As of late, we’ve been writing about the improving demand for housing-related retail , with the trend up after being in the dumps since 2022. We also see evidence of that improvement in the building confidence of the management teams of the related principal retailers in to the form of increased capital outlays– **Lowe’s **acquisitions of sheet rock distributor Foundation Building Materials and Artisan Design Group, and Home Depot’s $24B acquisitions of SRS and GMS. Another brand making new outlays is Wayfair; it isn’t adding more fulfillment, it’s adding more retail locations following its first in Wilmette (Chicago) – Atlanta / Denver in ’26, New York in ’27, and more from there. (Investors seem to support the move, given that the stock price has doubled this year.) Wayfair also plans to open locations for its affluent brand Perigold; its first location recently opened in Houston.

At a recent investor conference, CEO Nirag Shah explained their reasoning, “And we think we can draw. And so we don’t think we actually need to be in the center, but we – for the first handful, we didn’t want to take – underwrite that risk, right? So we figure, well, let’s make sure we’re in a good trading area. And so we ran sort of a search across the top 25 metros… And this location in Chicago was with the developer we liked… So that’s been open a little over a year now… And it’s been very successful, and we continue to iterate on it and try things and continue to see the performance grow. It also created a halo with the state of Illinois went from growing at the same rate at the U.S. to growing 15 percentage points faster than the rest of the US. So we measure the halo in also very scientific ways around the trading area with the data science model around different tracking we can do. But the state of Illinois halo math is sort of the easiest to talk about, right? It’s like you know what’s delivered to the state of Illinois before, after you can compare it to the U.S. numbers, and you can see the spread. And that has continued to endure. So we have a view as to why we think it’s very successful, and we have a view as to how we can make it even more successful… But we’re going to open next year in Atlanta, early in the year in Denver later in the year for the Wayfair brand, both large-format stores and one outside of New York in Ridge Hill in early ‘27. That’s what we’ve announced so far. And we think the economics are pretty compelling.”

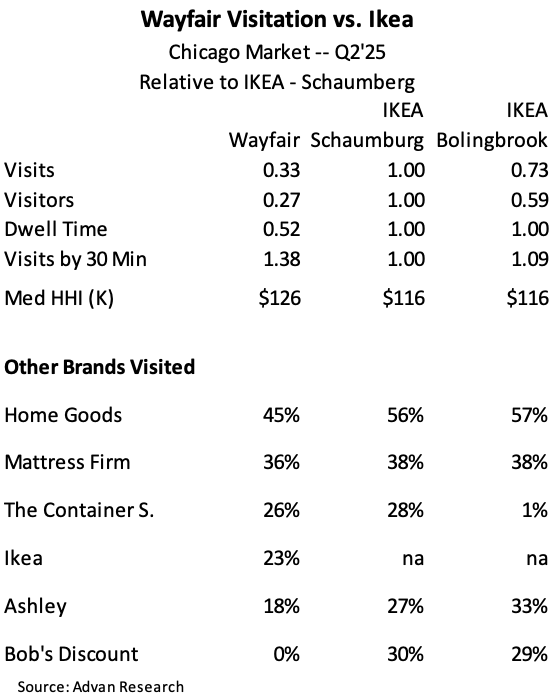

The following table benchmarks Wilmette, which opened in May ’24, against the two IKEAs in the Chicago market. Observed foot traffic to Wilmette is less than a third, but IKEA does monster traffic; the Schaumburg location was the 6th in the nation for traffic. As such, the “third” is a large amount on an absolute basis, bringing in over half the visitors that the closest Target store (Glenview) delivers. Wilmette also draws from a larger trade area than IKEA with visitors driving more than 30 minutes being 1.38X more prevalent, on a relative basis, than Schaumburg. Its shoppers’ median income was 10% higher than IKEA, which was our expectation. The cross shopping to other furniture / furnishings brands is interesting and suggests that Wayfair is attracting quite a different household.

