With Tesla’s earnings call, we got a better understanding of why production has remained firm despite the lapse in the $7500 EV tax credit. (See our prior reports on Q3 production / demand here and here .) Elon Musk, “I think that Tesla has the highest intelligence density of any AI out there in the car, and that is only going to get better. And we’re really just at the beginning of scaling at quite massively full self-driving and Robotaxi and fundamentally changing the nature of transport. I think people just don’t quite appreciate the degree to which this will take off where it’s – honestly, it’s going to be like a shock wave. So it’s because the cars are all out there. There – we have millions of cars out there that with a software update become full self-driving cars. And we’re making a couple of million a year. And in fact, with the advent of – with what we see now as a clarity on achieving full self-driving, unsupervised full self-driving, I should say, I feel confident in expanding Tesla’s production. So that is our intent to expand as quickly as we can our future production. So I was reticent to do that until we had clarity on achieving unsupervised full self-driving. But at this point, I feel like we’ve got clarity, and it makes sense to expand production as fast as we reasonably can… Aspirationally, it could be 3 million within – we could probably hit an annualized rate of 3 million within 24 months, I think, maybe less than 24 months… So we’re going to expand production as fast as we can and as fast as our suppliers can sort of keep up with it.”

CFO Vaibhav Taneja said, “North America [QoQ deliveries were] up 28%… The pace in deliveries was the function of continued excitement around the new Model Y. We had previously talked about 2025 being the year of the Y and have since delivered on that promise with the new Model Y released in Q1, followed by Model Y Long Wheelbase and Performance and more recently, Standard Y in North America and EMEA. We’re now operating our Robotaxi in 2 markets, Austin and most Bay Area cities. We’ve already expanded our coverage area in Austin 3x since the initial launch and are on pace to continue expanding further. Unlike our competitors, our Robotaxi fleet blends in the markets we operate in since they don’t have extra sensor sets or peripherals, which make them stick out. This is an underappreciated aspect of our current vehicle offerings, which are all designed for autonomous driving. We feel that as experience – as people experience the supervised FSD at scale, the demand for our vehicles, like Elon said, would increase significantly.”

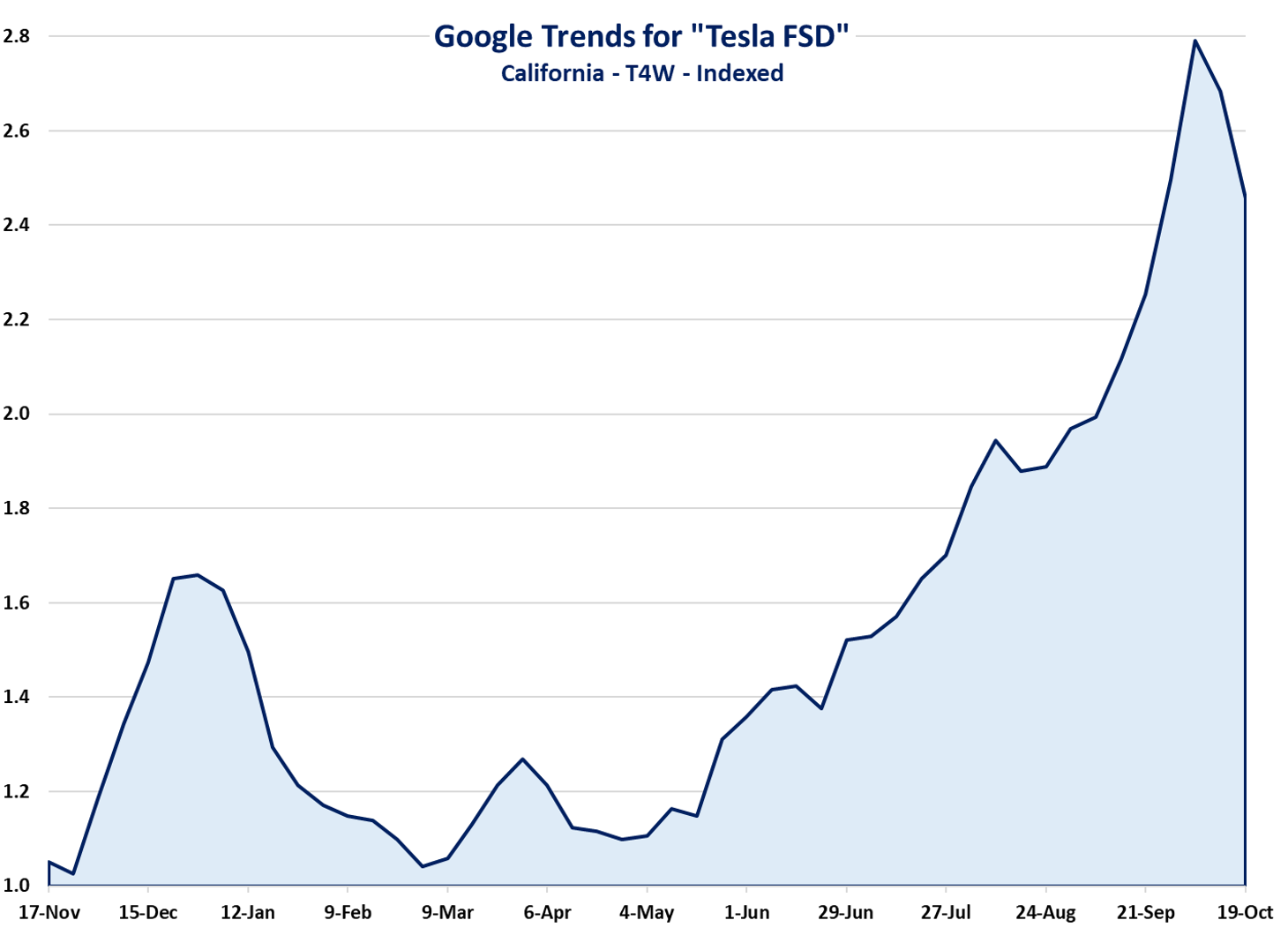

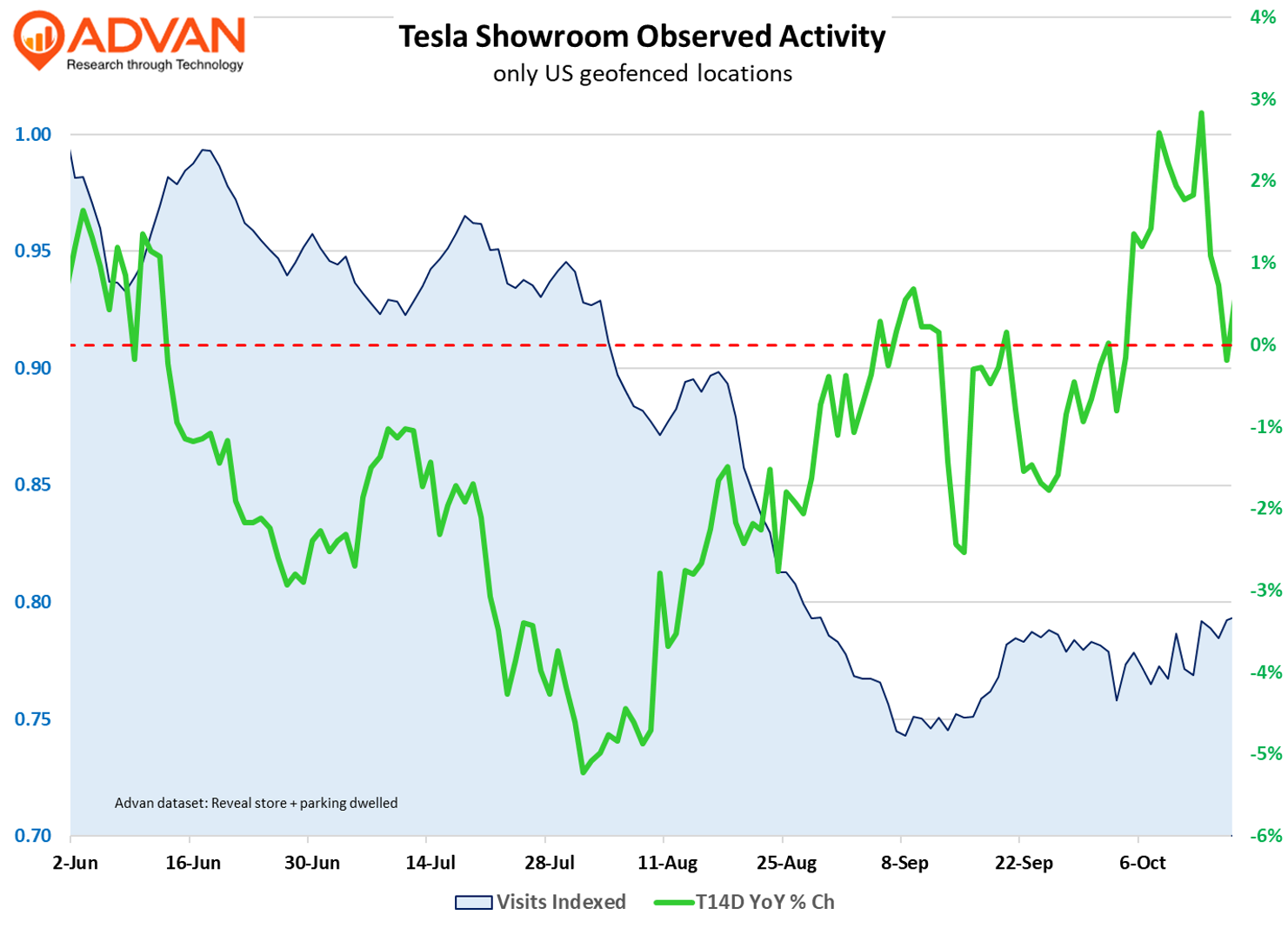

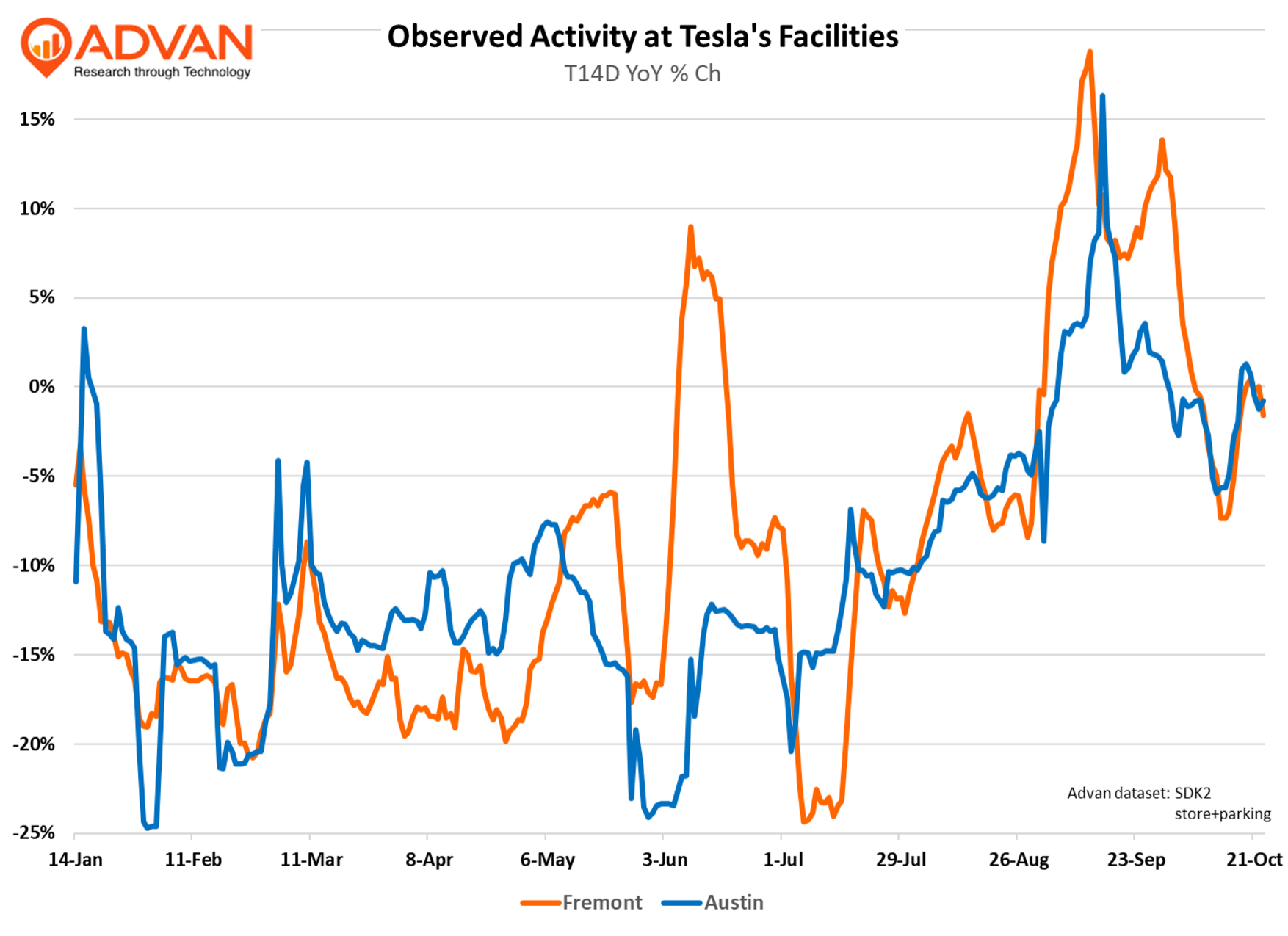

Our read of the above is that demand for Tesla vehicles in the US is stronger than expected and stronger than for non-Tesla EVs, with the “driver” being that Tesla makes highly desirable vehicles (not commenting on the Cyber) and a broadening of interest in FSD and the Tesla ecosystem. As evidence for this viewpoint, interest in Tesla FSD, as measured by Google searches by California residents, is up nearly 3-times from last year’s level. Further evidence is shown in the second chart, with showroom visitation remaining largely stable in late September and October, i.e. no observable air pocket following the expiration of the $7500. Finally, the third figure shows that activity has also largely been stable at the Fremont and Austin plants following the late September surge. Net-net, all signs suggest another good October and Q4 for Tesla vehicle sales in the US.

LOGIN

LOGIN