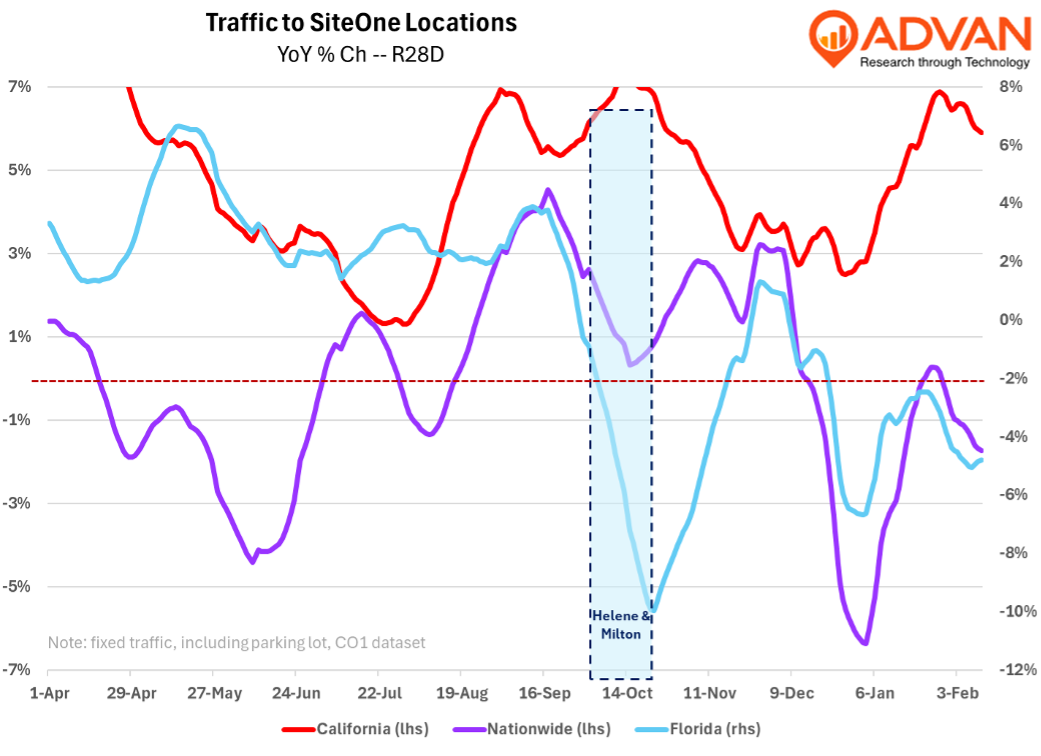

SiteOne’s business and results are interesting these days as they provide a read on the results of immigration policy on industries heavily dependent on immigrants, extreme weather and natural disasters, commodity inflation, and housing. The latter three of these were impactful to SiteOne’s Q4 as one can see in the chart below, obviously especially for Florida. The pick up following the hurricanes was quite abrupt and one would expect those orders to be larger which may be behind SiteOne’s daily volume increase of +4.0%, a 200 bps improvement from Q3’s rate. Deflation is still present for the business and that was a -300 bps headwind to organic daily sales growth. In January, California picked up nicely, which is more likely due to the warm dry weather (vs. wet last year) and not due to any recovery from the fires; that’s on the come as we note below. As to the pace of housing and landscape projects, i.e., the macro, management’s guidance is for only modest growth, and so, no pick up yet.

On the question of labor supply, CEO Doug Black said, “I just would say that labor constraints has been an issue for our customers for a long time, and landscapers seem to be pretty agile and working around that…. But I think it will be later in the spring before we see – if we’re going to see impact – any meaningful impact, haven’t seen that impact yet. John, do you want to address grass seed.” And on the LA fires, Black said, “And so the impacts on our business have been marginal, I would say. Obviously, as homes are rebuilt, landscape will go in, but that’s more of a long-term benefit. But in the short-term, I’d say, minor headwind, nothing major.” (For reference, a third of the business is for repair & upgrades, a third – new construction, and a third – maintenance.)

LOGIN

LOGIN