By Thomas Paulson, Head of Market Insights

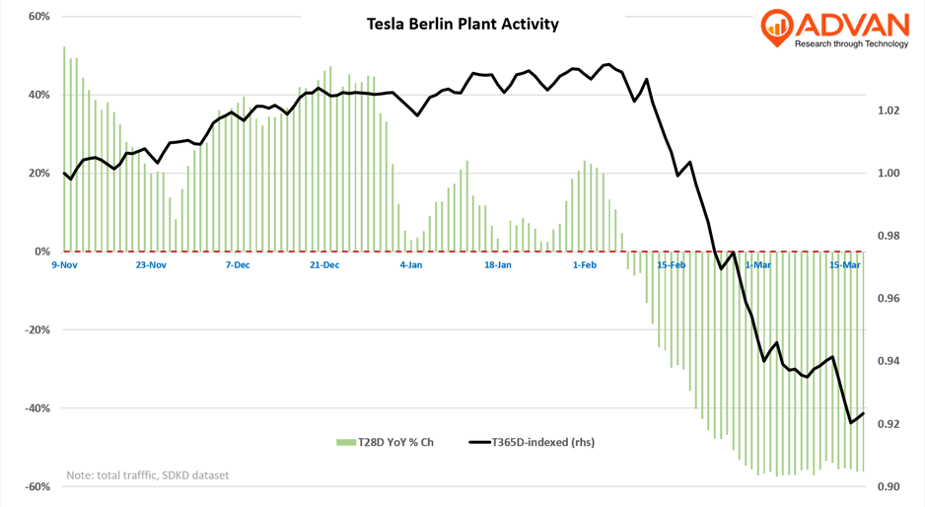

Reports of brand rejection of Tesla are shocking, “unprecedented” is also a relevant characterization. Germany was its largest market in Europe including a poll of 100,000 with 94,000 saying they wouldn’t buy the brand. This follows an estimated drop in sales of 76% in February. How is Tesla reacting to the decline, it hit the brakes hard in February as shown in the chart below; however, the “pressure on the brakes” doesn’t appear to be intensifying in March. This suggests that it is finding some new outlets for its production. We look forward to hearing about that when Tesla reports earnings in a month from now.

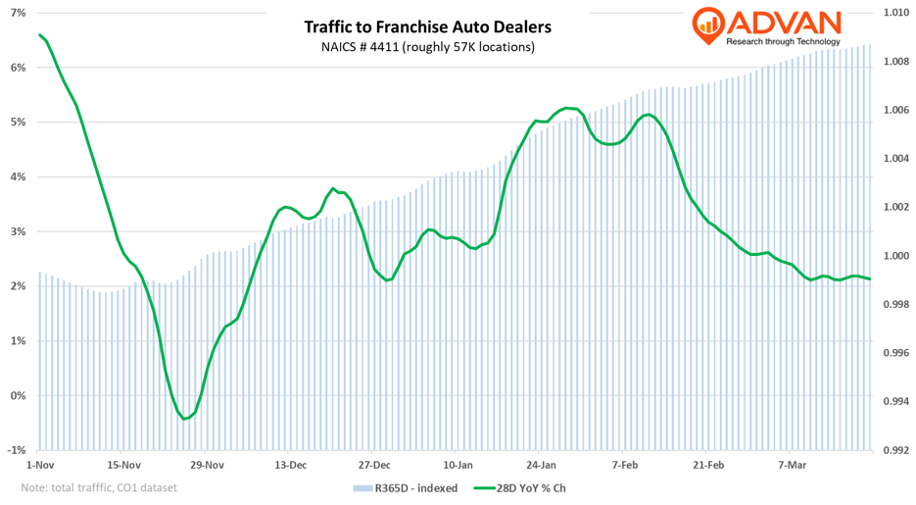

Turning now to the US, sales for the overall new car market were roughly flat in February, following an increase in January (per Wards). The chart below shows visits to new car dealerships in the US; this is roughly 57K dealerships. As shown, January’s traffic finished on a high note before slowing in February; March’s pace has been steady. Moreover, Cox Automotive’s survey of franchise dealers showed a surprisingly upbeat tone. By contrast, Tesla’s sales in the US were down -10% YoY in February after increasing in January. At this time, Advan does not have traffic data for Tesla’s showrooms, but the underperformance of Tesla’s new sales relative to overall sales and dealership visitation shows that the brand has issues in the US as well. Additionally, there are reports that trade-ins are up a lot.

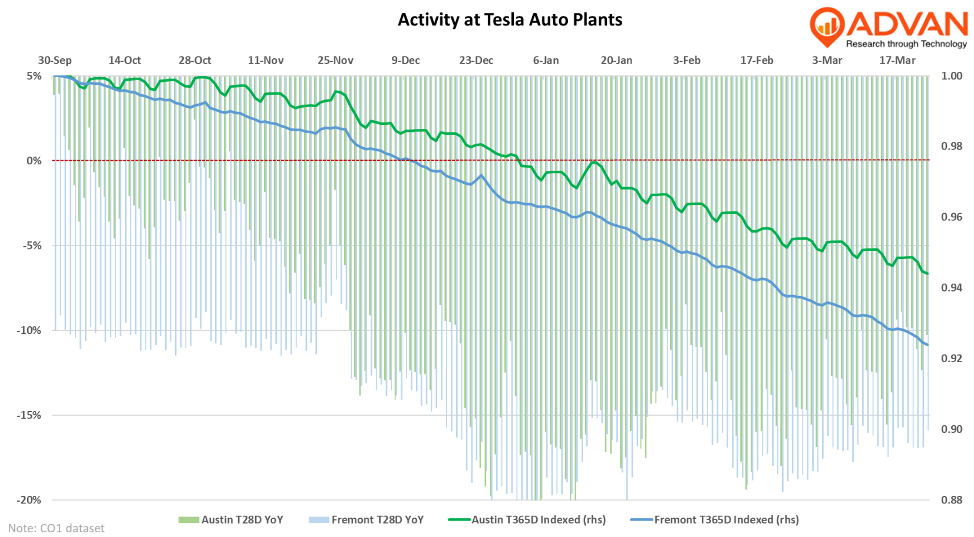

Two weeks ago, we reported on activity at its plants in Freemont and Austin. We’ve updated the data and created the chart below. Activity is down a lot, as shown. However, like with Berlin, the rate of decline peaked weeks ago and is now trending at a lower level and not intensifying. This suggests to us that things in the past two weeks have not worsened more than they expected, which is quite interesting. Tesla reports vehicle sales and deliveries in a couple of weeks, so we’ll learn more and obviously be attentive to their earnings call in a month.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN