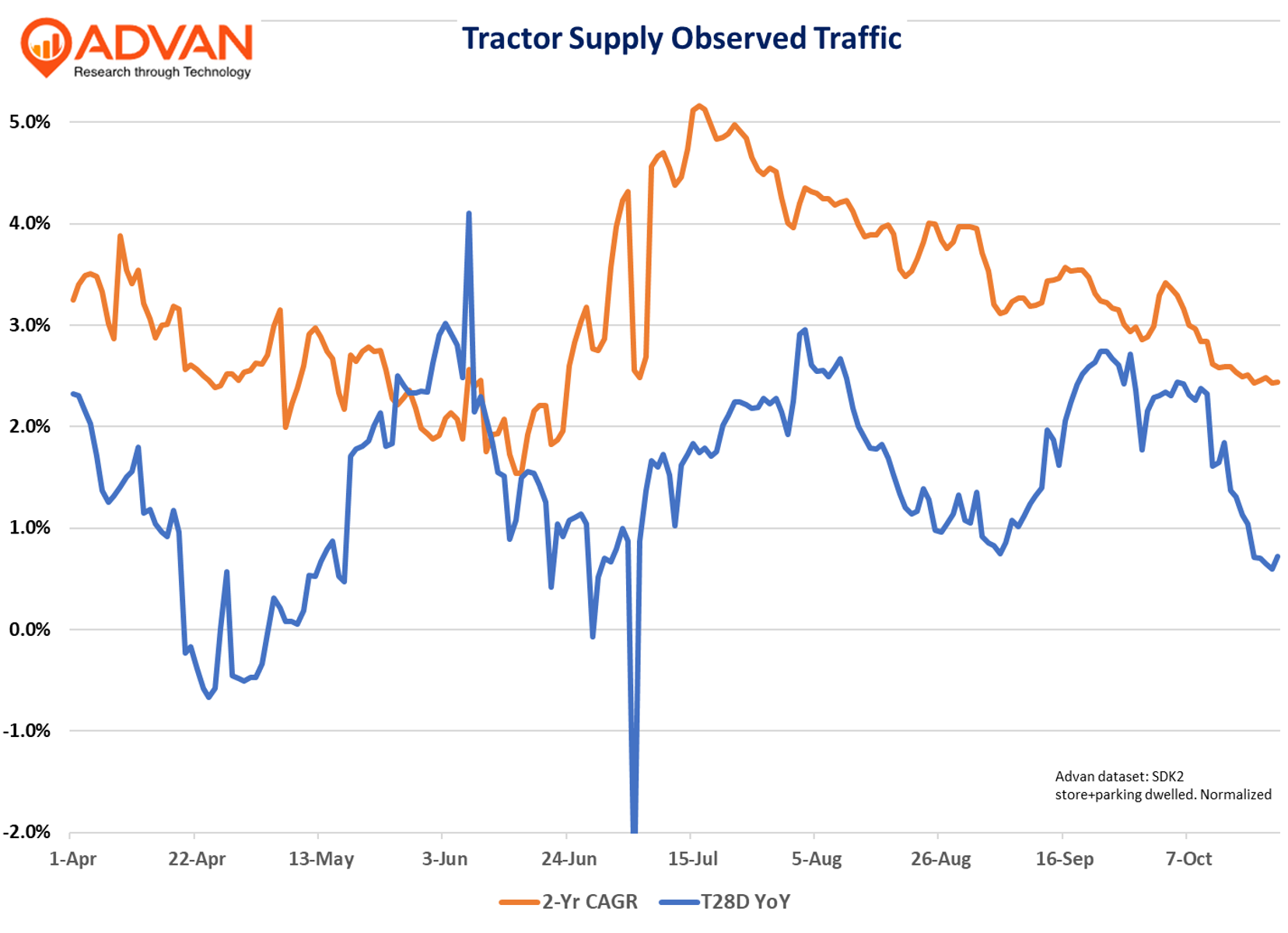

Tractor Supply (TSCO) reported solid top- and bottom-line results for Q3. (TSCO’s Q3 ended on September 27th.) Comp-sales increased +3.9%, driven by comp-transactions +2.7%. Adding in the contribution from new stores, sales increased +7.2%. That increase, plus slightly higher margins, lifted gross profits by +7.7%. The mid-point of guidance puts the Q4 comp in the range of +3.0%. In terms of the quarter cadence, CEO Hal Lawton shared, “We saw a strong start to the quarter with spending trends moderating into September. This pattern aligned with what we observed across the retail landscape, and in our case, was amplified by two key dynamics. First, the tailwind of an extended spring in July. And second, the headwind of an unseasonably warm weather in September and the absence of emergency response.” CFO Kurt Barton put a finer point on September saying, “…the later portion was pressured by lingering summer heat and dry conditions with no meaningful shift to fall weather. As far as emergency response sales, while we did not receive a significant year-over-year sales lift from emergency response last year, we did have a hurricane event in 2024 that provided some benefit to sales. This year we had no emergency weather-related…“ This cadence is clearly shown in the 2-yr CAGR of observed traffic, shown below.

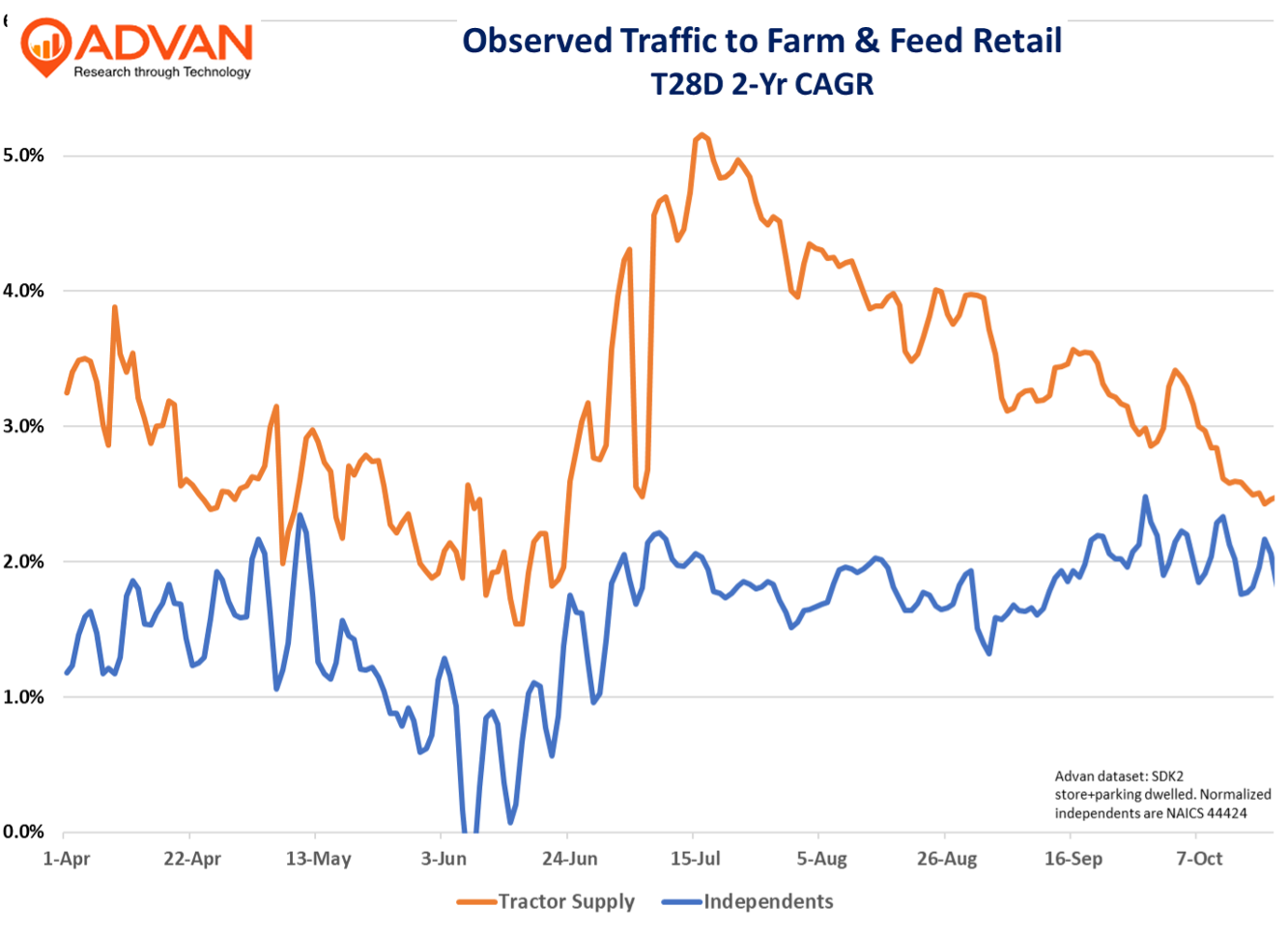

Lawton went on to say, “Seasonal categories strengthened meaningfully after a more modest first half. We benefited from the bathtub effect of the extended summer season… As it relates to seasonal, the team did a great job capitalizing on the elongated summer season weather through strategically positioned inventory, enhanced financing offers, and targeted labor investments across the company. Our merchants to our store teams to our supply chain, the organization leaned in to capture every single sales opportunity. And a great example of that execution was in our tractors and riders category, which delivered another strong quarter. Our industry-leading lineup of zero-turn mowers, combined with the disciplined inventory management and effective merchandising, continue to resonate with customers, and drove share gains in this category in the quarter. Additionally, other categories in seasonal