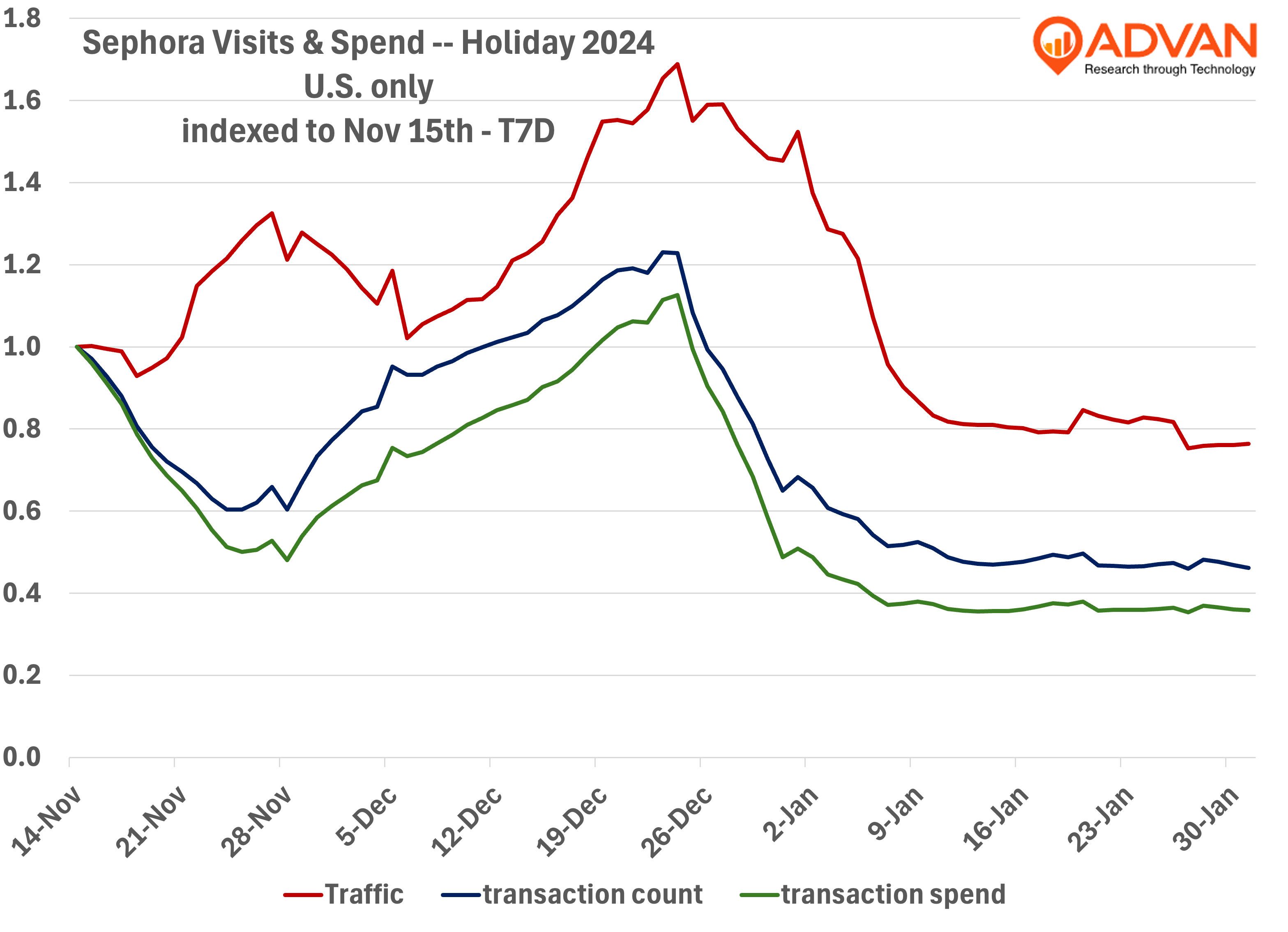

This past week brought a lot of news on the beauty market with earnings from Procter & Gamble, e.l.f. Beauty, Estée Lauder, and L’Oréal. The takeaway from those is that luxury part of the market remains robust, but L’Oréal is taking a lot of share from Estée, which is in trouble. The mass part of the market has experienced a further slowdown. That divergence demonstrates that the K-shaped consumer economy in the U.S. has become even more distinct, a trend now two years in growing. Additionally, the troubles in the drug store industry and the closing of locations are also hitting the mass segment. e.l.f. reported that trends slowed at retail in January and that retailers were slower in their spring orders. In the views of its management, one of the culprits of the January slowdown was a pull-forward of purchasing into December as consumers grabbed hot promotions, resulting in fuller pantries and purses going into January. And so, what’s been the trend for beauty specialty retail in January?

LOGIN

LOGIN