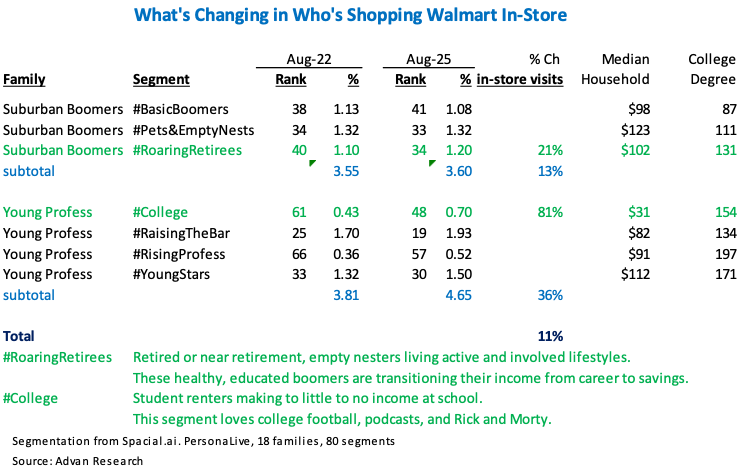

Next week kicks off retail earnings, including home improvement (our preview here ), Target (here ), off-price, and the behemoth – Walmart. Prior to the pandemic, generalists used to view Walmart as an important read on the consumer; however, Walmart generally was a misread, as it skewed rural and to the less-affluent. As followers and readers know , Walmart’s “contemporization” won them significant market share in the suburbs and near-burbs, and with the more-affluent. The table below shows that between 2022 and 2025, Walmart gained 11% more in-store shoppers; outperforming that growth were Suburban Boomers: Roaring Retirees (21% growth) and **Young Professionals: College (**81% growth). In August of 2022, Young Professionals: College ranked #61 out of #80 cohorts shopping inside a Walmart, by August 2025, it climbed to #48. This broadening of Walmart’s shopper base now makes the brand a closer read on our consumer economy, and as such, something to watch more closely (as we argued in our presentation at the National Association for Business Economics Annual Meeting). For analysts and economists, the need is more pressing these days due to the absence of national economic statistics.

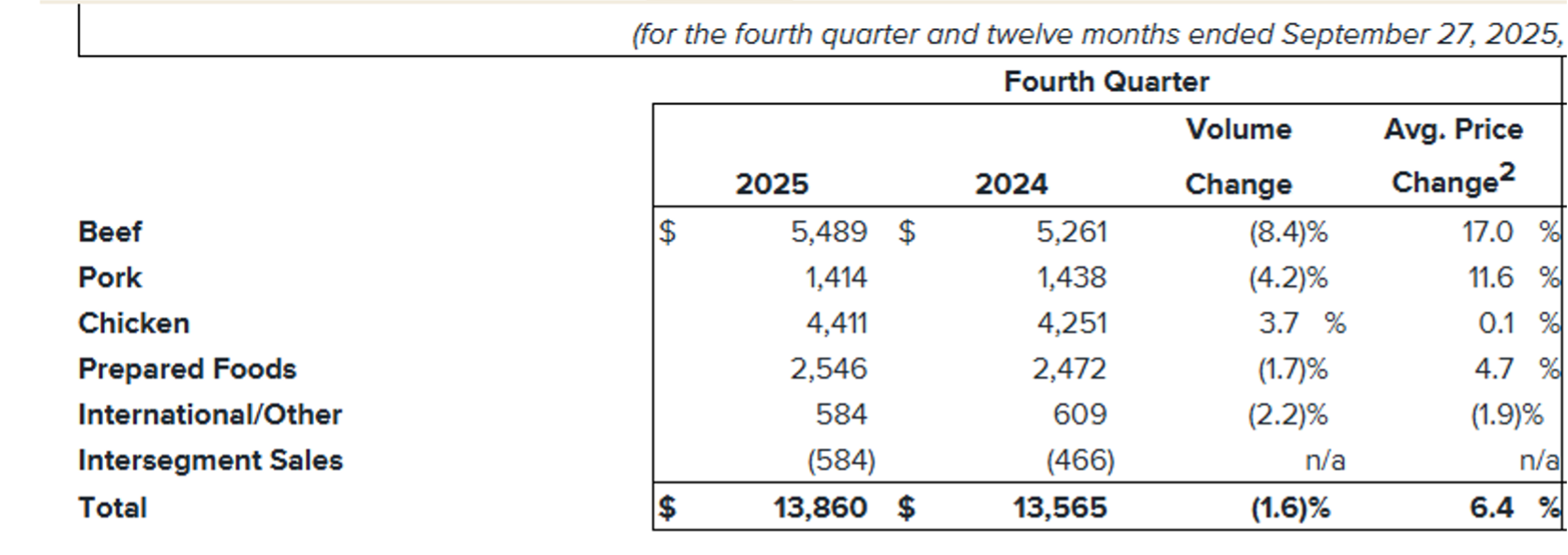

For FQ3, several significant trends have amplified/emerged that will impact Walmart’s results. First, Walmart enjoyed a very strong back-to-school season (here ). Second, as we’ve been writing frequently , since B2S, the less-affluent consumer has become more price-sensitive and volume has softened for fast food (limited service), consumables (private label taking more share + cutting consumption), and in leisure & entertainment . This has also led to a more pronounced paycheck cycle in Q3. Consumers are also making trade-offs to get the calories and proteins they need, more chicken, less beef – see the table below of Tyson’s Q3 results. Third, there’s all of the associated impacts of the Federal Government shutdown during October. Fourth, the more-affluent have been on a spending spree since August. Fifth, the impacts from increased GLP-1 usage have become more pronounced on food and alcohol consumption. And sixth, Amazon’s launch of same-day perishables in 1000 cities was significant (see our take here ). Further muddying the picture is Hurricane Helene, which drove a lot of stock up purchasing in September of 2024, and which temporarily dislocated 375K families. And lastly, gross margin in the 1H expanded by 25bps, FQ3 will be the first quarter that is fully loaded with tariffed goods, as such it will reveal how much it passed through to the consumer, i.e. what’s Walmart intent on demonstrating great value.

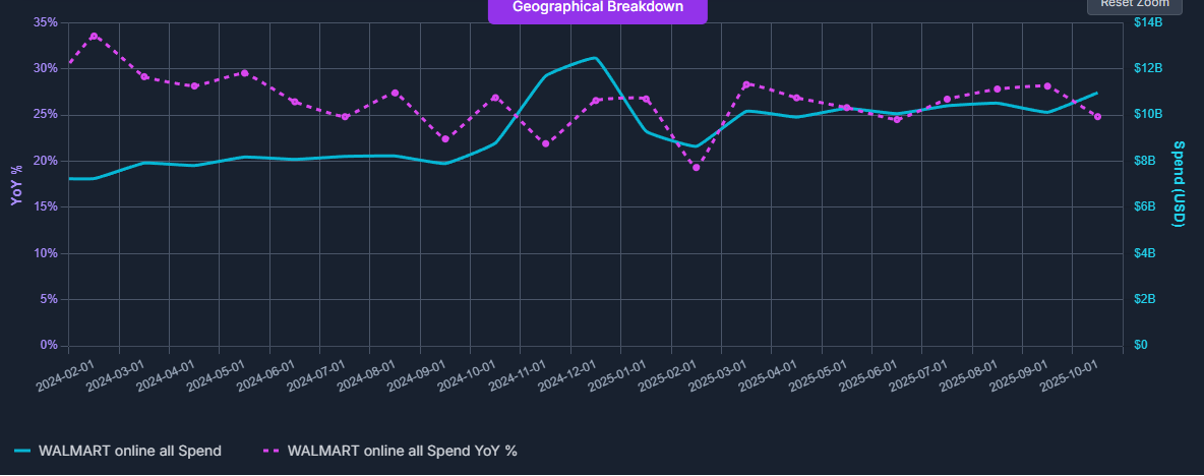

Despite all the above, the numbers* look good for fiscal Q3. Per Advan’s transaction data, sales growth is slightly lower QoQ on a 1-year basis, but largely consistent on a 2-year basis. Traffic is slightly stronger, which we take to be the result of a more pronounced paycheck cycle. As it relates to comp-ticket, in-store average transaction size (Advan) is little changed, the paycheck cycle will be a headwind to basket size (UPT). Walmart’s own strategic price rollbacks and value merchandising, as well as consumer trade down to Walmart’s brands will also be headwinds to average $-check size. (Industry-wide**, private label volume outgrew branded by 220bps.) These headwinds should be offset by triple-digit unit growth of GLP-1 drugs, store delivery (larger on average), and strong e-commerce sales (15% larger $-size than in-store per our estimate). Overall e-commerce growth should be in the range of 27-28%, demonstrating no deceleration. As a reminder, curbside and store-delivery are captured in this figure. To sum this up, and inclusive of both in-store and digital, comp-ticket and comp-transactions should increase nicely.

Estimated Walmart U.S. Digital Sales per Advan SpendView

Given all of the above, will one be able to get a true read on the US consumer from Walmart’s result? We think that given the noise hitting FQ3, it will be the FQ4 guide that is of more significance. Moreover, given the highlighted volatile environment, management will be conservative in the outlook (the timing of the government shutdown is suboptimal on this front). Our friends at JP Morgan Chase indicate that a +4% domestic comp for FQ4 is the bogey.

Additionally, it’s Walmart’s “implied guidance” on the Q4 gross margin rate that is also of importance. See Target’s latest news , “Target… is increasing support for families to help them further stretch their household budgets this holiday season. Starting this month, Target is lowering prices on 3,000 food, beverage, and essential items to help consumers save on the products they rely on most. From pantry staples and baby items to household essentials, these price reductions are designed to make everyday shopping more affordable through the holiday season.” – We point readers back to #6 above – Amazon’s bringing same-day delivery of perishables to 2300 cities, and our take-aways from its Q3 results and commentary. ‘* per The NRF, monthly sales (Aug/Sep/Oct) for the general merchandise category were +7.6%/+5.5%/+7.0%. ** per NielsenIQ, T12W AOC+C

LOGIN

LOGIN