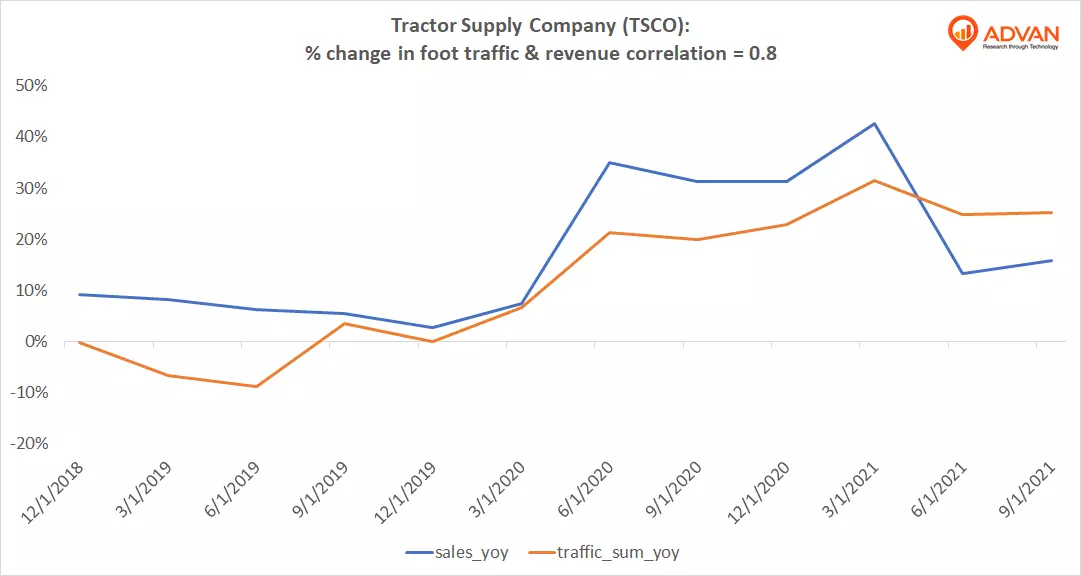

Notable Hit 1: (TSCO:NASDAQ) On Thursday October 21 , 2021 Tractor Supply Company (TSCO) posted better-than-expected revenues of $3.017bn beating the consensus estimate of $2.84bn (-6.2%) and in the same direction as Advan's forecasted sales. The revenue was +15.8% YoY - Advan's foot traffic data captured an increase in foot traffic of +25% YoY at its locations for Q3 2021. As a result of beating the sales and EPS, the stock opened at $211.51, up +4.5% from its previous day's closing price and hit a high of $212.88 (+5.2%) shortly after the opening bell. Advan's footfall data has a correlation of 0.8 on a YoY basis with TSCO's top-line revenue over the last 12 quarters.

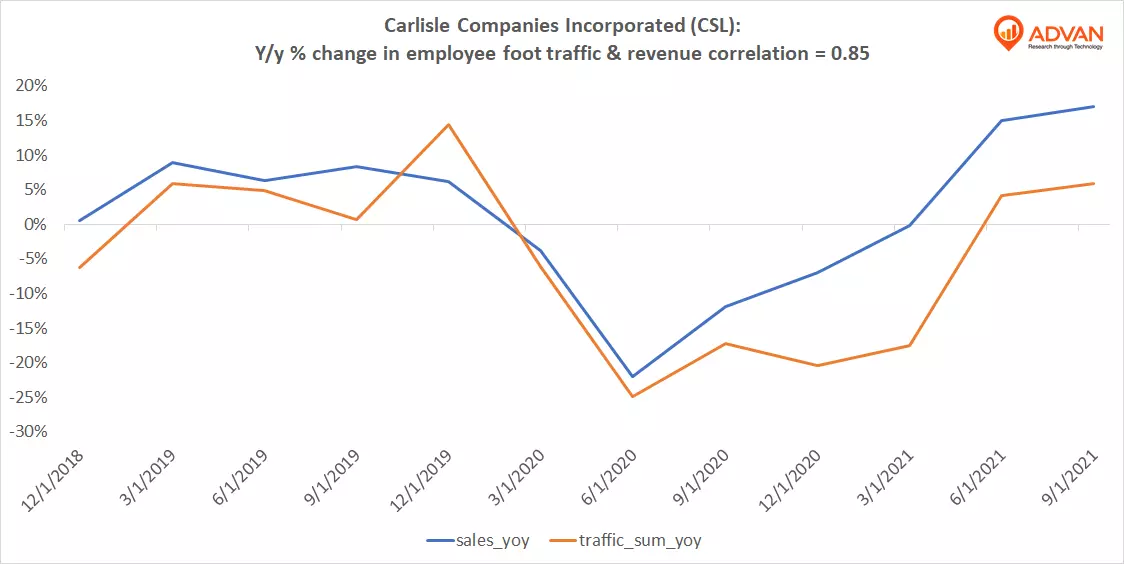

Notable Hit 2: (CSL:NYSE) On Thursday October 21 , 2021 Carlisle Companies Incorporated (CSL) posted better-than-expected revenues of $1.32bn beating the consensus estimate of $1.26bn (-4.8%) and in the same direction as Advan's forecasted sales. The revenue was +16.8% YoY - Advan's foot traffic data captured an increase in employee foot traffic of +6% YoY at its manufacturing locations for Q3 2021. As a result of beating the sales and EPS, the stock opened at $221.75, up +1.3% from its previous day's closing price and is currently trading at $228.45 (+4.3%). Advan's footfall data has a correlation of 0.85 on a YoY basis with TSCO's top-line revenue over the last 12 quarters.

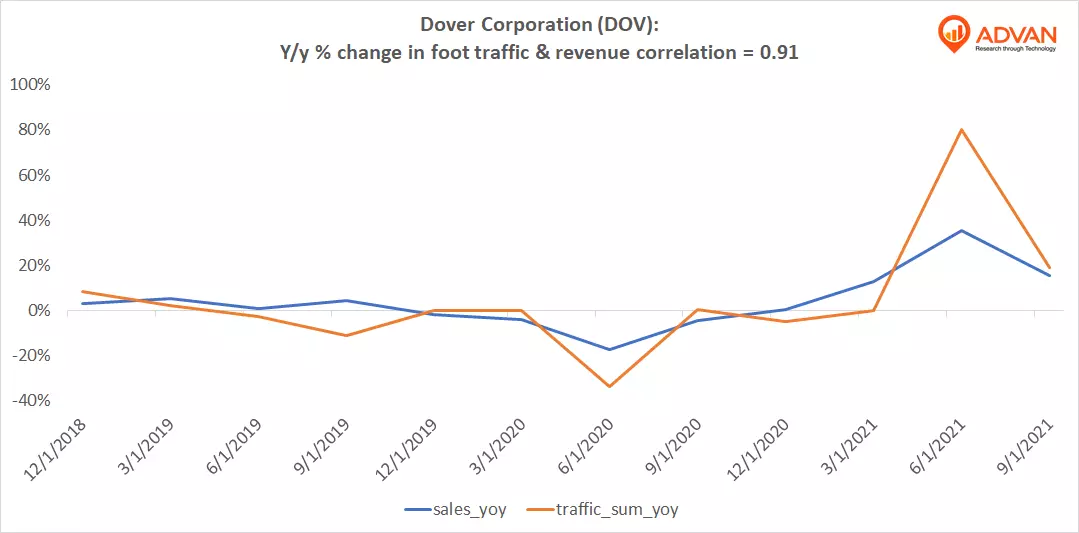

Notable Hit 3: (DOV:NYSE) On Tuesday October 19 , 2021 Dover Corporation (DOV) posted better-than-expected revenues of $2.02bn beating the consensus estimate of $1.26bn (-0.33%) and in the same direction as Advan's forecasted sales. The revenue was +15.4% YoY - Advan's foot traffic data captured an increase in employee foot traffic of +19.2% YoY at its manufacturing locations for Q3 2021. As a result of beating the sales and EPS, the stock opened at $173.06, up +3.8% from its previous day's closing price with a high of $174.23 during the trading session. Advan's footfall data has a correlation of 0.91 on a YoY basis with DOV's top-line revenue over the last 12 quarters.