By Thomas Paulson, Head of Market Insights

Ollie’s Bargain Outlet Holdings reported solid FQ4 results with adjusted sales growth of +9% to $667M (just shy of Advan’s estimate of $672M). Growth was driven by a +2.8% comp-sales increase and 47 (+9%) more stores over the past year, including locations taken over from Big Lots and 99 Cents Only. The earnings release quoted CEO Eric van der Valk saying, “With so many retailers closing stores or going bankrupt in the past year, there are a considerable number of abandoned customers, merchandise, real estate, and talent in the marketplace. We think there is a unique opportunity to take on some of these assets in a manner that strengthens our competitive positioning, broadens our footprint, and bolsters shareholder returns for years to come. With our expanded supply chain, flexible and resilient operating model, fortress balance sheet, and committed associates, we are ready. WE ARE OLLIE’S!” Reflecting that “opportunity” the number of openings in 2025 is now 75, a higher level than last year and inclusive of 40 additional former Big Lots store locations. The release read, “these store locations are leased properties with below market rent and favorable leasing structures, located in good trade areas, and have been serving value-oriented customers for many years.” (2026 will also be a larger number.)

Looking more closely at the comp-sales increase, Advan’s estimate for Ollie’s comp-traffic is around +3%, comp-transaction increased around +1.4% and comp-ticket a similar amount. Comp-ticket improved by nearly 200 bps QoQ and that reflects an improved merchandise assortment and priced value. Ollie’s loyalist members (Ollie’s Army) grew by 8% to 15.1M; given that these members are 80% of sales, sales per member is now $157 annualized. Looking at dwell time and frequency of visit for Q4, visits lasting 30 to 60 minutes outperformed total visits by 700bps and frequency of visits at 4 to 6 times in the quarter outperformed by 200 bps. (Recall that Ollie’s has a non-standardized treasure hunt merchandise strategy.) Those gains demonstrate that customer (i.e. loyalty member) engagement was very strong in the quarter. This is also reflected in managements’ above comments about the quality of merchandise and its ability to get those “hot buys” onto the shelves, as well as does the improvement in comp-ticket. Of note, this was also true for the off-price industry, our analysis here , i.e. it’s a macro thing. Moreover, the recent inventory and shipping movements in reaction to tariffs are likely to extend the favorable “macro thing” environment. If true, we’d expect comp-traffic for the off-price and liquidation channels to continue their outperformance.

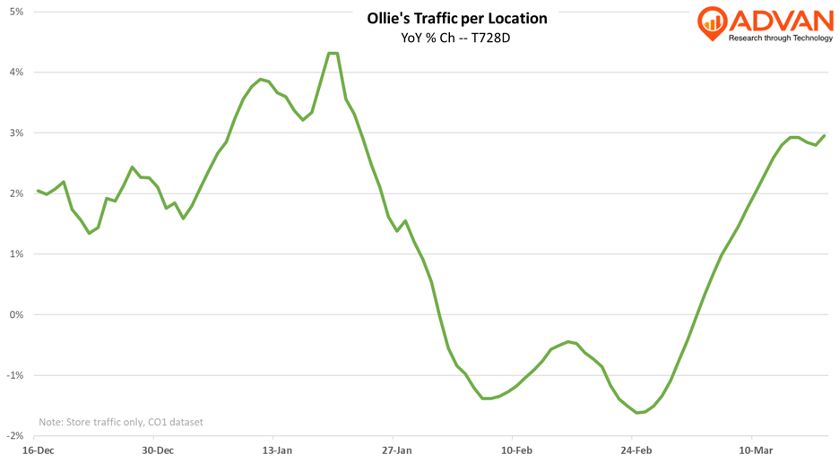

Management’s guidance for 2025, embraced the optimism noted above and as shown in the chart below, after a swoon in February, traffic is now running at a pace higher than December, which was the strongest month of its fiscal Q4. As such, it appears that “the General” has ordered his “Army” to charge. On FQ1, CFO Rob Helm said, “February was a pretty tough month. There were quite a bit of headwinds. There was weather. There were the Big Lots store closures. There was a delay early on in tax refunds, although that’s caught up and now started to accelerate. And there’s been widespread media reports of a slowdown in consumer demand [but] we have some pretty good momentum at this moment.”

*Utilizing the Maiden Century model.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN