While many U.S. residents feared public transportation during the COVID-19 pandemic, many started to shop around for a car resulting in driving the demand up, fact that led to a price hike as high as 30%. On the other side, rental car companies sold a big chunk of their fleet in exchange for cash liquidity as the demand for car rentals dropped 70%-80% especially in the early months of this turbulence. As restrictions started to loosen and the demand for car rentals started to slowly recover, rental car companies began shipping cars from the touristy destinations like Hawaii to the mainland to keep up with demand. Now, tourists flooding back to the island are left with fewer and more expensive options to get around on vacation. Using Advan’s foot traffic data, we are able to see the differences in traffic from car rentals to airports and hotels overall before, during, and following the pandemic.

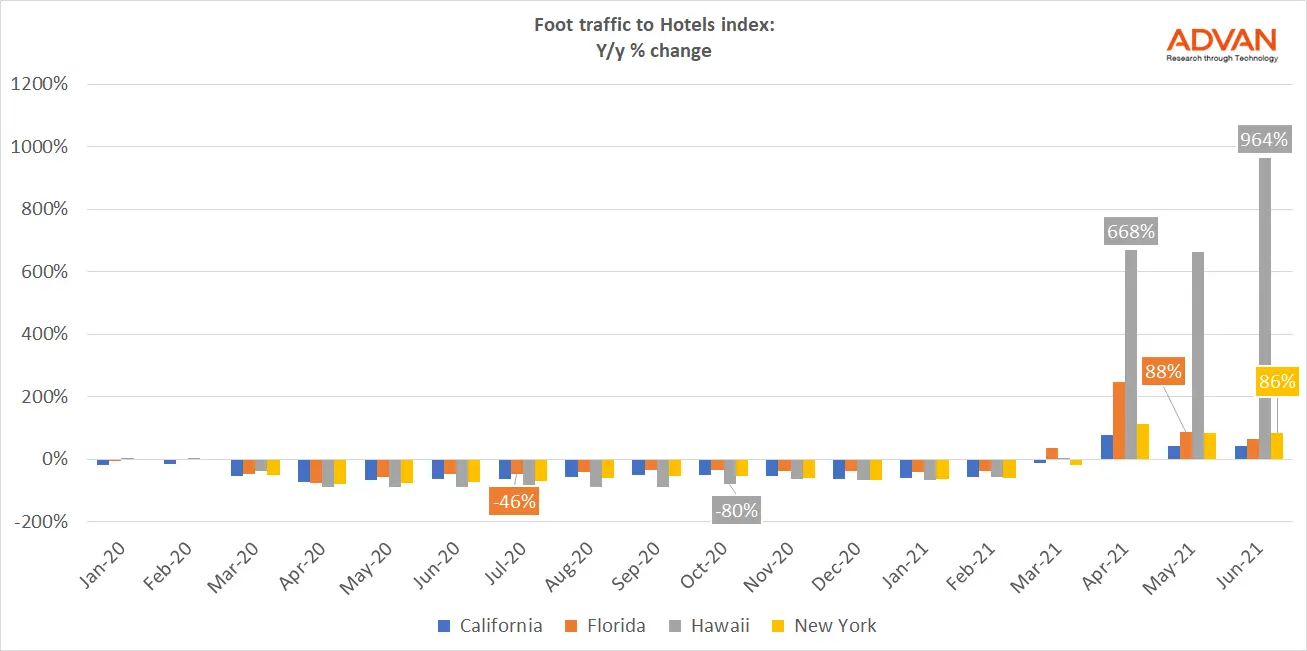

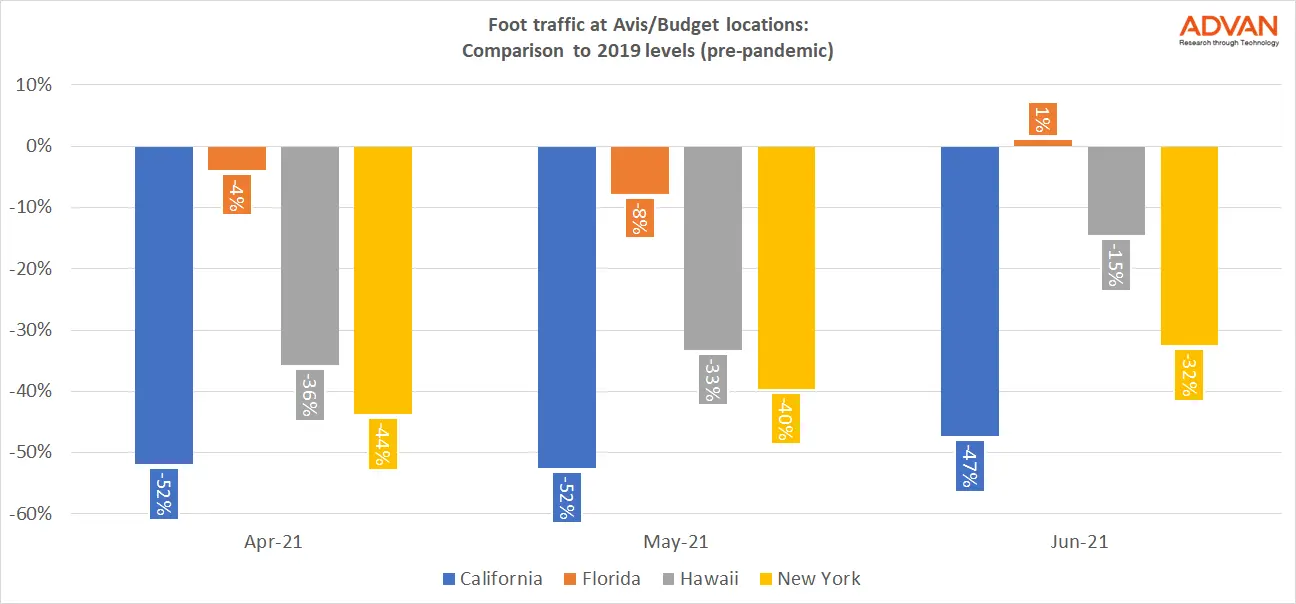

Looking at Avis/Budget locations across different states, we saw that the traffic in Hawaii has been consistently increasing from April 2021 while the other states started to cool off after the influx in April. More specifically, in June 2021 there was a 463% increase