By Thomas Paulson, Head of Market Insights

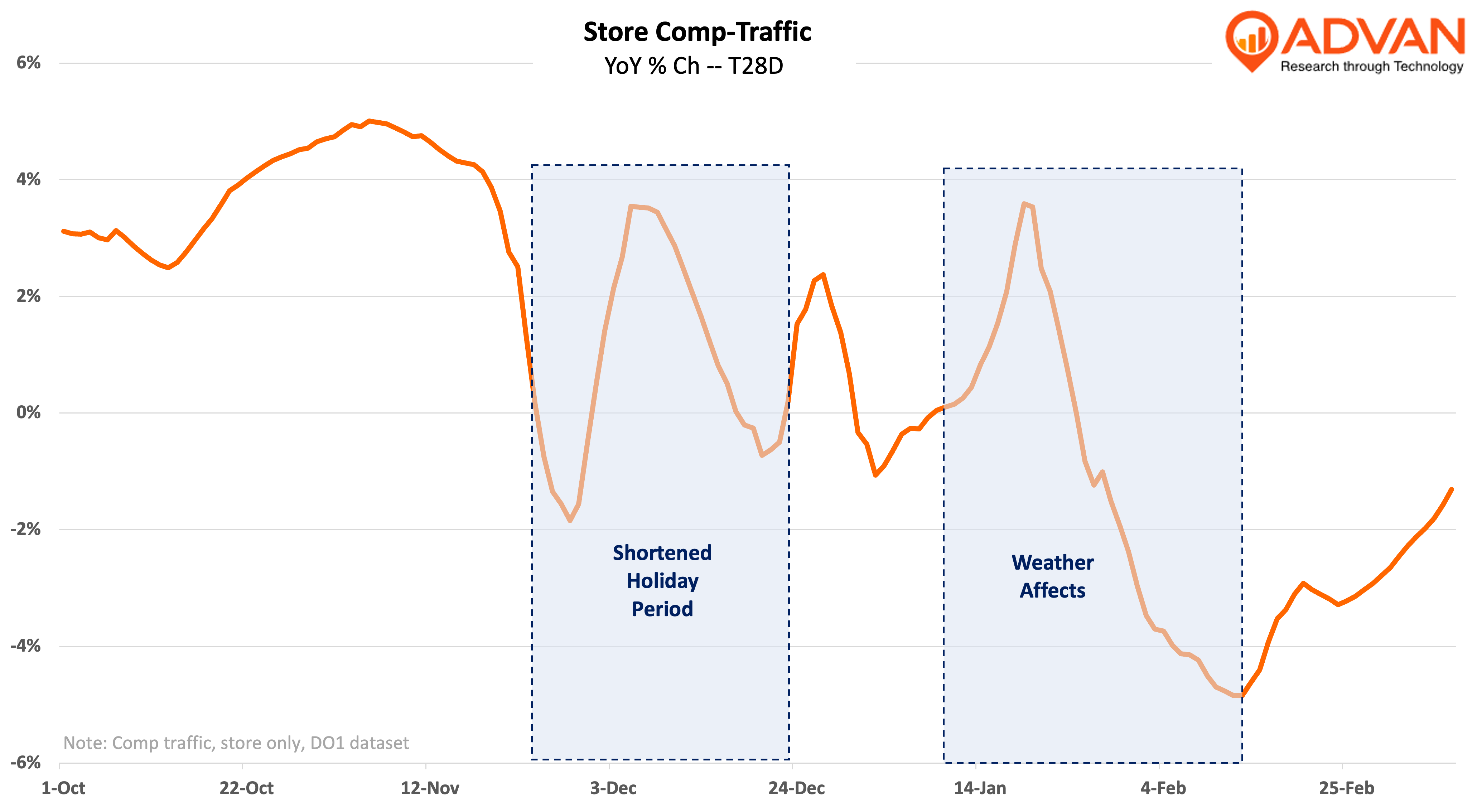

Ulta Beauty reported a comp-sales increase for Q4 of +1.5%, driven by a +3.0% increase in average ticket and a -1.4% decrease in comp-transactions. Removing the lift from ecommerce sales, store comp-sales increased modestly, suggesting a slight decline in store comp-transactions. Advan estimates that store comp-traffic increased +0.3%; if true, that would imply a modest decrease in the store conversion rate; that’s not unexpected given a more cautious consumer environment and substantial competitive encroachment on the retailer from Amazon and Sephora. Moreover, management’s plans (below) to improve the business also imply that they are seeing a decline in the conversion rate. Per the encroachment, many visitors may be trying on colors, creams, and scents before placing an order on Amazon Beauty. Over a decade ago, this happened in consumer electronics after Amazon entered the category. We’d also remind readers that the category has significantly softened (particularly mass color) over the past year, following a beautiful post-pandemic rebound, which we wrote about in our stories on the category category and department stores . For Ulta’s Q4, “color” comp-ed down mid-single-digits. Management doesn’t foresee a near-term upswing given its guidance on 2025 comp-sales to increase just lightly. Moreover, the 2025 operating margin was guided to 11.7%, down from 2024’s 13.3% (and the pre-pandemic range of 13%). That said, the lower level allows incoming CEO Kecia Steelman ample financial and “expectations” flexibility to fix up the brand for higher growth in the subsequent years. On that final point, Steelman said the following:

“Our business is bigger and we’ve managed unprecedented category growth, and it is more complex as we’ve expanded our assortment and added new fulfillment choices like buy online, pick up in store, ship from store and same-day delivery. These capabilities are driving guest engagement and enhanced accessibility that have also resulted in execution challenges, particularly in product transitions and launches as we leverage new tools and processes. As a result, our in-store presentation and guest experience today are not as strong as we would like. These are opportunities well within our control. We’ve identified specific gaps and we’re working quickly to address them. And I’m leaning in with our teams and brand partners to improve in-store presentation and inventory levels to deliver a better guest experience. It’s clear to me that how we’ve operated must change to ensure that we capture the opportunities in front of us… We’re calling our plan Ulta Beauty Unleashed… Our teams are focused on opportunities to sharpen our execution and get back to the basics of running excellent stores that are easy to navigate, fully stocked, appropriately staffed, clean, and inviting.”

Steelman, “In 2025, we’ll … accelerate our focus on wellness; launching a new marketplace, which will expand our e-commerce presence and allow us to offer a broader array of beauty and wellness products to our guests…

To successfully achieve our long-term growth ambitions, reassert our leadership position and deliver value to our stakeholders, we must optimize ways of working and streamline our cost structure… As we’ve shared at our Investor Day in October, we are targeting cost optimization of $200 million to $250 million over the next 3 years. It starts by focusing on the heart of our company, our teams and our culture. At our core, I believe that we have the very best talent and culture in retail, and we’re taking steps to reenergize this critical competitive advantage by optimizing the ways of working and positioning our leadership team to meet the needs of our evolving business…We’ve made several organizational changes to accelerate decision-making, remove friction and align teams and resources around guest-centric goals. This includes incepts to optimize our corporate and field support staff, reducing management layers and shifting resources to higher-growth driving areas. Additionally, I’ve made several changes to our executive leadership team to better focus on our key priorities to support a stronger guest experience in stores, we’ve centralized all store functions under Amiee Bayer-Thomas, an Ulta Beauty veteran, who will serve in the newly created role of Chief Retail Officer.“

Steelman, “I do truly believe that by focusing on these parts of the business, along with getting back to basics in the everyday running of the business in an exceptional way, is what’s going to really take us to the next level… really keeping the guests at the center of everything we do. That’s really what this Ulta Beauty Unleashed plan is. It’s about keeping the guests at the center of everything we do, along with closely aligning our associates at the same time because our associates are the best representation of our brand because they’re the ones who are interacting every single day with the guests that are coming in our stores.” (Back-to-Basics ironically is Dollar General’s program to fix its business and along the line of the old moniker about success in retail “retail is detail.” And so, in retail, it doesn’t matter if your offering is discretionary-based offering focused on more affluent consumers, or an essentials-based offering focused on the less-affluent, in both cases, getting the details right is key.)

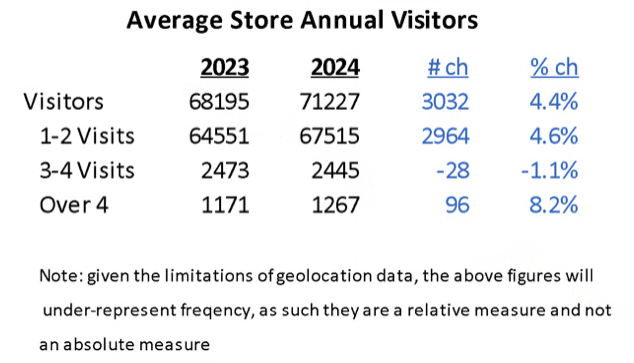

In speaking of the margin / dollar-investments for 2025, CFO Paula Oyibo called out wage inflation (paying the staff more and increasing labor hours), a greater use of technology, increased marketing and personalization (i.e. personalized promos), bringing more brands onto the .com marketplace, and the expansion into the wellness category. Most of these are focused on driving frequency. Along with boosting the conversion rate, improving frequency is one of Ulta’s largest opportunities to drive comp-traffic and -sales, as shown below. As to the interest in wellness, that’s a macro trend of increasing consumer engagement and expenditure (see L’Oréal’s recent acquisition of Aesop ); it’s also a strategy to take more share from the drug stores.

Lastly, as it relates to Ulta’s store traffic, we show in the chart below that the trend has recently drifted lower due to the recent consumer malaise and bad weather. (Today’s economic news further reinforced that we are in a malaise; the University of Michigan’s index of consumer sentiment decreased by 6.8pt to 57.9 in March, well below expectations.). In our referenced stories, we shared that all of the major beauty companies, Estée, L’Oréal, Coty, and e.l.f, have significantly increased their new product launches and spending for this spring. As such, it’s critical for Ulta and the beauty brands to see a positive inflection in trend in the coming weeks, more on that later.

*Utilizing the Maiden Century model.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN