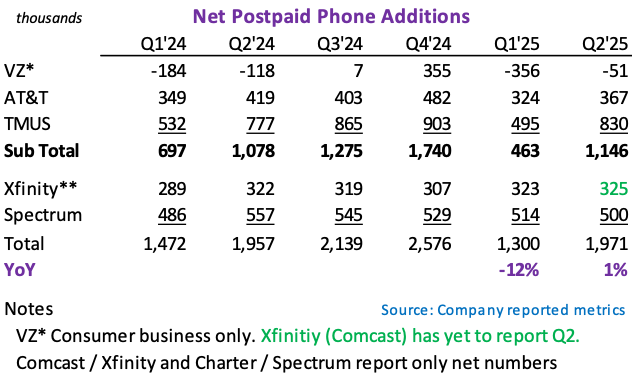

Most will know that the telecommunications industry is converging and transforming via new networks. By converging, we mean that legacy wireless brands are rapidly encroaching on cable’s broadband business with both new fiber builds and wireless broadband (5G fixed wireless), and cable is using Verizon’s network (a wholesale relationship) to offer wireless service and encroach on legacy wireless. Interesting, this week T-Mobile opened its network to cable to sell wireless service to small- to mid-sized enterprises. And then there are the newest networks in the sky, Starlink and Amazon’s Kubernetes. T-Mobile was the first wireless brand to make that available to its subscribers, and confusingly enough, Verizon and AT&T subscribers can use Starlink through the T-Mobile connectivity. The service is meant to appeal to households in rural and “off-the-grid” geographies. Finally, all of the operators are pushing into digitizing their consumer touchpoints, but T-Mobile most assertively with its T-Life app; consequently, retail visits are down as customer exchanges are shifting to digital touchpoints. That said, for new sign-ups, the bulk of those still occur at the store and having a retail footprint is necessary to have real market share in a geography. That again is especially true for T-Mobile, which following the merger with Sprint, opened hundreds of retail locations in suburban and rural markets, where they were largely absent, in order to take market share from AT&T and Verizon. In this vein, T-Mobile acquired UScellular last year; UScellular’s 4M wireless subscribers were largely in very rural markets. Similarly, Verizon expects to close on its acquisition of Frontier Communications in the near future. What this all means is that markets that were previously underserved (the so-called “digital- divide”) are now enjoying a choice of good service from multiple brands; several years ago, it was poor service by only one (if any at all). And so, in our opinion, it is this increased competition in more markets that is leading to stronger industry than industry analysts, and even the companies themselves, expected this year and over the last several. It also helps CRE owners in smaller markets as they have brands leasing stores in these markets and fostering better connectivity which improves these markets’ appeal and “workability.” As shown in the table below, net new postpaid phone additions for Q2 were higher YoY, an improvement from last quarter’s trend. With this backdrop set, we will discuss Q2 earnings results for the industry and show how Advan’s data revealed a strengthening trend during Q2 for T-Mobile, Verizon, and AT&T.

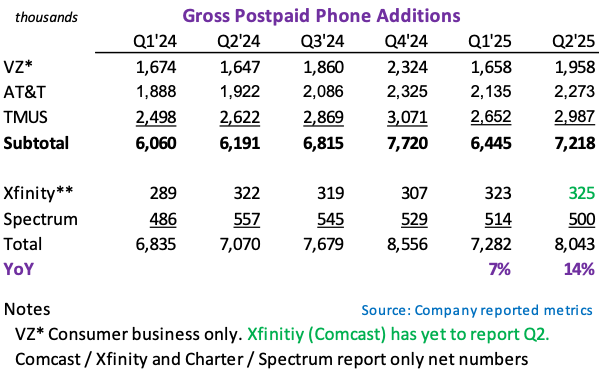

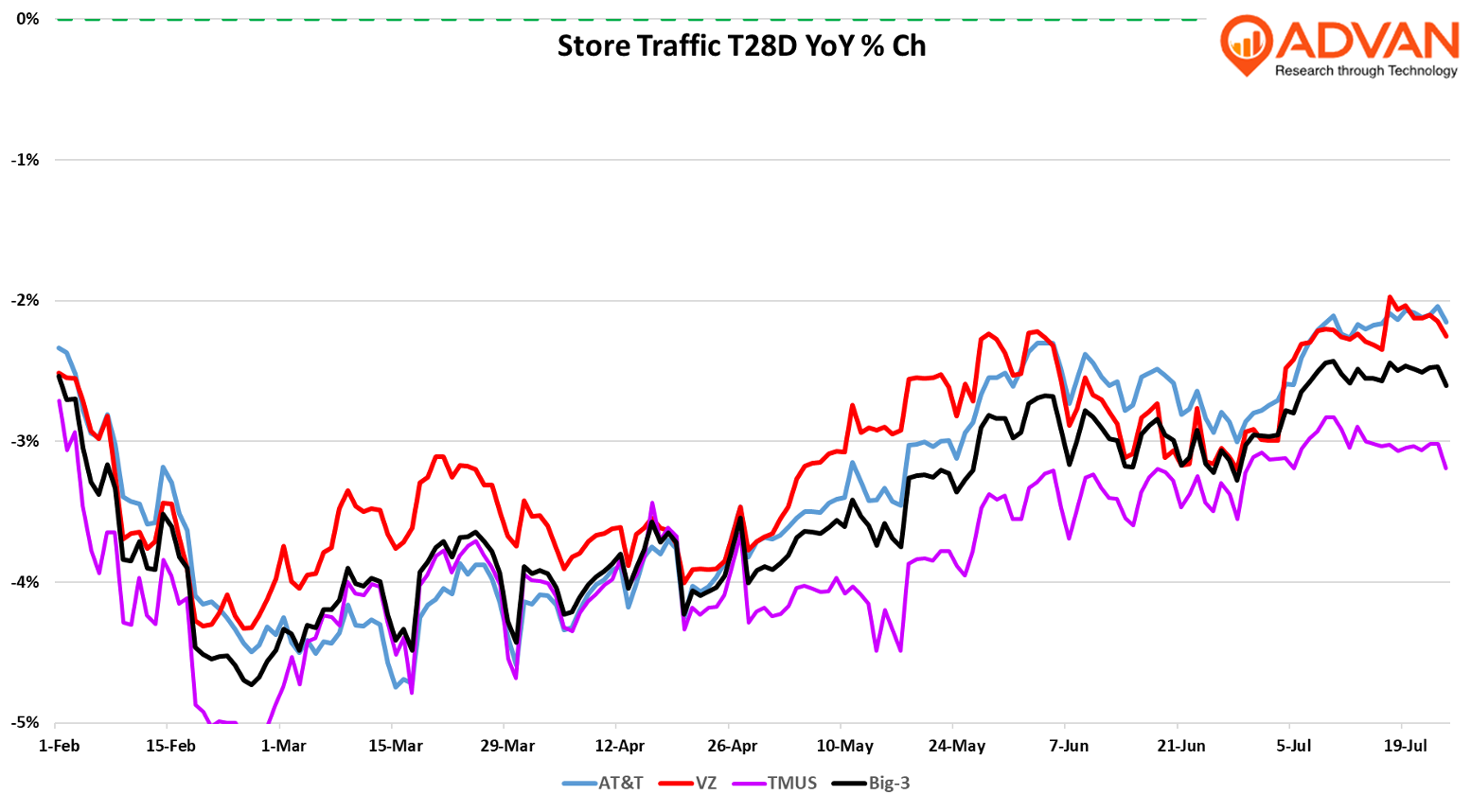

Where the improvement is especially evident is in gross postpaid phone additions, that is when the individual more likely visits a store location so that they can get the contract signed, credit approved, SIM card exchanged, and new phone(s) in hand. As shown in the table below, gross additions increased by 14% compared to last year. The chart of visits (below) shows a distinct firming in the trend for Q2 vs. Q1, aligning with the better gross adds. The trend was notably better in late May and in July, and one could hear that July was strong in the positive tone by managements during their earnings calls. The chart also shows that Verizon had the most improvement in trend, and that also shows in their YoY net and gross phone adds. We also see the same pattern when we filter to just visits 30min to 90min long, which we associate with new contracts and gross additions. These longer dwell times, visitors for Verizon were down only 4%, whereas T-Mobile declined 7%. This implies better percentage growth for Verizon in Q2; it was up +19% in gross adds vs. T-Mobile’s +14%.

In describing Verizon’s stronger consumer gross additions, CFO Tony Skiadas said, “On the gross adds, a couple of things here. The strength came from two places. First, we had very strong sales execution in our stores and distribution. … And then secondly, the value proposition when you think about – we launched the best value guarantee back at the beginning of April, and that is resonating with customers in the market. (See the jump in foot traffic.) …And what we said many times is volumes are important, and we’ll pulse in and pulse out but where it makes financial sense.” AT&T’s CFO said, “We delivered 401,000 postpaid phone net adds in the second quarter. This subscriber growth was ahead of our own expectations, driven by postpaid phone gross adds that increased more than 20% versus last year.” As shown in the chart above, AT&T traffic trends closely match Verizon’s. On rural markets, T-Mobile’s President John Freier, “We’re unbelievably excited about smaller markets, rural areas. Just for the first-time listeners here. The way we define this is outside, everything else out of our top 100 markets. So this would be 140 million people, 50 million households, roughly 40% of U.S. and we’re excited about it for two reasons. #1, we have surpassed 20% share (which was their initial long-term goal from a 7-9% level) of household in smaller markets and rural areas. So we have beat that goal that we set for you in 2025. We’re really excited about that… But the thing that excites us more is exactly to the premise of your question, is what the opportunity still is in smaller markets, rural areas with the addition of UScellular and all the assets, the complementary spectrum, the sell-side assets, et cetera, that we will be implementing into our network and the thousands of greenfield sites that are coming into the network as well.. And I don’t think anybody ever thought that we would hit 20% and pack up our tent and go back home to New York City. We’re going to stay in here and continue to drive this business to our fair share of the market, maybe even outside fair share of the market. So we’ll have more to say after we close the UScellular transaction give you a little bit more of an update in terms of what we’re up to, but we’re incredibly excited about our progress so far and even more progress to come.” And CEO Mike Sievert said, “Now in places we’ve been successful for a long time, there are places we have market shares way, way higher than our national average. And so it’s really about can we deliver the advantages that we think are really going to be required to be long-term market leaders in smaller markets and rural areas.” (We at Advan, have ways of watching their progress, such as segmenting their stores by population density and watching the traffic at those locations. More on this in the months to come.)

LOGIN

LOGIN