in Hawaii while Florida and New York were both close to 100% up, compared to the same month in 2020. The rental car operator’s locations in California seem to be the worst performing compared to the other states. However, even with Hawaii seeing a huge increase in traffic, the total is still down 15% compared to pre-pandemic levels.

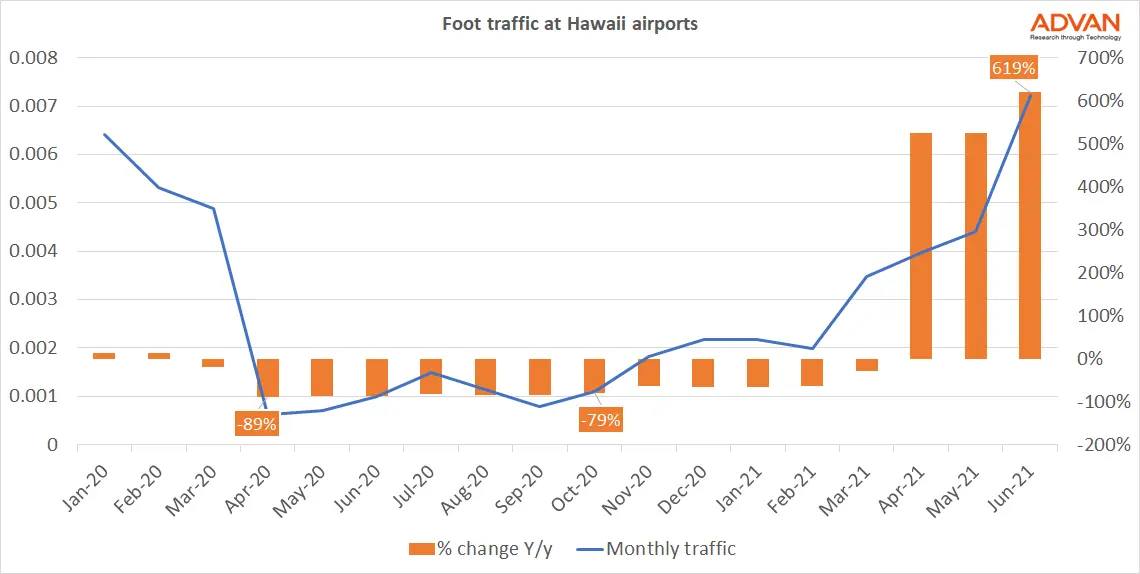

Further confirmation of this boost is seen in the rest of the Hawaiian travel industry: June 2021 saw increases in foot traffic at Hawaii airports of 619% over June 2020. According to a preliminary estimation by the Hawaii Tourism Authority (HTA), 630.000 visitors reported having arrived onto the island by air in May 2021: Advan’s estimated number of visitations is close to 1.116.000 (including passengers who departed from the airports plus airport employees).

Advan’s Hotels & Resorts index shows an 10x increase in foot traffic in Hawaii while New York and Florida averaged a 94% and 133% increase over the course of the last 3 months. California sees the least growth in the travel industry as the data shows an average of 54% up year over year. It is unclear at this point of how long this trend is going to last, however we will keep tracking it to see any further changes.