Notable Hit 1: (BYD:NYSE) On Tuesday October 24, 2023 Boyd Gaming Corporation (BYD) posted revenues of $903.16 mm surpassing the mean analyst estimate of $880.26 mm and in the same direction as Advan's forecasted sales. The revenue increased 2.3% YoY inline with Advan's foot traffic data increase of 13% YoY at its casinos in Q3 2023. Advan's footfall data has a correlation of 0.96 on a YoY basis with BYD's top-line revenue over the last 14 quarters.

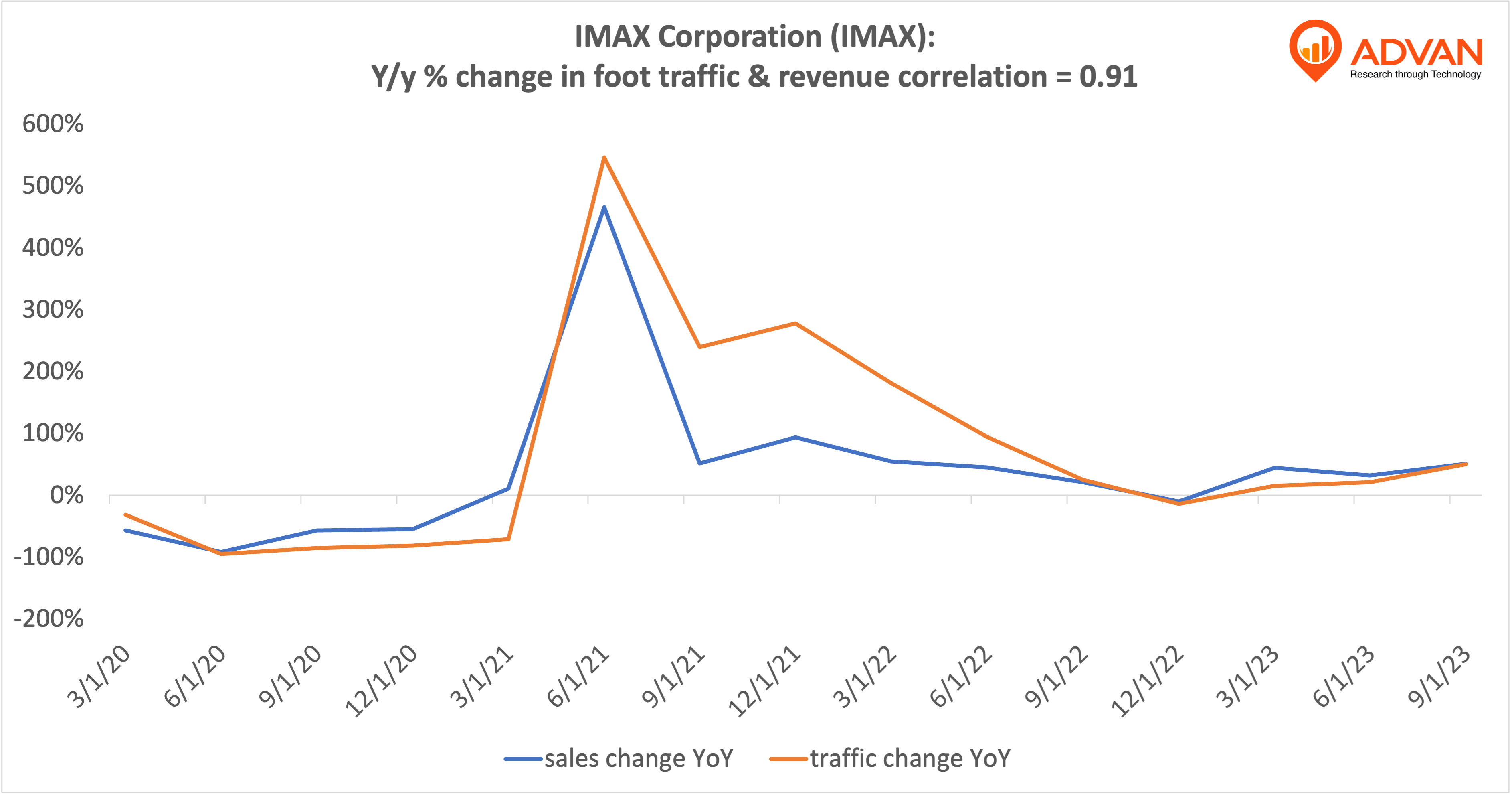

Notable Hit 2: (IMAX:NYSE) On Wednesday October 15, 2023 IMAX Corporation (IMAX) posted revenues of $103.9 mm surpassing the mean analyst estimate of $91.4 mm and in the same direction as Advan's forecasted sales. The revenue increased 51.1% YoY inline with Advan's foot traffic data increase of 51% YoY at its movie theaters in Q3 2023 fiscal. Advan's footfall data has a correlation of 0.91 on a YoY basis with IMAX's top-line revenue over the last 15 quarters.

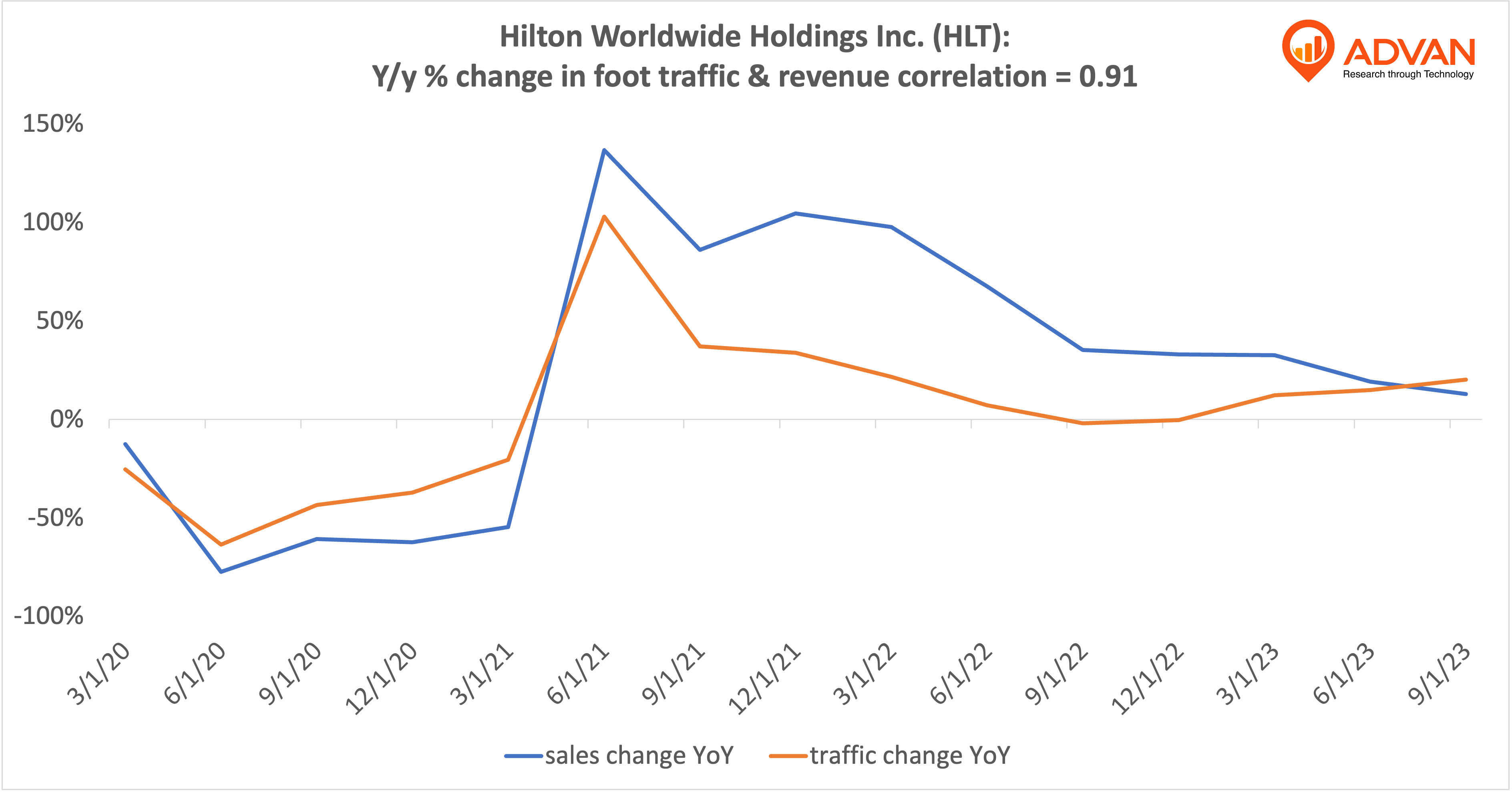

Notable Hit 3: (HLT:NYSE) On Wednesday October 25, 2023 Hilton Worldwide Holdings Inc. (HLT) posted revenues of $2.67 bn surpassing the mean analyst estimate of $2.59 bn and in the same direction as Advan's forecasted sales. The revenue increased 12.9% YoY inline with Advan's foot traffic data increase of 20.3% YoY at its hotels and hotel chains in Q3 2023 fiscal. Advan's footfall data has a correlation of 0.91 on a YoY basis with HLT's top-line revenue over the last 15 quarters.

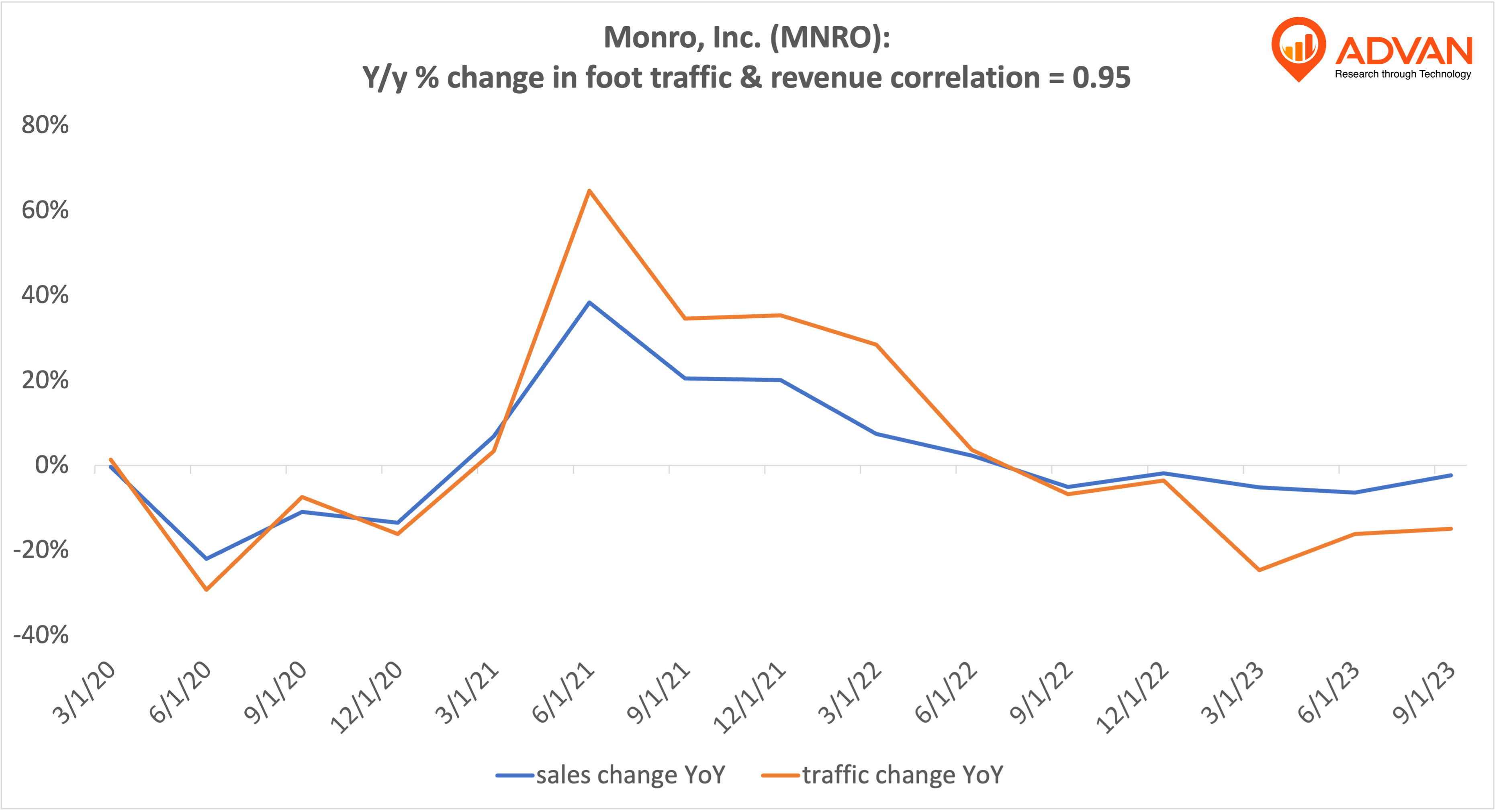

Notable Hit 4: (MNRO:NASDAQ) On Wednesday October 25, 2023 Monro, Inc. (MNRO) posted revenues of $322.09 mm missing the mean analyst estimate of $332.2 mm and in the same direction as Advan's forecasted sales. The revenue decreased 2.3% YoY inline with Advan's foot traffic data decrease of 14.9% YoY at its automotive repair locations in Q3 2023. Advan's footfall data has a correlation of 0.95 on a YoY basis with MNRO's top-line revenue over the last 15 quarters.