By Thomas Paulson, Head of Market Insights

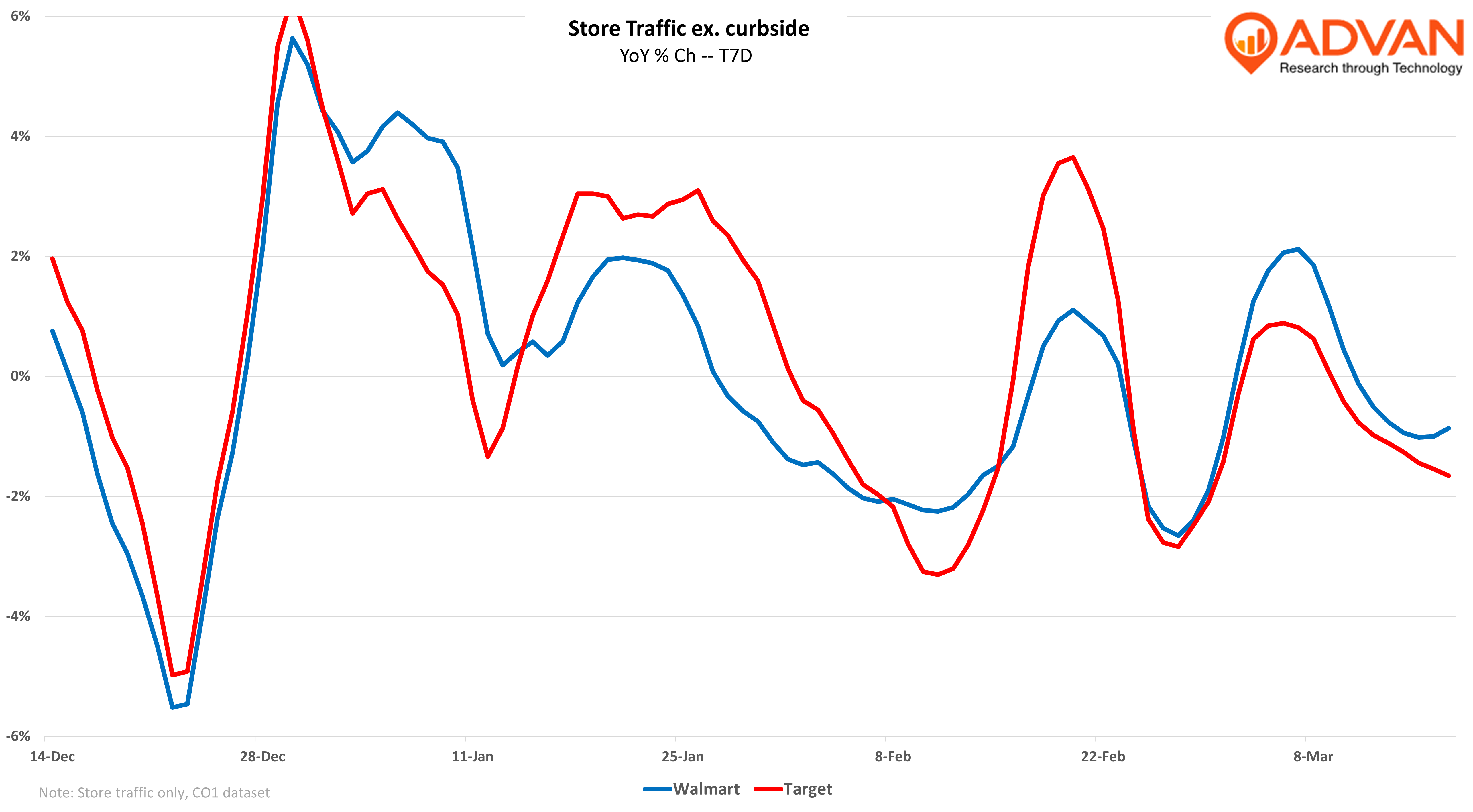

Over the weekend, again numerous press and blog reports declared Target’s store traffic to be down due to boycotts and upset feelings over Target’s messaging around DEI. However, those reports cite a traffic decline YoY against a week last year that included an extra day (Leap Day). We adjust for that by using 7-day and 91-day rolling periods and Advan’s data shows no unusual trend for Target vs. Walmart. Yes, traffic has been volatile due to this year’s weather vs. last year’s weather. Other elements also include a softer period after a blow-out holiday season and consumer unease due to the presidential election (and the subsequent hurricane in Washington).

As shown in the first chart below, the + /- gap between Walmart and Target is in line with the recent back and forth, with Walmart currently running slightly ahead. We’d expect that to flip around starting on March 23rd as Target brings back its “Target Circle Week” promotion.

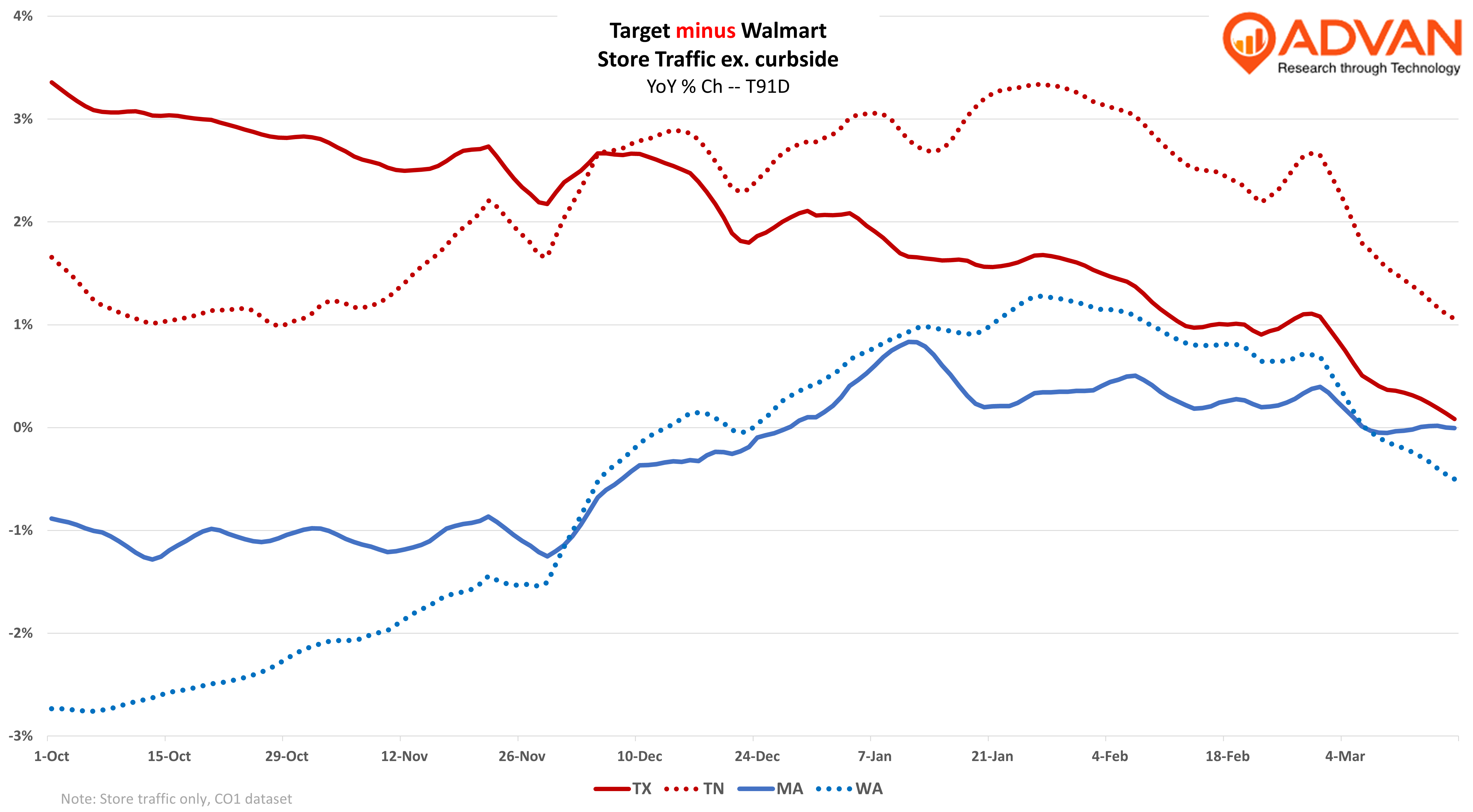

Texas and Tennessee heavily supported President Trump in the election, whereas Massachusetts and Washington heavily supported Vice President Harris. However, those affiliations don’t appear to be impacting recent traffic and spending trends at the two retailers. We show this above by taking the rolling-91-day YoY trend for Target and subtracting Walmart’s, in each of the four states. Massachusetts is about flat between Target and Walmart. Walmart has slowly been gaining in Texas, but that has been a trend since prior to the election. Target has recently lost some momentum in Tennessee and Massachusetts, both Red and Blue states.

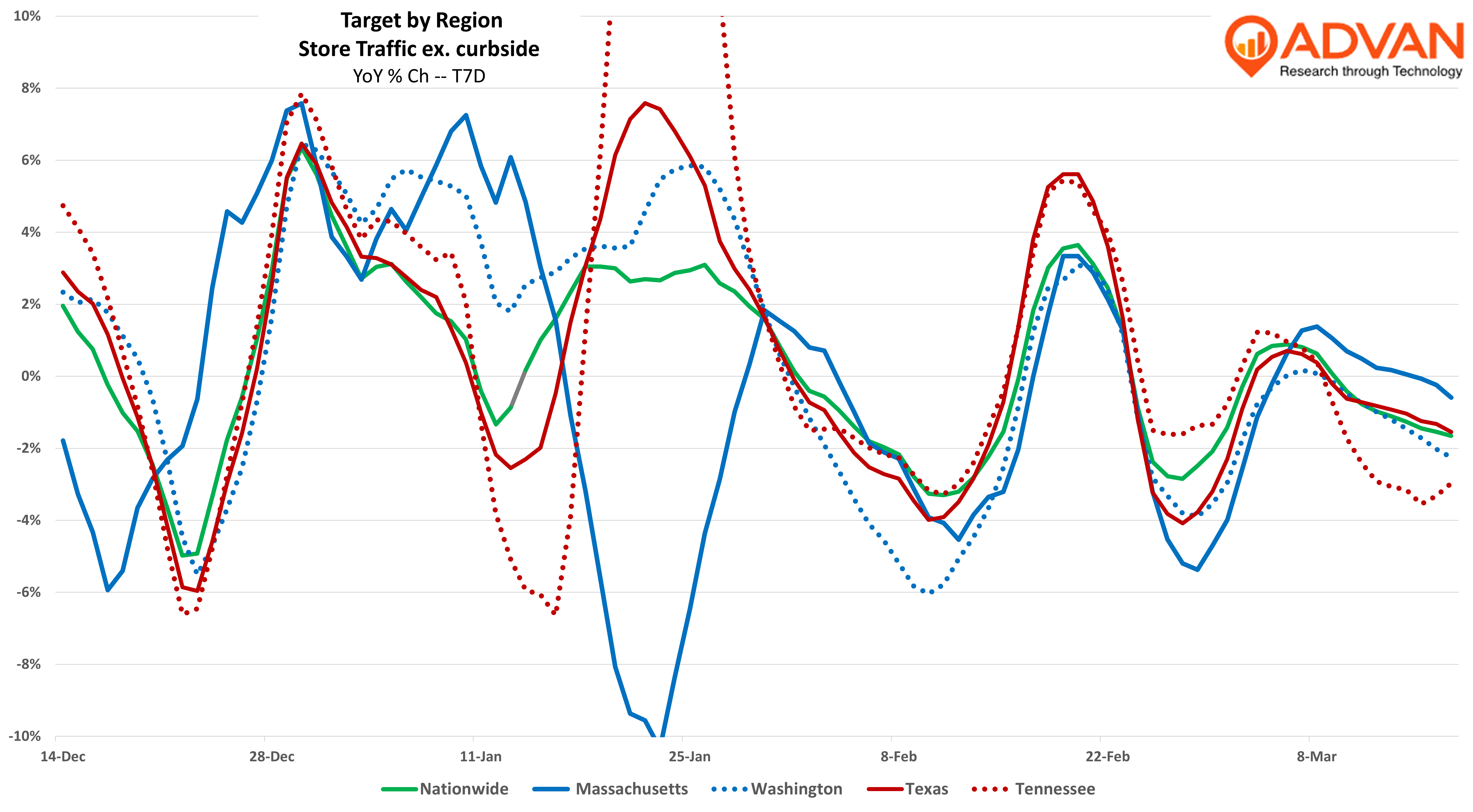

In the last chart below, we show traffic to Target stores in Blue vs. Red states. While Democrats’ consumer sentiment has dropped precipitously (to 41 in March from 91 in October), whereas Republicans’ has increased appreciably (to 84 from 55), that also isn’t clearly impacting Target’s store visitation and by association, consumer spending. As shown, the four states closely match one another and the overall nationwide chain. The takeaway, the picture is muddled and far from conclusive. We also expect the Target Circle Week to be a success. (More on that in the weeks to come.)

*Utilizing the Maiden Century model.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN