With FQ3 results from Walmart, Targe t, Home Depot , and Lowe’s, it is clear that our K-shaped economy is becoming more pronounced , and its “pronouncement” is now undermining aggregate consumer expenditure and the retail industry (and CPG). In response, retailers and brands are focusing even more on affordability and being more tactical in any price increases in response to tariffs or cost inflation. (See our story –What’s happening in Vegas, isn’t staying in Vegas) That, in turn, is pressuring margin rates and profits. For example, for Kraft Heinz’s last quarter, gross margin rate declined -200bps and North American profit declined -20%. Another example, Mattel’s North American segment declined -500bps in margin rate and -24% in profits.

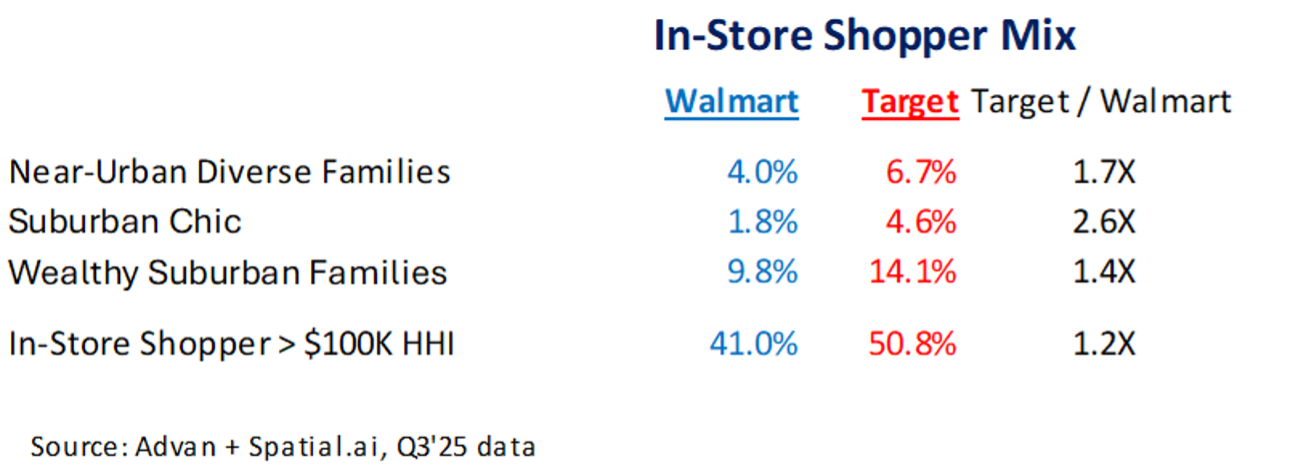

Where Walmart is sourcing profitable growth is with more affluent households (this being one of Target’s challenges). Readers will recall that this is being driven by (1) nearly all households becoming thriftier and Walmart’s leading EDLP position, (2) greater convenience (curbside and store-delivery), and (3) more relevant merchandise (gleaned from what’s working on Marketplace). Since 2019, Walmart has grown its sales by $150B (+45%) on an annualized basis. $69B of the increase is mostly from curbside and store-delivery, and $82B is in-store (Advan estimates). The vast majority of the $69B is from more affluent households (per management). Looking at the $82B, annualized spend per-store-visitor (Advan) has increased from $513 to $734, or 43%. Stripping off inflation (CPI) leaves the increase at 13%. That 13% increase comes from drawing more high-income households into the stores and more wallet share. Looking at the in-store customer segments that have outperformed 2025 vs 2019, three segments that have increased are Near-Urban Diverse Families (multi-ethnic families with above average income), SuburbChic families, and wealthy suburban families. All three are core segments for Target, as shown below.

SuburbChic Wealthy family-focused households straddling the suburban/rural line. Their retail patterns revolve around kids, health, and entertainment: visiting places like the Goddard School, CycleBar, Clean Juice, and Country Clubs. You’ll find them consuming sports and conservative, business-related news sources. They are willing to spend their money on fitness and the outdoors, picking up expensive items from Peloton, Lululemon, and Mountain Hardwear. On social media, you can find them following Christian authors Bob Goff and Beth Moore center-right leaning figures like John Kasich, Romney, and Boehner.

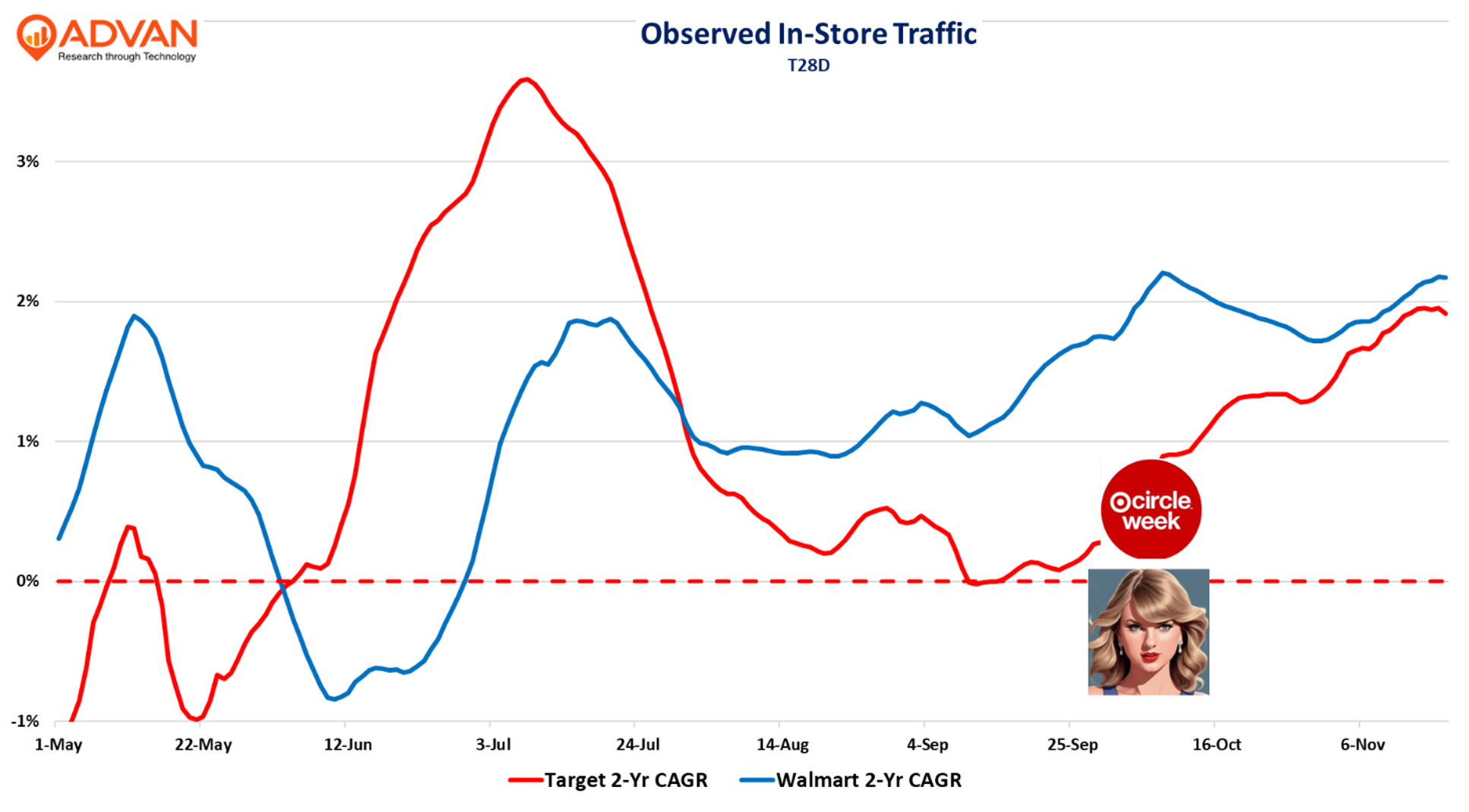

As to its convenience appeal, that’s still driving outsized growth; store delivery grew 50% and expedited delivery (<3 hours) grew 70%. CEO Doug McMillon said, “Comps were good across each month of the quarter, and share gains were consistent with what we’ve seen this year,” which contrasts with Target’s softer back-to-school and September period, i.e. it lost share for the critical shopping season.

Walmart management also shared that during the quarter they experienced a further softening in spend by the lower-income consumer. In the results, we see evidence of that as well as in-store comp-sales softened by -50bps QoQ to only +0.5% growth, despite food inflation (CPI-FAH) increasing 1.3% QoQ. Per the use of the word “tactical” above, despite the CPI increase, Walmart’s like-for-like inflation in grocery eased from 150bps to 120bps, i.e. they didn’t pass it through and took unit market share. CFO John Rainy said, “We’re leaning into price rollbacks and making both everyday essentials and seasonal celebrations more affordable for customers and members.” Separately, the baby care business also slowed, demonstrating the economic pressure on young families.

Rainey went on to say, “There’s certainly some pockets of moderation that we’re keeping an eye on. But if you look at our guidance for 4Q, it would indicate that we have an expectation that it’s going to look pretty similar to the other quarters this year. Holiday is off to a pretty good start. Back-to-school tends to be an early indicator for how that goes, Halloween, likewise for Thanksgiving, and everything that we’ve seen so far makes us optimistic and encouraged about customers and members leaning into the seasonal events and holiday shopping period. [As to the moderation] I don’t want to sound alarmist… but when we look by low-income cohort versus middle versus higher income, we have seen some moderation in spending in the low-income cohort… In October, wage growth – the disparity in wage growth between those cohorts was as large as it’s been in almost a decade. And so we’re seeing the same things that others are, and we’re keeping a watchful eye on it.“ See our Walmart preview here

LOGIN

LOGIN