By Thomas Paulson, Head of Market Insights

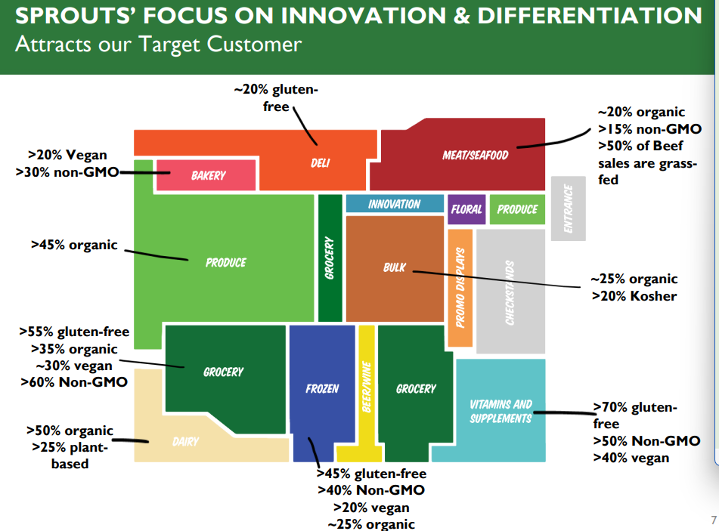

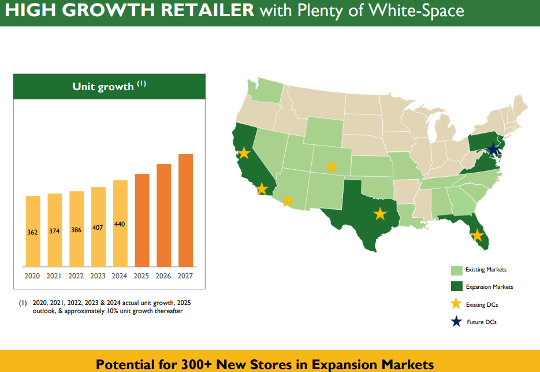

We’ve recently analyzed Sprouts Farmers Market’s strong 2024 performance and highlighted its success of driving capturing market share and avoiding the grocery industry’s woes. That success stems from merchandise differentiation (see the figure below). The merchandise strategy and the successful execution come from its team – a team that Sprouts affectionally calls its “foragers.” Since the results, Sprouts has met with investors and updated them on Sprouts medium- to long-term aspirations, particularly on retail store expansion, which is to be at a 10% rate in the markets shown in the chart below.

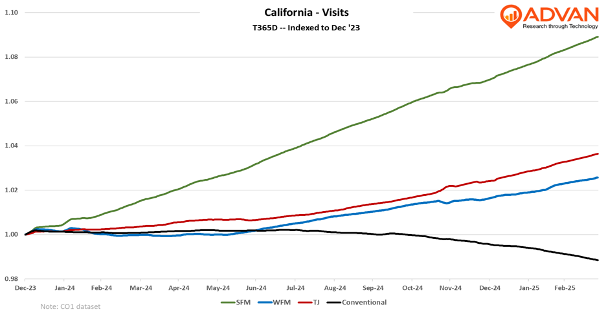

What does success look like in terms of shoppers, traffic, and comp-sales for its expansion markets? In the charts below, we compare visits (total, not comp-) in California and Florida vs. the incumbents. California: since 2023, Sprouts has grown visits by +8.9%, Trader Joe’s by +3.6%, and Whole Foods by +2.6% – within an industry that is down -1.1%. Sprouts’ growth is a combination of both more locations and comp-traffic; since ’23, Sprouts opened 12 new locations and closed one, which increased the store count from 140 to 151. Recognizing that it takes a few years for new locations to reach average levels of productivity, Sprouts’ 8.9% growth can be deconstructed into 5% from new units and 4% comp-traffic. Complementing that growth is Sprouts’ ecommerce expansion, which utilizes third-party delivery services; on a nationwide basis that expansion has added 5% to company-wide revenue. Its ecommerce business is really store-delivery and that revenue is dependent on the retail locations; i.e. it’s an extension of the store. We see little reason why the ecommerce contribution wouldn’t have been at least the 5% amount for the business in California and Florida.

In our recent industry analysis, we argued that growing the number of items in the basket (UPTs) was a key indicator of a grocer’s durable connections with its shoppers and its ability to steadily grow profits. For Q4, we estimate that Sprouts grew its UPTs by +1.5% YoY on a nationwide basis. Including inflation and ecommerce would imply roughly a +12% comp-sales increase for the region and somewhat miraculous given the high competitive intensity and diversity in the state. 12% comp growth certainly justifies expanding in the state.

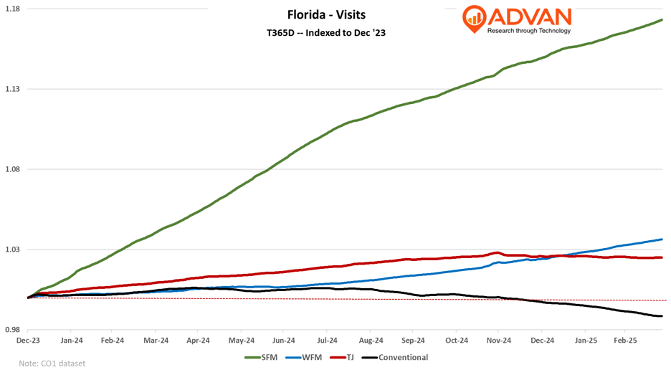

Florida: Since 2023, Sprouts has grown visits by +17.3%, Trader Joe’s by +2.5%, and Whole Foods by +3.6% – within an industry that is also down -1.1%. Sprout’s growth is again a combination of both more locations and comp-traffic; since ’23, Sprouts opened 10 new locations and closed one, which took the store count from 45 to 54. Again, recognizing that the new store productivity component, Sprouts’ growth can be deconstructed into 12% from new units and +5% comp-traffic. Making the same considerations as California, that would imply roughly a +13% comp-sales increase for Florida, again a level of growth that certainly justifies expanding in the state.

Looking one level deeper, Advan shows 38 locations in Florida that have been open since 2022. On a TTM basis through February ’24, this 2022-cohort has increased its monthly shoppers by +4.3%; moreover, there are only two locations that are down more than mid-single-digits. However, those two are now moving in a favorable direction as well. 36 out of 38 locations are growing shopper counts, demonstrating that the brand and the forager’s work have been embraced by Floridians .

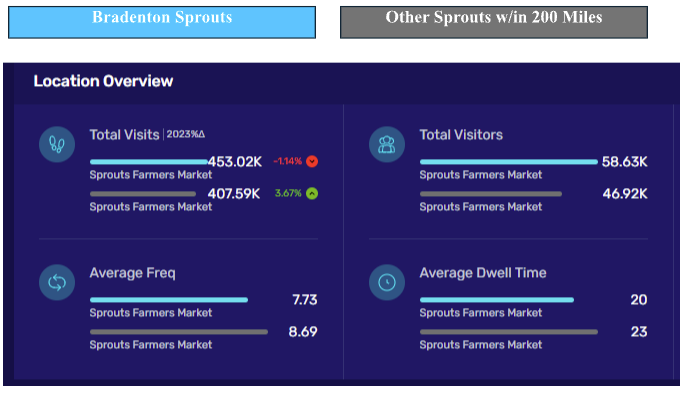

One of the two down locations is the Sprouts Bradenton, FL location, which is across the waterway from St. Petersburg. The two figures below show that Bradenton has an above average level of visitation vs. other locations in the region, however, frequency and dwell time are both below the average, which implies less loyalty and a smaller basket size. Those also imply that it is more of a secondary shop, than a full basket primary shop for its visitors. Being a secondary shop is known and typical dynamic (and opportunity). At a conference earlier this month, CEO Jack Sinclair said, “Our target customers, we’re a complementary shop for our target customers, and that’s the reality of it. We get 13% to 14% of their spend. And some of it in a lot of different trips, some of it in less trips, some of it online, some of it pick up, some of it delivered, but it’s a small share of that marketplace of that customer spend. The opportunity for us is to understand that customer better and to grow that share of wallet. As we grow this share of wallet, that will come through a few more extra trips and have a little bit more within the basket if we do the right things within our stores.“ Lastly, Sprouts plans to roll out a loyalty program this fall; Sinclair also said, “Our marketing has switched from mass marketing paper flyers to very specific digital marketing, which is focused on individual customer needs and the supply chain, making sure that our fresh food distribution is short enough to make the freshness of the product the key for the customer.” New loyalty members will also amplify the activity from that marketing spend.

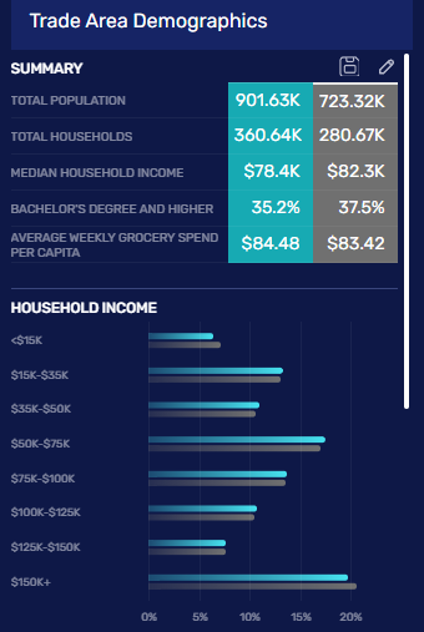

The data also shows that this location has less affluent shoppers than other Sprouts in the region, again suggesting a lower level of sales relative to visits. Shoppers that have a household income above $150K made up only 19.7% of the shoppers vs. 20.5% in the region. (The spend differential will be higher.) Advan’s data on sales shows that the location currently ranks at 63 out of 100 total points. And so, it produces above-average sales, but below its potential. Should Sprouts “do the right thing within the store,” Bradenton’s frequency, dwell time, and basket size will improve. Advan will be watching.

in retailer lingo this is “mark-on” vs. “mark-up” and it refers to the retail price listed vs. the cost of the product from the vendor.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN