By Thomas Paulson, Head of Market Insights

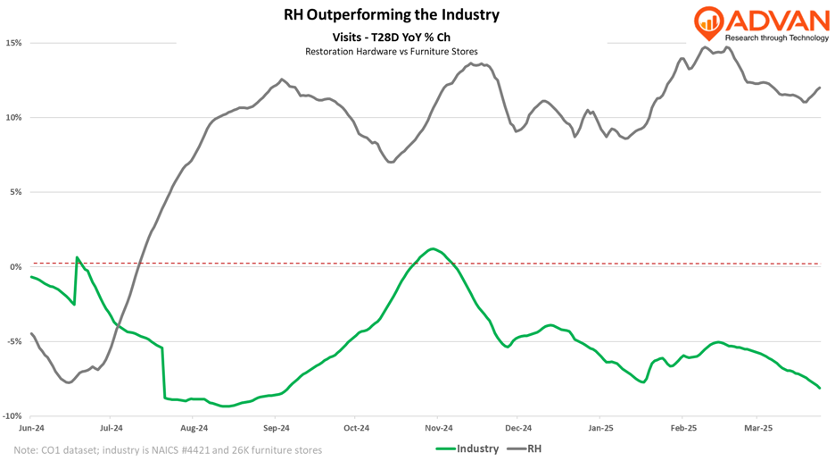

RH reports quarterly results next week and we expect strong revenue growth of +12% ($829M). RH has seen its revenue improve each quarter this past fiscal year, after declining -16% last year (meaning 2023). Visits are up roughly 10% for the quarter which is similar to FQ3. Given the lower conversion rate of the category, these metrics are less helpful in understanding revenue, but the trend is. For the 1H ‘23 revenue declined -20% and visitors declined -16%, with the difference reflecting an erosion in the conversion rate. Part of the improvement in 2024 has been a building conversion rate, i.e. higher intent to buy and a higher average ticket; the growth in spend has been +250bps higher than visits for the 2H of the year. Moreover, longer visits (30 to 90 minutes) are up more than the average.

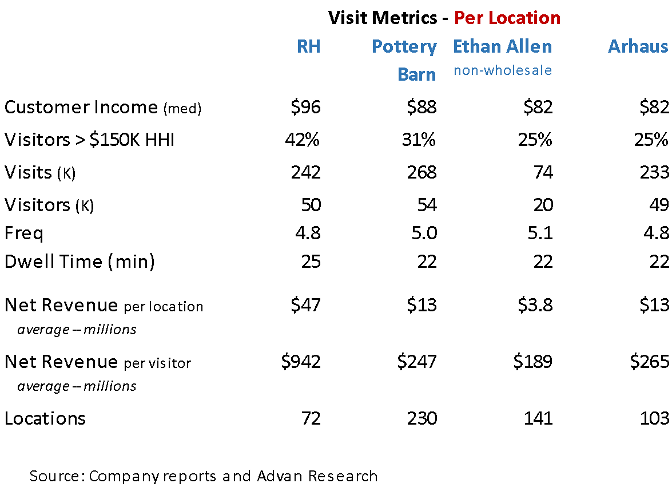

Not everyone is benefitting from the improvement; as shown above, RH is vastly outperforming the broader industry. That difference stems from RH catering to affluent households and affluence that have been driving category growth (our K-shaped economy and consumer spend is one of our primary themes for 2025). RH is also outperforming peers Arhaus, Pottery Barn, and Ethan Allen given a more affluent customer as shown in the table below; as shown the 42% of the visitors to RH locations have household income’s above $150K. Given this cohorts higher spending, the sales mix to this consumer is far higher, like 2X or more. As such, RH sales mix to upper income household is over 80% vs. Pottery Barn’s over 60% and the others, over 50%. We also see RH high exposure to the affluent in the store average ticket that is twice the size of Pottery Barn’s. Pottery Barn’s Q4 sales increased +5% and comp-sales declined -0.5%. Arhaus’ revenue declined 1% and Ethan Allen, -4%. (Written orders were better for Arhaus and Ethan Allen, which implies that demand is improving further down the level of affluence.) As noted above, we expect RH to post a superior +12% revenue growth.

The net revenue shown in the table includes store, catalogue, and online sales; for these brands, the channels have blended together and each of the brands is presented to consumers as an interwoven holistic channel-agnostic offering. And so, that’s how we are analyzing it. The longer dwell time at RH also allows for more spends and wallet capture; its net revenue per visitor is nearly 4X that of Pottery Barn and 5X that of Ethan Allen.

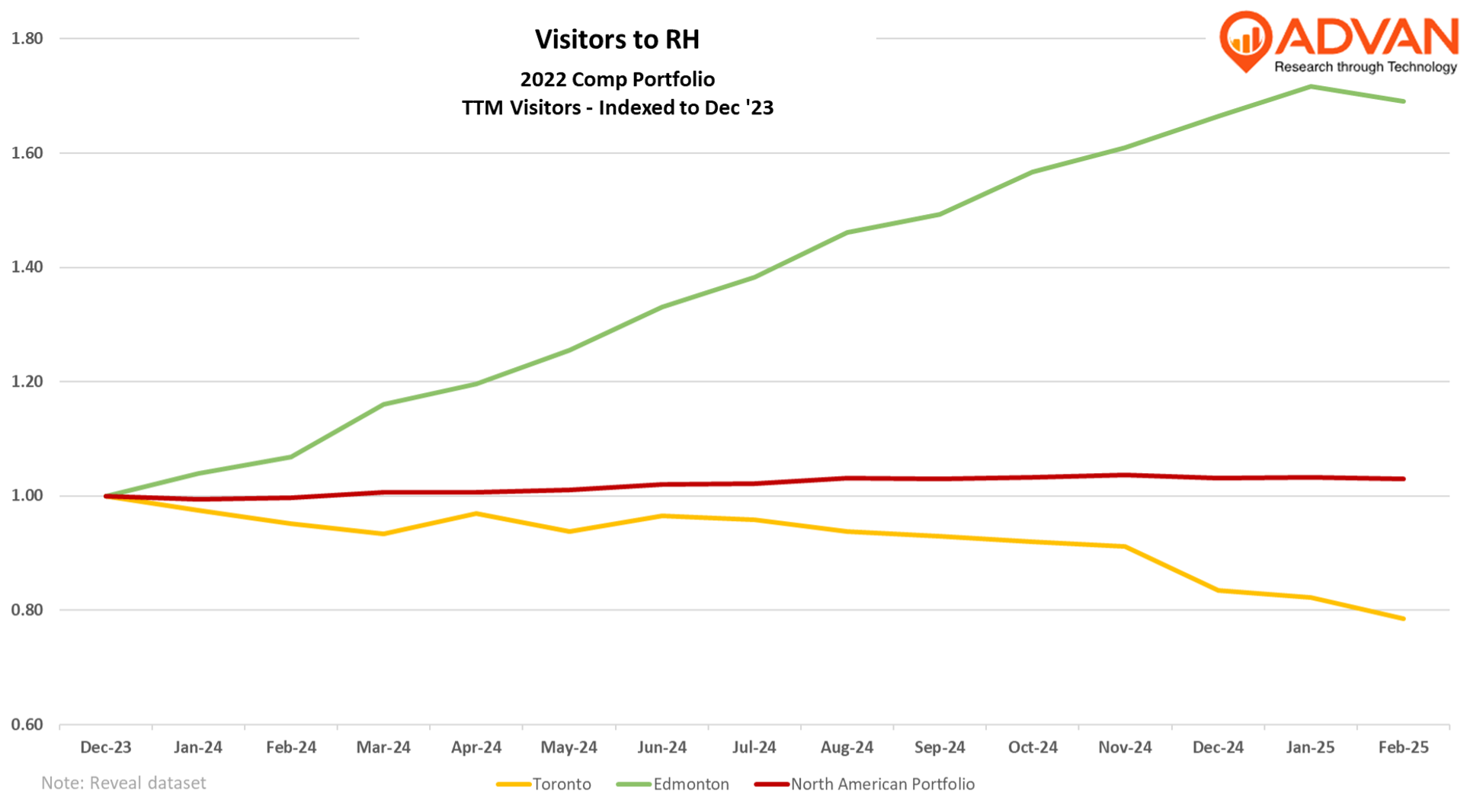

We also see breadth in RH visitation recovery. The chart below is trailing-twelve-month monthly visitors to locations that were open in 2022. Overall, this cohort of stores has seen a steady improvement since December ’23, with the overall level is now 3% above that December. Moreover, two-thirds of the stores have grown TTM visitors, including the strong outperformer in Edmonton, AB in Canada. (Yes, Advan has data on Canada.) Only 8 of the 70 comp-locations are down double-digits, including the Toronto large store. However, Toronto isn’t an underperformer; it’s just an average performer as of February ‘25. Moreover, that location may also generate outsized volume with decorators and on-line. (Our characterization only reflects visitors.)

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN