Notable Hit 1: (CNK:NYSE) On Friday May 5, 2023 Cinemark Holdings, Inc. (CNK) posted revenues of $610.7 mm surpassing the mean analyst estimates by 10.4% and in the same direction as Advan's forecasted sales. The revenue increased 32% YoY - in line with Advan's foot traffic data increase of 5.2% at its movie theaters in Q1 2023. Advan's footfall data have a correlation of 0.96 on a YoY basis with CNK's top-line revenue over the last 15 quarters.

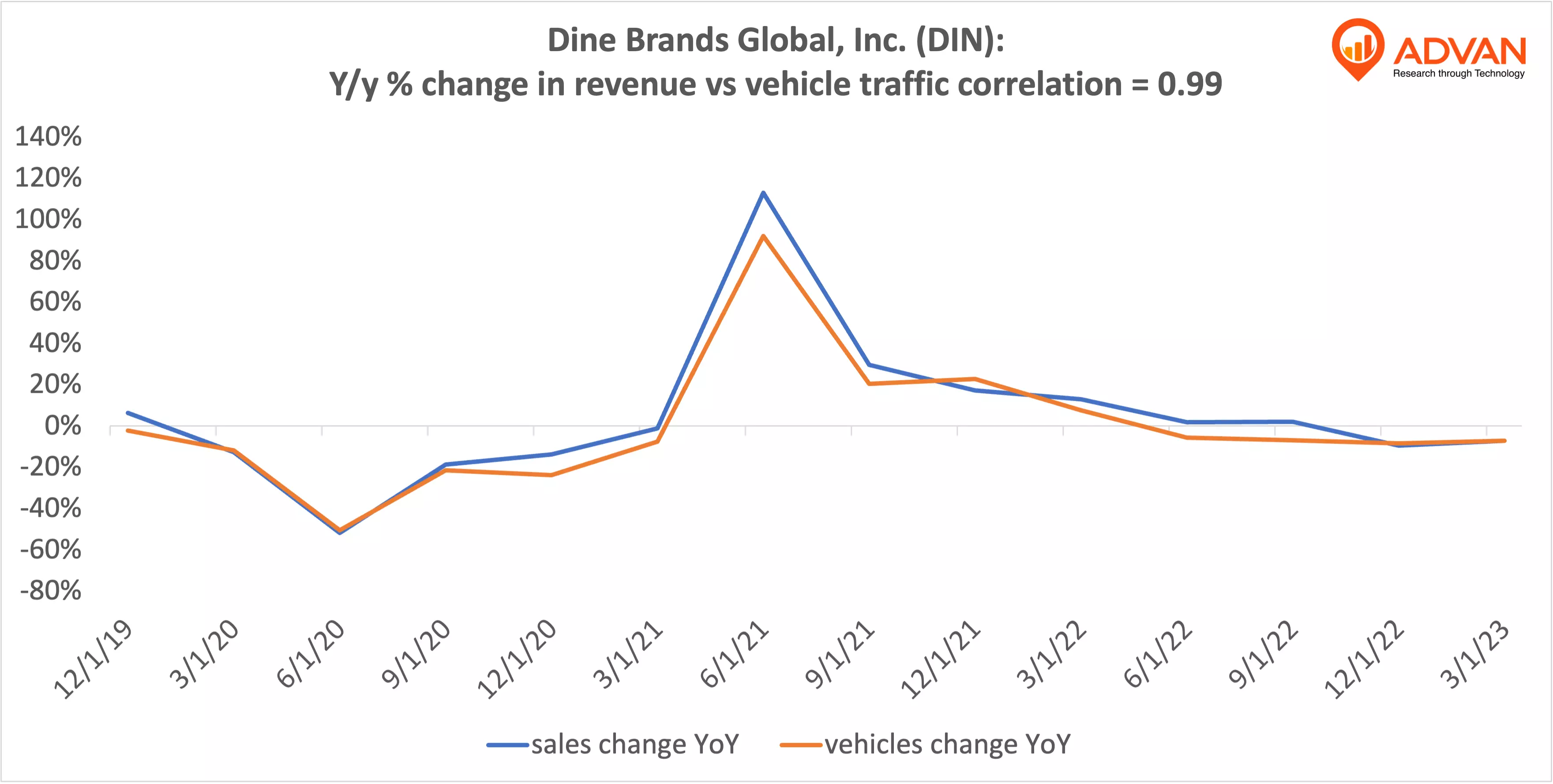

Notable Hit 2: (DIN:NYSE) On Wednesday May 3, 2023 Dine Brands Global, Inc. (DIN) posted revenues of $213.77 mm. down 7.23% YoY and in line with Advan's vehicle traffic data decrease of 7.68% YoY at its restaurant chains in Q1 2023. Advan's vehicle data has a correlation of 0.99 on a YoY basis with DIN's top-line revenue over the last 14 quarters.

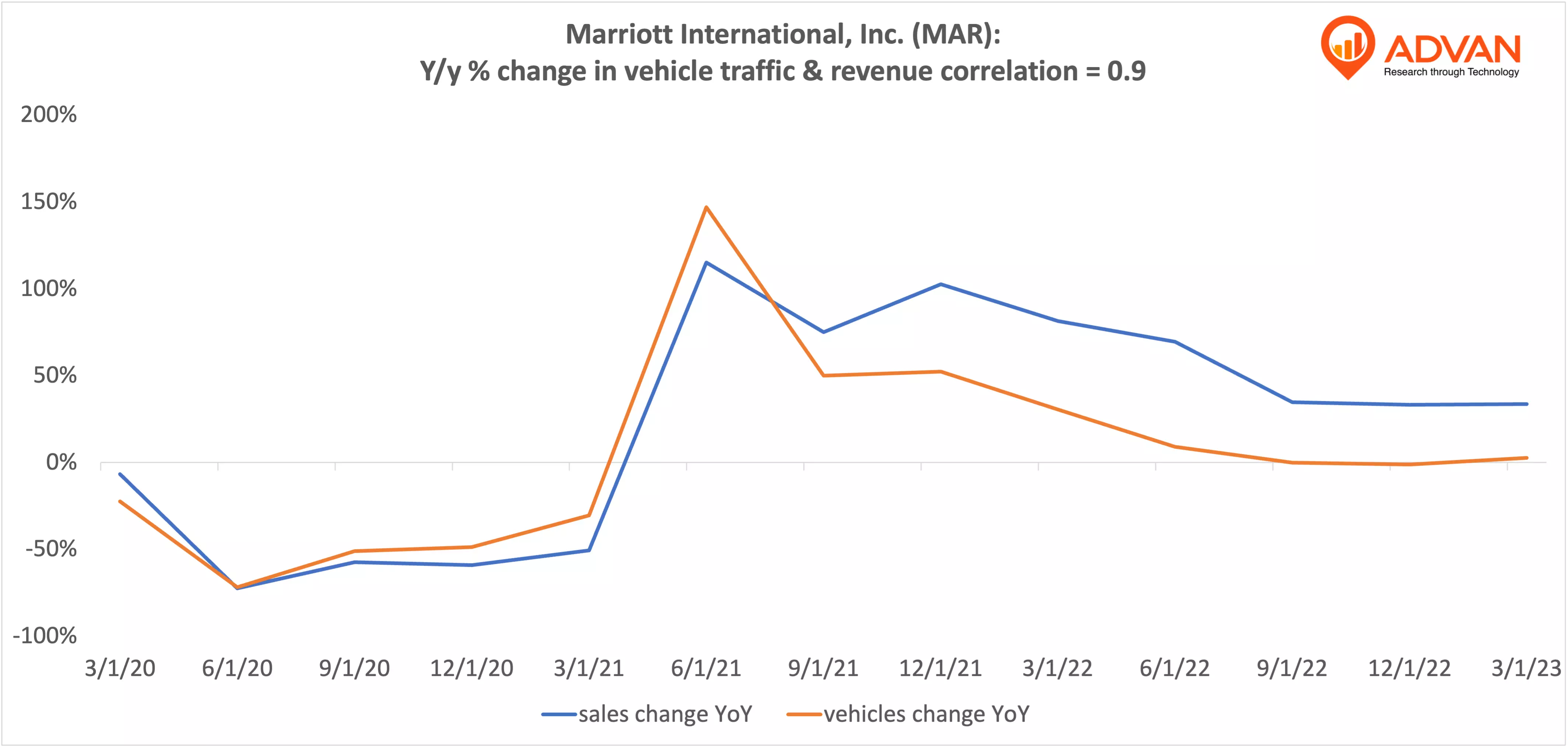

Notable Hit 3: (MAR:NASDAQ) On Tuesday May 2, 2023 Marriott International, Inc. (MAR) posted revenues of $5.62 bn, surpassing the mean analyst estimates by 12% and in the same direction as Advan's forecasted sales. The revenue increased 33% YoY - in line with Advan's vehicle traffic data increase of 2.7% YoY at its hotel chains in Q1 2023. The stock closed +4.55% from previous close. Advan's vehicle data have a correlation of 0.90 on a YoY basis with MAR's top-line revenue over the last 13 quarters.