Department Stores, Restaurants, Malls, all continue growing their traffic on Black Friday on a year over year basis. The growth rate has decelerated a bit, but it's still in the healthy double-digit numbers, from an already high base.

Only Hotels showed negative growth, but less so than in prior years -- a weighted average of -1% vs -3% and -2% in 2018 and 2017 respectively.

Below are a couple of graphs that illustrate the traffic. Do not be fooled by the simplicity of the graphs, the data underlying them consists of 3 Trillion data observations across 2 Million geofenced locations pertaining to 1,400 companies, all normalized using Advan's custom algorithms for reliable year over year comparisons. Simple is hard to do!

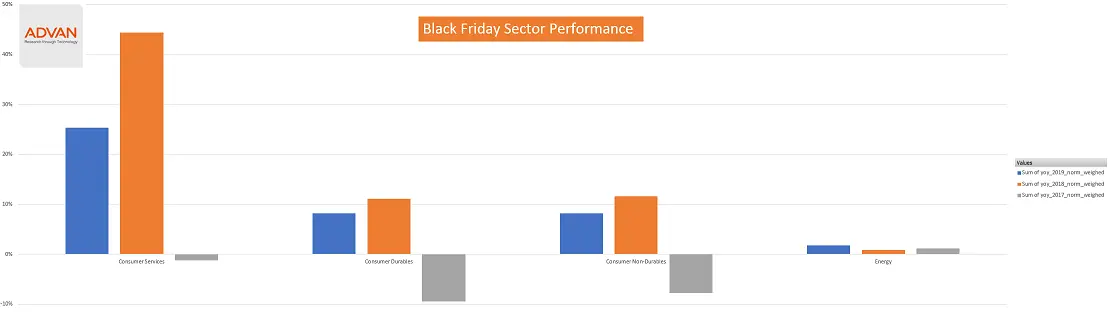

Sector performance: This shows how many more people visited a sector on Black Friday than they did the year prior.

As we can see all Consumer sectors (which include Apparel, Clothing, Malls, Supermarkets, etc) grew in 2019 between 8% and 25% versus 2018. Their growth rate is down between 20% to 40% since 2018, but it's growth nevertheless. Certainly much better than the meagre 2017 situation where traffic was falling.

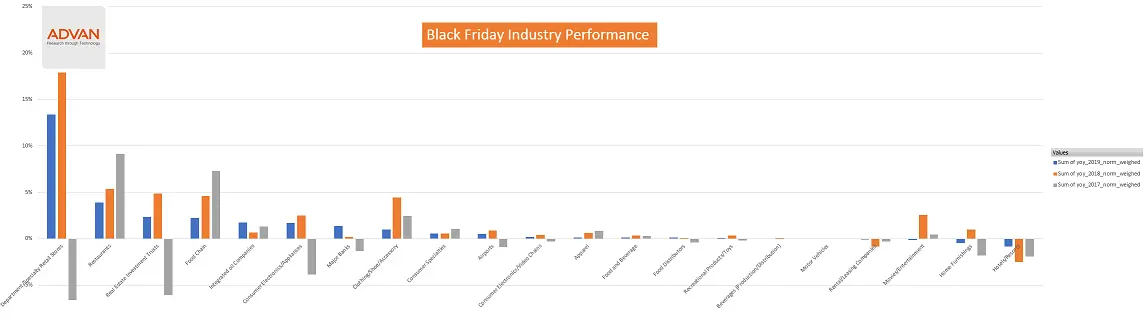

Drilling down to individual industries, the picture becomes clearer:

- Department Stores and Restaurants lead the growth, followed by Malls ("REITS") and Supermarkets.

- Growth is generally more muted than in the prior years.

- Clothing, Shoes and Accessories are still growing, just not as much as they used to anymore. 1% vs last year's 4%.

- Apparel is flat, vs a 1% growth in 2017 & 2018.

- Hotels are slightly down -- people stick around with family apparently.

- Airports show 0.5% growth (note, this is only on Black Friday, not the whole week of Thanksgiving), but note that

- Gas Stations ("Integrated Oil Companies") grew 1.7%. It takes some driving to go to all these stores!

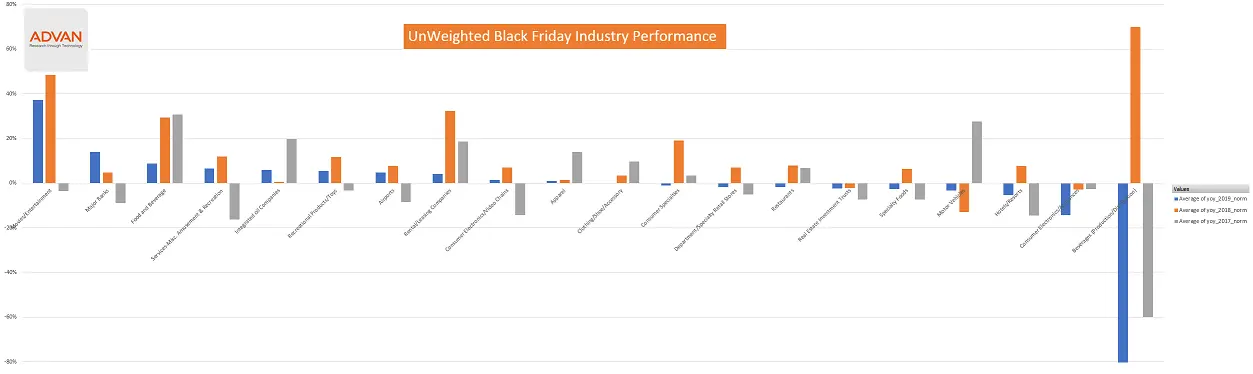

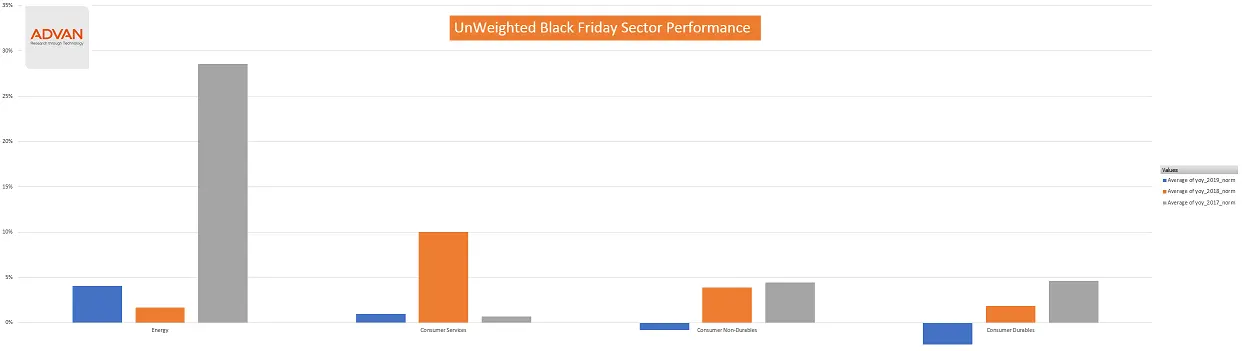

It is important to keep in mind that the growth patterns above are not uniform across companies. In fact, on

average the Consumer sectors are down vs 2018. This means the big department stores / retailers / malls are dominating

the growth (so that overall growth is positive) whereas most of the small chains are hurting (so that on average,

traffic is down on a company by company basis):

The same story unfolds on an industry basis, where the Department Stores and Malls are overall slightly down on average,

meaning the little guy is hurting, whereas the high trafficked stores see their traffic growing each year.