Notable Hit 1: (CAKE:NASDAQ) On Wednesday November 1, 2023 The Cheesecake Factory Incorporated (CAKE) posted revenues of $830.2 mm following the same direction as Advan's forecasted sales. The revenue increased 5.9% YoY inline with Advan's foot traffic data increase of 10.8% YoY at its stores in Q3 2023. Advan's footfall data has a correlation of 0.98 on a YoY basis with CAKE's top-line revenue over the last 14 quarters.

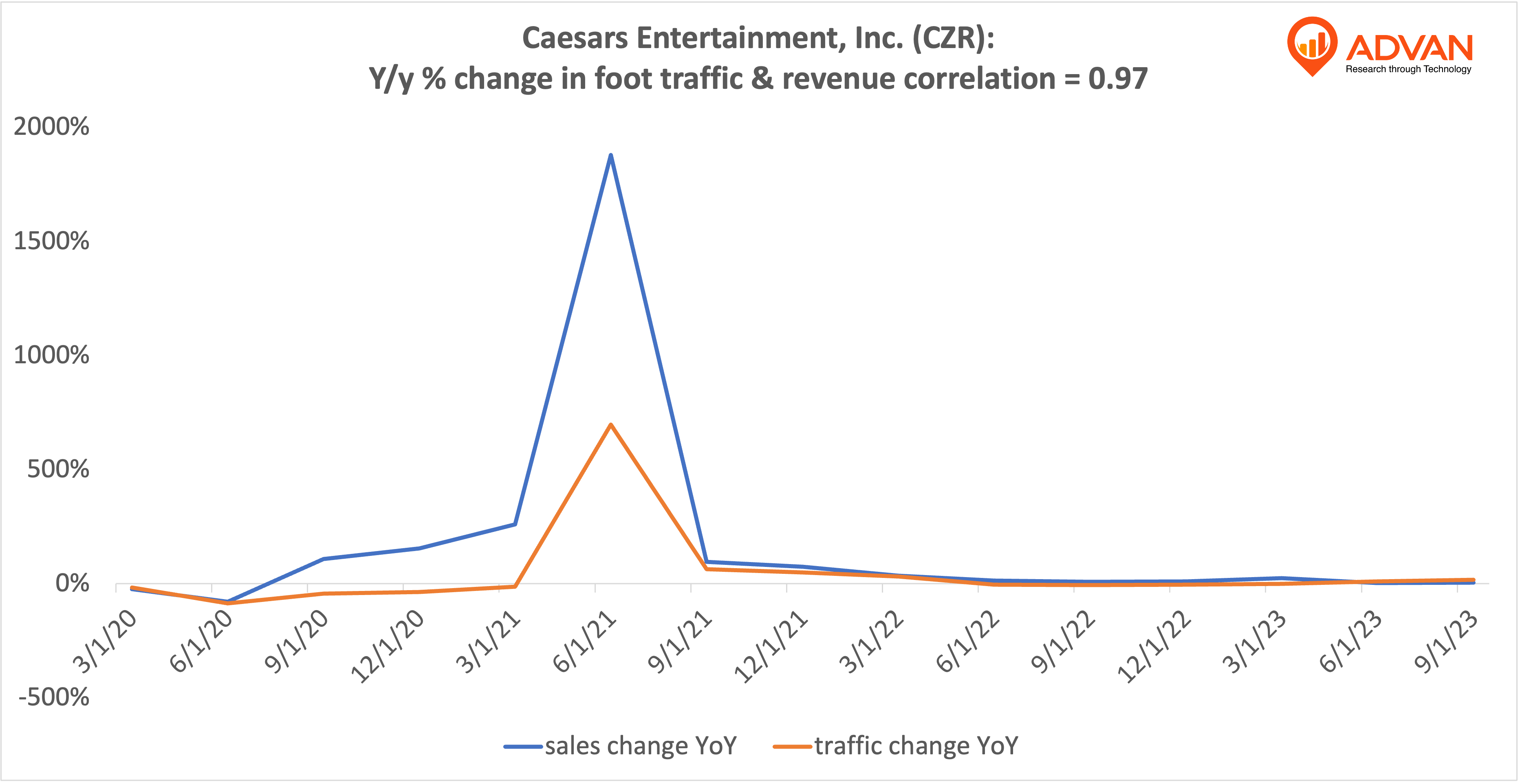

Notable Hit 2: (CZR:NASDAQ) On Tuesday October 31, 2023 Caesars Entertainment, Inc. (CZR) posted revenues of $2.99bn surpassing the mean analyst estimate of $2.92bn and in the same direction as Advan's forecasted sales. The revenue increased 3.7% YoY inline with Advan's foot traffic data increase of 16.1% YoY at its casinos in Q3 2023 fiscal. Advan's footfall data has a correlation of 0.97 on a YoY basis with CZR's top-line revenue over the last 15 quarters.

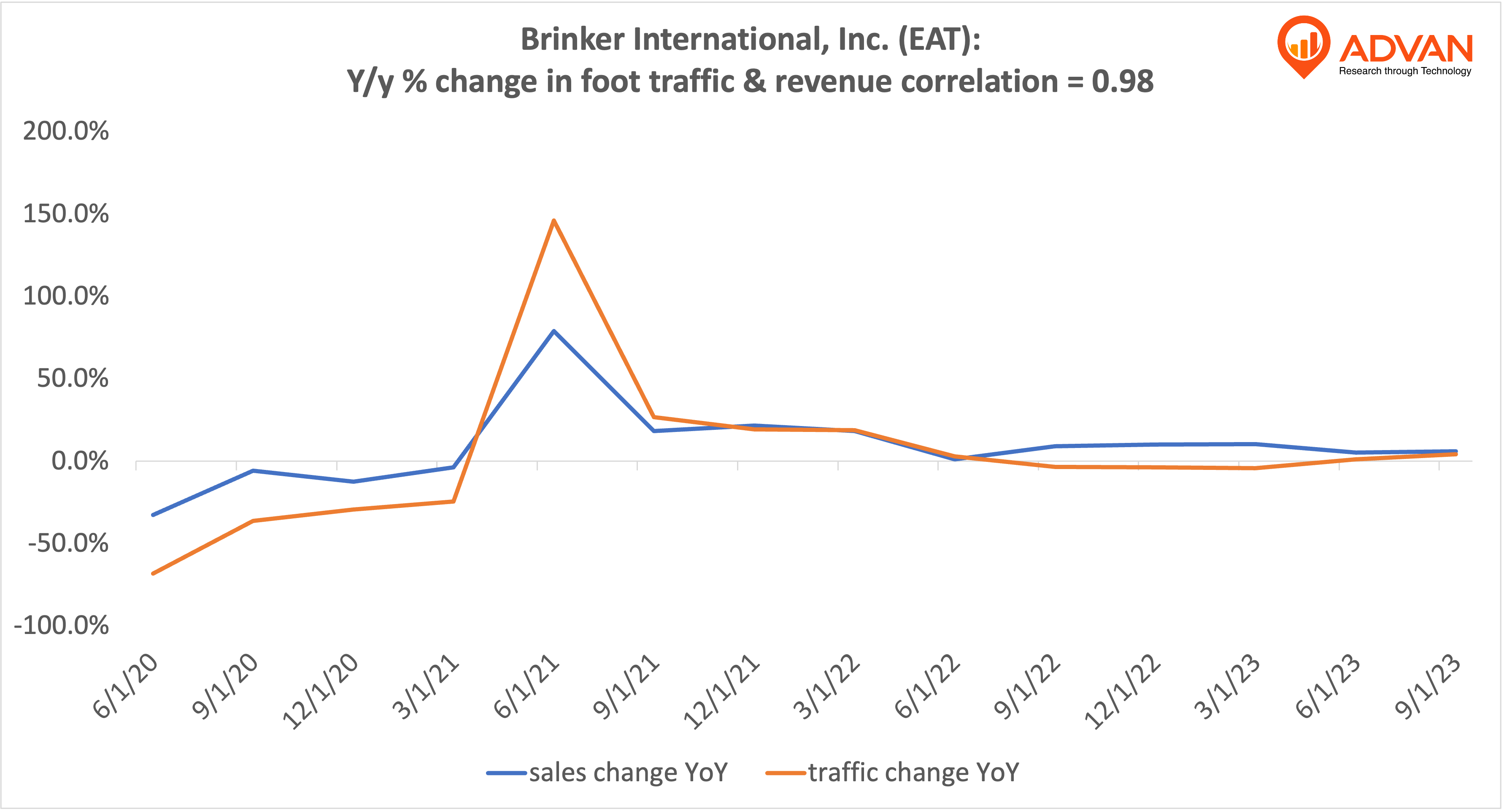

Notable Hit 3: (EAT:NYSE) On Wednesday November 1, 2023 Brinker International, Inc. (EAT) posted revenues of $1.01 bn aligning with the mean analyst estimate of $2.59 bn and in the same direction as Advan's forecasted sales. The revenue increased 6% YoY inline with Advan's foot traffic data increase of 4.2% YoY at its restaurant chains in Q3 2023 fiscal. Advan's footfall data has a correlation of 0.98 on a YoY basis with EAT's top-line revenue over the last 14 quarters.

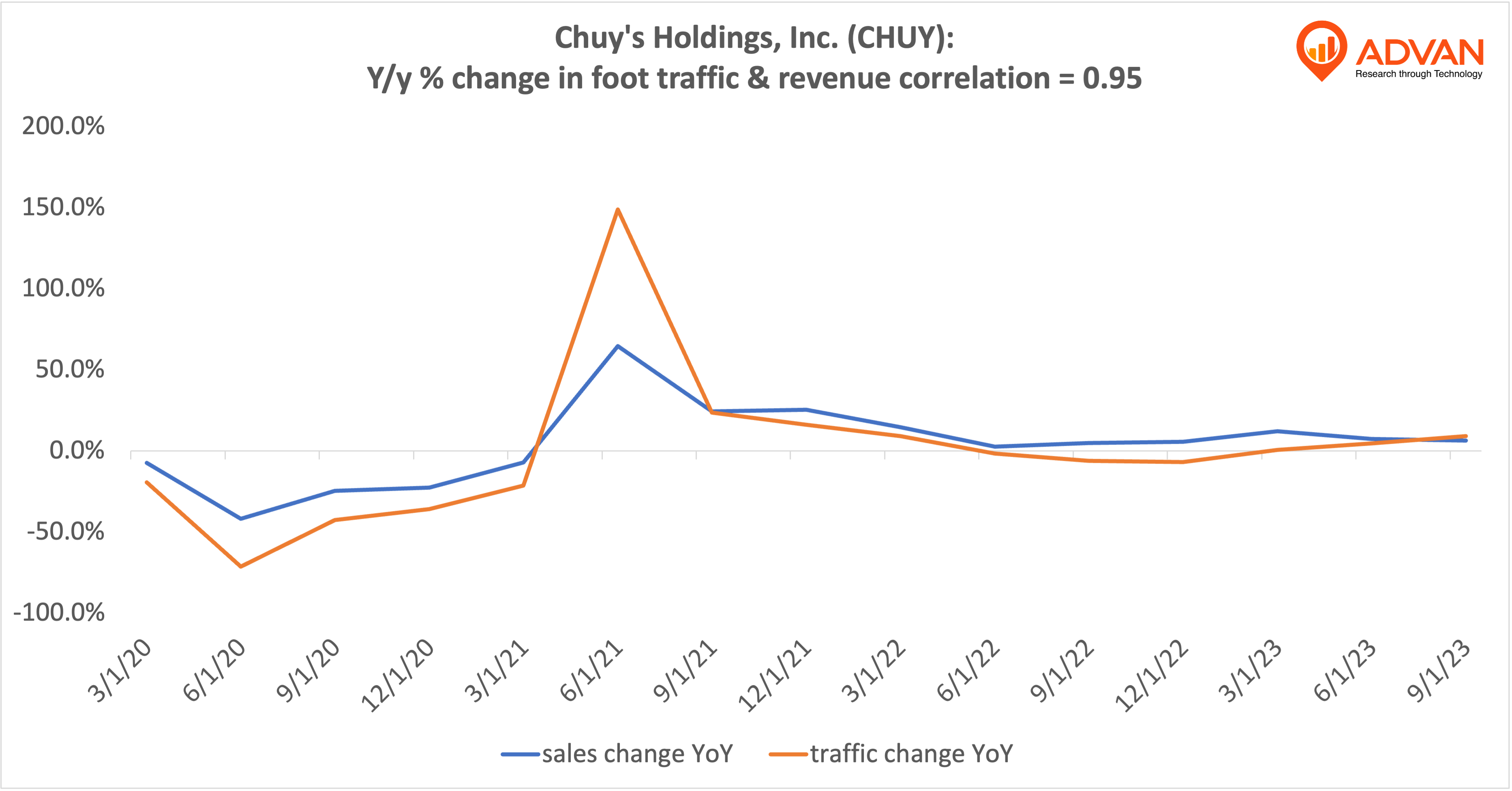

Notable Hit 4: (CHUY:NASDAQ) On Thursday November 2, 2023 Chuy's Holdings, Inc. (CHUY) posted revenues of $113.5mm surpassing the mean analyst estimate of $111.97mm and in the same direction as Advan's forecasted sales. The revenue increased 6.4% YoY inline with Advan's foot traffic data increase of 9% YoY at its restaurants in Q3 2023. Advan's footfall data has a correlation of 0.95 on a YoY basis with CHUY's top-line revenue over the last 15 quarters.

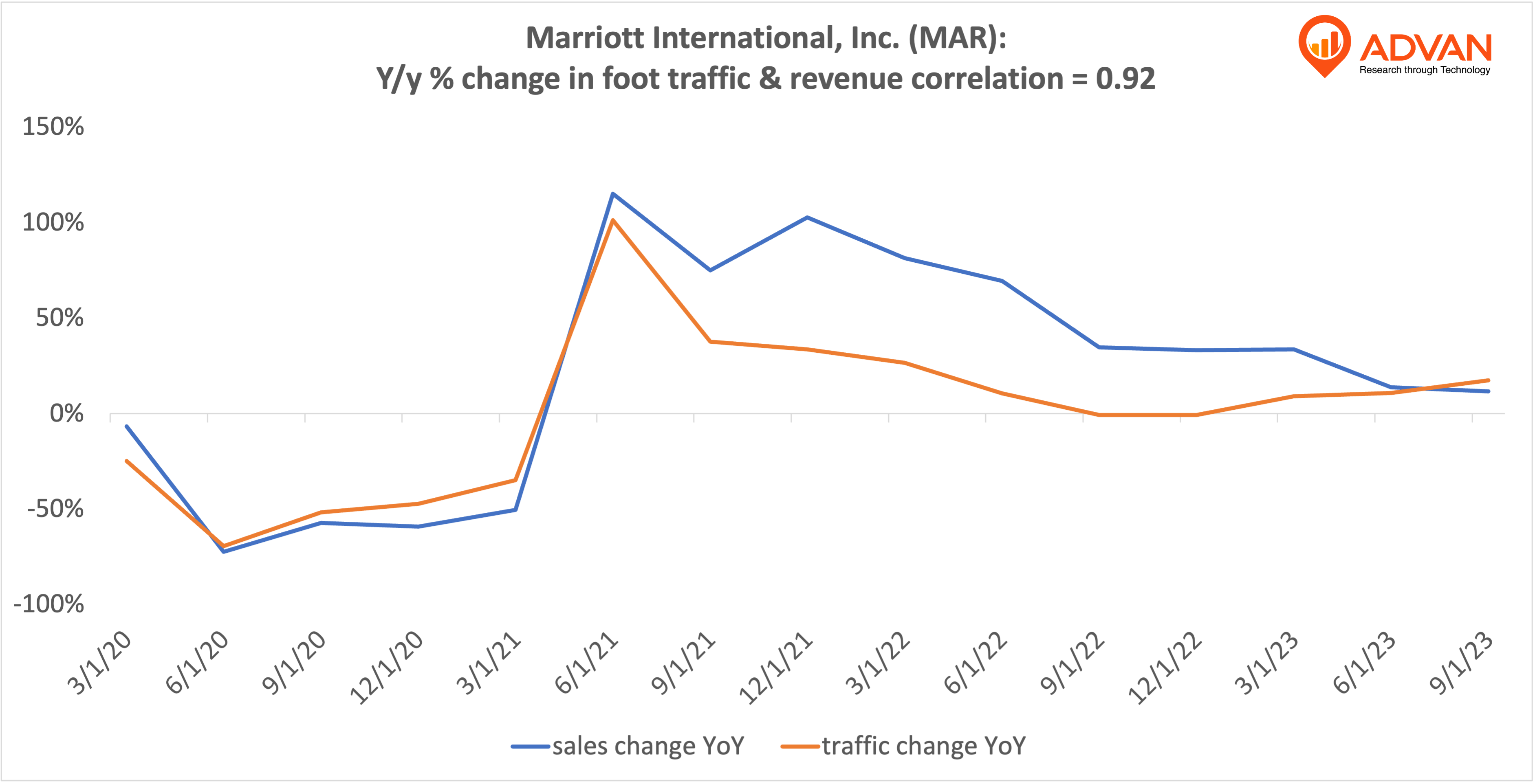

Notable Hit 5: (MAR:NASDAQ) On Thursday November 2, 2023 Marriott International, Inc. (MAR) posted revenues of $5.93bn surpassing the mean analyst estimate of $5.87bn and in the same direction as Advan's forecasted sales. The revenue increased 11.6% YoY inline with Advan's foot traffic data increase of 17.4% YoY across its hotel chains in Q3 2023. Advan's footfall data has a correlation of 0.92 on a YoY basis with MAR's top-line revenue over the last 15 quarters.

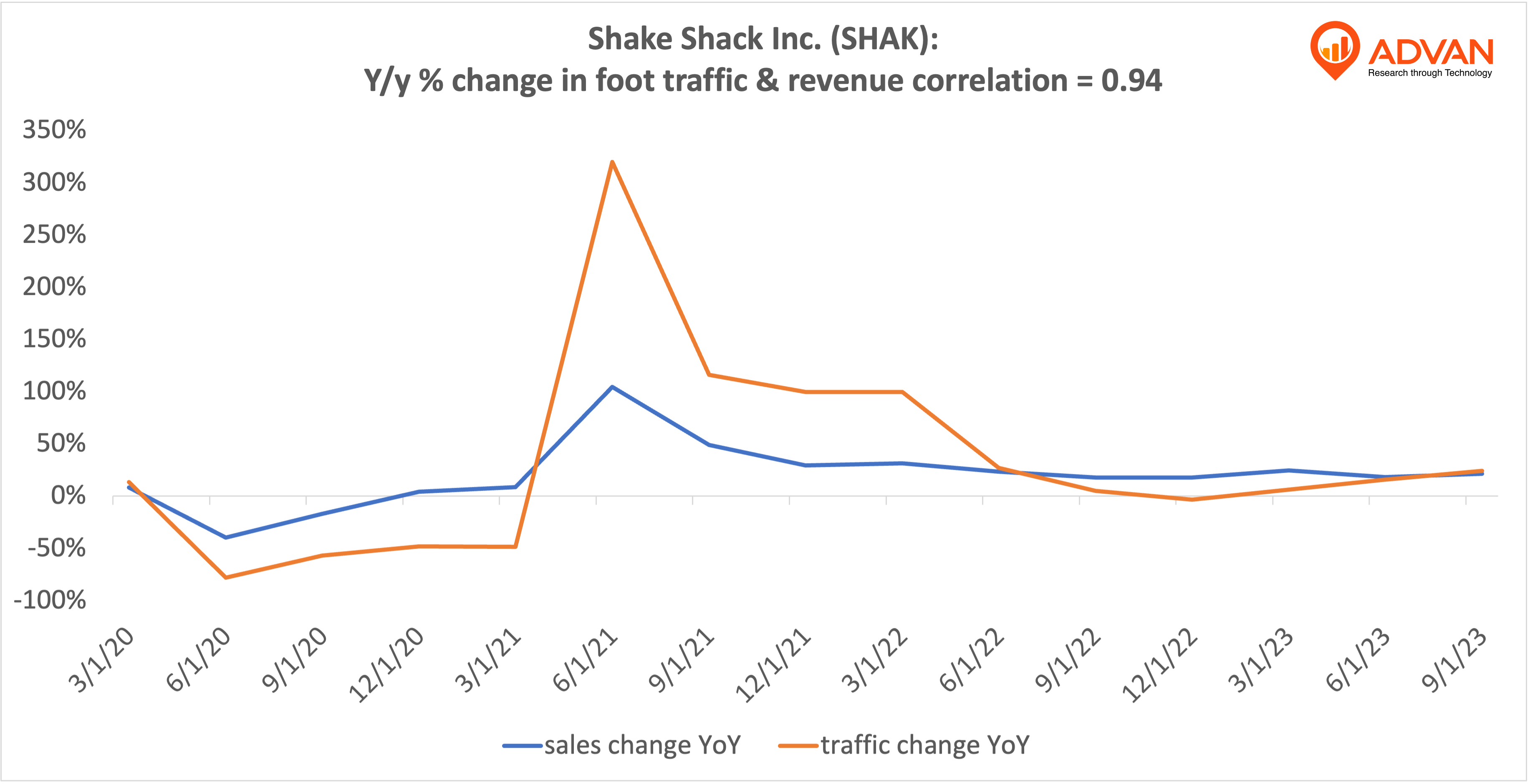

Notable Hit 6: (SHAK:NYSE) On Thursday November 2, 2023 Shake Shack Inc. (SHAK) posted revenues of $276.1mm aligning with the mean analyst estimate of $276.1mm and in the same direction as Advan's forecasted sales. The revenue increased 21.2% YoY inline with Advan's foot traffic data increase of 23.8% YoY across its QSR locations in Q3 2023. The stock opened +7.5% from previous close. Advan's footfall data has a correlation of 0.94 on a YoY basis with SHAK's top-line revenue over the last 15 quarters.

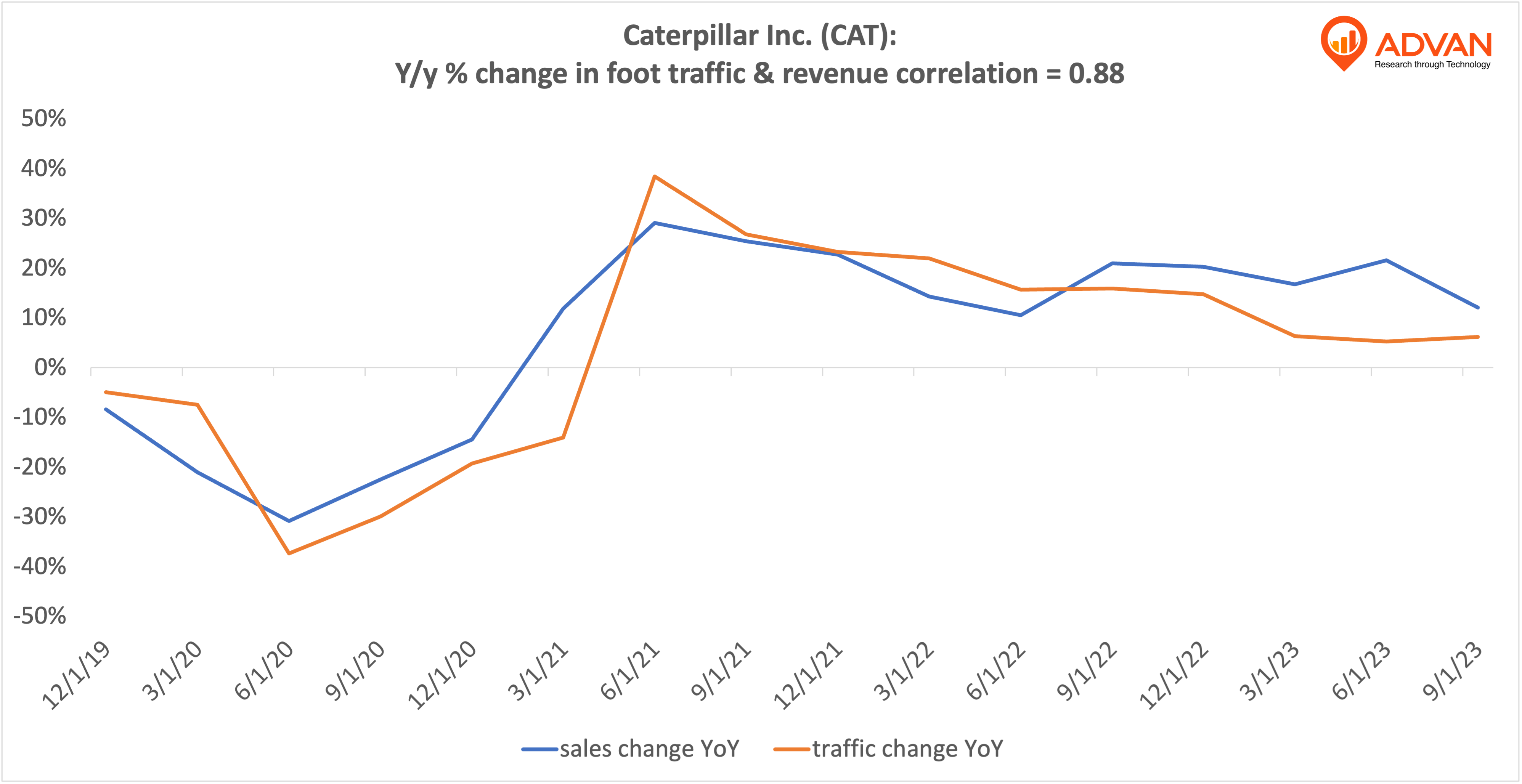

Notable Hit 7: (CAT:NYSE) On Thursday October 31, 2023 Caterpillar Inc. (CAT) posted revenues of $16.81bn surpassing the mean analyst estimate of $16.52bn and in the same direction as Advan's forecasted sales. The revenue increased 12.1% YoY inline with Advan's foot traffic data increase of 6.2% YoY at its manufacturing facilities in Q3 2023. Advan's footfall data has a correlation of 0.88 on a YoY basis with CAT's top-line revenue over the last 15 quarters.