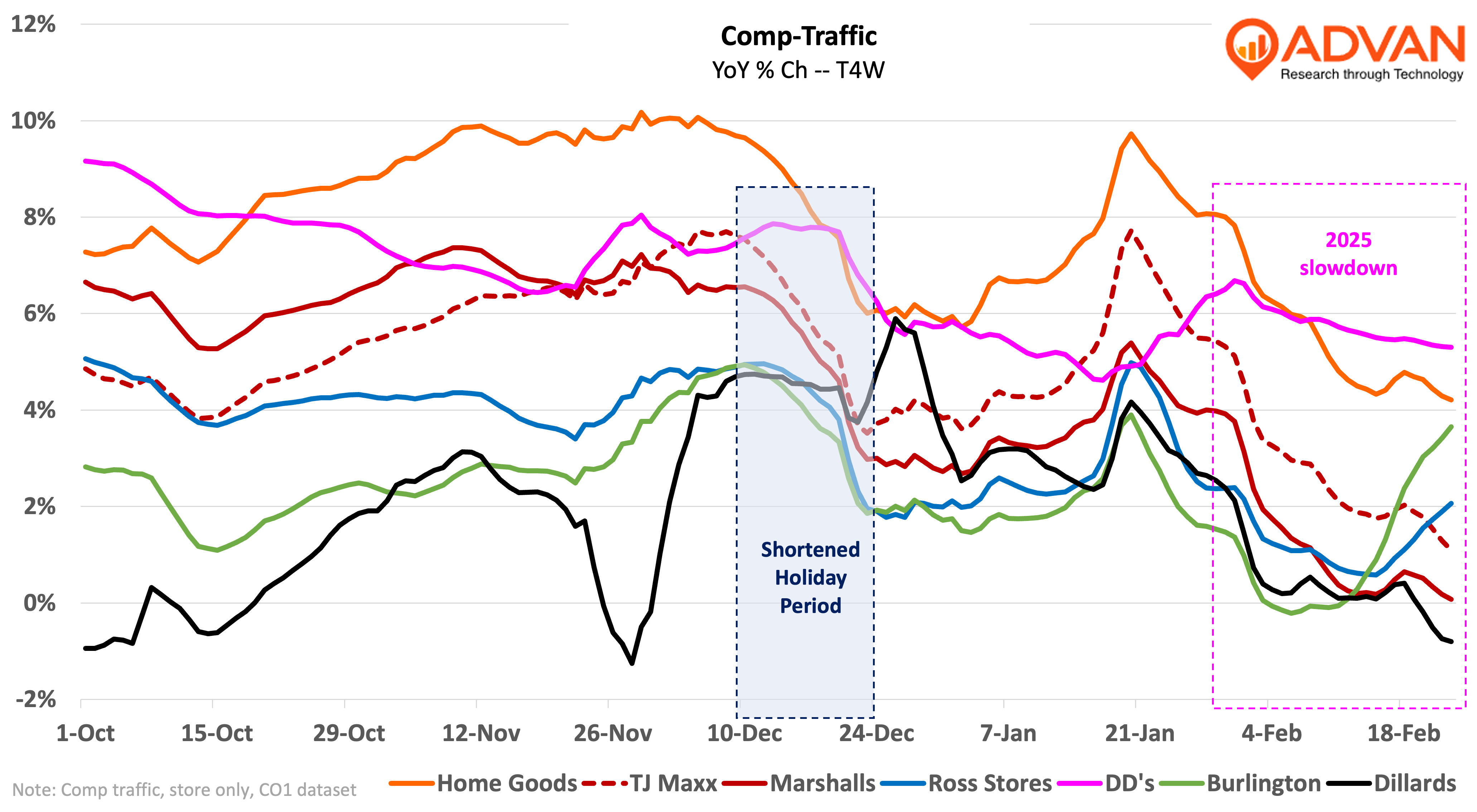

Looking at the off-price sector overall, comp-traffic was solid and while the rate was slower QoQ, that deceleration largely reflected the abbreviated shopping period this year (five fewer days and one fewer weekend between Thanksgiving and Christmas). Sales were likely little impacted as more items per visit were purchased. As has been the case all year, TJX’s Marshalls and TJ Maxx led its peers Ross Dess for Less and Burlington in comp traffic growth and likely in comp-store sales per Advan’s estimates.

Q4 results for the Marmaxx segment, which is composed of Marshalls, TJ Maxx, and Sierra, showed sales of $9.97B, comp-sales increasing +4%, and segment margin up +50 bps. The comp was consistent on a 2-year basis, but much stronger (+440 bps) on a 3-year basis. The improvement in 3-year trend and segment margins demonstrates the consistent performance of the company and the strong resonance that the brands have with the consumer. Management said that sales were driven by comp-transactions; Advan shows traffic up +3.8% and average ticket of $65.07, down -1.3% YoY, thus aligning with management’s claim. CEO Ernie Herrman also said, “Comp store sales increased across all of Marmaxx’s regions and income demographics,” i.e. implying that trends were consistent and that adverse weather and shorter holiday season were non-issues. Lastly, that comp-transaction growth led traffic growth implies that the conversion rate increased. An improvement in conversion rate and potentially units per transaction (UPTs) proves that the Marmaxx’s merchants delivered the goods that shoppers wanted, at a price they were willing to pay, and the stores were in high enough standards that shoppers could find those goods and check out of the store in a satisfactory amount of time.

The sales increase was ahead of Advan’s $9.84B estimate* (+/- 90 bps T4Q Moe, 76% T7Q correlation). We suspect that the 130bps error to the reported figure stems from the calendar anomaly this period as those visits will have yielded a much larger ticket (on average for this period vs. on a comp-basis).

For the HomeGoods segment, comp-sales increased +5% and segment margins decreased -80 bps. The 2-year comp-CAGR held steady at +9.2%, but the 3-year accelerated to +16.8% from 12.4%. Traffic per Advan increased +5% and the average ticket of $65.65 decreased -1.6% YoY. Given the decrease in average ticket at both HomeGoods and Marmaxx, it appears that the company is intentionally pushing price points slightly lower, a positioning also taken by Amazon, Walmart, Target, Burlington and others. (Government data shows prices for the table-top category down -4.6% (BEA PCE) and apparel as flattish, but we think that is a specious statistic; Walmart’s apparel AUR was down mid- to high-single-digits.) We also think that Marmaxx’s and HomeGoods UPTs (items in the basket) are up based on management’s favorable tone on the call, i.e. the merchants delivered on the goods and at the right value. Herrman, “I think you’re asking about the mark-on as we look forward on the buying. So the way we’re looking at it is, again, this environment, which, as you can see, we’ve made healthy progress in the last couple of years on that front. I feel as though some of those situations slow up a little bit, obviously. I think the environment right now, however, is a bit of, as I said earlier, it is textbook with more availability, I think, heading to almost every one of the divisions that we have because of the environment. And I believe a consumer confidence slowdown, as well as you have, again, a lot of public companies are aggressive on cutting merchandise in advance because they have to grow their earnings.”

Our reading between the lines on the above is: there is a greater availability of goods from vendors, as such, TJX is now offering lower prices to the vendors, yet their offer gets taken. TJX puts a higher mark-on to increase the penny-profit per unit while also offering a lower price to consumers. For Q4, gross margins improved by +100bps due to strong mark-on as well as less shoplifting (or “shrink” in industry-lingo.) That level of gross margin improvement at Marmaxx would have yielded a +7.5% increase in comp-profit-dollars, well ahead of the +4% comp-sales increase. Management (and shareholders) would be very happy with the +7.5% comp-profit-dollar increase. By pressing price point lower, Marmaxx is improving both its market share and penny-profit, or unit economics. Expect more of that in 2025, HomeGoods as well.

TJX Companies’ guidance for Q1 was a +2-3% comp store sales increase, slightly below Advan’s +3.3% current estimate. CFO John Klinger said, “While weather was not favorable to the start of the quarter, we have been pleased with what we’ve seen recently as weather has normalized.” Lastly, given the relative stability in traffic at Burlington vs. Marmaxx, we’d expect them to report in-line results (i.e. comps* of +2.6%, Moe 110 bps).

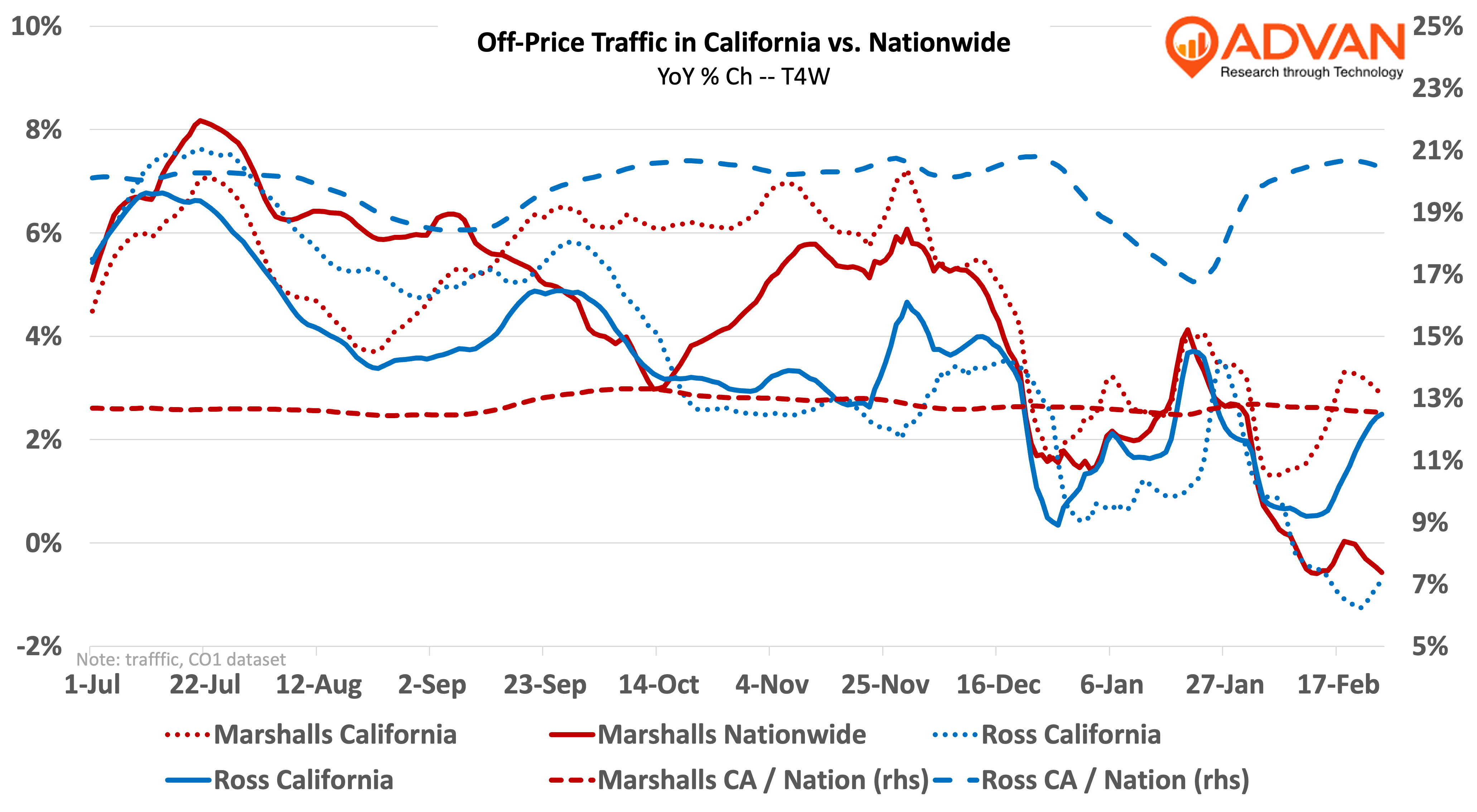

Ross Dress for Less’ relative performance has largely been consistent. We were worried the changes in immigration policy from the incoming Administration and Ross’ high exposure to California were a risk. (California is 20% of visits for Ross vs. Marshalls’ 12.7%.) While we do see dip in January for Ross, that has since recovered. Furthermore, we don’t see any such dip for Marshalls. Thus, there seems to be little evidence to support that concern. Moreover, the dip coincided with the fires, which seems to be a more probable explanation.

LOGIN

LOGIN