As we continue our trip across the property types analyzing the change in foot traffic using Advan data and the impact of Covid-19 on commercial real estate, Eigen 10 advisors examines the industrial property sector this week. The data this week comes from the Port of LA and an industrial warehouse park outside of Chicago.

The industrial park is a mix of food distribution, light manufacturing, auto part distribution and other uses. We picked this park since it has a mix of critical and non-critical components within the distribution chain.

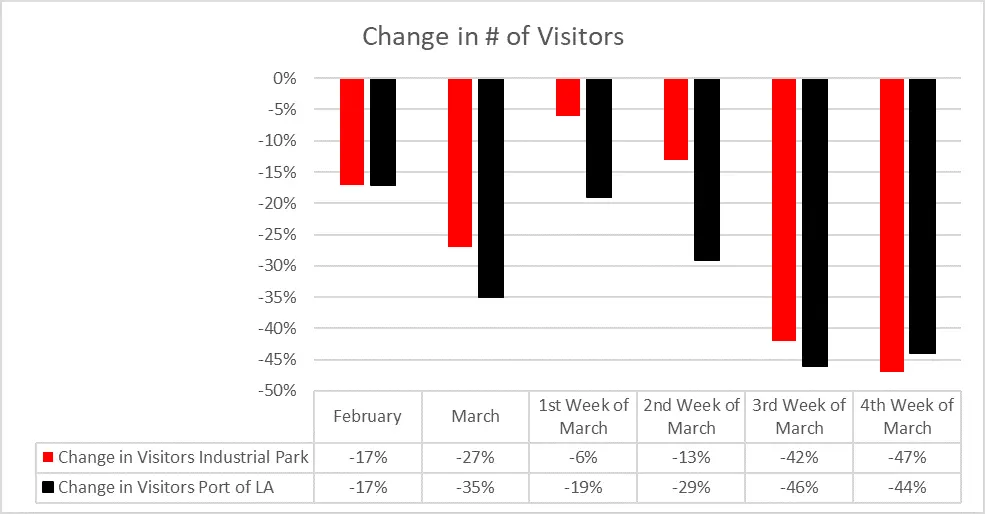

Foot traffic at both the port and industrial park was down 17% this February compared to February last year1. Foot traffic was already down in both locations due to the virus, having fallen 20% at the port and 14% at the industrial park in January. The impact at the port continued into March with foot traffic down 19% the first week and 29% the second week. In contrast, foot traffic at the park started to rebound with the decline in the first week of March down to 6% and 13% in the second week of March.

By the third week, restrictions had been put in place in both California and Illinois with regards to non-essential workers. Retail and restaurant sales had slowed dramatically. You can see the impact on foot traffic in both locations -- down more than 40% compared to the same week the previous year and that trend continued last week.

There is still foot traffic in both locations as ships arrive at the port to be unloaded and food distribution to supermarkets and other food retailers remains strong. However, other types of retail sales have plummeted, and a lot of manufacturing has stopped or slowed.

As China and other parts of Asia begin to rebound, there will likely be some increase in activity, though many retailers have limited or halted new shipments. Depending on what products are stored in the warehouses, activity will be impacted; traffic will remain strong for essential uses but greatly reduced for those deemed non-essential.

As the economy begins to recover and retailers prepare for the peak fall and Christmas season, port traffic should start to return towards previous levels. Depending on how the virus impacts both economic growth and any changes to supply chains, returning to previous levels may happen sooner or later than expectations. Warehouse activity will respond quickly to the pace of economic growth.

Advan and Eigen10 Advisors are working to track and analyze the data in a broader and more long-term indexed fashion. For additional analysis of your property contact

Eddy Hribar at  or Jeff Havsy at

or Jeff Havsy at  .

.

1 The analysis used the first 28 days of February 2020 to account for the additional day in the month due to Leap Year.