that saw standout results were lawn and garden sprayers and chemicals, and power equipment, parts and accessories. In our hallmark area of Q2, we saw stronger than average growth in livestock, equine, and poultry feed and supplies, and wildlife supplies. And in wildlife supplies, we continue to expand our position as a destination for outdoor enthusiasts across gun safes, deer, corn feeders, hunting blinds, attractants, trail cameras and more.”

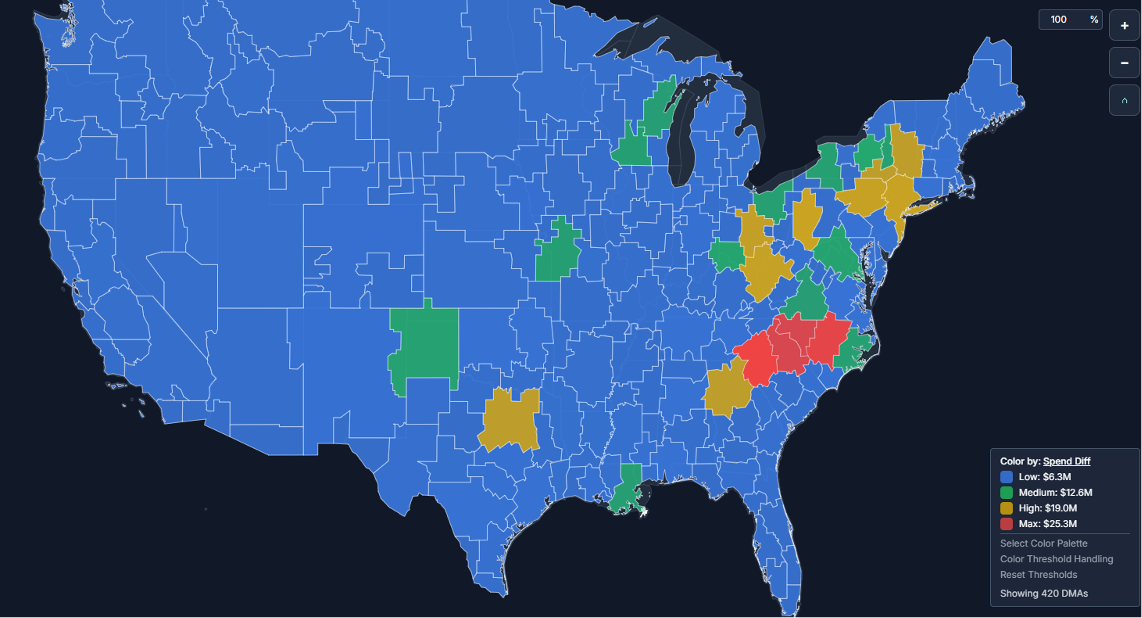

As demonstrated in the cart below, when those seasonal openings presented themselves, TSCO executed well to capture the “wind” / market share, affirming Lawton’s above characterizations, and also the weather anomalies. Based upon observed foot traffic, we see a similar strong execution by Lowe’s and Home Depot. The second graphic shows observed spend growth by geography; as shown, TSCO is driving strong spend growth in the Northeast.

LOGIN

LOGIN