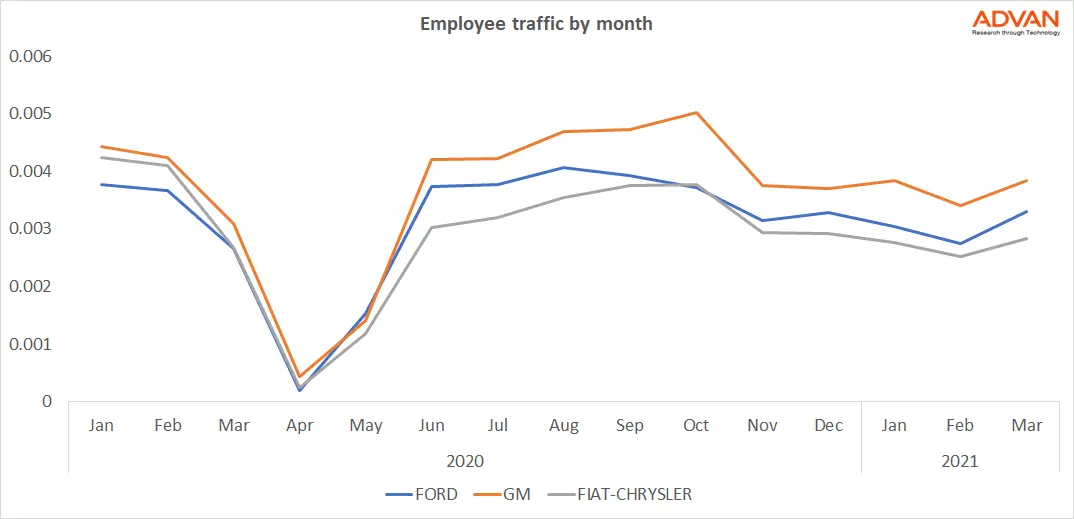

Following the recent news that Ford is expected to halt production for two weeks in April due to chip shortages, and given our recent study on this exact subject few months back we wanted to take a closer look and quantify how the largest US carmakers and the industry as a whole is currently affected. Employee counts are often times the right metric produced by our foot traffic data to analyze industrial companies. Looking at the employee traffic at the US plants for the three major carmakers it is clear that we are consistently for the last seven or so months at subdued levels of production, with March being the first month showing al recovery.

What is also worth pointing out is that each manufacture has its own path to optimal production rates and these could vary by month as shown on the graph below. Worth highlighting Ford has been consistently producing more than Fiat post the covid-19 recovery, even though this wasn’t the case before.

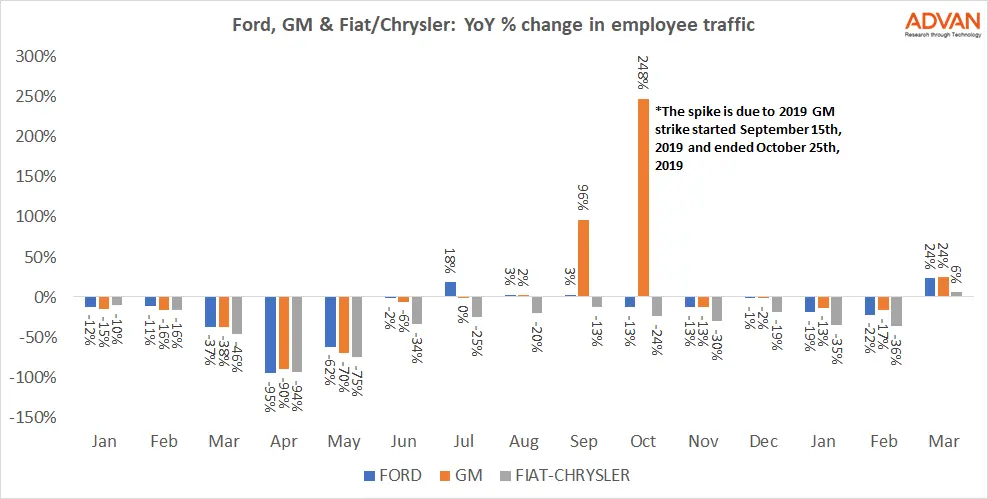

Looking at the same employee counts but at a YoY basis (graph below) it is clear that all manufacturers are similarly affected for the most part in 2021. Having said that a YoY analysis might not be the best in this case especially for the first three months of 2021.

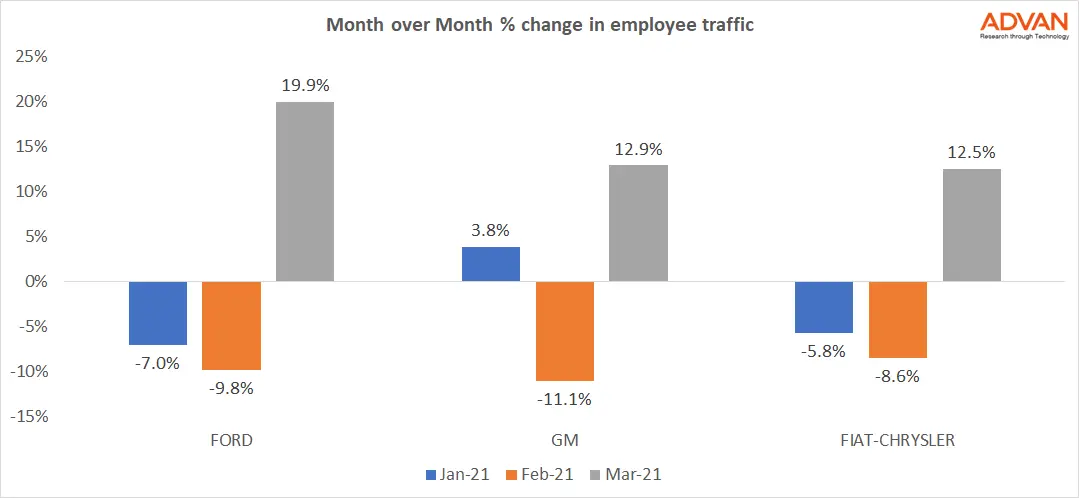

Focusing on 2021 production though by only looking on month over month changes for the same employee foot traffic, we can get a clearer picture on how things differentiate between the manufacturers. March was across the board a busier month than February with Ford leading the way posting a 19.9% increase. Could it be in anticipation of the April shutdowns? Perhaps since Ford was the only manufacturer of the three that recently confirmed of the April shutdowns in at least two of its factories.

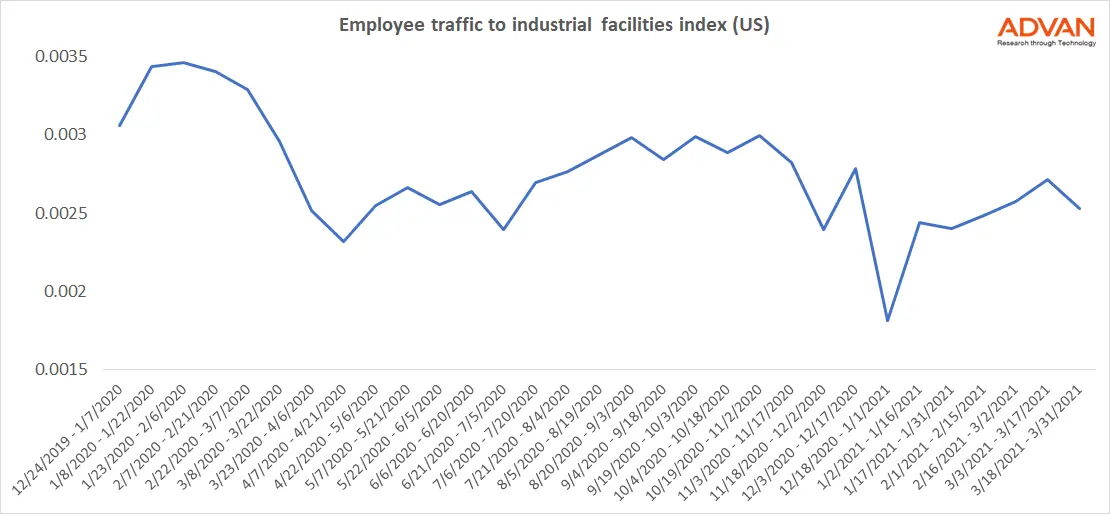

Similarly to our last report we wanted to expand the analysis to not only the automakers but the industry as a whole, this time looking at the Industrial Facilities index as computed by Advan. Besides the Covid-19 effect in early 2020 and the seasonal end of year drop due to the holidays, 2021 has been a year of modest but steady growth with a small hiccup towards the end of March.