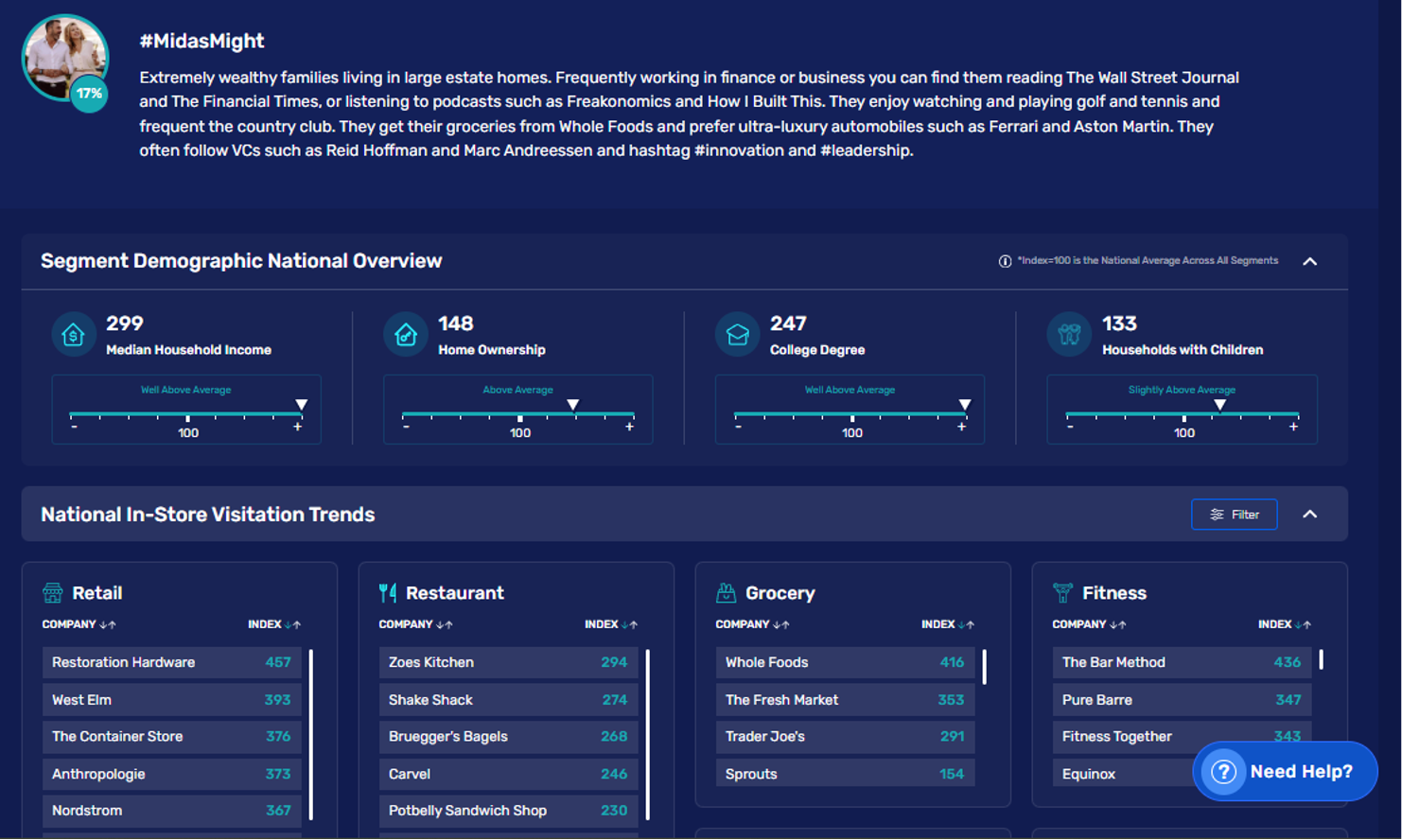

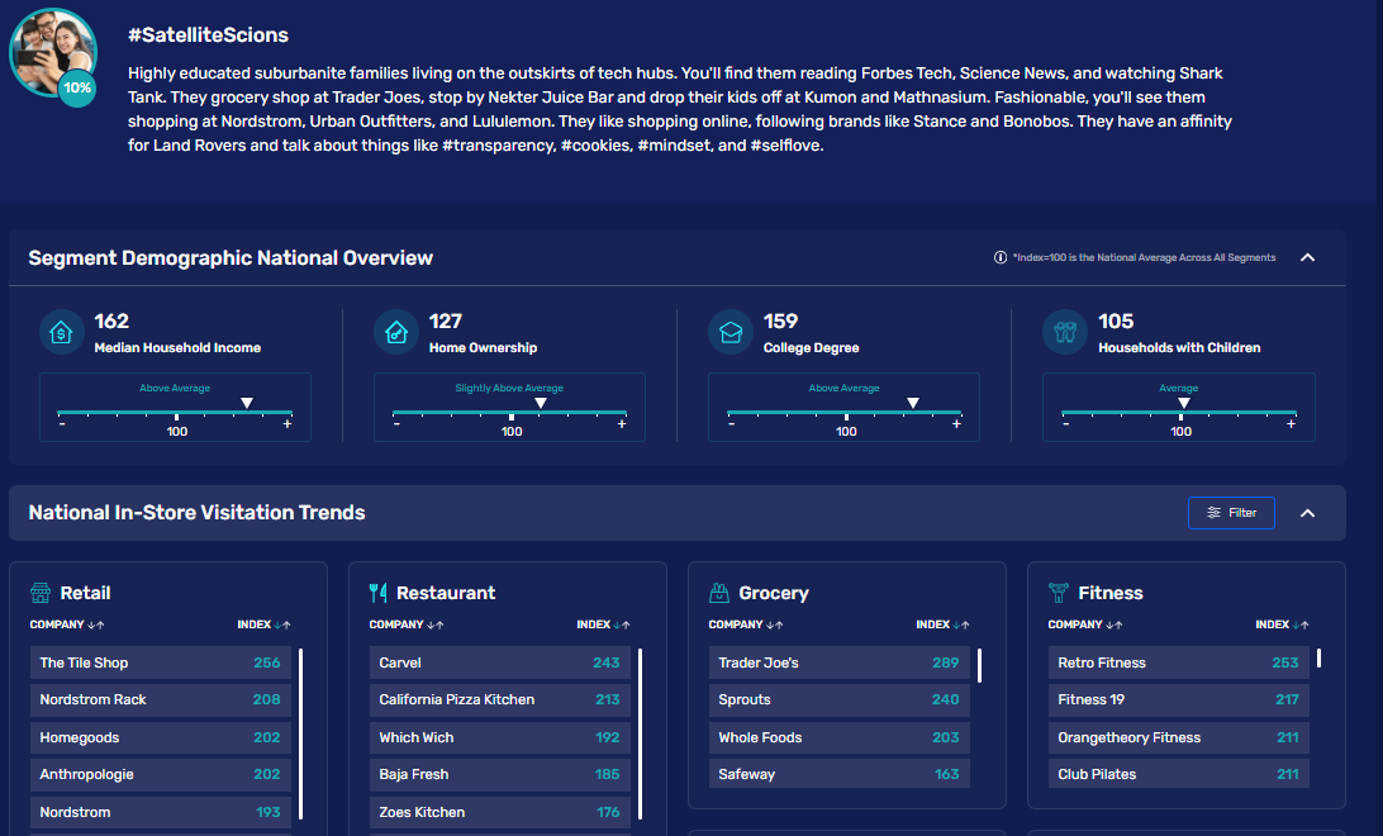

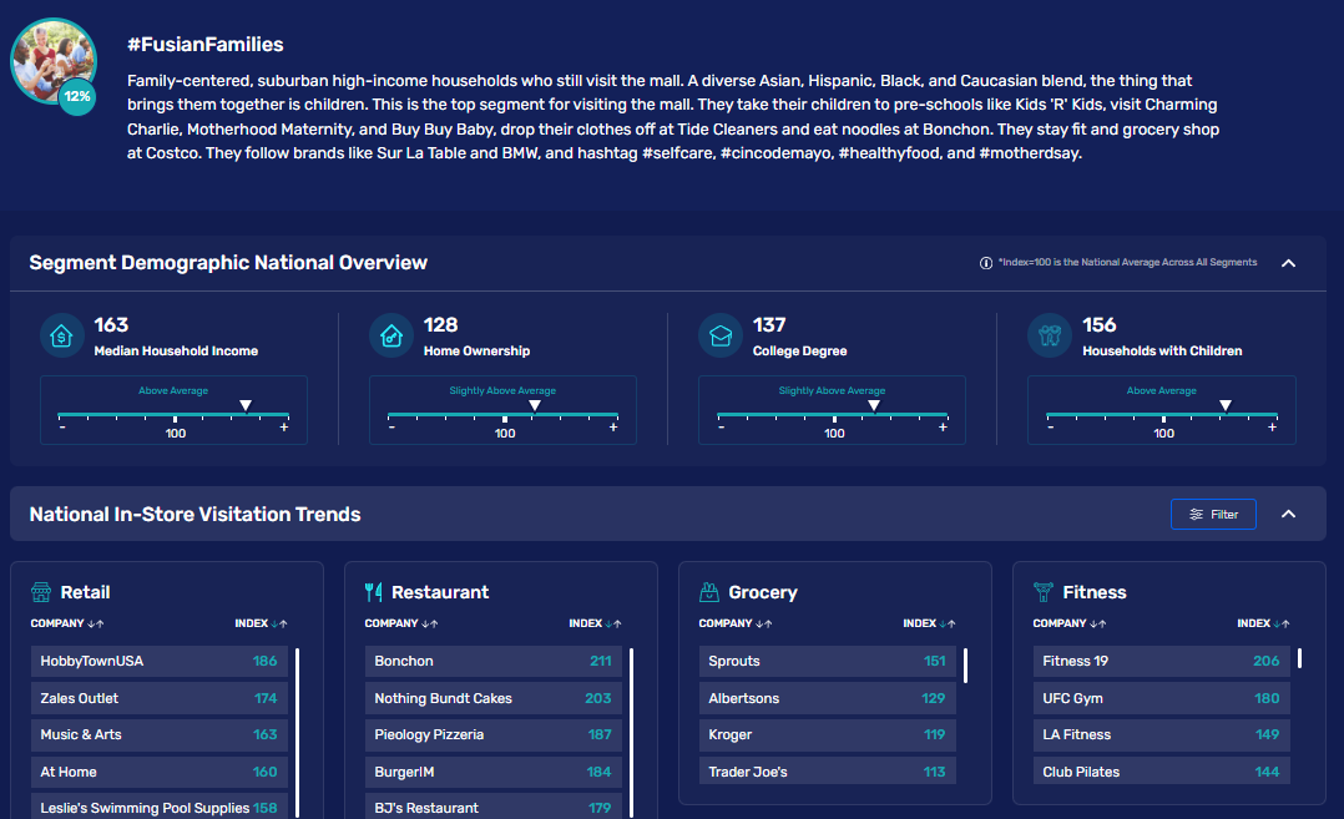

What type of consumer / household is visiting Wilmette? Looking at psychographic cohorts as segmented by Spacial.ai, Wilmette’s number one cohort was the MidasMight high-income household, which made up 17% of visitors. (There are 80 segments; thus, an average cohort size is 1.25%.) By contrast, MidasMight was only 1% of the visitation to IKEA’s stores. Wilmette’s #2 was SatelliteScions at 10% of visitors, far above Schaumburg’s 5% and Wilmette’s 4%. FusianFamilies (1.56X likely to have children) was #1 for Bolingbrook (12%) vs. Schaumburg’s #4 / 6% and Wayfair’s 4%. Our conclusion from this analysis is that the Wayfair store brings in a large number of visitors with outsized spending ability, and they are quite distinct from IKEA’s visitors. It will be interesting to see if Atlanta and Denver match that distinction.

LOGIN

LOGIN