With Target’s FQ3 results, we wanted to circle back to our preview note , “Target – Updated views on Target’s performance, any good news?” In that note, we opined that there were a few key things to listen for in the results, while also highlighting the competitive challenges. Below we highlight those items, along with what we heard. Our conclusion from all of this is we see progress in both management qualitative comments and Advan’s data, especially in the month of October – a fairer month to judge progress given that incoming CEO Michal Fiddelke is just getting started with his strategic plan to right Target.

What’s the progress in the “re-Tarjay-ification” of Target? The two most Tarjay categories are apparel & accessories and home furnishings & décor, and underperformed the total sales results and showed no sequential improvement in growth. However, within its hardlines business is toys, which grew +10%. Additionally, Halloween was called-out as a strong event as well (which wasn’t true across retail.) Fiddelke said, “Our ability to build a unique assortment of the right, stylish on-trend products at incredible value that’s so central to who we are and key to our differentiation and future growth. At Target, we believe that offering an assortment that’s distinctly ours is essential to maintaining our merchandising authority with our guests. Not every category plays the same role towards these efforts, but together, they create an assortment and experience that feels unmistakably Target. A great example is the transformation of our hardlines business into FUN-101 an evolution in bringing greater cultural relevance, style authority, and trend-right energy to the assortment, reinforcing what makes shopping at Target so special…. Home has been a challenged business for us. We are making changes to the product to elevate the style of the product, but then we’re also changing the store experience to facilitate more discovery to facilitate more inspiration and really stand tall for what will be a revamped and reinvented Threshold brand.”

Fiddelke also shared that the recent 1800 HQ reduction-in-force was more about removing layers to get things done with greater urgency and more intent, less, i.e. fingers in the pudding. Fiddelke, “We’re redefining roles throughout the cross-functional team that supports our assortment planning and buying decisions, what we call our merchant roundtable, to better equip our teams to make bolder decisions even faster. I’m also excited to share we welcome new leaders to the team in areas like our home business to bring new ways of thinking and accelerate change in the signature category. These steps forward are examples of how we’re solidifying our design-led merchandising authority by using people, process and technology to drive greater levels of newness and differentiation across our entire assortment more quickly reacting to emerging trends and amplifying these trends faster than ever before.”

Chief Merchant, Rich Gomez, “We have the largest assortment of exclusive products in retail in the U.S. along with throwback marketing campaigns that transport guests back to the 1980s Nostalgia. Plus, we’re dropping new items into the assortment every week to align with the new episode releases. This is yet another example of the incredible work we are doing to reimagine our hardlines assortment into FUN-101, a year-round celebration of culture, trend and style, served up in an only Target way. And next year, we’re planning to take these learnings and make bold investments to transform the in-store shopping experience and assortment. In fact, we already have plans to introduce more changes to our stores than we have in any year in the past decade.” What is Target doing to grow basket size (UPT) and what is Target doing incrementally to address the needs of households that hold a club membership that also shop Target, and what is Target doing to retain and increase the frequency-of-visit of these households? Fiddelke, “Because being in stock matters so much to our guests, that’s a topic you see us come back to over and over and over again in all of these earnings calls to come because it matters so much. If you’ve trusted us with a trip to the store, we can’t let you down by being out of stock and we haven’t been good enough over the last several years on that front. And so we’re laser-focused on improving that. And a huge credit to the team for the progress that we’ve seen so far. I can dimensionalize that just a little bit more here in a second. But I also want to emphasize that work is not done**. The bar for the consumer for our guests is higher than ever before on that front**. And so you’re going to see us continue to lean in to make progress over time. Where we’ve started is with a really acute focus on those most frequently purchased items, where if we’re out of stock, it hurts more, if you’re a guess, and we’ve let you down….

Fiddelke, “For guest shopping in our stores and online, we’re also investing resources to ensure we have the right product in the right place at the right time all year long. This includes modernizing the technology that forecasts, orders and positions our inventory, using machine learning to optimize flow from supplier to shelf. It’s helping us move inventory more efficiently, improve reliability for everyday frequently purchased items and further improve in-stocks. We’ve coupled these tech enhancements with process improvements some great root cause problem solving by the team and clear measurements that show where we have the most room to improve. All in, we’ve seen meaningful progress on this front. In fact, this past quarter, the on-shelf availability of our 5,000 top items, the ones for which being in stock is most important to our guests and which represent 30% of our total unit sales saw a more than 150 basis point improvement compared to this time last year. But even with this meaningful progress, I want to emphasize that we have much more room to improve and we’re not slowing down.

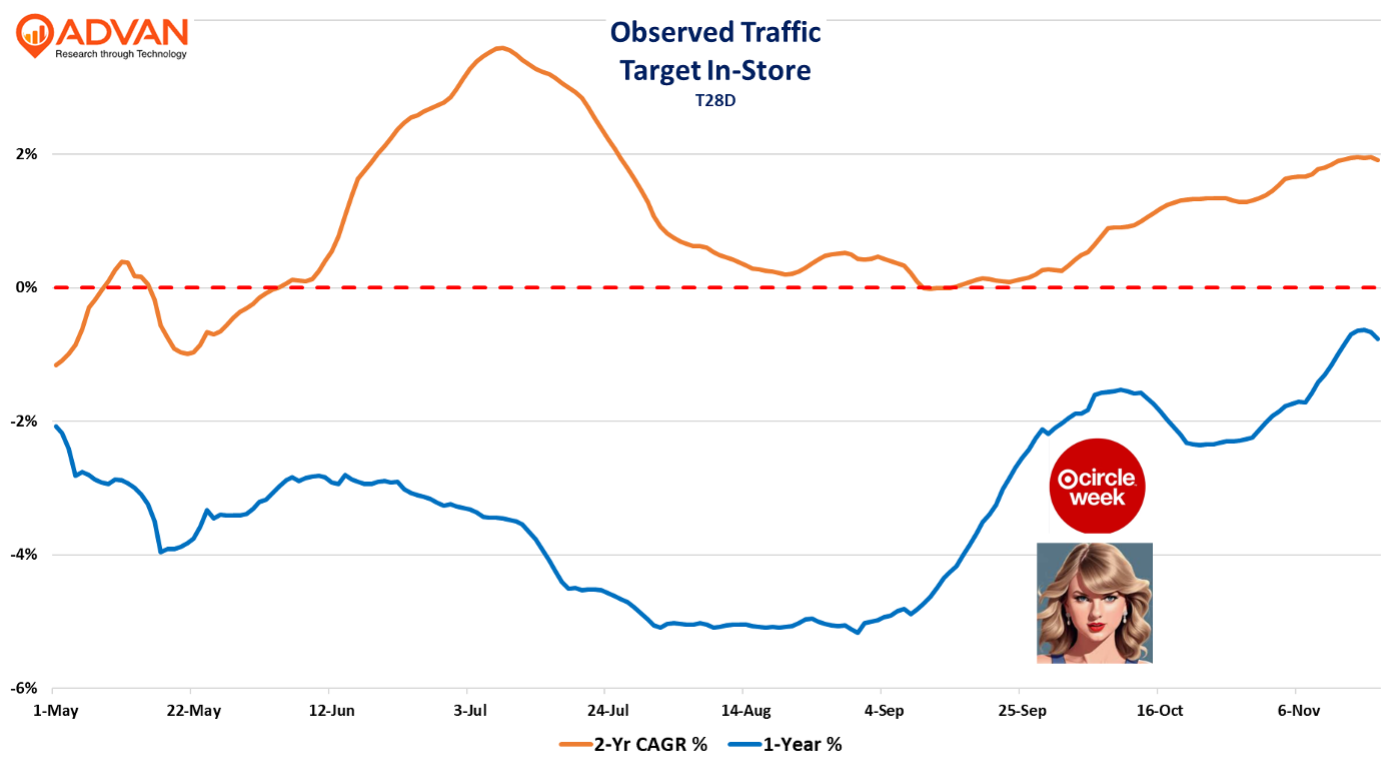

For October, Advan data shows a 2% YoY improvement in shopper frequency and dwell time (which is aligned with UPT); however, average transaction value was still down (product mix and price cuts). Fiddelke went on to say, “Our investments in new stores, store remodels, and chain-wide category changes aimed at providing greater inspiration in joy for our guests every time they shop. Our new larger-format stores are outpacing our initial sales expectations and continue to be a strong source of growth. Given current real estate opportunities, we expect to continue opening these bigger boxes in more and more markets across the U.S. Additionally, we’re formulating plans for next year that will bring greater changes to key floor pads throughout the store, which will accelerate both our merchandising authority and our experience. To support this change, we’ll be increasing our CapEx plans for next fiscal year, spending about $5 billion, about $1 billion more than this year to bring the latest and greatest of Target to new and existing markets.” And, “The work we’re doing to create a consistently elevated experience, we like the trajectory there. That starts with the basic being in-stock as part of a great guest experience, and we’re seeing real meaningful progress from the team’s incredible work to move the needle in the right direction there. And while on that front. We’re not yet satisfied. We’re not yet where we want to be, we like the direction of travel a lot.”

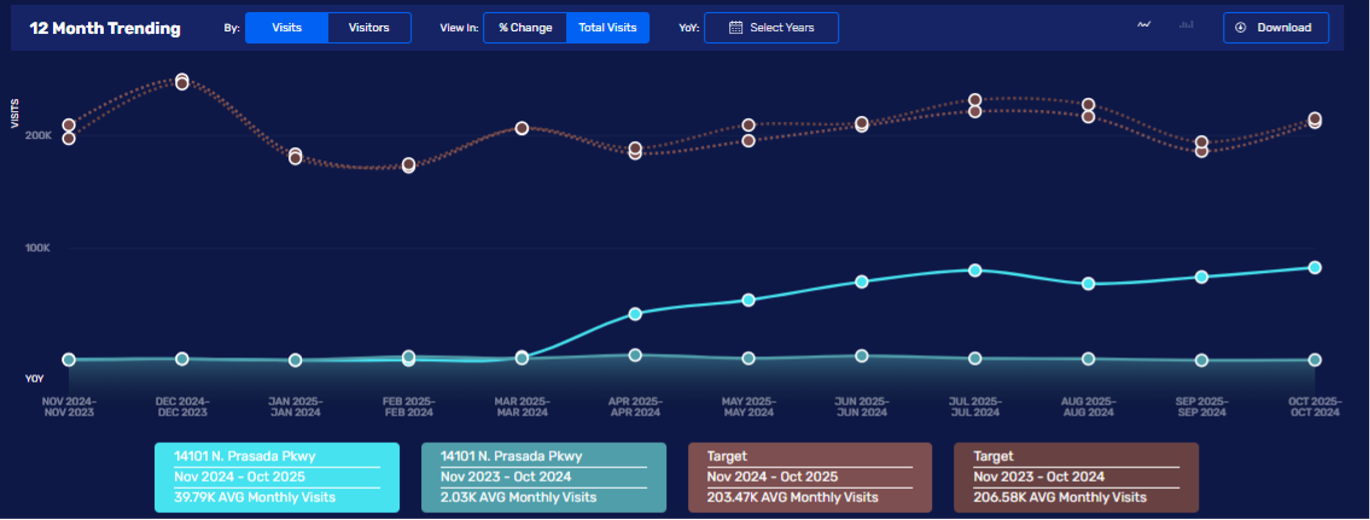

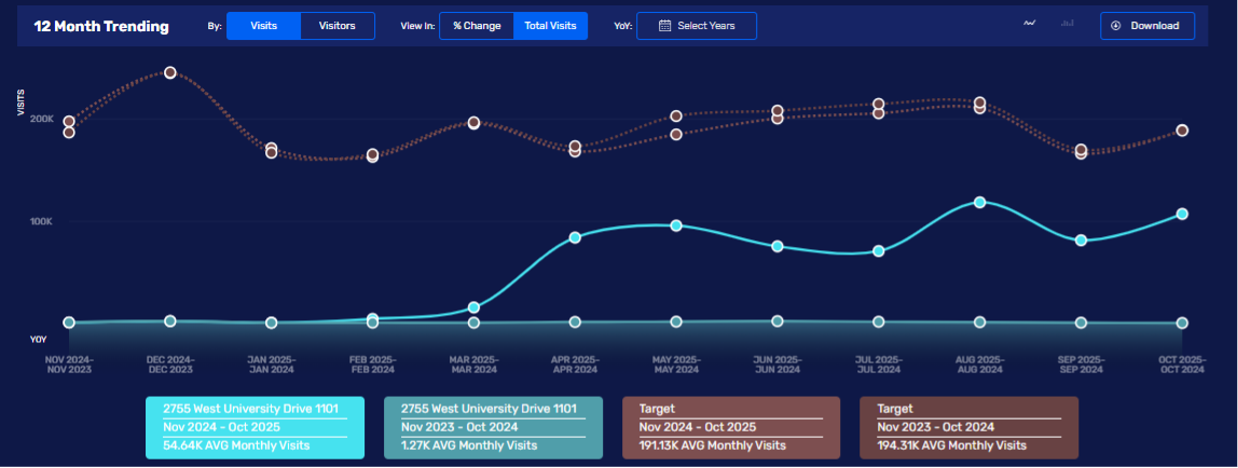

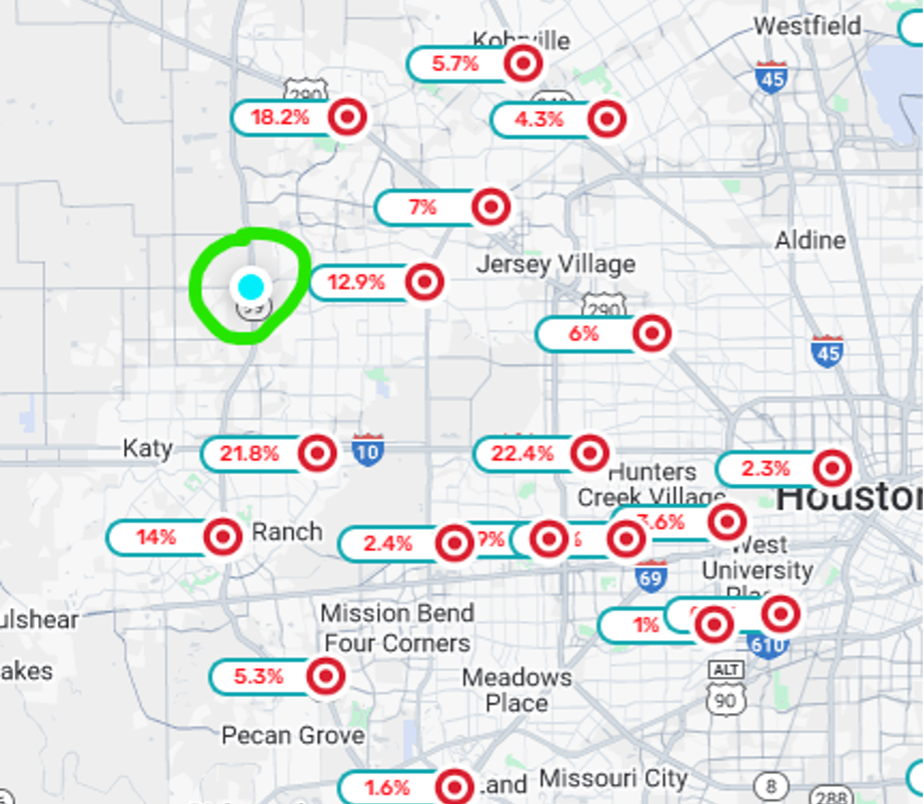

The first two figures below show visits to two new openings (April) of these bigger box stores, the first northwest of Phoenix and the second, northwest of Dallas. Monthly traffic has trended higher since opening to around 100K visits, which is roughly half the 200K visits the regions’ average. The third chart is the Dallas market and Target’s first bigger box store (Katy, Texas) at 140K. What’s shown on the map is shared visits from the Katy store (the green circle) with the other Target locations in the region. The Katy store, despite being on the edge of the region, matches the region’s average. And taken together, half of the Katy shoppers are incremental to Target’s business within the region, meaning that’s their only Target store.

As to the quarter’s sales cadence financial results, management shared, “top line results during the quarter were quite volatile with net sales close to flat in August and October and down about -4% in September… September apparel sales were hampered by unusually warm weather across the country, while October benefited from the response to our most recent Target Circle week as consumers continue to focus on value.” This description closely matches the T28D trend in observed traffic shown in the chart below. (The Taylor Swift drop on October 4th also boosted October.) We also suspect that Target’s customers bought their back-to-school items early in the season, which lifted July, but that pulled from August. That pull-forward was driven by fears that items would not be in-stock due to tariffs and that prices would be higher later in the season on tariff cost pass-through.

LOGIN

LOGIN