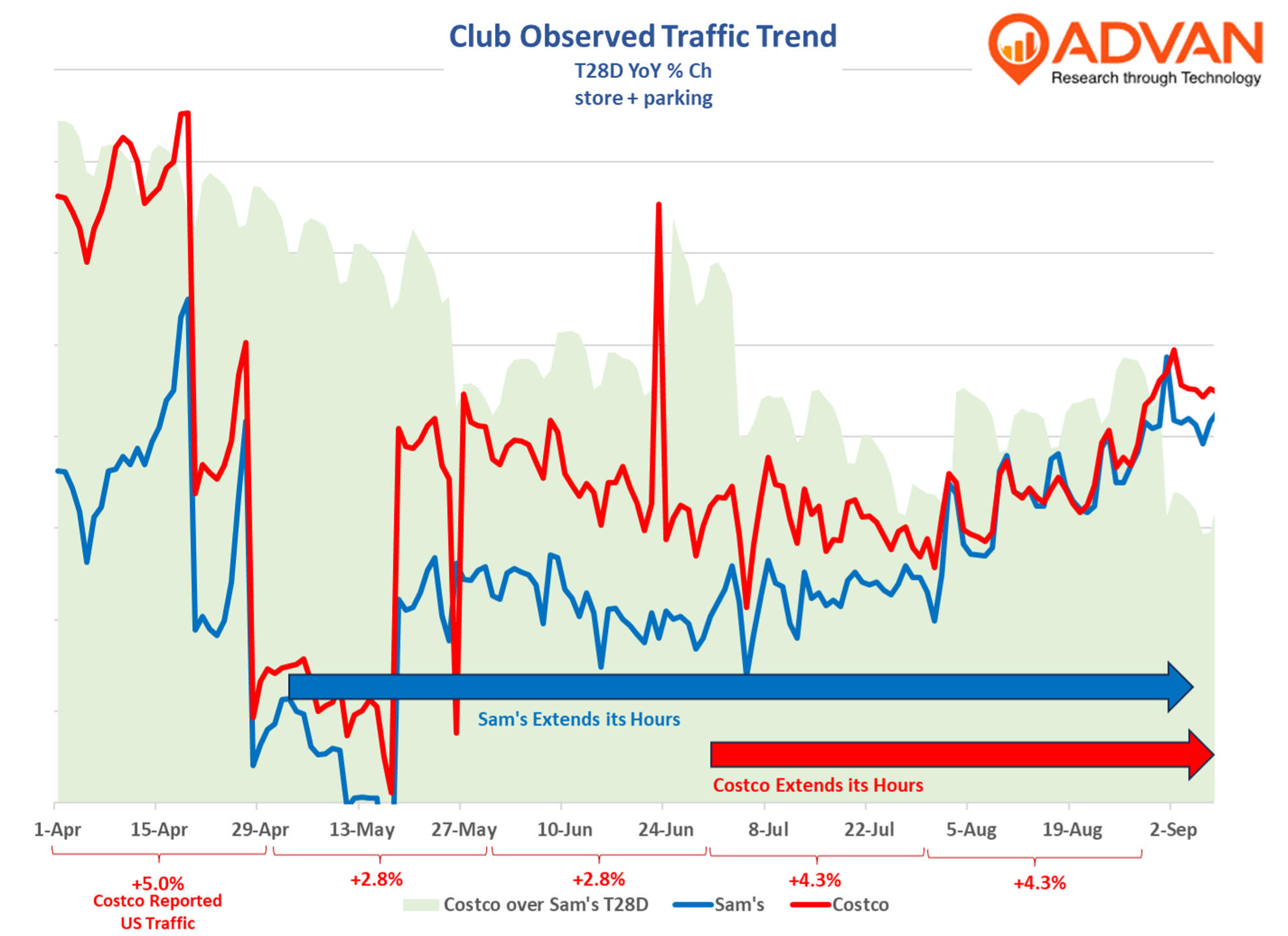

Lots of change in the wholesale club arena as we’ve been writing about , the accelerating pace of expansion, the accelerating embrace of multichannel, proof of membership at the door, scan & go, and more. Longer store hours is the latest change. In May, Sam’s opened its cafes an hour earlier. Club hours are now 10-8 for all members. At the end of June, Costco began opening its doors earlier (9:00 AM) to Executive Members, and extended closing time by an hour on Saturdays. It will be interesting to see how that impacts margins (incremental sales vs. incremental labor hours) when earnings are reported in a couple of weeks.

Since the change, the trends for Costco’s traffic and customer spending have improved, as shown. The lift to spend is slightly less than the lift to traffic. However, Sam’s has also shown a firmer trend; as such, it’s hard to know how much of the improvement is coming from the expanded hours vs. just more share capture with consumers fearing higher prices from tariffs and other matters, especially in consumables. August CPI has especially hot in the fresh category (and coffee). The all-items index rose +2.9% YoY, but beef & veal rose +14%, other fresh vegetables, +4%, apples +10%, bananas +7%, and coffee +21%. Fresh is where club wins in value, and historically high inflation in fresh has moved market share to the clubs. Conventional grocers know that and so we were not surprised to hear Kroger’s interim CEO Ron Sargent say this week on its earnings call, “ We know that fresh products are important to our customers, specifically in meat and produce. These categories continue to outpace center store sales and reflect the growing demand for healthier options. Our sales growth in fresh category shows that we’re making strong progress in the categories our customers care most about… Improving grocery volume is also important to us. We’re making strategic price investments, which led to another quarter of sequential improvement.” And CFO David Kennerly, “We are encouraged by the continued improvement in grocery volumes, particularly in the perimeter of the store.” (The perimeter of the store is dominated by fresh.)

On the consumer, Sargent said, “Customers are feeling pretty stressed about the economy. They’re doing things to save money. And when you look at income cohorts, low and middle-income households are really looking for deals. They’re using coupons more. They’re making smaller but more frequent trips and they’re buying more private label products. They’re also eating out less. When you look at the higher-income households, while they’re also concerned about the economy and food prices, they’re still spending. And they’re splurging on some of the premium products…. I think they’re also interested in value per serving. So in both groups, we’re seeing less of the maybe discretionary spending**. We’re seeing some declines in snack categories, adult beverages**. So looking ahead, I think we think that the consumer is going to remain cautious. Consumer sentiment continues to be low historically and customers continue to be sensitive about food pricing.” (Increasing use of GLP-1 drugs and the broader trend of “better for you” are impacting snacks, BevAlc, and center-of-the-store to the benefit of fresh.)

LOGIN

LOGIN