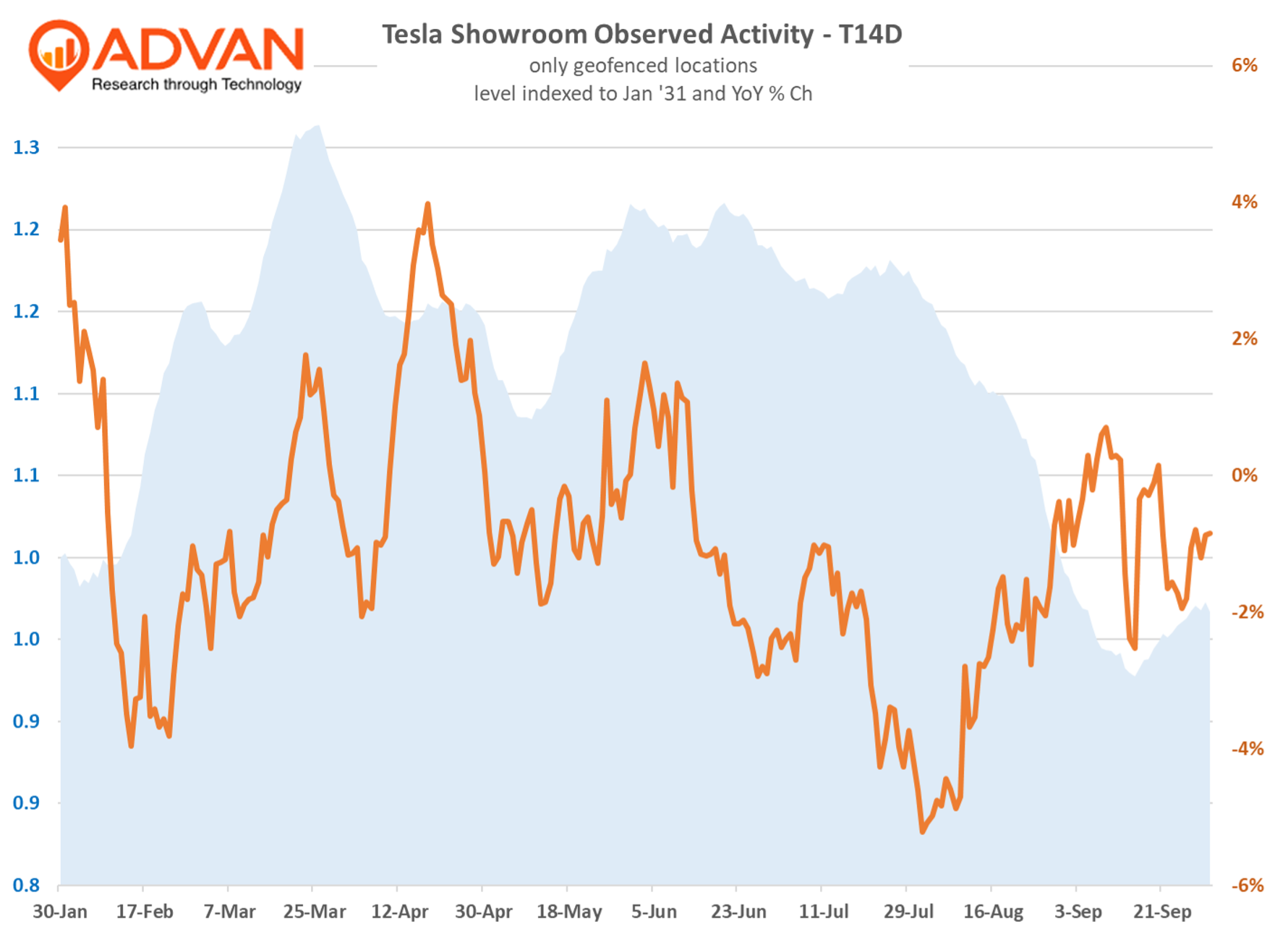

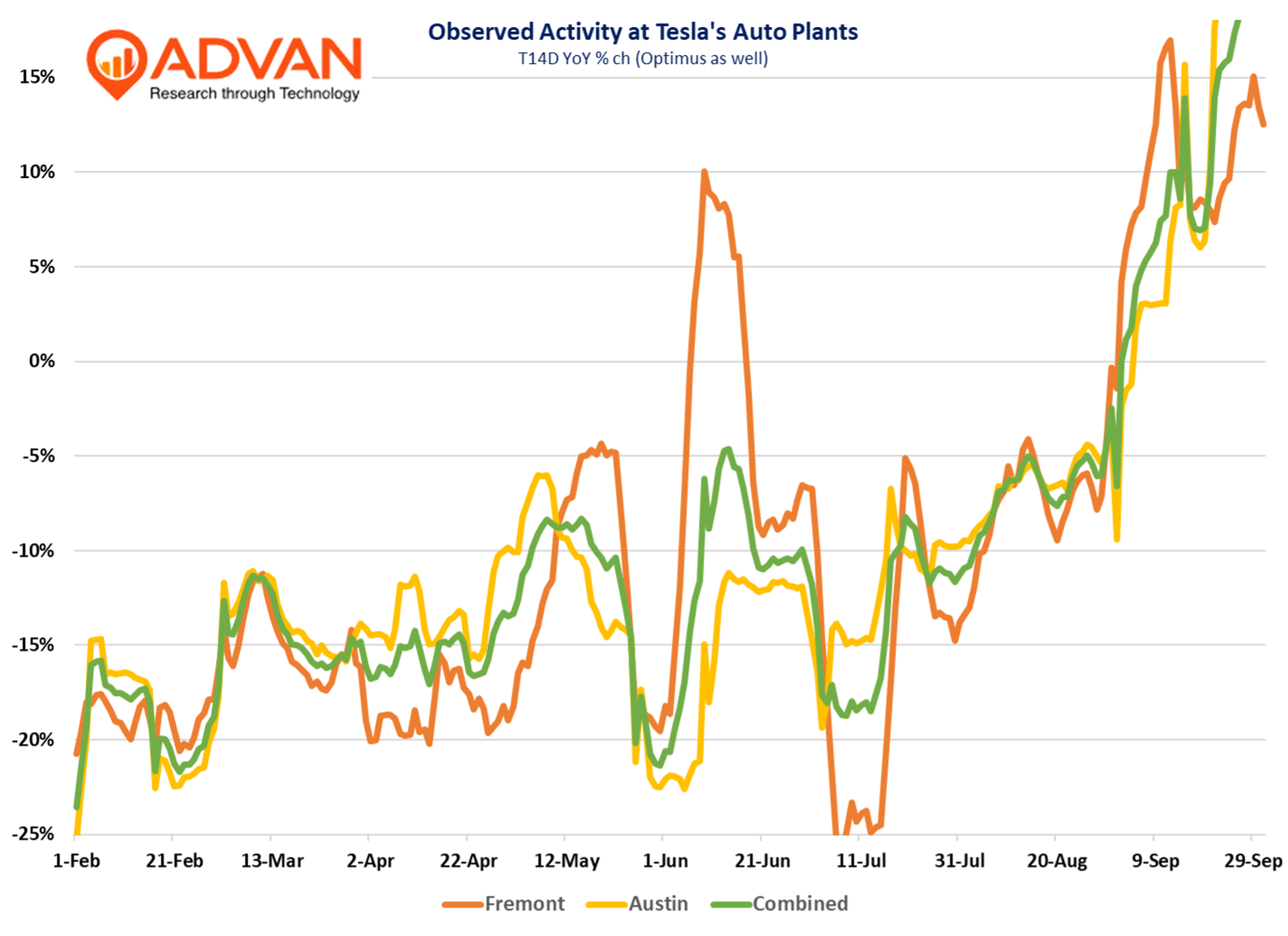

As previewed , Tesla’s Q3 global deliveries (+2%) were far ahead of expectations and Q2’s rate (-13%). Reported deliveries of 497K where 12% above the sell-side consensus of 443K. Given 3rd party reports of sales being down in Europe (-20% ish) and China (-HSD ish), the US was up strongly as Advan’s manufacturing and showroom data suggested. September domestic sales are estimated to be +6% per Morgan Stanley’s analyst. As shown, visits remained robust into the end of the month and the expiration of the $7500 tax credit. That suggests that that Tesla found a way to make “deliveries” quickly. We’ll come back to the story at the end of October to see show what the air-pocket looks like; however, given that the plants are still running hard, there may not be much of an air-pocket. That’s curious and unexpected!

LOGIN

LOGIN