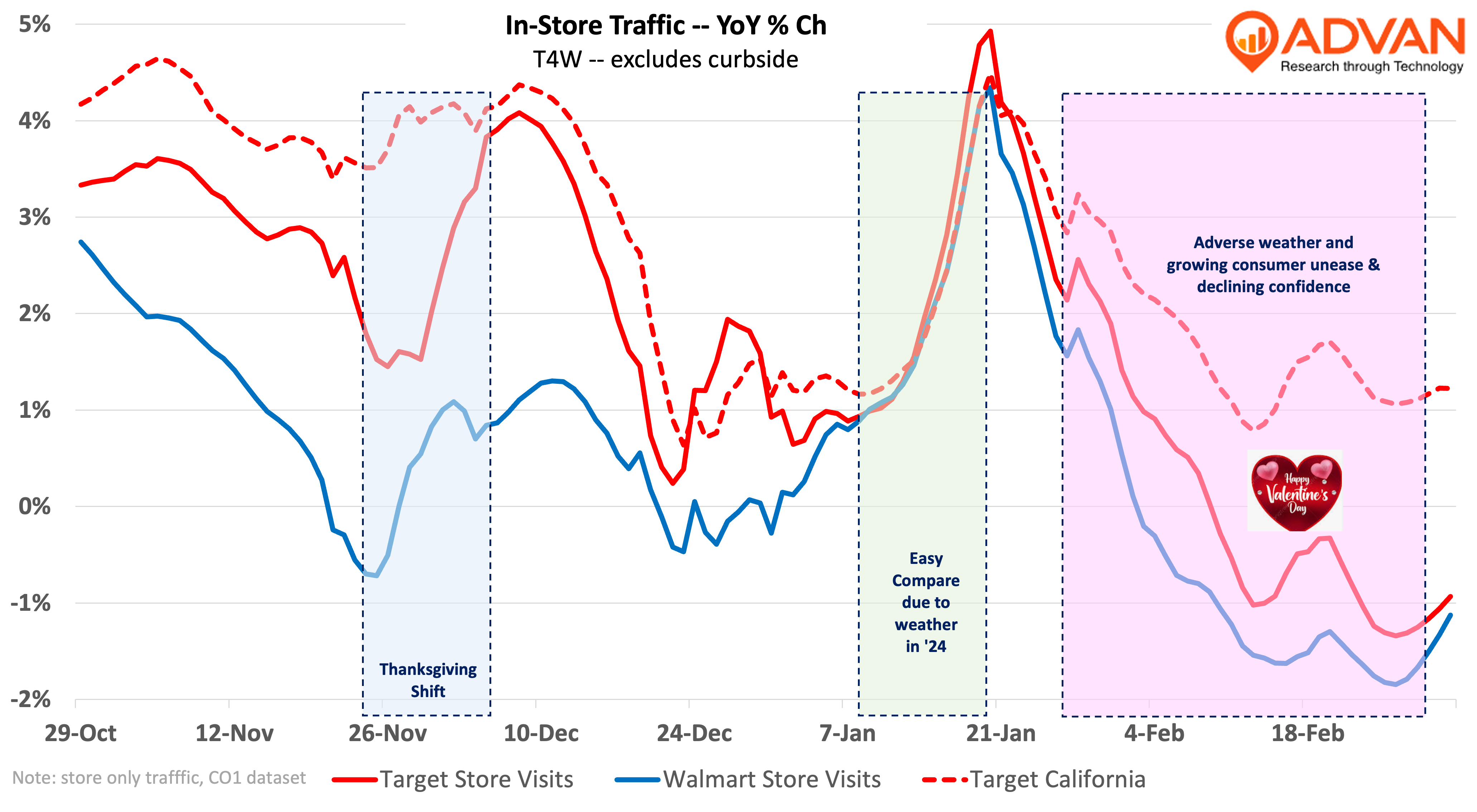

As expected, Target reported improved results QoQ and issued seemly conservative guidance for 2025. We write “seemly” because of all the consumer and business unease being stirred by the hurricane in Washington. That unease is leading to lower macro activity, which for retail means a lower volume month, resulting in bigger percentage-changes given a smaller denominator. A very wintery February is also a factor. We wrote about all of this in our Walmart story two weeks ago and the environment appears little changed since then – i.e. caution and volatility remain as the chart below indicates. (We show Target in California to isolate weather effects on traffic versus the caution impact.)

On Target’s business in February, a small sales decline, CEO Brian Cornell said, “We’re keeping a close eye on near-term sales trends. The sales decline in February we reported this morning reflects a mix of factors. Consumers continue to show a willingness to splurge on newness. We saw this play out around Valentine’s Day, where we saw record-high sales. Yet, as we’ve discussed before, persistent economic uncertainty has consumers taking a cautious approach to spending, particularly in discretionary categories.” (The pop in traffic around Valentine’s Day, February 14th, is clearly visible below.) We also read that Cornell said that there have been no observable change from Hispanic consumers and it’s difficult to tease out the social controversy impact. On the latter, last time there were discrete demand changes regionally, but the company isn’t seeing the same strong evidence of the recent social media boycott headlines like it did last time. We’ve also looked at several chains in the Los Angeles market that have outside exposure to less-affluent Hispanics and have seen little diminution, outside of the time of the wildfires.

As to Target’s quarter, comp sales increased +1.5% with comp-transactions increasing +2.1% overall. In-store comp-transactions were roughly flat to up slightly, or roughly in-line with traffic (+0.7%) per Advan. Digital-comps (which include store-delivery and curbside) were up 9-10%. Comps were ahead of Advan’s estimate* of +0.2% (Moe +/- 20 bps with a 94% correlation) due to the strong growth in digital and a comp-ticket that, while still down (-0.6%), was +160 bps strong QoQ. As the above chart demonstrates, Target did a very good job at driving traffic during the Christmas holiday period, and the ticket improvement also demonstrates that Target did well as a merchant with inspiring and loosening shoppers’ wallets such that more items were put into the shopping cart. Supporting that viewpoint was the category performance. The sales trend improved in apparel & accessories (+500 bps QoQ) and home furnishings & décor and (+200bps), i.e. more “Tarzhay” is working. Beauty continues to hum along at a mid-single-digit rate. Food & beverage grew at the industry’s rate. By contrast, household essentials comp-sales were flat, relative to industry growth of +3.6%, which may reflect share losses to the club channel (Costco, Sam’s, etc.) (There is a lot of household overlap between club and Target.)

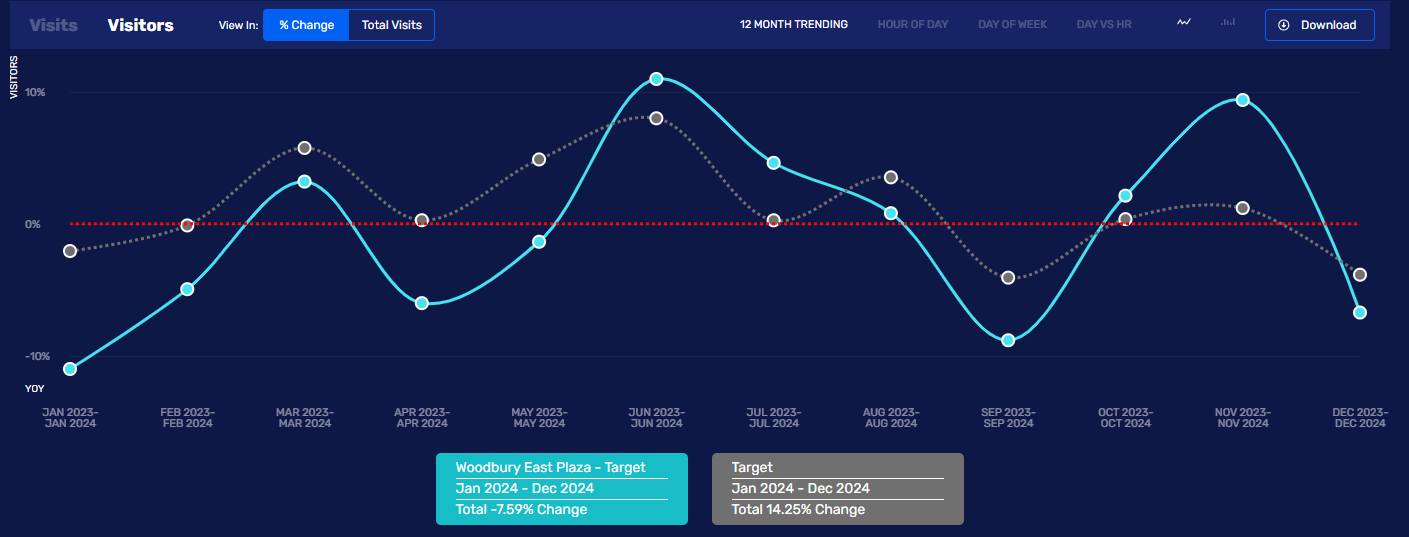

We also see favorability in visitor growth, along with increasing shopper frequency. For Q4, frequency both in the Twin Cities and nationwide increased +2.5%, demonstrating that Target’s loyalty programs continue to produce a lift. The chart below looks at visitor trends for the Twin Cities and one of the market’s higher volume Target stores (Woodbury), and as shown, monthly visitor counts are roughly steady.

Management’s 2025 guidance was for flat comp-sales and a modest improvement in operating margins. Without question, the “flat” reflects the choppy start to the fiscal year; at this time, the Advan* estimate for fiscal Q1 is -1.2% and caution around consumer spending this year in light of tariffs and other matters. However, management’s medium-term outlook also implies a subdued comp outlook.

The results day was also accompanied by an investor day where management presented a compressive view of the business (405 PowerPoint slides, 405 is pretty comprehensive) and their strategies for delivering profitable growth for the next five years. The plan is to expand margins slightly and grow sales at a roughly +2.7% rate, which we would peg as slightly above the growth in consumer spending, excluding durable goods and services. (From 2014 to 2019, annual growth in nominal personal consumption expenditure, PCE, for this segmentation was +2.4%.) However, management’s plan for sales growth is principally predicated on new stores, assuming that those stores deliver company average levels of sales, which seems to be a very conservative assumption. Comp sales growth? We didn’t hear them specifically address the topic; however, we know from Cornell’s orientation, that comp-traffic growth is part of the plan.

The plan’s release included the quote by CEO Brian Cornell, “Shoppers continue to seek differentiated options and distinctive shopping experiences without sacrificing value, and Target has the scale, strategy and capabilities to support all the ways consumers shop and engage with brands. With gains in consumer traffic, continuing improvements in speed and reliability, and accelerating growth across digital capabilities, we are doubling down on initiatives that scale these capabilities and drive meaningful top-line and bottom-line growth. Our strategy is all about creating today’s Tarzhay, offering everyday discovery and delight for millions of families and ensuring Target is a consumer favorite for years to come."

The points from the plan that struck us were as follows:

-- “Beginning in 2025, a multi-year initiative will build momentum in product categories with growth potential. For example, a reinvention in gaming, sports and toys will offer new and expanded assortments and an enhanced in-store experience that will strengthen Target’s position as a gaming destination with video game releases and expand its youth sports offerings.” Said differently, they view these categories as underdeveloped and underserved, interesting.

-- “To spur further growth in frequency categories, Target will launch a new series of Good & Gather Collabs with celebrated chefs, kicking off March 9 with James Beard Award-winner Chef Ann Kim. More owned brand newness — including up&up and other essentials-brand expansions, 600 new food and beverage items across Good & Gather and Favorite Day and a refresh in Boots & Barkley pet supplies — will bring consumers a wider range of affordable options.” As we wrote in our notes on Sprouts and Walmart, growth in grocery is in private label.”

-- “Through its ongoing effort to add more than 300 stores over 10 years, Target plans to open around 20 new stores, the majority large formats, and invest to remodel many more across the country in 2025. Physical stores offer the space and flexibility to incorporate the best of Target’s shopping experience while powering more efficient fulfillment operations and fueling digital growth as part of the company’s stores-as-hubs.”

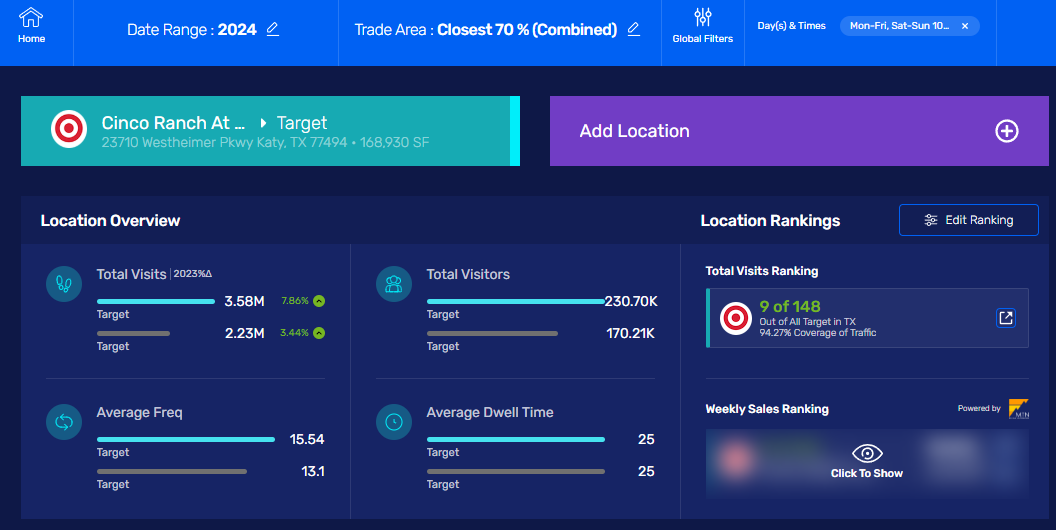

-- We suspect that the 30 large stores per year will be in markets that are seeing in-migration as part of the redistribution that has been ongoing. (See Advan’s migration data for insights on that.) Part of the movement is due to where the US’ economic mojo is moving around to. Part of it is new families seeking out more affordable markets to buy a home and grow a family. And finally, recall that Target opened one of its newer large format stores in Katy, Texas in November of ’22. As shown in Advan’s data below, the location had 18% more shoppers in 2024 than the Dallas regional average with nearly a 50% higher frequency. Moreover, the location was ranked #9 in visits out of the 148 Target’s in Texas. Wow!

-- “Enhancing same-day services – Target’s signature same-day services were its fastest-growing mode of shopping in 2024, driven by meaningful growth from Same-Day Delivery powered by Target Circle 360. The retailer aims to accelerate these services’ growth in 2025 and beyond by improving awareness and ease of same-day delivery throughout the shopping journey and adding new enhancements to make the Drive Up and Returns experiences even more convenient.” This reinforces a known fact that Target, Walmart, and Amazon are all competing on convenience. Stores are giving Target and Walmart an advantage in smaller markets on same-day and next-day. Our speculation, is that Amazon restarts Amazon Fresh in the not too distant future. Lastly,

-- The snip from CFO Jim Lee’s presentation also struck us because of the disclosure that curbside / drive up that is now 11% of sales (we had believed it to be around 8%). We believe that Walmart is just below that level; however, its store delivery business is larger than its curbside. By contrast, at 2% of sales, Target has a long way to go in developing that business. Both statistics have importance to co-tenants and center owners which contain a Target or Walmart as the nature of “activity” is rapidly transforming as store-delivery and curbside are both big and growing at a double-digit rate. See again Amazon.

‘* Utilizing the Maiden Century model.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN