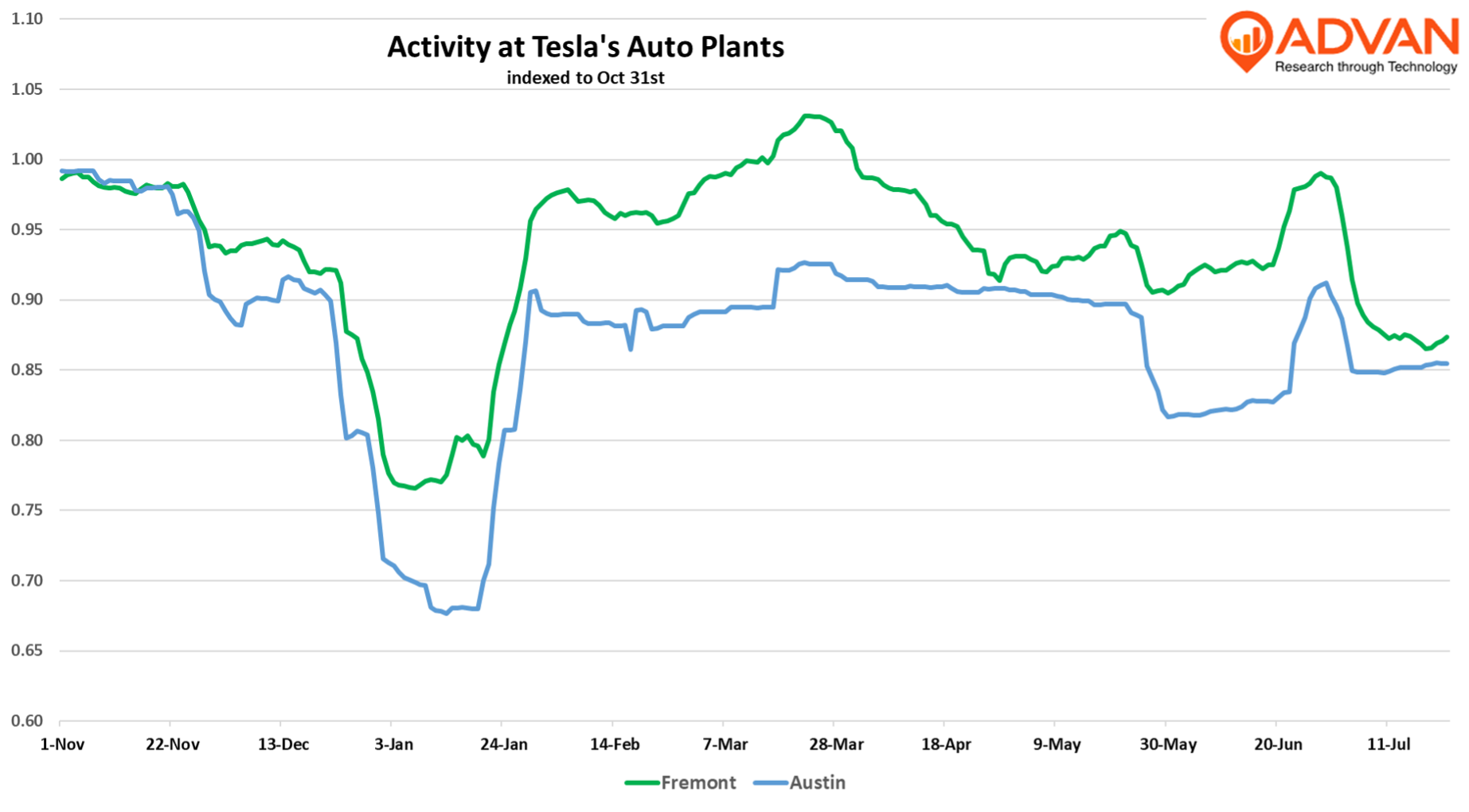

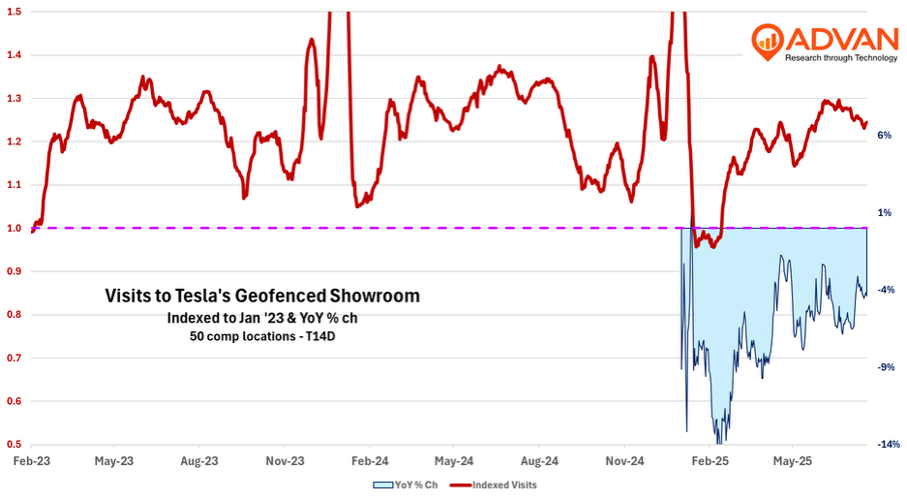

Tesla’s quarterly results and commentary allowed us to delve deeper into our Advan Buysider theme / use case on Tesla’s autos business (on its other sentiment drivers – ZEV credits, FSD, Robotaxi, Optimus, Gronk, etc, we have no data or opinions). Q2 deliveries / production were already known, as such, it was the 2H tone / feel that mattered, and on this, management only offered that the environment was “challenging.” Moreover, they shared that they have pushed back the new lower-cost new model, again, to maximize production on existing models before the EV tax credit expires, which is September 30th. That deadline applies to both new and used vehicles and is the date the buyer needs to have both purchased and taken delivery. Logically, that means that the vehicles need to exit the plant well in advance of the 30th, maybe as early as the end of August, or in five weeks. CFO Vaibhav Taneja’s stated, “We started the production of the lower-cost model as planned in the first half of ‘25. However, given our focus on building and delivering as many vehicles as possible in the U.S. before the EV credit expires and the additional complexity of ramping a new product, the ramp will happen next quarter, slower than initially expected.” Our data, in the chart below, does show a spike in activity in late June, but as shown, it was only a short-lived spurt; therefore, we are a little skeptical of Taneja’s claim. Furthermore, the second chart below shows visits for 50 Tesla showrooms that we can set as POIs and that have been open since January 2023. Yes, there was an improvement in visitation in mid-June; however, that has since faded. What’s this going to look like in late August and September? We’ll be watching, and that’s what management is waiting for too, before they put more investment into the lower-cost model.

Another observation from the above chart is that Austin has been down more starkly than Fremont; Austin solely produces the Cybertruck and Model-Y. (Austin also supports Robotaxi and Optimus.) Tesla reported that production for models other than the 3/Y was down -45% in QQ2. Model-Y sales for the quarter were down -21% per Motor Intelligence, indicating a very large decline for Cybertruck, which explains the lower activity at Austin.

LOGIN

LOGIN