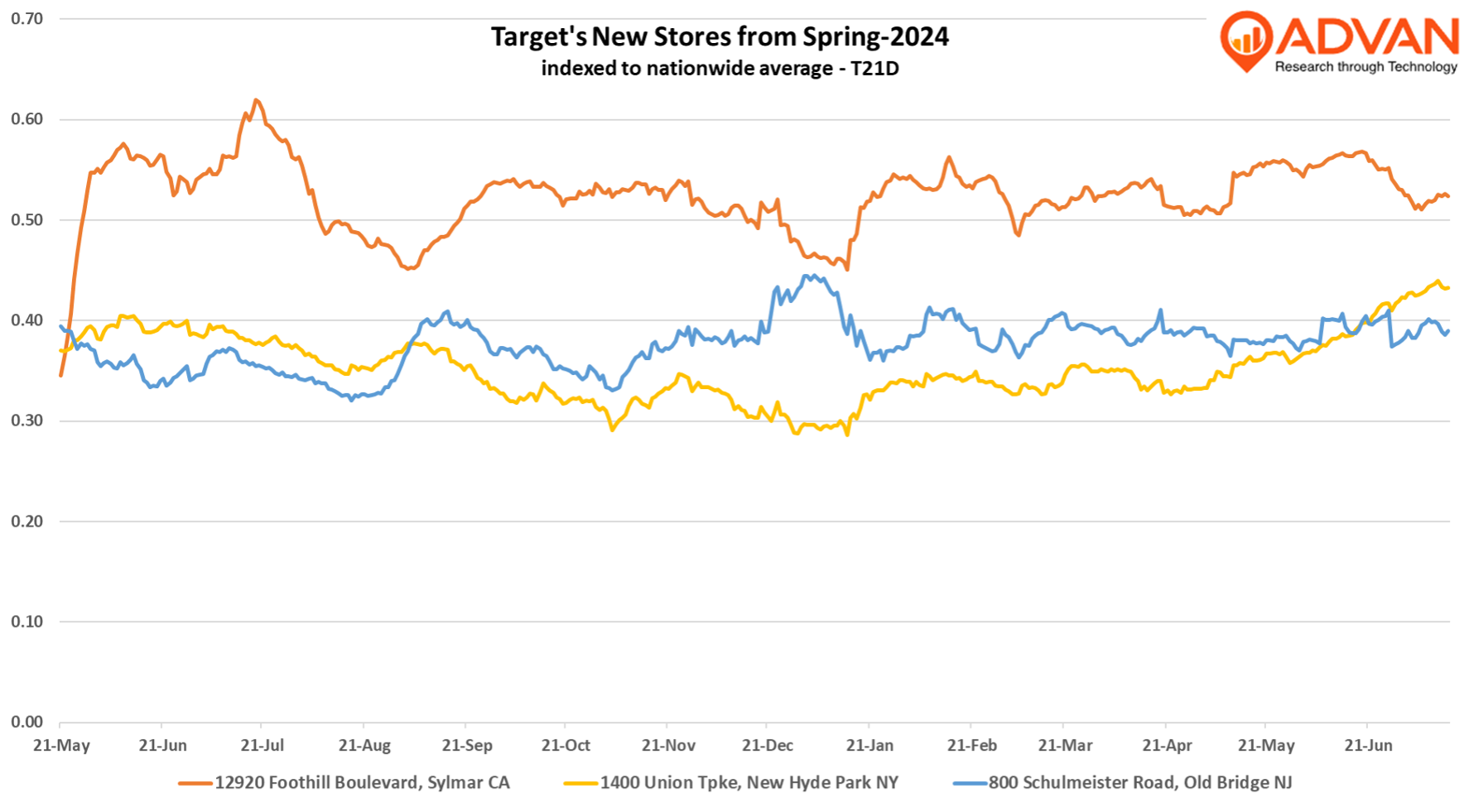

- The final chart below shows Target’s stores that opened in spring-2024. While two are trending in a favorable direction, the one in Sylmar is down from last year. Slymar is on the east side of Los Angeles’ San Fernando Valley; the location is over 100K sq-ft and a former Sam’s Club location. Home Depot is a cotenant and it ranked #24 out of 231 traffic-wise in California for 2024, i.e. darn good. This Depot location had grown traffic (+15%) consistently for the past year; however, for the past two months, the trend has substantially softened. That may reflect Federal policy changes and actions over the past couple of months in Los Angeles, which may hold for the Target-Sylmar location as well.

Our conclusion from this analysis is that Target has work to do on a few of its new high-potential stores. Success on this front will contribute to comp-store sales increases in the long term.

New Target location (opened in April 2025): 14101 N. Prasada Pkwy

New Target location (opened in April 2025): Tahoe Village Center

Target Prasada Customer Overlap with Walmart, Costco, and Sam’s

Average Monthly Revenue vs. the Costco-Florida Locations on Average

Foot Traffic to Target’s New Stores of Spring ‘24 vs. Company Average

LOGIN

LOGIN