By Thomas Paulson, Head of Market Insights

Sprouts Farmers Market again produced stellar quarterly results; comp-sales increased +11.7% (vs. Advan’s estimate* of +11.9%) and management guided Q2 for a 6.5% - 8.5% increase. We take that outlook to be “conservative” as Advan’s ML estimate* is +8.8%, i.e. something would materially need to change in the external environment for them to not beat their guidance. The +11.9% for Q1 and +8.8% for Q2 embed a 140bps improvement in the 3-year trend. Sprout’s reported figures imply a +180bps acceleration in brick & mortar comp-traffic, which is well aligned with Advan’s estimate that comp-traffic accelerated +170 QoQ. Complementing comp-traffic was a comp-ticket increase of around +3.5% and digital sales growth of +28%. The comp-ticket is both more items in the basket and egg inflation. More items demonstrates that Sprouts’ merchants (called “foragers”) are winning over shoppers to try new items, which builds basket size over time. All of these contributors, combined, produced a total sales increase of +19% and a gross profit-$ increase of +23%.

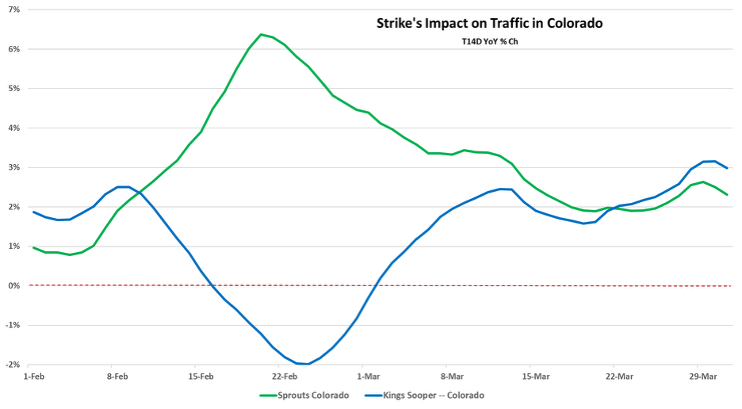

Management noted outperformance in Colorado resulting from disruption during the workers strike at Kings Soopers that lasted from February 6th to February 18th. As shown below, there was a positive lift to Sprouts during the strike, however, in totality, the effect was small. Colorado has 34 locations, out of 443 total, or 7.7%. Advan estimates that comp-traffic on a nationwide basis was +6.7% / +6.8% / +6.2% for the three months of the quarter, i.e. pretty smooth and not reflective of any material strike effect.

Management shared that they are seeing very healthy customer growth. Advan shows visitors per location increasing +1.6%; given the drag from new locations, on a comp-basis the gains would be nearly +2%. Obviously, they are also gaining new customers by putting up stores in new markets and trade areas. Comp stores are annualizing at $20.3M per location and the 29 new stores added over the past year impressively reached 89% of that level, or $18.2M. As a reminder, Sprouts intends to expand locations at a 10% annual rate to eventually exceed 1000 locations; Florida and California are important expansion markets, and the Great Lakes region is next.

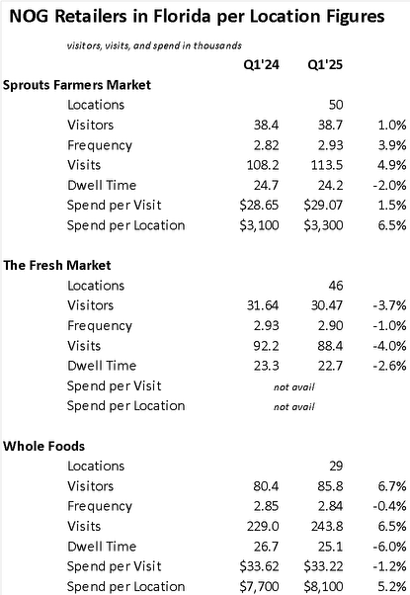

The 2025 store program is for 35 new locations, including 7 in Florida. Florida is an intensely competitive market and below we provide metrics for Sprouts vs. the NOG incumbents. For Q1, Sprouts strongly outperformed The Fresh Market in growth for all the metrics. While Whole Foods drove outperformance in visitors-per-location, the decline in dwell-time and spend-per-visit suggest some of the growth came from Amazon returns vs. shopping trips. One may also notice that Sprouts’ spend-per-location is only 40% that of Whole Foods. Recall that Sprouts doesn’t intend to be a whole shop, but as a supplement to a primary grocery where consumers visit to get Sprouts’ diet-specific offerings and forager discoveries. (See our earlier comments on basket size.)

*Maiden Century Model

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN