In this second post based on data from our summer webinar, we reviewed the sectors at the heart of the tourism industry - hotels, restaurants and casinos.

We had previously analyzed hotel foot traffic in multiple states. You can read our full analysis in a previous blog post here. Just to recap, in the majority of states hotel foot traffic remains well below average, pre-pandemic levels. The exception is South Carolina, where hotel traffic has returned to levels 5% above the start of the year.

Drilling down to a more specific resort, we reviewed overall foot traffic for casinos in Nevada. Many casinos opened earlier this month and the chart below shows the spike in traffic, up from zero in April and May.

Yet, the uptick remains small. Foot traffic is still over 75% down year over year.

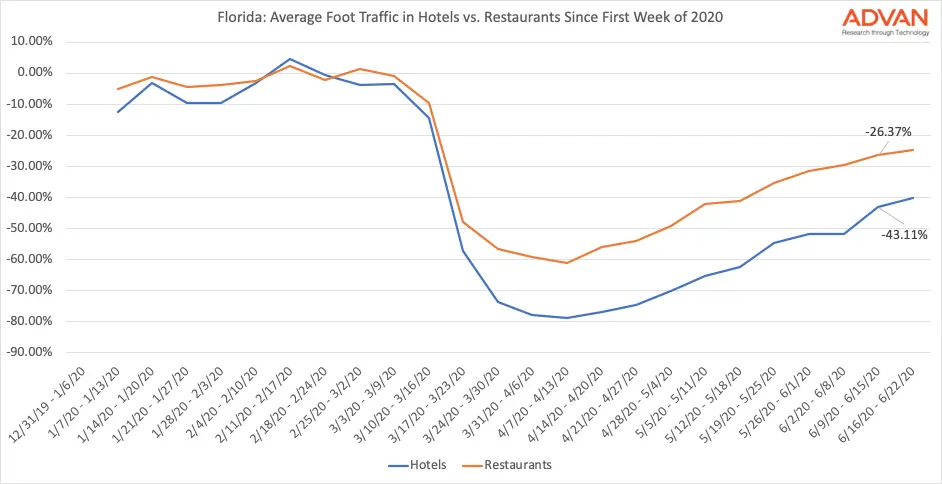

Finally in this category we looked at hotels and restaurants in Florida. With restrictions lifted early in the state, and given its popularity as a vacation destination, hotel traffic has seen a steady rise since mid-April. As of the third week of June, traffic in Florida hotels was 43% below the start of the year. Though with case numbers rising again over the past several days we may see a reversal of the trend as we head into July.

Restaurants in Florida have followed a very similar trend line to hotels, though fell relatively less with average foot traffic only 26% below January levels.

Stay tuned for our next post, in which we'll look at consumer discretionaries across various states and factory traffic as an indicator for recovery.

For more detailed data please contact us directly contact us.