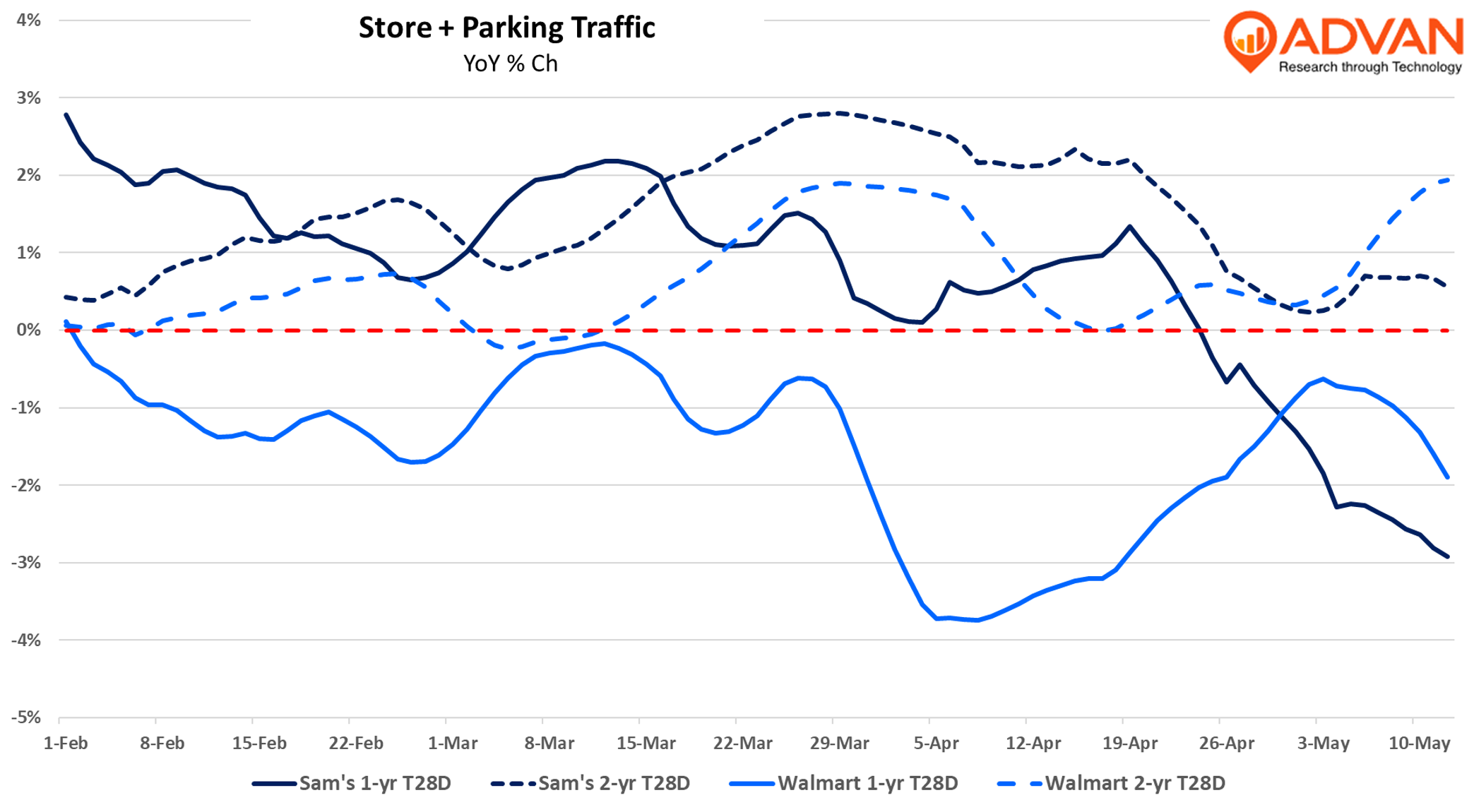

In our review of Q4 Walmart Inc. results, we highlighted Sam’s compounding success in gaining household share which stems from strong execution on merchandise and service contemporizing (while also benefiting from the favorable macro-consumer trends that are lifting the entire club sector). Today, we shift the focus to Walmart US and its grocery business for this Q1 commentary. (We’ll come back to Walmart’s general merchandise results post Target’s earnings release next week.) We’ll also weave in our recent theme of weight loss drugs (GLP-1s, i.e, Wegovy and Zepbound) and the lost traffic resulting from less consumption, and the theme of the consumer shift to private label and the retailers that excel at it. In addition to GLPs and private label, delivery and convenience continue to reshape the grocery business. On today’s results call, CEO Doug McMillon said, “Delivery speed continues to help drive our business. We’ll soon reach 95% of the population in the U.S. with delivery options of 3 hours or less. For Walmart U.S., the number of deliveries in less than 3 hours grew by 91% for Q1 versus a year ago [and that is now a third of deliveries].” The primary macro trend impacting Walmart’s business (like in 2024) is the growing prominence of the “thrifty K-shaped” economy and consumer spending – that is the affluent spending more and the non-affluent, less, and everyone is looking for lower prices and deals. Given that trend, Walmart is leaning more into price and winning more household share given the trust that consumers have with Walmart’s EDLP position (and best value as they have enhanced the assortment to include more premium items and fresher perishables). McMillon’s tone on the call was that Walmart will be the last to increase grocery prices, should tariffs and second-order effects result in higher producer prices. Walmart’s retail media network revenue, subscription fees, and third-party seller fees are large and growing profit pools that Walmart can draw upon to further lower prices and enhance its value positioning. McMillon, “We want to keep our food and consumables prices as low as we can. Food prices in the U.S. have gone up in recent years, and our customers have been feeling that all along. We won’t let tariff-related cost pressure on some general merchandise items put pressure on food prices. But as it relates to food, tariffs on countries like Costa Rica, Peru and Colombia, are pressuring imported items like bananas, avocados, coffee and roses. We’ll do our best to control what we can control in order to keep food prices as low as possible… In some cases, we’re holding our retails where they are despite the tariff cost pressure” Within this context and that the competitive challenges for conventional are rising, especially for those that do not have the capacity to invest in freshness, value, and convenience - the data from Advan and others demonstrate that Walmart is outperforming vs. conventional grocery . For Q1, Walmart’s visitors per location increased +1.7% and dwell-time (which is related to basket size) was stable. By contrast, in 2025, most conventional grocers are losing households, wallet-share, and basket size. What household types is Walmart gaining? Using PersonaLive Spatial.ai segmentation data in Advan shows that the Wealthy Suburban Families segment grew at a +2.6% YoY rate, or above the average. Wealthy Suburban Families are an important segment for Walmart, making up 10.2% of its visitors vs. the nationwide benchmark at 7.2%. Within this segment, the BackyardBliss cohort grew at +3.6%. Walmart’s visitor mix of BackyardBliss is twice the national benchmark. Spatial.ai defines BackyardBliss as “outdoor-loving upper-income families straddling the suburban-rural divide. On the outskirts of cities, where the yards are plentiful, you’ll find these white-collar families raising their kids and enjoying the outdoors near suburban amenities. They watch Fox News, read Runner’s World, and Golf Digest. They follow brands like Nike Golf, Mod Cloth, and Under Armour. They drive GMC and Lincoln and stay fit at the local YMCA. They follow country music, Dave Ramsey, the NCAA, ESPN, and the Masters.” Other psychographic segments are mostly even YoY, however, the contribution of lower-income segment visitors was down slightly. The lessening of lower-income visitation likely stems from the “paycheck cycle” becoming more pronounced (the money “running” out ahead of the next paycheck). When we combine March and April (to offset the shift of Easter), we see that the first three weeks of the months were 450 bps stronger than the last week, which is the paycheck cycle. Frequency of visit for the quarter was also down slightly and that’s likely the result of the more pronounced paycheck cycle. Walmart US’ Q1 comp-sales increased +4.5% and ahead of Advan’s +3.7% estimate*. The “upside” stemmed from a stronger contribution from membership fees, advertising, and e-commerce results, which added 60bps more to growth than in Q4. E-commerce grew high-teens, which was much faster than Amazon’s +6% (per our analysis ). Added to that upside is pharmacy** sales were exceptionally strong, comp-ing high-teens, and contributing more than half of the total comp (the +4.5% figure). This rate was above Q4’s mid-teens and it stems from the strong flu season, robust GLP-1 sales, and share gains from Rite Aid and Walgreens with their store closures. Advan estimates that in-store comp-transactions fell -1%, -170 bps worse QoQ, and in line with Advan showing a -220bps QoQ moderation in traffic. The decline reflects the paycheck cycle effect, channel shift to curbside and store-delivery, and the impact of bad weather in February and March. The chart below shows that Walmart’s 1-year traffic trend dipped in early April with Easter out of the mix, and then the trend built going into Easter. Walmart US leader John Furner said, “…We had Leap Year last year and then we had a very late Easter. So February was softer than we expected. March was back to normal, and we exited the quarter with a very strong April, including a strong Easter holiday, which is a reminder that customers are prioritizing seasonal events, getting together, having meals at home.” These Easter sales are larger basket visits that would have moved sales into April from March, which would create a dis-synchrony between traffic and sales. Walmart’s transaction spend in April was 8% ahead of traffic vs. only 3% in March. Additionally, these figures suggest that there was a pull-forward effect for April that will come out of May and the months ahead. That steaming from more-affluent consumers loading up on high-ticket durables ahead of any tariff impact on shelf prices. Furner said, “We had a strong April in eCommerce.” Amazon, Apple, and other retailers also experienced the same.

Aside from the pull forward, we don’t think there is any meaningful change in trend because: first, the recent 2-year traffic trend remains at near +2%. Second, we see that in management’s guidance for Q2; company-wide revenue is expected growth by +3.5% to +4.5%, exactly in line with Q1’s +4.0% rate, and it implies a similar US comp for Q2 as Q1. And third, Advan’s current estimate* for Q2 was slightly above (+10bps) Q1’s estimated rate; said differently, our model is in line with management’s outlook when adjusting for the Q1 upside. Walmart’s grocery business produced a mid-single-digit comp, which compares to the conventional grocery industry’s +3.5% increase per Census . Assuming that mid-singles is +5%, comp units + traffic increased +3.5%, which compares to overall food-at-home volume consumption of +3.1%, per the Bureau of Economic Analysis . These demonstrate that Walmart gained dollar- and volume-share in the quarter. Aligned with the macro industry trends that we highlighted at the start of this story, Walmart’s private label increased +60 bps as part of the sales mix. Importantly, private label volume would be well ahead of that given that its prices are meaningfully lower than branded. Separately, curbside and store-delivery (i.e. convenience) were up double-digits. To conclude, Walmart’s scaled new business, its contemporization of both Sam’s and Walmart’s consumer offering, and the macro dynamics are compounding and amplifying one another to produce market share gains at higher levels of profitability, obviously, the ingredients for more of that ahead. To this mix, is whatever comes out of trade policy and the resulting producer price levels and sourcing / inventory availability. For competing grocers to persevere in this new world, a world that Walmart, Sam’s, Costco, and Amazon are thriving and dominating, they need to think, service, and merchandise differently. (See our stories on the ongoing success in this new world for Sprouts , Aldi, and TJ .)

-Maiden Century Model, Walmart reports this as “Health and Wellness” business segment

LOGIN

LOGIN