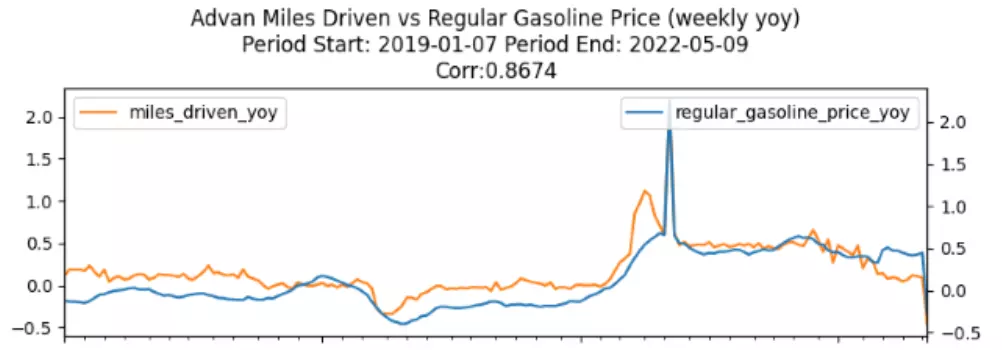

Historically, gas demand has been pretty predictable for any given time of the year, so the supply has been what mostly determined the pricing we see in the pumps. With the advent of remote working and as a result the ability to commute less, however, Americans have at least one lever to reduce the amount of gas they purchase. The other major aspect of the demand of course being leisure travel.

Have the unprecedented prices at the gas pump resulted in lower gas consumption as a result? As we see below, we are definitely experiencing signs of reduced demand, even in an environment where everyone wants to travel after 2 years of lockdowns, and the consumers are flush with cash from the pandemic stimulus checks.

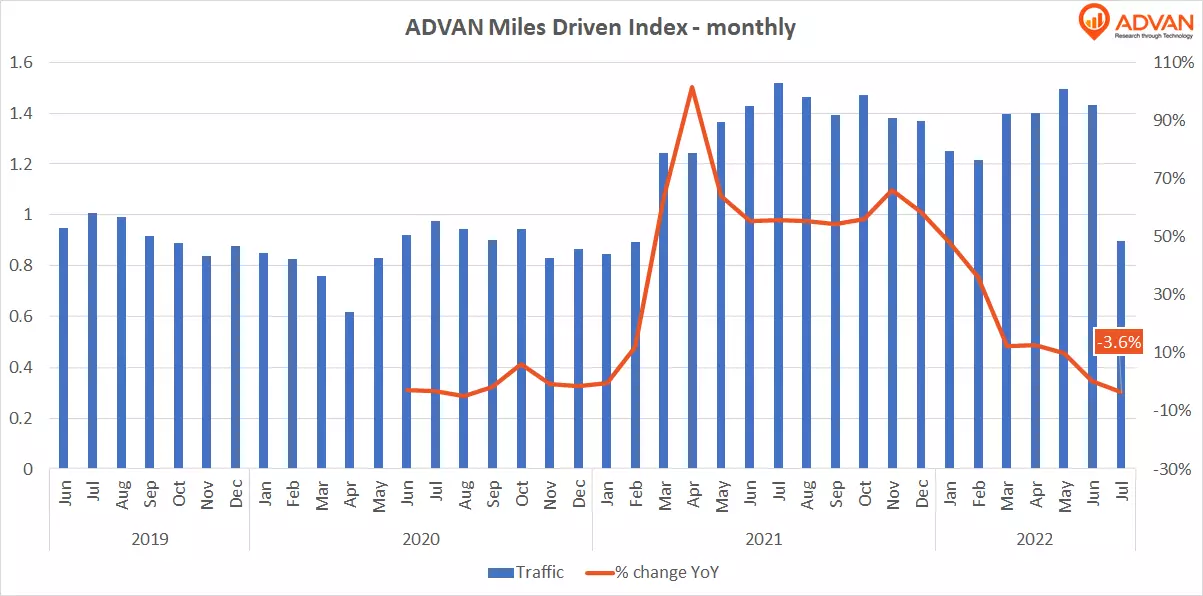

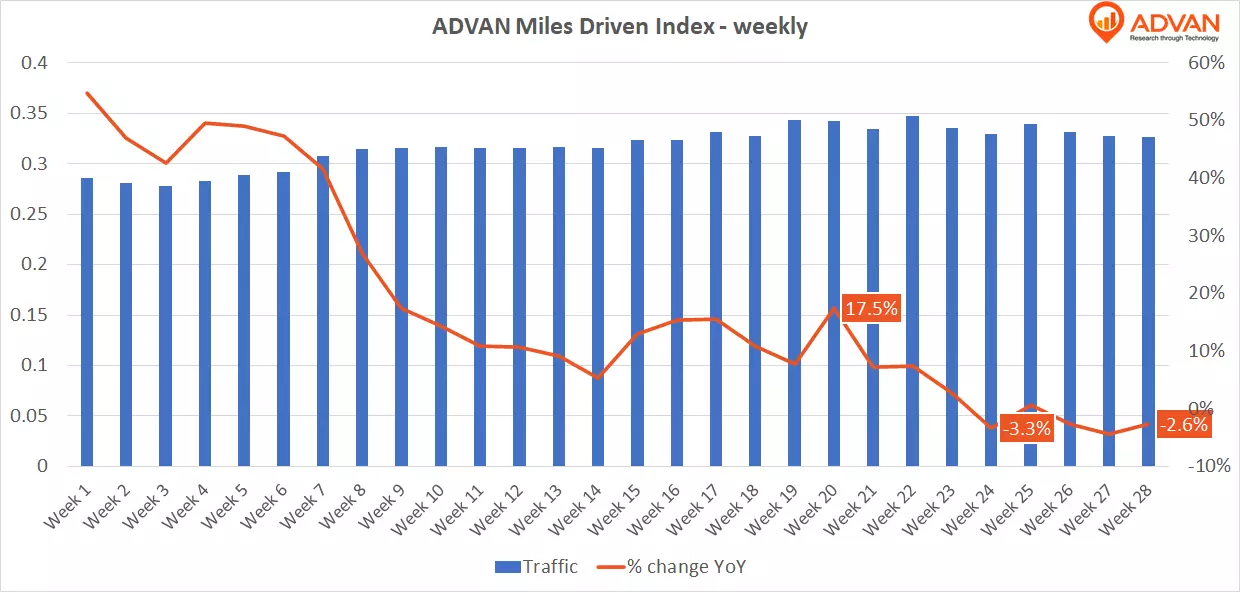

As shown in the graph above, the year over year change in miles driven is becoming negative for the first time in more than a year. July* driving is down about 4% versus last year. The trend of lower traffic than a year ago actually started in the 3rd week of June as we can see from the yearly change of weekly traffic below, with the driving habits constantly dropping throughout 2022.

The drops are still small, but we are seeing a clear trend of Americans driving less; potentially bad news for oil companies, and good news for everyone’s wallet and the environment. And, as history has proven, the miles driven that Advan computes is highly correlated to gas prices, as per the chart below.

For daily miles driven data and other economic indicators across all sectors of supply and demand, delivered on a T+1 basis, feel free to contact us directly.

*data until 7/19/2022

LOGIN

LOGIN