By Thomas Paulson, Head of Market Insights

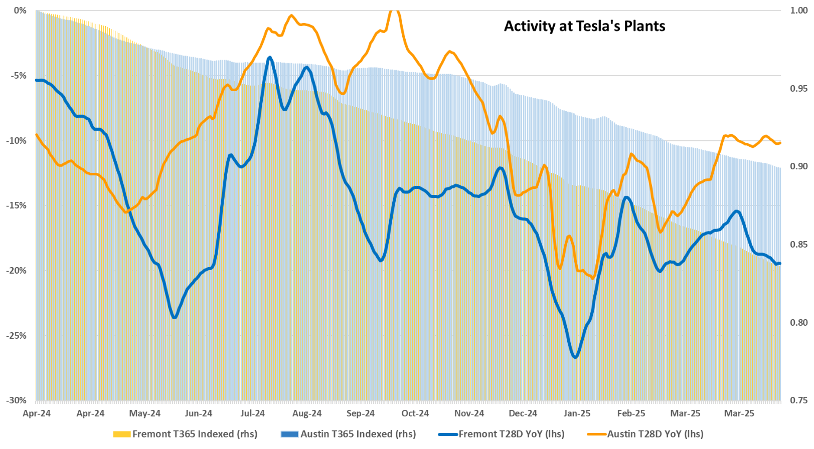

Elon Musk started off the Q1 results call saying, “Well, it’s never a dull moment these days. Well, thanks, for sure, every day is going to be exciting.” That’s a statement that most would agree with. Following TSLA the company and stock has never been dull for us over the past decade; as such, it has been a topic in our Advan Insights. And so, here we go with one more update. On the topic of Tesla’s auto business and this year, not unexpectedly, Tesla withdrew its outlook on unit sales for the year, which is going to create confusion for Wall Street analysts, particularly on how consumer demand is looking in the near-term, call it April and for Q2. Based upon activity at Fremont and Austin, production levels remain down but in a controlled manner, as we show in the chart below. (Recall our last article , “Tesla – Not Yet Hitting the Brakes with Both Feet.”) If we mark the current production pace to the end of Q2, that would put US deliveries at down 9-11% YoY. For March, Tesla’s US sales were down -11% YoY per Motor Intelligence which implies that Tesla’s read on current demand is that things are not worsening.

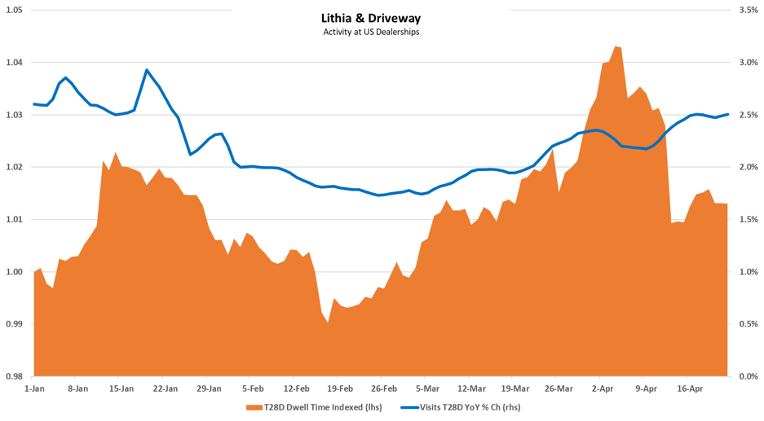

To put things in a bit of context from an industry perspective, Lithia & Driveway also reported Q1 results overnight. (Lithia sells roughly 800k new and used vehicles annually across 18 different brands; they are a “franchise dealership” holding company.) Vehicle sales results for Q1 were similar to Q4’s, which was the expectation. New comp-store units were up +3.6% vs Tesla -11%. As shown in the chart below, momentum picked up in March as buyers came into dealerships to get ahead of any tariffs, i.e. it’s a pull forward effect. That activity also reflected a 400 bps improvement in used comp-units as well (but that was still behind the industry’s rate). Traffic to its dealership (per Advan) accelerated to +6.3% YoY growth vs. +2.6% in Q4; as aftermarket sales growth was slightly less QoQ (+2.4% from +3.4%), it appears that the traffic lift was solely driven by more people interested in purchasing a new vehicle, particularly foreign-made brands, and that is principally macro-related.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN