- Monday was the first day non-essential office workers could return to work in Boston.

- There was NO rush back to the office.

- Using mobile tracking data from Advan Research, overall foot traffic was up 7.3% in the Seaport waterfront last week compared to 2 weeks ago.

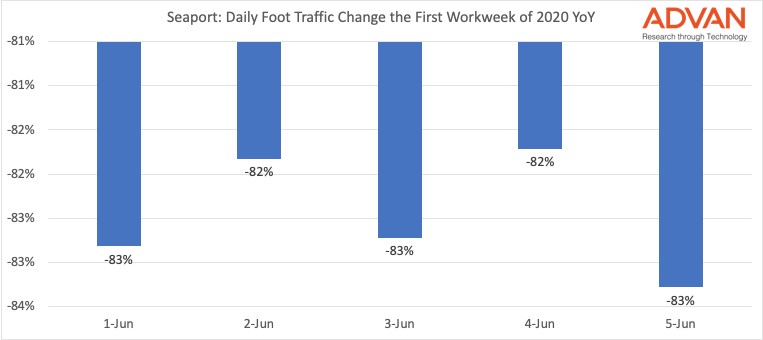

- Compared to one-year ago, foot traffic is down 83%.

- Numerous employers have pushed back their plans to return to the office between Independence Day and Labor Day, significantly limiting overall foot traffic for the foreseeable future.

Last Monday was the first day that Mayor Walsh allowed non-essential office workers to return to work in Boston. Anecdotally, there wasn't a rush to get back into the office. Multiple news articles spoke to the fact. We thought it would be interesting to look at some numbers. Using mobile tracking data, we analyzed foot traffic activity in the Seaport waterfront to see what happened last week.

The short answer: there was no rush back.

Overall last week, there was a 7.3% increase in foot traffic compared to 2 weeks ago (we avoided the week prior as it was the Memorial Day weekend). The largest increase was on Thursday -- up 17.9% versus May 21st.

When comparing June 1st to the first Monday of June last year (June 3rd), overall Seaport foot traffic is down 83%.

Many employers are taking a cautious approach to opening up, with some planning a return between Independence Day and Labor Day. Meanwhile both the Commonwealth, and the city of Boston have their own guidance in place on reopening. It will be quite some time before offices are back up and running with any semblance of pre-COVID-19 foot traffic.

For more detailed data please contact us directly contact us.