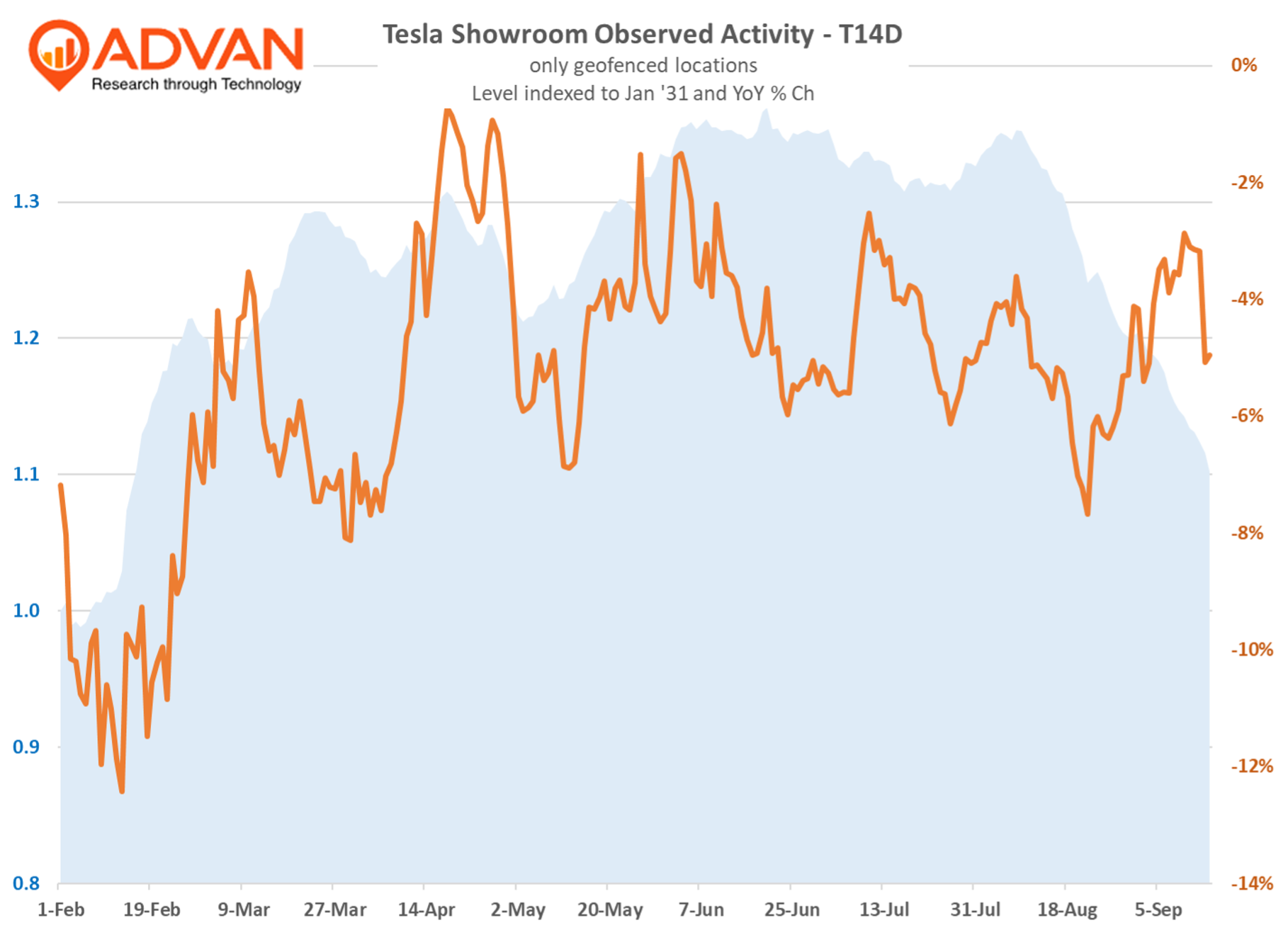

Contrary to our expectation, observed activity at Tesla’s showrooms has not dramatically slowed on a YoY basis as the calendar pushes closer to the expiration of the EV tax credit, something that Tesla is highlighting at its showrooms and website (second panel below). Moreover, it’s a deadline that every active EV buying prospect has to be aware of. Activity has moved lower on an absolute basis as is shown in the blue shade below. In terms of registered new sales, 3rd party estimates peg Tesla at up low-single-digits in July and down low-singles in August.

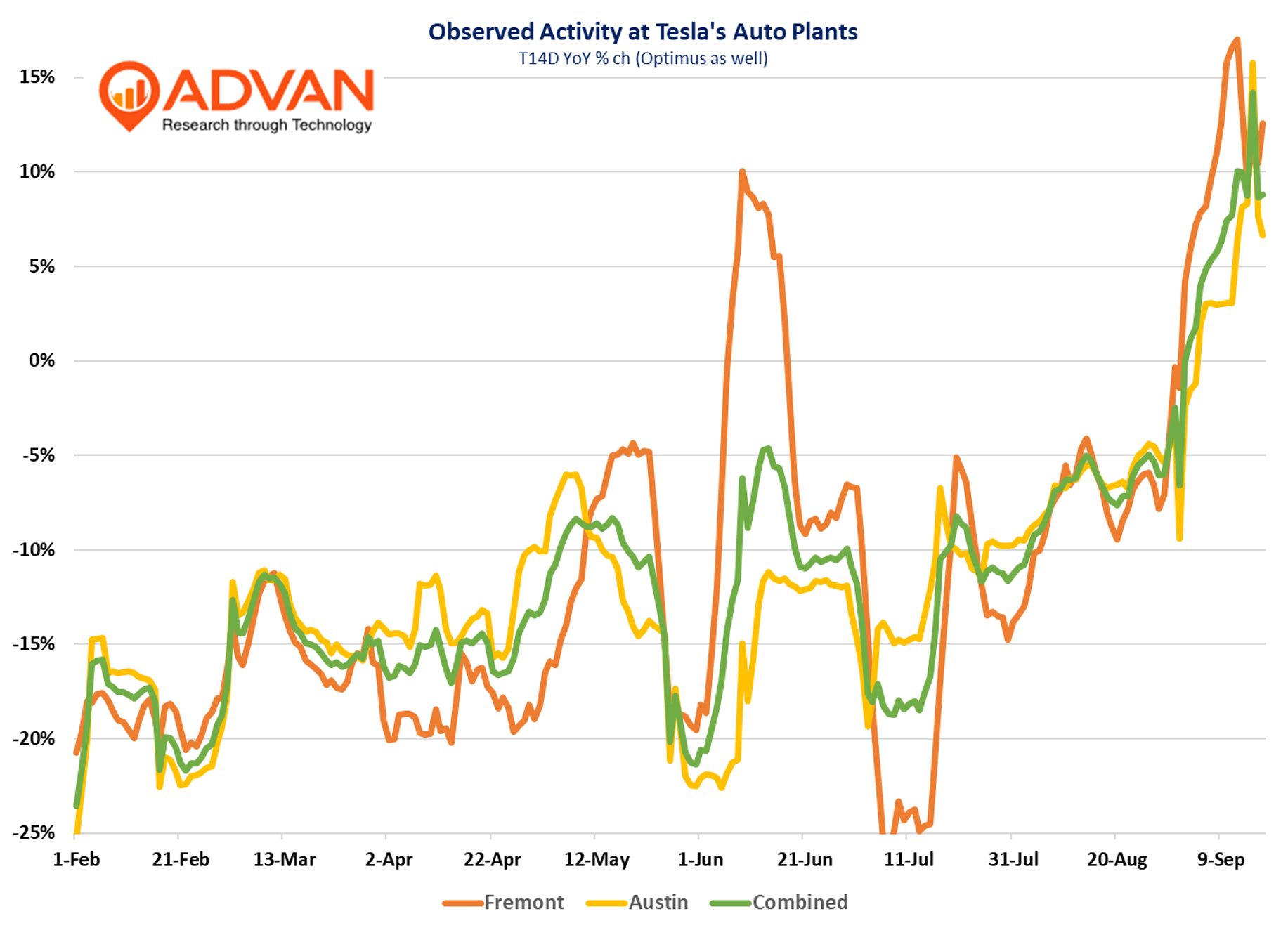

Is it just people visiting the showrooms to kick the tires and doors (or other)? Looking at the activity at Tesla’s Fremont and Austin plants, it appears that consumer demand is stronger. Surly the surge in September’s activity is to get vehicles made and delivered before the September 30th deadline. Earlier we wrote that it took about a month for a Tesla to move from start of production to being delivered to the buyer. Perhaps Tesla has found a way to compress that period, allowing them to run hard into mid-September. Perhaps there are other “delivery” schemes at play. Perhaps lower interest rates are at play, combined with the fact that consumers really, really, like Tesla automobiles (i.e. not speaking to the Cyber Truck). We’ll have to circling back in mid-October to share what the data suggests. However, there has been other signals that demand has been better than feared, including Musk’s $1B open market purchase of TSLA and the $1T incentive plan for Musk to hit “outrageous” targets. See you mid-October.

LOGIN

LOGIN