Automotive is one of the industries that has been struggling with chip shortages, supply chain issues and labor shortages for months now. But do all the carmakers struggle at the same level? To answer the question, we employed Advan’s foot traffic data for two US automakers and one Japanese: Ford (F), General Motors (GM) and Toyota (TM) respectively.

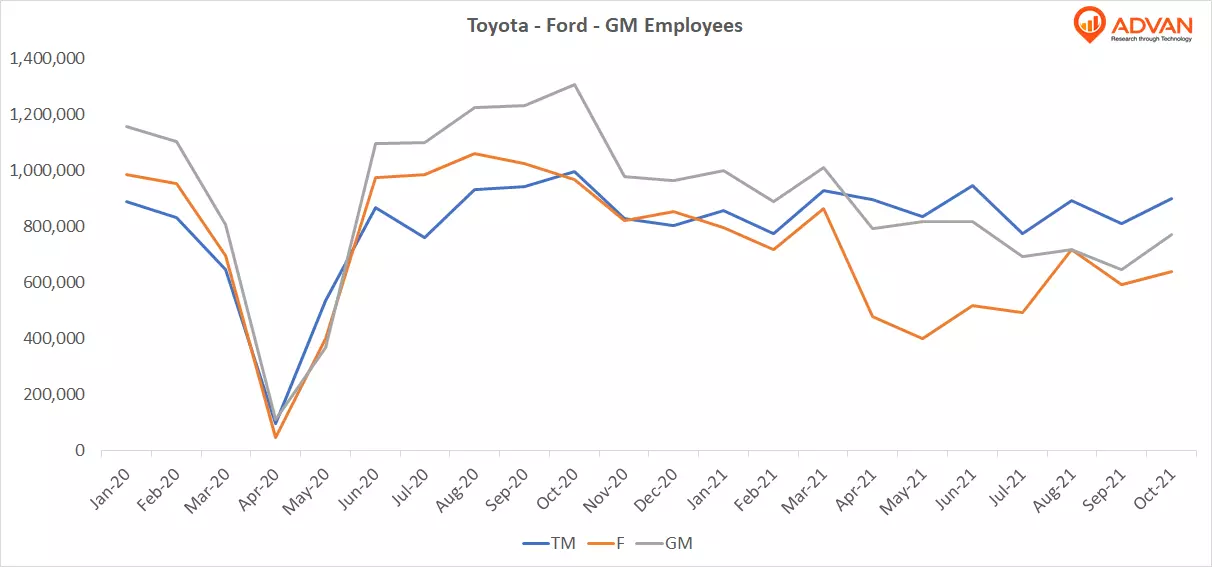

Starting with Toyota, the largest manufacturer in the world by the number of units produced, we see that the total number of employees each month does not fluctuate considerably after the sharp drop in the early months of the pandemic. For Ford and GM, the employee monthly traffic follows a different pattern, being more volatile throughout this period.

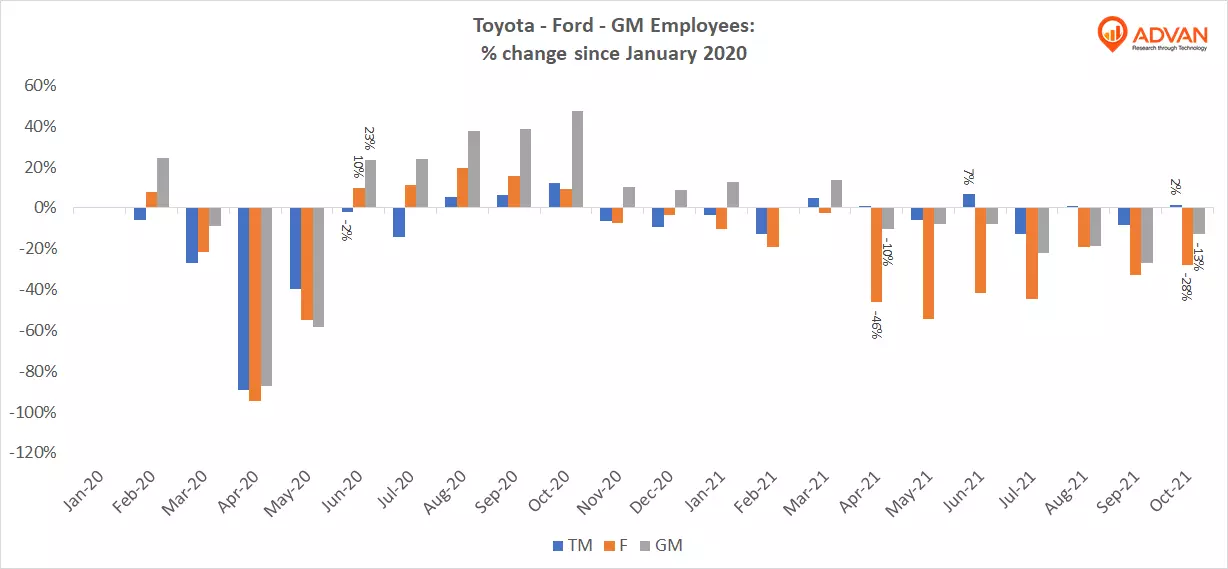

To have a better understanding of how much each carmaker is affected, we compared the employee traffic data to January 2020, the last normal month before the pandemic disruption. In June 2020, there were slightly less employees at Toyota’s plants compared to January’s levels (-2%) while employee traffic at Ford and GM plants was in fact up, 10% and 23% respectively. In November 2020, we see the numbers to come closer to January’s levels, signaling a slowdown in production.

Early 2021, carmakers started to announce plans to idle factories as they were seeing the shortage of chip semiconductors would impact car production. Ford was the first to take action and cut production resulting in 46% less employees in April 2021, almost half the workforce it had in January 2020. The GM employee traffic was down 10% while Toyota remained intact. The downtrend continued until October for Ford (-28%) and GM (-13%) while Toyota saw even a 7% increase in June.

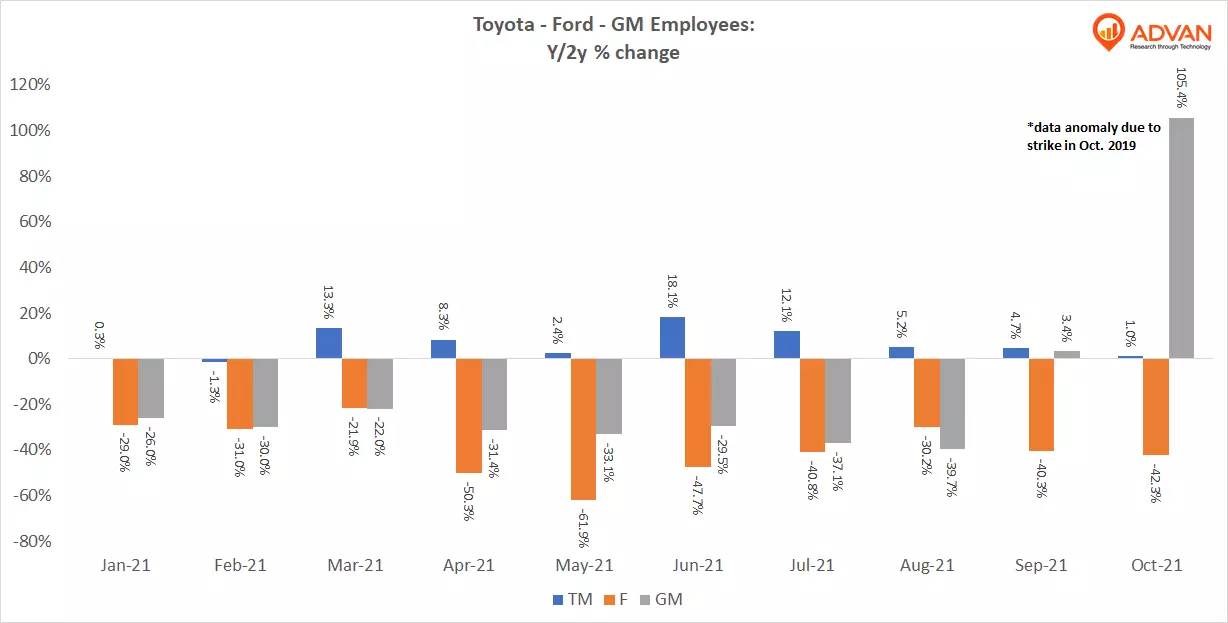

On a year over two-year comparison, Ford employee traffic was down 40% on average January through October 2021, while Toyota saw an increase of 6.4% (on average) during the same period. General Motors employees were down 14% on a Y/2y basis, but if we assume the traffic in October 2021 was the same as in September 2021 (+4%) (disregarding the strike in October 2019 that inflated the 2o2y change), then employee traffic was down 24%.

The prolonged shortages have hit harder the production for Ford and GM having impacted their quarterly earnings: both companies reported lower earnings compared to year-ago while Toyota reported a year over year growth. The correlation between Advan’s employee foot traffic data and the revenue of the company is 0.88 for GM, 0.96 for Toyota and 0.67 for Ford.