By Thomas Paulson, Head of Market Insights

Polaris makes snowmobiles, motorcycles, ATVs, and power boats – all big-ticket discretionary goods, a category of consumer expenditure that has been in a world of hurt following a pandemic / fiscal stimulus fueled super-cycle in 2021 / ‘22. Higher interest rates (vis-a-vis financing) has also been a headwind during the downturn. Looking at personal consumption expenditure from the BEA, pleasure boats are down -10% from peak and RVs are down -25%. For Polaris, sales in its North American region are down- 31% from peak and down -11% YoY for Q1. Polaris is worse because of share losses to Japanese OEMs which are undercutting on price, leading to Polaris cutting price as well, and because it is under-shipping consumer off-take in order to lower dealer inventory levels. For Q1, retail / dealer sales for its Indian motorcycle were down low-teens YoY, deck boats were down low-twenties (lots of price cuts there as well), and ATVs were down -11%. However, due to good snowfall, snowmobile retail sales increased nearly 50% (the period also had an easy comparison as last year had poor snowfall leading to a low-twenties decline in retail sales).

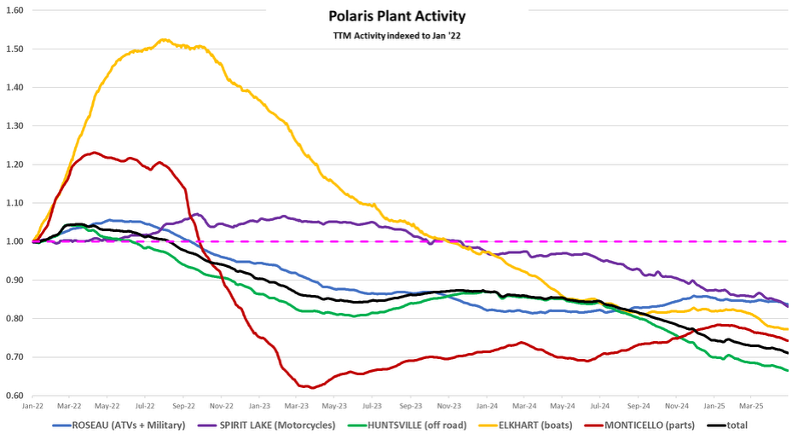

The chart below shows activity at Polaris’ US manufacturing plants and as can be seen, activity continues to trend lower, leading the pace of sales. This year, activity increased only at Roseau (snowmobiles) and Monticello (replacement parts). By contrast, activity at Spirit Lakes (motorcycles) is down -14%, Huntsville (ATVs) is down -22%, and Elkhart (boats) is down -10%. The swoon at Elkhart is stunning. Revenue for the Marine segment peaked in Q2’22 and the coming quarter will be -60% below that level.

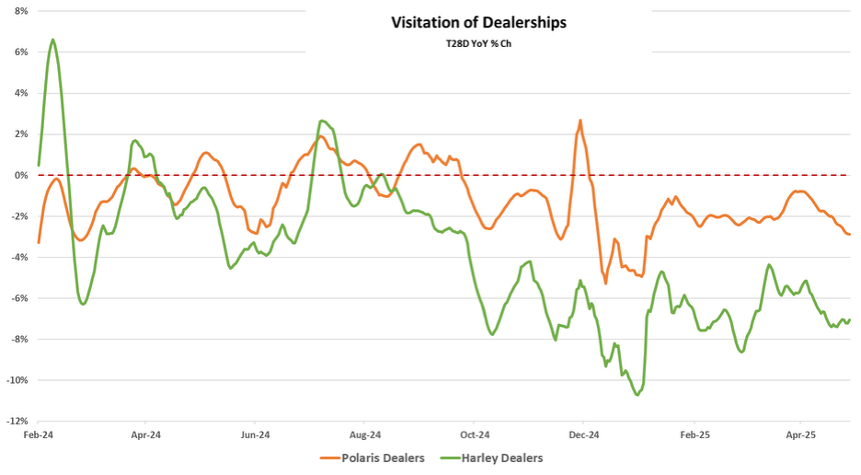

On consumer engagement and spending, CEO Mike Speetzen said, “When they look at products like ours, of which are highly discretionary, things like RZRs, snowmobiles, spending a lot of money when you’re worried about the could there be higher inflation in the economy, is there a risk to your job, I think those things are all playing in, and we’re seeing that volatility. I would tell you, April, really, we haven’t seen anything much different than what we saw in March. The good news is we haven’t seen it get significantly weaker relative to where we were expecting. But at the same time, we were hoping to start to see some positive green shoots. And I think just the overhang created from tariffs as well as just the uncertainty that drives into the broader economic equation is probably causing a fair amount of consumer reluctance to spend on very large items – purchase items.” One can see that consumer interest in Polaris’ products vis-a-vis traffic to dealerships is higher than what the sales data suggests. Additionally, given that Polaris’ / Indian traffic declined less than Harley-Davidson’s for the quarter, we were not surprised to hear management state that the Indian brand took meaningful share from Harley.

_Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN